Evertz Technologies Third Quarter Fiscal 2014 Revenue Up 30%

BURLINGTON, ONTARIO--(Marketwired - Mar 4, 2014) - Evertz

Technologies Limited (TSX:ET), the leader in Software Defined Video

Network ("SDVN") technology, today reported its results for the

third quarter ended January 31, 2014 of its fiscal 2014 year.

Quarterly Highlights

- Revenue of $93.2 million, up $21.4 million from prior quarter

ending January 31, 2013

- United States/Canada region revenue up 63% compared to the same

quarter last year

- Adoption of the recently released state-of-the-art technology

in DreamCatcher replay for a major sports league, and the EXE

46Tb/s Ethernet SDN switching platform for a major network,

resulted in over $15 million in total sales

- Net earnings of $21.3 million for the quarter

- Fully diluted earnings per share increased 61% to $0.29 for the

quarter as compared to $0.18 one year ago

|

|

|

|

|

|

Selected Financial Information |

|

|

|

|

|

Consolidated Statement of Earnings Data |

|

|

|

|

|

(in thousands of dollars, except per share amounts) |

|

|

|

|

|

|

|

|

Q3 ' 14 |

|

Q3 ' 13 |

|

Revenue |

$ |

93,185 |

$ |

71,771 |

|

Gross Margin |

|

53,737 |

|

40,272 |

|

Earnings from operations |

|

28,223 |

|

17,108 |

|

Net earnings |

|

21,349 |

|

13,179 |

|

Fully-diluted earnings per share |

$ |

0.29 |

$ |

0.18 |

|

|

|

Selected Financial Information |

|

|

|

|

|

|

Consolidated Balance Sheet Data |

|

|

|

|

|

|

(in thousands of dollars) |

|

|

|

|

|

|

|

Q3 ' 14 |

|

YE ' 13 |

|

Cash and instruments held for trading |

$ |

118,782 |

$ |

220,668 |

|

Working capital |

|

271,609 |

|

352,164 |

|

Total assets |

|

388,797 |

|

465,307 |

|

Shareholders' equity |

|

329,222 |

|

406,797 |

Revenue

For the quarter

ended January 31, 2014, revenues were $93.2 million as compared to

revenues of $71.8 million for the quarter ended January 31, 2013.

For the quarter, revenues in the United States/Canada region were

$55.0 million, an increase of $21.2 million as compared to $33.8

million in the same quarter last year. The International region had

revenues of $38.2 million, an increase of $0.2 million as compared

to $38.0 million in the same quarter last year.

Gross Margin

For the quarter

ended January 31, 2014 gross margin was $53.7 million compared to

$40.3 million in the same quarter last year. Gross margin

percentage was approximately 58% compared to 56% in the same

quarter last year.

Earnings

For the quarter

ended January 31, 2014 net earnings were $21.3 million as compared

to $13.2 million in the corresponding period last year.

For the quarter

ended January 31, 2014, earnings per share on a fully-diluted basis

were $0.29 as compared to $0.18 in the same period in 2013.

Operating Expenses

For the quarter

ended January 31, 2014 selling and administrative expenses were

$14.9 million, an increase of $1.2 million or 9% compared to $13.7

million for the quarter ended January 31, 2013.

For the quarter

ended January 31, 2014 gross research and development expenses

increased by $1.9 million or 15% as compared to the corresponding

period in 2013. Gross research and development expenses represented

approximately 16% of revenue for the quarter ended January 31,

2014.

Liquidity and Capital

Resources

The Company's

working capital as at January 31, 2014 was $271.6 million as

compared to $352.2 million on April 30, 2013.

Cash and instruments

held for trading were $118.8 million as at January 31, 2014 as

compared to $220.7 million on April 30, 2013.

Cash generated by

operations was $24.4 million for the quarter ended January 31, 2014

as compared to $22.0 million for the quarter ended January 31,

2013. Before taking into account taxes and the changes in non-cash

working capital, the Company generated $24.5 million from

operations for the quarter ended January 31, 2014 compared to $16.8

million for the same period last year.

The Company used

$2.6 million in investing activities largely a result of purchases

in capital assets during the quarter ended January 31, 2014,

compared to $6.2 million used during the quarter ended January 31,

2013.

For the quarter

ended January 31, 2014, the Company used cash in financing

activities of $112.6 million which was principally a result of the

payment of dividends of $115.8 million, including a special

dividend of $104.0 million, offset by the issuance of capital stock

of $3.5 million.

Shipments and Backlog

Purchase order

backlog at the end of February 2014 was in excess of $43 million

and shipments during the month of February 2014 were $25

million.

Dividend Declared

Evertz Board of

Directors declared a regular quarterly dividend on March 4, 2014 of

$0.16 per share.

The dividend is

payable to shareholders of record on March 14, 2014 and will be

paid on or about March 21, 2014.

|

|

| Selected Consolidated Financial Information |

|

| (Unaudited) |

|

| (in thousands of dollars, except earnings per share

and share data) |

|

|

|

|

Three month period ended |

|

|

Nine month period ended |

|

|

|

January 31, |

|

|

January 31, |

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenue |

$ |

93,185 |

|

$ |

71,771 |

|

$ |

238,287 |

|

$ |

250,890 |

|

| Cost of goods sold |

|

39,448 |

|

|

31,499 |

|

|

101,184 |

|

|

106,103 |

|

| Gross margin |

|

53,737 |

|

|

40,272 |

|

|

137,103 |

|

|

144,787 |

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative |

|

14,913 |

|

|

13,659 |

|

|

40,196 |

|

|

39,118 |

|

|

|

General |

|

2,438 |

|

|

1,393 |

|

|

5,365 |

|

|

4,290 |

|

|

|

Research and development |

|

15,049 |

|

|

13,098 |

|

|

43,133 |

|

|

37,502 |

|

|

|

Investment tax credits |

|

(3,168 |

) |

|

(3,519 |

) |

|

(9,033 |

) |

|

(9,569 |

) |

|

|

Foreign exchange gain |

|

(3,718 |

) |

|

(1,467 |

) |

|

(7,183 |

) |

|

(2,790 |

) |

|

|

25,514 |

|

|

23,164 |

|

|

72,478 |

|

|

68,551 |

|

| Earnings before undernoted |

|

28,223 |

|

|

17,108 |

|

|

64,625 |

|

|

76,236 |

|

|

|

| Finance income |

|

496 |

|

|

699 |

|

|

1,720 |

|

|

1,576 |

|

| Finance costs |

|

(61 |

) |

|

(103 |

) |

|

(275 |

) |

|

(269 |

) |

| Other income and expenses |

|

47 |

|

|

276 |

|

|

(38 |

) |

|

272 |

|

| Earnings before income taxes |

|

28,705 |

|

|

17,980 |

|

|

66,032 |

|

|

77,815 |

|

|

|

| Provision for (recovery of) income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

7,672 |

|

|

3,968 |

|

|

19,387 |

|

|

19,280 |

|

|

|

Deferred |

|

(316 |

) |

|

833 |

|

|

(2,140 |

) |

|

1,505 |

|

|

|

7,356 |

|

|

4,801 |

|

|

17,247 |

|

|

20,785 |

|

|

|

| Net earnings for the period |

$ |

21,349 |

|

$ |

13,179 |

|

$ |

48,785 |

|

$ |

57,030 |

|

|

|

| Net earnings attributable to non-controlling

interest |

|

68 |

|

|

195 |

|

|

349 |

|

|

550 |

|

| Net earnings attributable to shareholders |

|

21,281 |

|

|

12,984 |

|

|

48,436 |

|

|

56,480 |

|

| Net earnings for the period |

$ |

21,349 |

|

$ |

13,179 |

|

$ |

48,785 |

|

$ |

57,030 |

|

|

|

| Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.29 |

|

$ |

0.18 |

|

$ |

0.65 |

|

$ |

0.77 |

|

| Diluted |

$ |

0.29 |

|

$ |

0.18 |

|

$ |

0.65 |

|

$ |

0.77 |

|

|

| Consolidated Balance Sheet Data |

|

As at January 31, 2014 |

|

As at April 30, 2013 |

| Cash and instruments held for trading |

$ |

118,782 |

$ |

220,668 |

| Inventory |

|

125,324 |

|

111,619 |

| Working capital |

|

271,609 |

|

352,164 |

| Total assets |

|

388,797 |

|

465,307 |

| Shareholders' equity |

|

329,222 |

|

406,797 |

|

|

|

|

|

| Number of common shares outstanding: |

|

|

|

|

|

|

Basic |

|

74,279,746 |

|

73,632,566 |

|

|

Fully-diluted |

|

78,068,346 |

|

78,246,966 |

|

|

|

|

|

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

Basic |

|

73,994,700 |

|

73,300,647 |

|

|

Fully-diluted |

|

74,398,758 |

|

73,816,338 |

Forward-Looking

Statements

The report contains

forward-looking statements reflecting Evertz's objectives,

estimates and expectations. Such forward looking statements use

words such as "may", "will", "expect", "believe", "anticipate",

"plan", "intend", "project", "continue" and other similar

terminology of a forward-looking nature or negatives of those

terms.

Although management

of the Company believes that the expectations reflected in such

forward-looking statements are reasonable, all forward-looking

statements address matters that involve known and unknown risks,

uncertainties and other factors. Accordingly, there are or will be

a number of significant factors which could cause the Company's

actual results, performance or achievements, or industry results to

be materially different from any future results performance or

achievements expressed or implied by such forward-looking

statements.

Conference Call

The Company will

hold a conference call with financial analysts to discuss the

results on March 4, 2014 at 5:00 p.m. (EDT). Media and other

interested parties are invited to join the conference call in

listen-only mode. The conference call may be accessed by dialing

1-416-849- 6166 or toll-free (North America) 1-866-250-6267.

For those unable to listen to the live call, a rebroadcast will

also be available until April 4, 2014. The rebroadcast can be

accessed at 1-416-915-1035 or toll-free 1-866-245-6755. The pass

code for the rebroadcast is 988819.

About Evertz

Evertz Technologies

Limited (TSX:ET) designs, manufactures and markets video and audio

infrastructure solutions for the television, telecommunications and

new-media industries. The Company's solutions are purchased by

content creators, broadcasters, specialty channels and television

service providers to support their increasingly complex

multi-channel digital, high definition television ("HDTV") and next

generation high bandwidth low latency IP network environments, and

by telecommunications and new-media companies. The Company's

products allow its customers to generate additional revenue while

reducing costs through the more efficient signal routing,

distribution, monitoring and management of content as well as the

automation of previously manual processes.

Evertz Technologies LimitedAnthony GridleyChief Financial

Officer(905) 335-7580ir@evertz.com

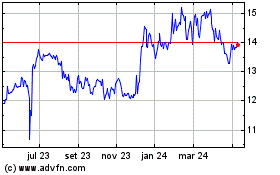

Evertz Technologies (TSX:ET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

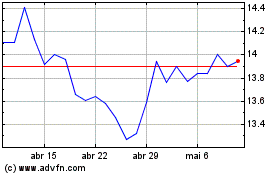

Evertz Technologies (TSX:ET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024