Ivanhoe Mines Announces C$150 Million Equity Financing

20 Maio 2014 - 4:48PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Ivanhoe Mines Ltd. (TSX:IVN) (the "Company" or "Ivanhoe") announced today that

it has entered into an agreement with a syndicate of underwriters led by BMO

Capital Markets, CIBC and Macquarie Capital Market Canada Ltd. under which the

underwriters have agreed to buy, on a bought deal basis by way of a short form

prospectus, 83,334,000 units (the "Units"), each Unit consisting of one class A

common share ("Common Shares") and one Common Share purchase warrant, at a price

of C$1.50 per Unit for gross proceeds of C$125,001,000 (the "Offering"). Each

whole Common Share purchase warrant will entitle the holder to purchase one

Common Share of the Company at a price of C$1.80 prior to the date which is 18

months following the closing of the Offering. The Company has granted the

Underwriters an option, exercisable at the offering price for a period of 30

days following the closing of the Offering, to purchase up to an additional 15%

of the Offering to cover over-allotments, if any. The Offering is expected to

close on or about June 10, 2014 and is subject to the Company receiving all

necessary regulatory approvals.

Concurrent with the Offering, the Company will complete a private placement

pursuant to which Robert Friedland will purchase approximately C$25 million of

Units on the same terms and conditions as the public Offering (the "Concurrent

Private Placement"). The Company has also granted Mr. Friedland, an option to

purchase up to 15% of the Units he purchases in the Concurrent Private Placement

if, and to the extent, the Underwriters exercise their over-allotment option in

whole or in part. Such option will be on the same terms and conditions,

including price and amount exercised, as the over-allotment option and will

expire 30 days following the closing of the Offering

The net proceeds of the offering will be used for the advancement of and

pre-development activities at, the Kamoa and Kipushi Projects, and for general

corporate purposes.

The Units will be offered by way of a short form prospectus in all of the

provinces and territories of Canada.

This news release shall not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of the securities in the United

States or in any other jurisdiction in which such offer, solicitation or sale

would be unlawful. The securities have not been registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from the registration

requirements thereunder.

About Ivanhoe Mines Ltd.

Ivanhoe Mines, with offices in Canada, the United Kingdom and South Africa, is

advancing and developing its three principal projects:

-- The Kamoa copper discovery in a previously unknown extension of the

Central African Copperbelt in the DRC's Province of Katanga.

-- The Platreef Discovery of platinum, palladium, nickel, copper, gold and

rhodium on the Northern Limb of the Bushveld Complex in South Africa.

-- The historic, high-grade Kipushi zinc, copper and germanium mine, also

on the Copperbelt in the DRC, being drilled and upgraded following an

18-year care-and-maintenance program that ended when Ivanhoe acquired

its majority interest in the mine in 2011.

Ivanhoe Mines also is evaluating other opportunities as part of its objective to

become a broadly based, international mining company.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements in this release constitute "forward-looking statements" or

"forward-looking information" within the meaning of applicable securities laws,

including without limitation, the completion of the offering of units described

herein, and the completion of the private placement to Robert Friedland. Such

statements involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of the company,

or industry results, to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements or information. Such statements can be identified by the use of words

such as "may", "would", "could", "will", "intend", "expect", "believe", "plan",

"anticipate", "estimate", "scheduled", "forecast", "predict" and other similar

terminology, or state that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved. These statements

reflect the company's current expectations regarding future events, performance

and results and speak only as of the date of this release.

Forward-looking statements involve significant risks and uncertainties, should

not be read as guarantees of future performance or results, and will not

necessarily be accurate indicators of whether or not such results will be

achieved. A number of factors could cause actual results to differ materially

from the results discussed in the forward-looking statements, including, but not

limited to, the factors discussed here, as well as unexpected changes in laws,

rules or regulations, or their enforcement by applicable authorities; the

failure of parties to contracts with the company to perform as agreed; the

occurrence of a material adverse change, or failure to obtain any regulatory

approval or to meet any condition of the Offering.

Although the forward-looking statements contained in this release are based upon

what management of the company believes are reasonable assumptions, the company

cannot assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are made as of the

date of this release and are expressly qualified in their entirety by this

cautionary statement. Subject to applicable securities laws, the company does

not assume any obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after the date of

this release.

The company's actual results could differ materially from those anticipated in

these forward-looking statements as a result of the factors set forth in the

"Risk Factors" section and elsewhere in the company's most recent Management's

Discussion and Analysis report and Annual Information Form, available at

www.sedar.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Investors:

Bill Trenaman

Tel.: +1.604.331.9834

Media

North America:

Bob Williamson

Tel.: +1.604.512.4856

South Africa:

Jeremy Michaels

Tel.: +27.11.088.4300

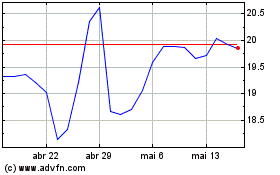

Ivanhoe Mines (TSX:IVN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Ivanhoe Mines (TSX:IVN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024