Ivanhoe Mines Announces C$500 Million Private Placement

12 Dezembro 2023 - 6:31PM

Ivanhoe Mines Ltd. (TSX: IVN; OTCQX: IVPAF) (“Ivanhoe

Mines” or the “Company”) is pleased to announce that it has engaged

BMO Capital Markets as sole agent in connection with a proposed

offering of 41,667,000 Class A common shares (the “Common Shares”),

on a private placement basis (the “Offering”) at a price of

C$12.00 per Common Share (the “Offering Price”) for aggregate gross

proceeds of C$500 million (approximately US$370 million). The

Company expects to grant BMO Capital Markets an option, exercisable

at the Offering Price up until 48 hours prior to the closing of the

Offering, to place up to an additional 15% of the number of Common

Shares purchased pursuant to the Offering. The Offering is expected

to close on or about December 18, 2023 and is subject to Ivanhoe

Mines receiving all necessary regulatory approvals, including

approval of the Toronto Stock Exchange.

The net proceeds of the Offering will be used to fund

exploration, working capital, and for general corporate

purposes.

The Offering will be conducted in reliance upon certain

prospectus and private placement exemptions. The securities

issuable to Canadian purchasers under the private placement will be

subject to a hold period expiring four months and one day after the

closing date. The Common Shares have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements. This

press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

shares in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Pursuant to the investor rights agreements between the

Company and CITIC Metal Africa Investments Limited (“CITIC”) and

Zijin Mining Group Co. Ltd. (“Zijin”), respectively, each of CITIC

and Zijin will have the right to acquire Common shares at the

Offering Price to maintain their pro rata equity interest in the

Company. Any Common Shares issued to CITIC or Zijin on exercise of

their respective anti-dilution rights under their investor rights

agreements will be in addition to those issued as part of the

Offering.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on

advancing its three principal projects in Southern Africa; the

expansion of the Kamoa-Kakula Copper Complex in the DRC, the

construction of the tier-one Platreef

palladium-nickel-platinum-rhodium-copper-gold project in South

Africa; and the restart of the historic ultra-high-grade Kipushi

zinc-copper-germanium-silver mine, also in the DRC.

Ivanhoe Mines also is exploring for new copper

discoveries across its circa 2,400km2

of 80-100% owned exploration licenses, as well as on the

247km2 of newly acquired joint

venture licenses, in the Western Foreland located adjacent to the

Kamoa-Kakula Copper Complex in the DRC.

Information Contact

Investors

Vancouver: Matthew Keevil +1 604 558

1034London: Tommy Horton +44 7866 913 207

Cautionary Statement on Forward-Looking

Information

Certain statements in this news release constitute

“forward-looking statements” or “forward-looking information”

within the meaning of applicable securities laws. Such statements

and information involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or

achievements of the company, its projects, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. Such statements can be identified by the

use of words such as “may”, “would”, “could”, “will”, “intend”,

“expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”,

“forecast”, “predict” and other similar terminology, or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will” be taken, occur or be achieved. Readers are cautioned not

to place undue reliance on forward-looking information or

statements. These statements reflect the company’s current

expectations regarding future events, performance and results and

speak only as of the date of this news release.

Such statements include without limitation, statements regarding

the anticipated aggregate gross proceeds, pricing and timing of

closing of the Offering and the anticipated use of proceeds of the

Offering, statements regarding receipt of Toronto Stock Exchange

approval in respect of the Offering and statements in respect of

the exercise of the CITIC and Zijin anti-dilution rights.

Forward-looking statements and information involve significant

risks and uncertainties, should not be read as guarantees of future

performance or results and will not necessarily be accurate

indicators of whether or not such results will be achieved. A

number of factors could cause actual results to differ materially

from the results discussed in the forward-looking statements or

information, including, but not limited to, the factors discussed

under “Risk Factors” and elsewhere in the company’s MD&A for

the three and nine months ended September 30, 2023, and its Annual

Information Form, as well as the inability to obtain regulatory

approvals in a timely manner; the potential for unknown or

unexpected events to cause contractual conditions to not be

satisfied; unexpected changes in laws, rules or regulations, or

their enforcement by applicable authorities; the failure of parties

to contracts with the company to perform as agreed; social or

labour unrest; changes in commodity prices; and the failure of

exploration programs or studies to deliver anticipated results or

results that would justify and support continued exploration,

studies, development or operations.

Although the forward-looking statements contained in this news

release are based upon what management of the company believes are

reasonable assumptions, the company cannot assure investors that

actual results will be consistent with these forward-looking

statements. These forward-looking statements are made as of the

date of this news release and are expressly qualified in their

entirety by this cautionary statement. Subject to applicable

securities laws, the company does not assume any obligation to

update or revise the forward-looking statements contained herein to

reflect events or circumstances occurring after the date of this

news release.

Ivanhoe Mines (TSX:IVN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

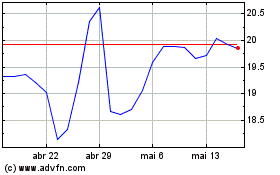

Ivanhoe Mines (TSX:IVN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024