Lithium Americas Closes Over-Subscribed Rights Offering for Gross Proceeds of Approx. $18.55 Million

18 Março 2014 - 4:43PM

Marketwired Canada

Lithium Americas Corp. (TSX:LAC) (the "Company") is pleased to announce that it

has received gross proceeds of approximately $18.55 million before expenses as a

result of the successful closing of its over-subscribed rights offering through

the issuance of 77,308,481 common shares at a subscription price of C$0.24 per

common share.

Under the rights offering, 65,120,902 common shares were issued under the basic

subscription privilege extended to rights holders (representing over 84% of the

total shares on offer) with 12,187,579 additional common shares issued pursuant

to exercises of the additional subscription privilege.

As previously announced, the Company's largest shareholder, Geologic Resource

Partners LLC, through four funds that it manages, agreed to act as a standby

purchaser in respect of the rights offering in consideration for a fee equal to

3% of the gross proceeds of the offering. Geologic purchased a total of

22,094,912 common shares under its basic and additional subscription privileges

under the offering.

The net proceeds of the rights issue will be used by the Company to repay all

its outstanding debt, currently approximately $9.5 million, and for general

working capital purposes, including the continuing funding of its flagship

Cauchari-Olaroz lithium project in Jujuy province, Argentina.

The total number of issued and outstanding shares of the Company is now

154,616,962.

The Company's Executive Chairman, Tom Hodgson, commented: "We are very

appreciative of this strong show of support from our existing shareholders. In

particular, I want to thank Geologic Resource Partners, whose willingness to act

as a Standby Purchaser ensured the success of the financing. The funds raised

will strengthen our balance sheet and provide working capital for the Company as

we continue to pursue the best development opportunity for our Cauchari-Olaroz

lithium project in Jujuy province, Argentina. In the foreseeable future, our

principal development focus will be on implementing the previously announced

Co-operation Agreement with POSCO, pursuant to which POSCO will be delivering

their PP3 pilot plant to our Cauchari location."

About the Company

Lithium Americas is developing one of the world's largest and lowest cost

lithium operations. The Company has defined the world's third largest lithium

brine resource, and a completed definitive Feasibility Study identified that

Lithium Americas' operating cost per tonne of lithium carbonate is expected to

be one of the lowest in the industry.

Cautionary Note and Forward-looking statements

This press release contains forward looking statements, which can be identified

by the use of statements that include words such as "developing", "expect",

"will", "continue", "implementing", or other similar words or phrases.

Forward-looking statements express, as at the date of this press release, the

Company's plans, estimates, forecasts, projections, expectations, or beliefs as

to future events or results. Forward-looking statements are based on certain

assumptions, including the key assumptions and parameters on which such

estimates are based, involve risks and uncertainties and there can be no

assurance that such statements will prove to be accurate. Therefore, actual

results and future events could differ materially from those anticipated in such

statements. Factors that could cause results or events to differ materially from

current expectations expressed or implied by the forward-looking statements,

include, but are not limited to, possible variations in mineral resource and

reserve estimates, grade/concentration or recovery rates, lithium or potash

prices, operating or capital costs; changes in project parameters as plans

continue to be refined; political, community relations, regulatory,

environmental and other risks of the mining industry and other risks more fully

described in the Company's Short Form Prospectus dated January 31, 2014

available on SEDAR. The Cauchari-Olaroz project has no operating history upon

which to base estimates of future cash flow. The capital expenditures and time

required to develop any new project is considerable and changes in capital

and/or operating costs or construction schedules can affect project economics.

It is possible that actual capital and/or operating costs may increase

significantly and economic returns may differ materially from the Company's

estimates or that prices of lithium and/or potash may decrease significantly or

that the Company could fail to enter into a commercialization agreement for the

project or obtain further project financing on acceptable terms and conditions

or at all, in which case, the project may not proceed either on its original

timing or at all. It is not unusual in the mining industry for new mining

operations to experience unexpected problems during the start-up phase,

resulting in delays and requiring more capital than anticipated. Although the

Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in forward looking statements,

there may be other factors that cause results to be materially different from

those planned, estimated, forecasted, projected or expected. The Company does

not intend, and does not assume any obligations, to update forward-looking

statements, whether as a result of new information, future events or otherwise,

unless otherwise required by applicable securities laws. Readers should not

place undue reliance on forward looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lithium Americas Corp.

Mike Cosic

Chief Financial Officer

416-360-1921

mcosic@lithiumamericas.com

www.lithiumamericas.com

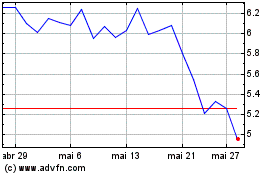

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024