Aura Minerals Announces US$22.5 Million Gold Loan

17 Março 2014 - 6:05PM

Marketwired Canada

Aura Minerals Inc. (TSX:ORA) is pleased to announce that the Company has

obtained a US$22.5 million gold loan (the "Loan") from Auramet International LLC

(the "Lender"), a subsidiary of Auramet Trading LLC. The proceeds of the Loan

will be used to settle the Company's entire outstanding obligations pursuant to

the Company's credit facility dated March 18, 2011, as amended.

The Loan will be repaid in 40 weekly installments of 458 ounces of gold

commencing on April 7, 2014. The Loan may be repaid at any time with no

prepayment penalties. In addition to fixing the price of the 18,320 ounces of

gold deliverable under the Loan the Company has hedged a further 10,000 ounces

of gold with the Lender at an average fixed price of $1,373 per ounce as well as

15,000 ounces of gold with a $1,300 floor price and $1,423 ceiling price.

In partial consideration of the Loan, the Company has issued 4,500,000

non-transferable common share purchase warrants (the "Warrants") to the Lender,

with each Warrant entitling the holder thereof to acquire one common share in

the capital of the Company. Each Warrant has an exercise price of $0.36, being

equal to a 100% premium over the 20 day VWAP of the Company's common share price

as at March 16, 2014. Each Warrant has an expiry date of 12 months from

issuance. The Warrants and the common shares underlying the Warrants are subject

to a four-month hold period pursuant to Canadian securities laws. The issuance

of the Warrants is subject to the customary final approval conditions of the

TSX.

The Loan is guaranteed by the Company's interests in its Aranzazu, San Andres,

Sao Francisco and Sao Vicente operating entities and is secured by a continuing

security interest in all of the Company's present and future personal property.

In furtherance of the Loan, the Company has entered into gold purchase

agreements in respect of all of the gold produced at the Company's San Andres,

Sao Francisco and Sao Vicente mines. The gold will be sold at market rates for a

period of two years from the date of the Loan.

"This gold loan provides a source of repayment of our existing credit facility,

which is set to expire on June 30, 2014, as well as locking in gold prices on a

significant portion of our production at a good moment in the gold market," said

Jim Bannantine, the Company's President and CEO. "We are also continuing to work

on additional long term financing to help fund our Aranzazu copper project

expansion."

About Aura Minerals

Aura Minerals is a Canadian mid-tier gold and copper production company focused

on the development and operation of gold and base metal projects in the

Americas. The Company's producing assets include the copper-gold-silver Aranzazu

mine in Mexico, the San Andres gold mine in Honduras and the Sao Francisco and

Sao Vicente gold mines in Brazil. The Company's core development asset is the

copper-gold-iron Serrote da Laje project in Brazil.

Cautionary Note

This news release contains certain "forward-looking information" and

"forward-looking statements", as defined in applicable securities laws

(collectively, "forward-looking statements"). All statements other than

statements of historical fact are forward-looking statements. Forward-looking

statements relate to future events or future performance and reflect the

Company's current estimates, predictions, expectations or beliefs regarding

future events and include, without limitation, statements with respect to

settlement of other credit obligations and the repayment of the Loan. Often, but

not always, forward-looking statements may be identified by the use of words

such as "expects", "anticipates", "plans", "projects", "estimates", "assumes",

"intends", "strategy", "goals", "objectives" or variations thereof or stating

that certain actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved, or the negative of any of these terms and

similar expressions.

Known and unknown risks, uncertainties and other factors, many of which are

beyond the Company's ability to predict or control, could cause actual results

to differ materially from those contained in the forward-looking statements.

Specific reference is made to the most recent Annual Information Form on file

with certain Canadian provincial securities regulatory authorities for a

discussion of some of the factors underlying forward-looking statements, which

include, without limitation, gold and copper or certain other commodity price

volatility, changes in debt and equity markets, the uncertainties involved in

interpreting geological data, increases in costs, environmental compliance and

changes in environmental legislation and regulation, interest rate and exchange

rate fluctuations, general economic conditions and other risks involved in the

mineral exploration and development industry. Readers are cautioned that the

foregoing list of factors is not exhaustive of the factors that may affect the

forward-looking statements.

All forward-looking statements herein are qualified by this cautionary

statement. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company undertakes no obligation to update

publicly or otherwise revise any forward-looking statements whether as a result

of new information or future events or otherwise, except as may be required by

law. If the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with respect to

those or other forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Aura Minerals Inc.

Josh Perelman

Sr. Financial Analyst

(416) 649-1056

(416) 649-1044 (FAX)

info@auraminerals.com

www.auraminerals.com

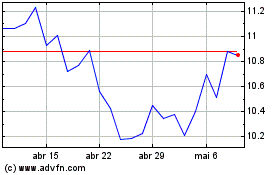

Aura Minerals (TSX:ORA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Aura Minerals (TSX:ORA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025