Aura Minerals Inc. (TSX: ORA, B3: AURA33)

(“

Aura” or the “

Company”), is

pleased to announce that Aura has completed the previously

announced acquisition of Bluestone Resources Inc.

(“

Bluestone”) by way of a plan of arrangement

under Part 5 of Division 9 of the Business Corporations Act

(British Columbia) (the “

Transaction”).

Aura paid approximately C$26,255,313 in cash,

C$0.287 for each Bluestone Share held, and issued 1,007,186 Aura

shares, 0.0183 common shares of Aura for each Bluestone Share held.

Bluestone shareholders also received contingent consideration in

the form of contingent value rights (“CVRs”) providing the holder

thereof with the potential to receive a cash payment of up to an

aggregate amount of C$0.2120 for each Bluestone Share, payable in

three equal annual installments, contingent upon the Cerro Blanco

gold project achieving commercial production. The shares of

Bluestone are expected to be delisted from the TSX Venture Exchange

(“TSXV”) on or around market close on January 14, 2025. Aura will

apply for Bluestone to cease to be a reporting issuer in each

relevant jurisdiction under applicable Canadian securities laws.

The listing of the Aura shares issued as consideration to certain

former holders of Bluestone shares is subject to final approval by

the Toronto Stock Exchange (“TSX”).

Rodrigo Barbosa, CEO of Aura, stated, “Cerro

Blanco is a world-class deposit with over 3 million ounces in

Measured and Indicated (M&I) resources. Over the next few

months, we will be reviewing the feasibility study and exploring

alternatives to optimize the size, risk, and return of the project

while rolling out our Aura 360 concept with the highest

environmental and social standards, preparing it to start

construction. Moreover, the geothermal energy project, with a

capacity to reach 50MW, gives Cerro Blanco a unique angle to use

renewable energy and potentially sell the surplus to Guatemala.

This acquisition exemplifies our ability to execute a growth

strategy. Finally, we welcome one of the most reputable mining

investors, the Lundin family, as our shareholders."

Bluestone is the owner of the Cerro Blanco

Project, which is a near-surface gold deposit located in Jutiapa,

Guatemala. An NI 43-101 technical report and feasibility study on

the project were prepared by G Mining Services and filed publicly

in April 2022 by Bluestone (the “Report”). The

Report contains the following mineral resource estimates: 63.5 Mt

at an average grade of 1.5 g/t of gold and 6.6 g/t of silver for

3.09 Moz of gold, and 13.4 Moz silver contained in the measured and

indicated mineral resources, along with 1.67 Mt at an average grade

of 0.6 g/t Au and 2.1 g/t of silver for 0.031 Moz of gold and 0.112

Moz silver contained in the inferred mineral resources. Bluestone

also owns the Mita Geothermal project, which is an advanced-stage,

renewable energy project licensed to produce up to 50 megawatts of

power. As previously disclosed by Bluestone, on June 17, 2024,

Bluestone received a notice from the Guatemalan Ministry of

Environment (“MARN”) challenging the approval procedure that

approved the surface mining method for Cerro Blanco. In its public

disclosure, Bluestone has clarified its belief that the

environmental permit amendment met and exceeded the terms of

reference provided by the MARN, and that it has adhered to

Guatemalan law in this respect. Aura intends to evaluate the

alternatives for future potential development of Cerro Blanco.

The Company is disclosing contained ounces based

on mineral resource estimates contained in the Report which are

based on an open pit scenario. All mineral resources in the Report

were estimated in accordance with Canadian Institute of Mining and

Metallurgy and Petroleum (CIM) definitions, as required under

National Instrument 43-101 (NI 43- 101), with an effective date of

December 31, 2020. Mineral resources reported in the Report

demonstrate reasonable prospect of eventual economic extraction, as

required under NI 43-101 based on an open pit scenario. Mineral

Resources are not mineral reserves and do not have demonstrated

economic viability.

Qualified Person

The scientific and technical information

contained within this news release has been reviewed and approved

by Farshid Ghazanfari, P.Geo. Mineral resources and Geology

Director for Aura Minerals Inc. and serve as the Qualified Person

as defined in National Instrument 43-101 – Standards of Disclosure

for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking

holistically about how its business impacts and benefits every one

of our stakeholders: our company, our shareholders, our employees,

and the countries and communities we serve. We call this 360°

Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the

Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San

Andres) gold mine in Honduras. The Company’s development projects

include Borborema and Matupá both in Brazil. Aura has unmatched

exploration potential owning over 630,000 hectares of mineral

rights and is currently advancing multiple near-mine and regional

targets along with the Aura Carajas copper project in the prolific

Carajás region of Brazil.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as “plans,” “expects,” “is

expected,” “budget,” “scheduled,” “estimates,” “forecasts,”

“intends,” “anticipates,” or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved. Forward-looking

statements used herein include, but are not limited to: payment of

the contingent cash consideration underlying the CVRs; the expected

timing for de-listing of the common shares of Bluestone from the

TSXV; the application to cease Bluestone from being a reporting

issuer in each relevant jurisdiction; final approval of the TSX;

and evaluating alternatives for future development of Cerro

Blanco.

All forward-looking statements are made based on

the Company’s current beliefs as well as various assumptions made

by the Company and information currently available to the Company.

Generally, these assumptions include, among others: the presence of

and continuity of metals at the Cerro Blanco Project at estimated

grades; metals sales prices and exchange rates assumed; the

availability of acceptable financing; anticipated mining losses and

dilution; success in realizing proposed operations; and anticipated

timelines for community consultations and the impact of those

consultations on the regulatory approval process.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements, including, but

not limited to the fact that the results of the Report may differ

significantly based on the eventual mining method of Cerro Blanco;

the resolution of the challenge by MARN; risks and uncertainties

related to the ability to obtain, amend or maintain necessary

licenses, permits or surface rights; risks associated with

technical difficulties in connection with mining development

activities; risks and uncertainties related to the accuracy of

mineral resource estimates; title matters; risks associated with

geopolitical uncertainty and political and economic instability in

Guatemala; the possibility that future exploration, development or

mining results will not be consistent with the Company’s

expectations; uncertain political and economic environments and

relationships with local communities and government authorities;

risks relating to variations in the mineral content and grade

within the mineral identified as mineral resources from that

predicted; risks related to the volatility in the prices of gold,

copper and certain other commodities; risks related to changes in

debt and equity markets; the uncertainties involved in interpreting

geological data; increases in costs, environmental compliance and

changes in environmental legislation and regulation; interest rate

and exchange rate fluctuations; general economic conditions, and

other risks involved in the mineral exploration and development

industry. Readers are cautioned that the foregoing list of factors

is not exhaustive of the factors that may affect the

forward-looking statements. All forward-looking statements herein

are qualified by this cautionary statement. Accordingly, readers

should not place undue reliance on forward-looking statements. The

Company undertakes no obligation to update publicly or otherwise

revise any forward-looking statements whether as a result of new

information or future events or otherwise, except as may be

required by law. If the Company does update one or more

forward-looking statements, no inference should be drawn that it

will make additional updates with respect to those or other

forward-looking statements.

For more information, please contact Investor Relations:

ri@auraminerals.com

www.auraminerals.com

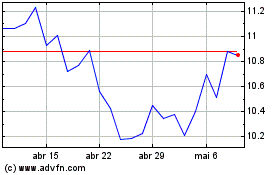

Aura Minerals (TSX:ORA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Aura Minerals (TSX:ORA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025