Stornoway Portfolio Management requests full disclosure and reconsideration of the Jovian Capital Corp Senior Management Profit

28 Abril 2012 - 9:55AM

PR Newswire (Canada)

TORONTO, April 30, 2012 /CNW/ - On February 8, 2012, Jovian Capital

Corp. ("Jovian") issued a press release in connection with its

third quarter 2012 financial results which contained the following

cryptic statement: "In the quarter ended December 31, 2011, Jovian

has recorded a preliminary provision for the Jovian senior

management profit plan of $12.2 million attributed to the results

of both continued and discontinued operations". The Ravensource

Fund, managed by Stornoway Portfolio Management Inc. ("Stornoway"),

is a shareholder of Jovian Capital Corp. Stornoway's calculations

show that the proposed $12.2 million payment amounts to: -- 17.6%

of Jovian's fiscal 2012 net income, including gains on asset

dispositions, to December 31, 2011; -- 9.6% of its book value; --

10.5% of its market capitalization as of April 27, 2012; and --

62.2% of its retained earnings. Alarmed by the sheer scale of the

proposed payment, Stornoway spoke to Jovian's senior management

team to try to understand the aforementioned "senior management

profit plan" (the "Plan") and the rationale behind the size of the

award. Unsatisfied with management's response, Stornoway

wrote to the Board of Directors of Jovian on April 10, 2012 to

request that the Board immediately provide full public disclosure

of all material provisions of the Plan and seriously reconsider the

amounts which were proposed to be paid thereunder. To date,

Jovian's Board has not responded to this request. In the face of a

history of significant operating losses, Jovian's payout to its

senior management under the Plan appears to have been triggered by

a one-time capital gain on the sale of assets. In other words the

payout is, in effect, based on a return of capital rather than a

return on capital. We believe that by granting this massive award,

Jovian's Board is rewarding a management team that has failed

abjectly to create shareholder value. Since the creation of Jovian

in its current form on July 9(th), 2003, Jovian's shares have

declined by 6.2%, or 0.72% on an annualized basis. In comparison,

over the same period of time, the TSX Total Return Index has

appreciated by 114%, or 9% on an annualized basis. As the same

senior management team has been at the helm of Jovian since 2003,

this decline in the share price would seem to reflect the capital

markets' concurrence with our assessment of management's

performance. The quantum of this rich award to senior management,

particularly when measured against the metrics noted above, is

certainly material to Jovian's shareholders. We would have expected

the material terms of the Plan to have been outlined in the

company's periodic Management Discussion and Analysis. Moreover,

given its impact, we are of the view that the Plan itself is a

material contract for Jovian which must be filed publicly. As part

of the compensation package to senior management, we would have

also expected annual detailed disclosure of the Plan in each

management proxy circular delivered to shareholders in connection

with every annual meeting since its adoption, as required by

applicable law. However, after searching through public documents

filed since Jovian became a public company, we could find no such

disclosure. In effect, this Plan is awarding 10% of the company's

equity value to unidentified "senior management". In our view, most

plans of this nature would be structured as equity plans that would

require shareholder approval under applicable TSX rules. In

our recent conversation with Philip Armstrong and Jason Mackey,

Jovian's CEO and CFO, they made it clear to us that Jovian did not

seek shareholder approval of the Plan because the Plan did not

contemplate the issuance of securities to Senior Management. This

strikes us as a matter of form over substance as the effect on

shareholders is the same, namely a transfer of 10% of the equity

value of Jovian to management in the form of cash, rather than

shares, under a compensation plan the terms of which have not been

disclosed to, or approved by, Jovian's shareholders. We strongly

believe that the management of the companies in which we invest

should be well compensated when they deliver superior operating

performance and create shareholder value. In addition, we expect

our investee companies to do so in a transparent manner with full

and proper disclosure. The proposed payout under the Plan

fails both of these tests. Given the failure of the Board to take

any action in response to our concerns, we feel compelled to make

those concerns public. Accordingly, we hereby publicly ask the

Board to: (1) disclose the material provisions of the Plan and the

identities of the members of senior management who are its

beneficiaries; (2) file a copy of the Plan on SEDAR forthwith so it

can be subject to public scrutiny; and (3) reconsider the payments

proposed under the Plan for fiscal 2012. We encourage other Jovian

shareholders who share our concerns regarding this matter to

communicate their concerns to the Board. In addition, we

invite Jovian shareholders and other interested parties to contact

us at the number listed below if they would like to discuss the

matter further. Stornoway Portfolio Management Inc. CONTACT:

Stornoway Portfolio Management Inc.Scott Reid,

President(416)250-2845

Copyright

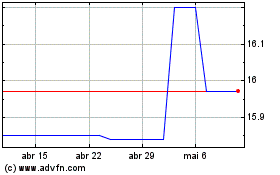

Ravensource (TSX:RAV.UN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

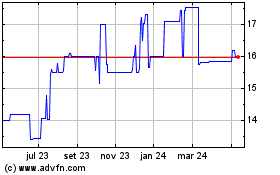

Ravensource (TSX:RAV.UN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024