Canadian Zinc Announces Filing of Final Prospectus

24 Julho 2014 - 7:00AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Canadian Zinc Corporation (TSX:CZN)(OTCQB:CZICF) ("the Company" or "Canadian

Zinc") is pleased to announce it has filed a final prospectus in connection with

the previously announced $15 million bought deal public offering and that a

receipt has been issued by the British Columbia Securities Commission.

As announced on July 9, 2014, the Company has entered into an agreement with

Dundee Securities Ltd., on behalf of a syndicate of underwriters including

Canaccord Genuity and Paradigm Capital (together, the "Underwriters"), to

purchase on a "bought deal" basis by way of short form prospectus, 13,160,000

flow-through common shares of the Company ("Flow-Through Shares") and 28,572,000

units of the Company ("Units") subject to all required regulatory approvals at a

price per Flow-Through Share of $0.38 for gross proceeds of $5,000,800 and at a

price per Unit of $0.35 for gross proceeds of $10,000,200 (the "Offering").

Each Unit shall consist of one common share of the Company ("Share") and

one-half of one common share purchase warrant ("Warrant"). Each whole Warrant

shall entitle the holder thereof to acquire one Share at a price of $0.50 for a

period of 36 months following the Closing Date.

The Offering is scheduled to close on or about July 31, 2014 (the "Closing Date").

Closing of the Offering is subject to a number of conditions, including, without

limitation, receipt of all necessary approvals, including the approval of the

Toronto Stock Exchange.

The Underwriters have been granted an option to purchase up to an additional 15%

of the Offering, exercisable in whole or in part at any time up to 30 days

following the Closing Date.

This press release does not constitute an offer to sell or a solicitation of an

offer to buy nor shall there be any sale of any of the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful. The

securities have not been and will not be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities Act"), or the

securities laws of any state of the United States and may not be offered or sold

within the United States or to or for the account or benefit of a U.S. Person or

a person in the United States (as such terms are defined in Regulation S under

the U.S. Securities Act) unless registered under the U.S. Securities Act and

applicable state securities laws or pursuant to an exemption from such

registration requirements.

About Canadian Zinc

Canadian Zinc is a TSX-listed exploration and development company trading under

the symbol "CZN". The Company's key project is the 100%-owned Prairie Creek

Project, a fully permitted, advanced-staged zinc-lead-silver property, located

in the Northwest Territories.

The Prairie Creek Project contains a Mineral Reserve of 5.2 million tonnes

averaging 9.4% zinc, 9.5% lead and 151 g/t silver. In addition, Prairie Creek

hosts an Inferred Resource of 6.2 million tonnes averaging 14.5% zinc, 11.5%

lead, 0.57% copper and 229 g/t silver. (AMC Mining Consultants (Canada) Ltd. J M

Shannon and D Nussipakynova, Qualified Persons, June 2012, (revised July 23,

2014).

A Preliminary Feasibility Study was completed by SNC-Lavalin in July 2012.

Prairie Creek is an underground operation that will utilize multiple mining

methods to access readily available ore. Canadian Zinc has the majority of

infrastructure in place including a 1,000 tonne per day mill, five kilometres of

underground workings and related equipment, a heavy duty and light duty surface

fleet, three exploration diamond drills and a 1,000 m airstrip.

Canadian Zinc also owns an extensive land package in central Newfoundland that

it is exploring for Cu-Pb-Zn-Ag-Au deposits. Key projects include the South

Tally Pond project (Lemarchant deposit), the Tulks South project

(Boomerang-Domino deposit) and Long Lake project (Long Lake deposit). The

Company's strategy is to continue build the zinc-copper-lead-silver-gold

resources base with the aim of developing the deposits capable of processing

through a central milling facility.

Qualified Person

Alan Taylor, P.Geo., Vice President of Exploration, Chief Operating Officer and

Director of the Company, who is a Non-Independent Qualified Person as defined in

National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has

prepared, supervised the preparation of, or reviewed, parts of this press

release that are of a scientific or technical nature.

Cautionary Statement - Forward-Looking Information

This press release contains certain forward-looking information and

forward-looking statements within the meaning of applicable Canadian and United

States securities laws, including, among other things, the expected completion

of acquisitions and the advancement of mineral properties and the timing for

closing of the offering. This forward looking information includes, or may be

based upon, estimates, forecasts, and statements as to management's expectations

with respect to, among other things, the completion of transactions, the issue

of permits, the size and quality of mineral resources, future trends for the

company, progress in development of mineral properties, future production and

sales volumes, capital costs, mine production costs, demand and market outlook

for metals, future metal prices and treatment and refining charges, the outcome

of legal proceedings, the timing of exploration, development and mining

activities, acquisition of shares in other companies and the financial results

of the company. There can be no assurances that such statements will prove to be

accurate and actual results and future events could differ materially from those

anticipated in such statements. Mineral resources that are not mineral reserves

do not have demonstrated economic viability. Inferred mineral resources are

considered too speculative geologically to have economic considerations applied

to them that would enable them to be categorized as mineral reserves. There is

no certainty that mineral resources will be converted into mineral reserves. Any

forward-looking statements are made as of the date of this press release and the

Company does not undertake to update any forward-looking statements that may be

made from time to time by or on behalf of the Company other than as required by

applicable securities laws.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission ("SEC") permits U.S. mining

companies, in their filings with the SEC, to disclose only those mineral

deposits that a company can economically and legally extract or produce. We use

certain terms in this press release, such as "measured," "indicated," and

"inferred" "resources," which the SEC guidelines prohibit U.S. registered

companies from including in their filings with the SEC.

FOR FURTHER INFORMATION PLEASE CONTACT:

John F. Kearney

Chairman

(416) 362-6686

220 Bay Street, Suite 700

Toronto, ON M5J 2W4

Fax: (416) 368-5344

Alan B. Taylor

Vice President Exploration & Chief Operating Officer

(604) 688-2001

Suite 1710 - 650 West Georgia Street, Vancouver, BC V6B 4N9

Fax: (604) 688-2043

Tollfree: 1-866-688-2001

Steve Dawson

Vice President Corporate Development

(416) 203-1418

220 Bay Street, Suite 700

Toronto, ON M5J 2W4

Fax: (416) 368-5344

Canadian Zinc Corporation

E-mail: invest@canadianzinc.com

Website: www.canadianzinc.com

Senvest Capital (TSX:SEC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

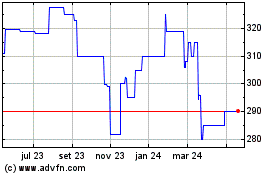

Senvest Capital (TSX:SEC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024