Urbana Corporation Files Amended and Restated Preliminary Prospectus

23 Outubro 2009 - 4:42PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. WIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

Urbana Corporation ("Urbana") (TSX:URB)(TSX:URB.A) has filed an amended and

restated preliminary short form prospectus with Canadian securities

administrators, providing for the offering of units (the "Units") and amending

and restating the preliminary prospectus filed on October 21, 2009. The

prospectus was amended to add the full syndicate of agents, consisting of

co-lead agents Blackmont Capital Inc. and National Bank Financial Inc. and

including BMO Nesbitt Burns Inc., CIBC World Markets Inc., HSBC Securities

(Canada) Inc., Raymond James Ltd., Scotia Capital Inc., TD Securities Inc.,

Cormark Securities Inc., Canaccord Capital Inc. and GMP Securities L.P. and to

insert the price of the Units, which are being offered at $1.90 per Unit. Each

Unit will be comprised of one non-voting Class A Share ("Non-Voting Class A

Share") in the capital of Urbana and one-half of one Series B Non-Voting Class A

Share purchase warrant ("Warrant"), which will entitle the holder of a whole

Warrant to buy at any time up to two years after closing of the Offering, one

Non-Voting Class A Share at an exercise price of $2.50. A copy of the amended

and restated preliminary prospectus is available at www.sedar.com under Company

Profiles - Urbana Corporation.

The securities described herein have not been and will not be registered under

the United States Securities Act of 1933, as amended, and may not be offered or

sold in the United States absent registration or an applicable exemption from

registration requirements.

Urbana is an investment fund corporation that is listed on the Toronto Stock

Exchange. Urbana's current investment focus is acquiring interests in private

and public exchange properties around the world for long-term gains. Currently,

Urbana's portfolio includes shares or seats of NYSE Euronext, TMX Group, Chicago

Board Options Exchange and The Bombay Stock Exchange, among others.

Caldwell Investment Management Ltd. ("CIM") is the investment manager of Urbana.

Thomas S. Caldwell, the Chairman of CIM is also the Chairman and President of

Urbana.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of the Units in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

Forward Looking Statements

Certain statements included in this news release constitute forward-looking

statements that involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of Urbana or

industry results to be materially different from any future results, performance

or achievement expressed or implied by such forward-looking statements. When

used in this news release, words such as "may", "could", "anticipate",

"believe", "plan", "estimate", "expect", "intend" and similar expressions to the

extent they relate to Urbana or CIM are intended to identify forward-looking

statements. These statements reflect Urbana's and CIM's current views regarding

future results or events, are based on information currently available to Urbana

and CIM and speak only as of the date hereof. Forward-looking statements are

based on assumptions and are subject to a number of risks and uncertainties that

could cause the actual results, performance or achievements of Urbana to be

materially different from any future results, performance or achievements that

may be expressed or implied by such forward-looking statements. These

assumptions and risks include, among others, the ability of CIM to find suitable

investments for Urbana; fluctuations in the value of Urbana's investments;

changes in the market prices of securities in which Urbana has an interest;

risks related to fluctuations in market conditions and currencies, the risk that

certain exchanges may have restrictions on ownership and result in illiquid

investments; the concentration of Urbana's investments in the exchange industry

and among certain geographic regions or countries; risks related to foreign

government policies, political or social instability and foreign withholding

taxes; the risk that the offering may not be completed or if completed, will be

completed on terms otherwise than as contemplated herein; the risk that certain

exchanges may have restrictions on ownership and result in illiquid investments;

the concentration of Urbana's investments in the exchange industry and among

certain geographic regions or countries; risks related to foreign government

policies, political or social instability and foreign withholding taxes; the

reliance on and discretion of CIM in making investment decisions; the

potentially high rate of portfolio turnover; risks related to the effect of

consolidation on Urbana's competitive position; reliance on key personnel of

Urbana and CIM; conflicts of interest between Urbana, CIM and other funds and

portfolios managed by CIM;

the possibility of termination of the investment management agreement between

Urbana and CIM; the effect of alternative trading systems on exchanges in which

Urbana has an interest; risks related to the fact that the Non-Voting Class A

Shares may trade at a discount to the net asset value per share; risks related

to the use of leverage and short-term margin borrowings; the absence of a prior

public market for the Warrants; the potential decrease in the market price of

Non-Voting Class A Shares and Warrants if Urbana issues additional securities;

risks related to short selling; the use of options; and risks related to legal

and tax matters and the regulatory environment, and other factors which are

discussed in the section entitled "Risk Factors" in the preliminary prospectus,

in other sections of the preliminary prospectus and in Urbana's Annual

Information Form under the heading "Risk Factors". Although the forward-looking

statements contained in this news release are based on what Urbana and CIM

believe are reasonable assumptions, should one or more of these risks or

uncertainties materialize, or should the assumptions underlying the

forward-looking statements prove incorrect, actual results may vary materially

from those described herein as intended, planned, anticipated, believed,

estimated or expected. Readers should not place undue reliance on forward-

looking statements. Unless required by applicable securities law, Urbana does

not intend, and does not assume any obligation, to update or revise these

forward-looking statements.

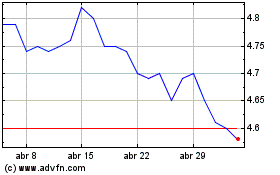

Urbana (TSX:URB.A)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Urbana (TSX:URB.A)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024