Wireless Matrix Corporation (TSX: WRX), the leading provider of

mobile resource management solutions targeting field service

organizations is pleased to provide the results for its three and

six months ended October 31, 2008 (second quarter of fiscal 2009).

All currency expressed in U.S. dollars.

During the second quarter, Wireless Matrix continued to drive

revenue growth and strengthen its leadership position in the mobile

resource management space. The Corporation has experienced

increased adoption of its software-as-a-service solution suite,

FleetOutlook, resulting in a 12% increase in service revenue over

the second quarter of fiscal 2008 and a vibrant, high quality sales

pipeline. The subscriber growth has created over $1,040,000 in

adjusted earnings before interest, taxes, depreciation and

amortization ("adjusted EBITDA") and net income of $483,000, a

sizable improvement over prior year's losses.

"The second quarter was another quarter of healthy revenue

growth and solid execution for Wireless Matrix. Clients continue to

embrace our application suite to reduce operating costs and drive

productivity gains despite the tough economic environment due to

the rapid returns our solutions offer." said J. Richard Carlson,

president and chief executive officer of Wireless Matrix. "We have

released into production our first low cost GPS wireless broadband

device, the Reporter 100 and will soon release an in-cab personal

navigation device. These low priced devices, when coupled with

innovation on the FleetOutlook platform, will accelerate subscriber

additions by driving additional productivity savings, opening up

the small-to-medium sized business fleets market as well as price

sensitive enterprise fleet segments to the Company."

The first six months of fiscal 2009 included new subscriber

additions in the rail industry from major operators like Union

Pacific, General Electric and CSX; additional activations from

Cable One and Time Warner in the cable & broadband space;

further penetration of the utility vertical and six new rural

cooperatives; and additions in other vertical markets including the

oil and gas sector. Wireless Matrix is continuing to experience

strong sales momentum, despite current economic conditions, in each

of these rapidly growing markets as demonstrated by its growing

sales pipeline and subscriber additions. Wireless Matrix ended the

second quarter fiscal 2009 with 66,777 application and data

communication subscribers, a growth of 12% over the same period in

the prior year.

"We have the financial strength to grow through the overall

economic storm, with service revenue growth of 12% over the prior

year's comparable quarter, recurring revenues from high margin long

term contracts, over $16 million of cash in the bank, no debt, and

operations that are generating substantial cash flow." said Maria

C. Izurieta, chief financial officer of Wireless Matrix.

The Corporation's subscriber gains resulted in another quarter

of strong financial results, healthy growth and improved metrics

for the three months ended October 31, 2008.

- Grew hosted applications subscribers base to over 37% of total

subscribers.

- Generated recurring service revenue of $6,686, of which,

application revenues accounted for 26% of service revenues, and

increased 13% over the second quarter of fiscal year 2008.

- Total revenue growth of 7% over the second quarter of fiscal

2008 to $9,701.

- Increased service gross margin to $4,858, an increase of 17%

over the prior year's comparable quarter.

- Achieved adjusted EBITDA of $1,040 for the second quarter

fiscal 2009, an increase over the prior fiscal year's second

quarter of 781%.

- Generated net income for the second quarter fiscal 2009 of

$483, an increase of 157% over the net loss in the second quarter

fiscal 2008 of $847.

- Drove cash flows from operations of $2,782, an improvement of

$1,984 when compared with the same period in the last fiscal

year.

- Grew the cash balance from $14,078 at the end of fiscal 2008

to $16,499 at the end of the second quarter fiscal of 2009, with no

debt, resulting in a strong balance sheet.

Financial Highlights:

----------------------------------------------------------------------------

All currency in thousands Three months ended, Six months ended,

except per share and ARPU data October 31, October 31,

----------------------------------------------------------------------------

2008 2007 2008 2007

----------------------------------------------------------------------------

Network services revenues $4,933 $ 4,414 $9,829 $ 8,432

----------------------------------------------------------------------------

Application services revenue 1,753 1,555 3,544 2,887

----------------------------------------------------------------------------

6,686 5,969 13,373 11,319

----------------------------------------------------------------------------

Hardware revenues 3,015 3,130 5,542 5,630

----------------------------------------------------------------------------

Total revenues 9,701 9,099 18,915 16,949

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross margin 5,461 4,672 10,835 8,859

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Service gross margin % 73% 70% 73% 70%

----------------------------------------------------------------------------

Hardware gross margin % 20% 17% 18% 16%

----------------------------------------------------------------------------

Gross margin % 56% 51% 57% 52%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating expenses 4,421 4,554 8,773 8,490

----------------------------------------------------------------------------

Adjusted EBITDA 1,040 118 2,062 369

----------------------------------------------------------------------------

Net income (loss) $ 483 ($847) $ 854 ($1,244)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic and diluted (loss)

income per share: $ .01 ($0.01) $ .01 ($0.02)

----------------------------------------------------------------------------

Weighted average number of

common shares outstanding

- basic 82,619,916 82,521,469 82,629,978 78,816,487

----------------------------------------------------------------------------

Weighted average number of

common shares outstanding

- diluted 83,177,195 82,521,469 83,283,493 78,816,487

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash balance 16,499 11,740 16,499 11,740

----------------------------------------------------------------------------

Working Capital 12,129 12,137 12,129 12,137

----------------------------------------------------------------------------

Total subscribers 66,777 59,574 66,777 59,574

----------------------------------------------------------------------------

Average Revenue Per Unit

(ARPU) $32.93 $ 32.79 $32.93 $ 32.79

----------------------------------------------------------------------------

About Wireless Matrix:

Wireless Matrix provides enterprise-class wireless data

solutions for business-critical mobile and remote asset operations.

The Corporation delivers real-time data services across cellular,

satellite and WiFi networks; a variety of modems and hardware

platforms; and transportation applications that increase

productivity and reduce operating expenses with service fleet

operations. Wireless Matrix is headquartered in Reston, VA, and has

offices in San Francisco, CA, and Burnaby, British Columbia. For

more information visit www.wrx-us.com.

Forward Looking Statements:

General information regarding the Corporation set forth in this

document, including management's assessment of the Corporation's

future plans and operations contains forward looking statements

that involve substantial known and unknown risks and uncertainties.

These forward looking statements are subject to numerous risks and

uncertainties, some of which are beyond the Corporation's and

management's control, including but not limited to, the impact of

general economic conditions, industry conditions, fluctuation of

commodity prices, fluctuation of foreign exchange rates,

imperfection of estimates, effective integration of acquisitions,

industry competition, availability of qualified personnel and

management, stock market volatility, timely and cost effective

access to sufficient capital from internal and external sources,

ability to integrate and realize anticipated benefits from

acquisitions, ability to resell third party network communications

at favorable rates, and to effectively manage growth. The

Corporation's actual results, performance or achievement could

differ materially from those expressed in or implied by, these

forward looking statements and accordingly, no assurance can be

given that any of the events anticipated to occur or transpire from

the forward looking statements will provide what, if any benefits

to the Corporation. All data presented herein should be read in

conjunction with the Corporation's regulatory filings, with the

appropriate Securities Commission and SEDAR. These filings,

including the Corporation's Annual Information Form ("AIF''), are

located at www.sedar.com.

The Toronto Stock Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Contacts: Wireless Matrix Corporation Maria C. Izurieta Investor

Relations (703) 262-4020 Email: maria.izurieta@wrx-us.com Website:

www.wrx-us.com

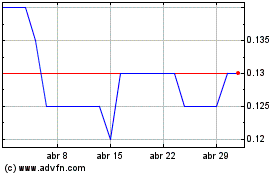

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

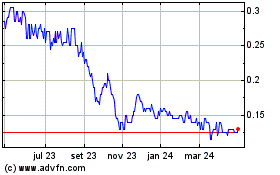

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024