Asia Packaging Group Inc. (Formally HT Capital) Announces 2011 Annual Financial Results

04 Agosto 2011 - 2:04PM

Marketwired Canada

Asia Packaging Group Inc. (TSX VENTURE:APX) ("Asia Packaging" or the "Company")

announced the financial results of its wholly owned subsidiary, Mei Tak (HK)

Group Inc. ("Mei Tak") for the twelve-month period ending March 31, 2011.

Interim Financial Results

Highlights

-- On April 26, 2011 Asia Packaging completed a Qualifying Transaction with

HT Capital (formally TSX VENTURE:HKT.P) a capital pool company.

-- After completion of the Qualifying Transaction, and after the issuance

of Milestone Shares (see "Qualifying Transaction" below), Asia Packaging

will have total shares outstanding of 127.8 million basic and 133.4

million fully diluted.

-- Asia Packaging is in the business of manufacturing and sales of

packaging materials thru its 100% ownership of Mei Tak and Mei Tak's

wholly owned subsidiary, Qingfeng (Jiangxi) Packing Material Technology

Co., Ltd.

-- During the 12 month period ending March 31, 2011, Mei Tak achieved

revenues of $38.7 million representing 24% growth over the previous

fiscal year.

-- Gross margin for Mei Tak was 25% during the year ended March 31, 2011

and earnings before tax was $9.1 million representing 36% growth over

fiscal 2010.

-- Net Income for the year ended March 31, 2011 was $8.0 million which,

based on the current basic shares outstanding, would be $0.06 earnings

per share.

The financial statements and Management Discussion and Analysis for the HT

Capital (the capital pool company) as well as the audited financial statements

for Mei Tak are available on SEDAR.

Background

Asia Packaging changed its name on July 13, 2011 after completion of the

acquisition of Mei Tak by a capital pool company, HT Capital, on April 26, 2011

("Qualifying Transaction"). The Company commenced trading on May 2, 2010 as a

Tier 2 Technology/Industrial issuer on the TSXV, and graduated from being a

Capital Pool Company listed on the TSXV. (See "Qualifying Transaction" below)

As a Tier 2 Technology issuer, Asia Packing Group Inc. holds all of the issued

and outstanding shares of Mei Tak , which is a Hong Kong company incorporated

under the Companies Ordinance of Hong Kong. Mei Tak is a holding company that

holds all of the issued and outstanding shares of Qingfeng (Jiangxi) Packing

Material Technology Co., Ltd. ("Qingfeng"), which is a wholly foreign owned

enterprise, incorporated under the business laws of the PRC and is based in the

County of Fengxin, City of Nanchang, PRC.

Mei Tak operates in the packaging industry through Qingfeng and provides

packaging products and services to Chinese companies in the drug and

pharmaceutical as well as food sectors. Qingfeng's current products include cast

polypropylene films, polypropylene bags and containers, and it also offers

multi-colour printing and related packaging services. Qingfeng currently

supplies packaging products and services to over 200 Chinese customers in China.

Selected audited annual financial information for Mei Tak is as follows:

Years Ended March 31 2008 2009 2010 2011

---------------------------------------------------------------------------

Total revenues $10.50 $15.40 $31.30 $38.66

Gross margin 9.40% 15.20% 23.20% 25.16%

Earnings before tax $ 0.60 $ 2.00 $ 6.70 $ 9.11

Earnings after tax $ 0.60 $ 2.00 $ 6.40 $ 7.96

Cash $ 0.10 $ 1.20 $ 2.00 $ 3.23

Net working capital $ 2.40 $ 3.30 $ 6.50 $ 8.81

Qualifying Transaction

On October 10, 2010, the Company entered into a letter agreement (the "Letter

Agreement") amended on December 8, 2010 and January 29, 2011 for the arm's

length acquisition of 100% of the common shares of Mei Tak. This transaction was

intended to be the Company's Qualifying Transaction under Exchange Policy 2.4.

Pursuant to the Letter Agreement, the Company acquired all of the issued and

outstanding shares of Mei Tak in consideration for 80,000,000 common shares in

the capital of the Company (the "Payment Shares"). This resulted in Mei Tak's

shareholders holding approximately 75% of the outstanding shares of the Company

immediately after the closing (the "Closing") of the Qualifying Transaction.

As additional consideration, in the event that Qingfeng achieves a minimum

consolidated net profit of RMB 50 million (approx. $7.7 million) for the fiscal

year ended on March 31, 2011, as evidenced by the Company's consolidated audited

financial statements for the fiscal year ended on March 31, 2011 (the "2011

Audited Financial Statements"), the Company will issue to the shareholders of

Mei Tak an additional 20,000,000 common shares (the "Milestone Shares") within

10 business days from the date the 2011 Audited Financial Statements are

published.

The Payment Shares and the Milestone Shares will be subject to the standard

escrow requirements imposed by Exchange policies. In addition, the Company will

be required to maintain a Public Float (as such term is defined under the

Exchange's policies) of no less than 20% of the Company's total issued common

shares. Accordingly, any Payment Shares or Milestone Shares that, through their

issuance would result in a contravention of the 20% Public Float requirements,

will also be escrowed in a manner acceptable to the Exchange, with such shares

only being released from this additional escrow when to do so would not

contravene the 20% Public Float requirement.

On April 26, 2011, the Company closed the proposed Qualifying Transaction.

Concurrent with the Qualifying Transaction, the Company completed a non-brokered

private placement of 20,288,800 units (the "Units") at $0.40 per Unit. Each Unit

is comprised of one common share in the capital of the Company (each, a "Common

Share") and one-half of one Common Share purchase warrant (each, a "Warrant").

Each full warrant is exercisable into one Common Share for a period of two years

following the closing of the Qualifying Transaction, at 0.60 in the first year

and $1.00 in the second year.

This news release contains certain statements that may be deemed "forward

looking statements". Forward looking statements are statements that are not

historical facts and are generally, but not always, identified by the words

"expects,", "plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or conditions

"will", "would", "may", "could" or "should" occur. Although the Company believes

the expectations expressed in such forward looking statements are based on

reasonable assumptions, such statements are not guarantees of future performance

and actual results may differ materially from those in forward looking

statements. Forward looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made. The

Company undertakes no obligation to update these forward looking statements,

except as required by law, in the event that management's beliefs, estimates or

opinions, or other factors, should change.

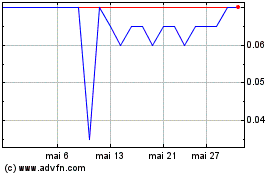

Apex Resources (TSXV:APX)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

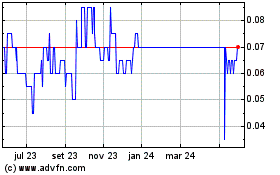

Apex Resources (TSXV:APX)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024