Avante Logixx Inc. Announces Q3 Revenue up 32% and Gross Profit up 48%

17 Janeiro 2014 - 1:17PM

Marketwired

Avante Logixx Inc. Announces Q3 Revenue up 32% and Gross Profit up

48%

TORONTO, ONTARIO--(Marketwired - Jan 17, 2014) - Avante Logixx

Inc. ("the Company") (TSX-VENTURE:XX)(OTCBB:ALXXF), through its

wholly owned subsidiary, Avante Security Inc., provides best in

class residential and commercial security services including system

design and installation, rapid alarm response, alarm monitoring and

secure transport through the use of advanced technology and a focus

on client service. The Company is pleased to announce its results

for the quarter ended December 31, 2013:

|

Quarter ended |

Nine month period ended |

|

Dec 31, 2013 |

Dec 31, 2012 |

Variance |

Dec 31, 2013 |

Dec 31, 2012 |

Variance |

|

|

|

|

|

|

|

| Total

revenues |

$2,259,091 |

$1,711,785 |

32.0% |

$6,737,945 |

$4,668,028 |

44.3% |

|

Revenues - Recurring Monitoring and

Response1 |

801,197 |

717,633 |

11.6% |

2,339,145 |

2,084,915 |

12.2% |

|

Revenues from other security services and transport |

1,457,894 |

994,152 |

46.6% |

4,398,800 |

2,583,113 |

70.3% |

| Total

gross profit |

858,464 |

580,880 |

47.8% |

2,606,692 |

1,514,463 |

72.1% |

|

Adjusted EBITDA2 |

336,941 |

112,530 |

|

1,095,531 |

136,684 |

|

| Net

income (loss) for the period |

279,149 |

85,395 |

|

1,017,851 |

75,536 |

|

| Basic

income (loss) per share |

0.005 |

0.002 |

|

0.018 |

0.001 |

|

|

Diluted income (loss) per share |

0.005 |

0.002 |

|

0.017 |

0.001 |

|

|

|

|

|

|

|

|

| Total

common shares outstanding |

55,983,843 |

55,908,843 |

|

55,983,843 |

55,908,843 |

|

| Total

assets |

$3,542,138 |

$1,841,902 |

|

$3,542,138 |

$1,841,902 |

|

|

|

|

|

|

|

|

|

Total liabilities (excluding deferred revenue) |

796,566 |

621,123 |

|

796,566 |

621,123 |

|

|

Deferred revenue |

1,489,804 |

1,342,409 |

|

1,489,804 |

1,342,409 |

|

| Total

liabilities |

2,286,370 |

1,963,532 |

|

2,286,370 |

1,963,532 |

|

| Bank

and other debt |

-nil- |

-nil- |

|

-nil- |

-nil- |

|

|

Shareholders' equity |

1,255,768 |

(121,630) |

|

1,255,768 |

(121,630) |

|

|

|

|

|

|

|

|

| 1 Revenues - Recurring Monitoring and Response

includes Alarm Response along with Digital, Wireless and Video

Monitoring services |

| 2 Adjusted EBITDA = Net income (loss) + Income tax

+ Depreciation / amortization + Shared based payments

expense |

Co-CEOs George Rossolatos and Emmanuel Mounouchos announced

Avante Logixx Inc.'s results for the quarter ended December 31,

2013. The Company reported strong results driven by growth across

all lines of business.

Net income for the quarter was $279,149 as compared to $85,395

for the same quarter in the prior fiscal year. Adjusted EBITDA for

the quarter was $336,941 (December 31, 2012: $112,530). The Company

continues to focus on organic growth in the Rapid Alarm Response,

Security Monitoring and Installations segments, while developing

new security solutions for residential and corporate customers.

This was evidenced by growth of approximately 10% in both Alarm

Response and Monitoring respectively. Overall growth in recurring

security revenue has continued to trend over 10%.

The Avante Intelligent Perimeter Protection ("AIPP"), a recent

offering, comprises both Intrusion Detection and Intelligent Video

Analytics, using sophisticated software algorithms to study the

environment the camera is focused on. When the camera detects an

intrusion by an individual, the Avante Control Centre is instantly

notified. Avante's response team acts on these alerts immediately,

typically arriving at the scene within six minutes or less on

average. The AIPP creates a perimeter 'bubble' around homes and

businesses, detecting intruders before a break-in attempt

occurs. The number of customers using this solution has grown by

more than 150% as compared to December 31, 2012.

International Security Travel Advisory Services ("ISTAS") is

another recent offering by Avante. With this offering, Avante is

working with several multinational companies to ensure that their

travelling employees have appropriate protection, transportation

services and logistics while travelling to places which are

considered to be higher risk environments. ISTAS has shown

significant growth in the past year. Revenues from this offering

were almost 175% as much as the quarter ended December 31, 2012.

ISTAS revenue depends on the international activities of our

clients during the period and is not recurring in nature.

Avante's prospects for the remainder of fiscal 2014 continue to

be positive. The company's cash balance rose to over $1.5 million

at December 31, 2013 with no debt. Management believes that there

are significant opportunities for organic growth or for the Company

to consolidate and further improve its market share, which would

result in increased profitability.

Avante Logixx Inc. (TSX-VENTURE:XX)(OTCBB:ALXXF) is a Toronto

based security and technology company. Its primary operating

division, Avante Security Inc. (www.avantesecurity.com), provides

best in class security response and other security services for

residential and commercial applications as well as being an

industry leader in designing and installing complex security

systems, access control, intelligent video analytics and smart home

automation. The company continuously develops innovative products

and applications within its core competencies. Please visit

www.avantelogixx.com.

Forward looking information: The information set forth

in the Company's MD&A and this press release to readers may

contain statements concerning Avante's future results, future

performance, intentions, objectives, plans and expectations that

are, or may be deemed to be, forward-looking statements or

information within the meaning of securities laws. In some cases,

forward-looking information can be identified by the use of terms

such as "may", "will", "should", "expect", "plan", "anticipate",

"believe", "intend", "estimate", "predict", "potential", "continue"

or other similar expressions concerning matters that are not

historical facts. Forward-looking statements are not guarantees of

future performance.

These forward-looking statements are based on current

expectations that involve numerous risks and uncertainties,

including, but not limited to, those identified in the Risks

Factors section of the Filing Statement the Company filed with

regulatory authorities on February 28, 2008. Assumptions relating

to the foregoing involve judgments with respect to, among other

things, future economic, competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond Avante's

control. Although Avante believes that the assumptions underlying

the forward-looking statements are reasonable, any of the

assumptions could prove inaccurate. These factors should be

considered carefully, and readers should not place undue reliance

on forward-looking statements. Avante has no intention and

undertakes no obligation to update or revise any forward-looking

statements, whether written or oral that may be made by or on the

Company's behalf.

Please visit our newly updated websites at www.avantelogixx.com

and www.avantesecurity.com and consider joining our investor email

list.

Avante Logixx Inc.George RossolatosCo-CEO(416) 923-6984

x221george@avantelogixx.comAvante Logixx Inc.Leland

VernerChairman(416) 823-7474leland@avantelogixx.com

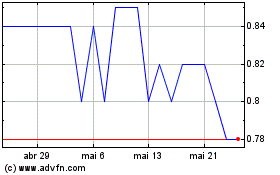

Avante (TSXV:XX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Avante (TSXV:XX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024