Aberdeen Asia-Pacific Income Investment Company

Limited (the “Company”) (TSX: FAP), a closed-end investment

company trading on The Toronto Stock Exchange, today announced

performance data and portfolio composition details as of April 30,

2011.

The Company’s total returns for various periods

through April 30, 2011 are provided below. (All figures are based

on distributions reinvested at the dividend reinvestment price and

are stated net-of-fees):

Period

NAV Total Return (%)

Market Price Total Return (%)

Cumulative

Annualized Cumulative

Annualized Since inception (June 1986) 601.3

8.2 639.2 8.4 10-years

90.4 6.6 151.0

9.6 5-years 30.8 5.5

42.7 7.4 3-years 20.0

6.3 42.2 12.5 1-year

10.5 20.4

The Company’s returns, which are denominated in

Canadian dollars, are affected by the performance of the Canadian

dollar against the various currencies listed below.

As of April 30, 2011, the portfolio was

invested as follows:

Currency Exposure (%) Geographic

Exposure (%) Australia 26.6 25.0

New Zealand 0.9 0.6

United States *

21.1 1.6 Canada 0.2 0.2

Mexico 9.7 9.7 United Kingdom

- 0.7 Germany -

0.6 Norway - 0.1

Brazil 8.9

8.9 Turkey 3.7 3.7

South Korea -

3.5 Singapore - 0.4 Thailand

- 0.9 Philippines 6.7

9.1 Malaysia - 1.2 India

9.0 12.5 China -

2.7 Hong Kong - 3.1 Indonesia

13.2 15.5

*Of which 19.2% held in US$ denominated

bonds issued by foreign issuers.

As of April 30, 2011, the top ten holdings of

the portfolio based on total assets were as follows:

Holding

Coupon / Maturity (%)

Turkey Government Bond 16.00%, 03/07/2012

3.4 Philippine Government 9.13%, 09/04/2016

3.4 Philippine Government 7.00%,

01/27/2016 3.3 India Government 7.02%,

08/17/2016 3.0 Mexico Government 9.50%,

12/18/2014 2.9 Mexican Bonos 8.50%,

05/31/2029 2.7 Federal Republic of Brazil

10.00%, 01/01/2012 2.6 Mexico Government

8.50%, 12/13/2018 2.6 Brazil Notas de

Tesouro Nacional (Series F) 10.00%, 01/01/2021

2.6 Nota de Tesouro Nacional 10.00%,

01/01/2017 2.5

TOTAL

29.0

As of April 30, 2011 the holdings of the

portfolio represented approximately 67.6% sovereign and state

government securities, 3.0% supranationals, 27.3% corporates, 1.3%

cash and 0.8% mortgage backed securities.

As of April 30, 2011, the Company’s net assets,

including C$137.6 million in bank borrowing, amounted to C$492.5

million. The net asset value per ordinary share was C$6.86.

As of April 30, 2011, 43.0% of the portfolio

was invested in securities where either the issue or the issuer was

rated “A” or better, or judged by the Investment Manager to be of

equivalent quality.

The credit quality and maturity breakdown of

the portfolio was as follows:

Credit Quality (%) AAA/Aaa AA/Aa

A BBB/Baa BB/Ba B

16.7 7.6 18.7 22.8

34.0 0.2

Maturity (%) 10

Years 17.3 25.8 39.7 17.2

As of April 30, 2011, the average maturity of

the portfolio was 7.0 years.

The Company has a Normal Course Issuer Bid

(“NCIB”) in place whereby shares of the Company may be purchased at

times when the market price per share trades at a discount in

excess of 8% to the Company’s net asset value per share. During the

month of April there were no shares purchased under the NCIB.

The Fund has in place leverage in the form of a

loan facility that renews annually. The outstanding balance on the

loan as of April 30, 2011 is US$145,000,000, which represents no

change from the previous month.

The leverage is used with the intent of

enhancing returns by borrowing at interest rates that are lower

than the relatively higher yields of the Asian-Pacific fixed income

securities in which the Company invests. The Company has entered

into interest rate swap agreements in order to fix the interest

payable on a portion of the credit facility. Details regarding the

revolving credit loan facility and the interest rate swap

agreements are contained in the Company’s annual and semi-annual

reports to shareholders.

Important Information

Aberdeen Asset Management Inc., the

Company’s Administrator, has prepared this report based on

information sources believed to be accurate and reliable. However,

the figures are unaudited and neither the Company, the

Administrator, Aberdeen Asset Management Asia Limited (the

Investment Manager), Aberdeen Asset Management Limited (the

Investment Advisor), Aberdeen Fund Management Limited (the

Sub-Adviser), nor any other person guarantees their accuracy.

Investors should seek their own professional advice and should

consider the investment objectives, risks, charges and expenses

before acting on this information.

Total return figures are stated

net-of-fees, in C$ and represent past performance. They assume

reinvestment of dividends at the dividend reinvestment price on the

ex-dividend date and include long-term capital gains. The returns

are not adjusted for any issuance of rights or warrants by the

Company. Past performance is not indicative of future results,

current performance may be higher or lower. Holdings are subject to

change and are provided for informational purposes only and should

not be deemed as a recommendation to buy or sell the securities

shown. Inception date June 13, 1986.

Information in this press release

that is not current or historical factual information may

constitute forward-looking information within the meaning of

securities laws. Implicit in this information, particularly in

respect of future financial performance and condition of the

Company, are factors and assumptions which, although considered

reasonable by the Company at the time of preparation, may prove to

be incorrect. Shareholders are cautioned that actual results are

subject to a number of risks and uncertainties, including general

economic and market factors, including credit, currency, political

and interest-rate risks and could differ materially from what is

currently expected. The Company has no specific intention of

updating any forward-looking information whether as a result of new

information, future events or otherwise, except as required by

law.

If you wish to receive this information

electronically, please contact

InvestorRelations@aberdeen-asset.com

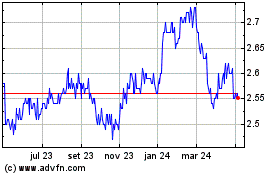

Abrdn Asia Pacific Incom... (TSX:FAP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

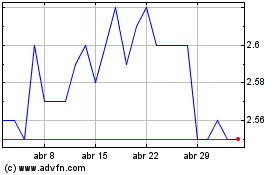

Abrdn Asia Pacific Incom... (TSX:FAP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025