Regulatory News:

Total Gabon (Paris:EC):

Main Financial Indicators

Q1 18

Q1 17

Q1 18vs.Q1 17

Average Brent price $/b

66.8 53.7

+24% Average Total Gabon crude price(1) $/b

61.7 48.7 +27%

Crude oil production from fieldsoperated

by Total Gabon

kb/d (2)

24.0 53.7 -55% Crude

oil production from Total Gabon interests(3) kb/d

35.7 46.0 -22% Sales volumes(1) Mb(4)

2.93 3.79 -23% Revenue(5) $M

208 210 -1% Funds generated from

operations(6) $M

33 86 -62%

Capital expenditure $M

30 17

+76% Net income (loss)(7) $M

23 5

x5

(1) Excluding profit oil reverting to the Gabonese Republic as

per production sharing contracts.

(2) kb/d: Thousand barrels per day

(3) Including profit oil reverting to the Gabonese Republic as

per production sharing contracts.

(4) Mb: Million barrels.

(5) Revenue from hydrocarbon sales and services (transportation,

processing and storage). As from December 31th 2017, the Company’s

financial statements are prepared in accordance with International

Financial Reporting Standards (IFRS). Following the application of

IAS 18 – Revenue, profit oil reverting to the Gabonese Republic is

now included in revenue. This reclassification, which was also

applied to Q1 17 revenue, has no impact on net income.

(6) Funds generated from operations = operating cash flow +

gains (losses) on disposals of assets + working capital

changes.

(7) The Company’s financial statements are prepared in

accordance with International Financial Reporting Standards (IFRS).

Various items taken into account in the calculation of Q1 17 net

income have been adjusted as a result of the adoption of IFRS. A

summary of these adjustments is provided in Appendix 1.

First Quarter 2018 Results

Selling Prices

Reflecting the higher Brent price, the selling price of the

Mandji and Rabi Light crude oil grades marketed by Total Gabon

averaged $61.7 per barrel, up 27% compared to first quarter

2017.

Production

Total Gabon’s equity share of operated and non-operated oil

production(1) was 35,700 barrels per day in first quarter 2018, a

decline of 22% compared to first quarter 2017, due mainly to:

- the sale of mature assets to Perenco on

October 31, 2017;

- compression issues on the Anguille and

Torpille fields;

- the natural decline of fields.

This was partly offset by:

- The impact of the acquisition of an

additional 50% in the Baudroie-Mérou license in June 2017.

Revenue

Revenue amounted to $208 million in first quarter 2018,

stable compared to first quarter 2017, with the price effect

offsetting lower volumes.

Funds Generated From Operations

Funds generated from operations amounted to $33 million, down

62% compared to first quarter 2017, mainly due to the increase in

working capital (price effect on receivables, cost reduction effect

on payables).

Capital Expenditure

Capital expenditure amounted to $30 million in first

quarter 2018, up 76% compared to first quarter 2017, and included

the commencement of an onshore drilling campaign, integrity works

offshore (Anguille, Torpille, Grondin) and onshore (Cap Lopez

terminal), and geoscience and development studies.

Net Income

Net income amounted to $23 million in first quarter 2018, a

significant improvement from $5 million in first quarter 2017

thanks primarily to a positive price effect, the Company's

cost-cutting program, lower depreciation and reduced financial

expenses due to the Company’s debt reimbursement.

First Quarter 2018 Highlights

Board of Directors Meeting of March 27, 2018

The Board of Directors approved on March 27, 2018 the accounts

for the year ending December 31, 2017 and decided that it will

recommend at the Annual Meeting on May 22, 2018 that shareholders

approve the payment of a dividend of $5.5 per share, for a total

payout of $24.75 million. This represents an increase of 22% from

the previous year’s dividend of $4.5 per share.

APPENDIX 1: IMPACT OF ADOPTING IFRS ON THE Q1 17 INCOME

STATEMENT

Information on Options Retained in First-Time

Adoption

The move from the Organization for the Harmonization of Business

Law in Africa (OHADA) accounting standard to International

Financial Reporting Standards (IFRS) was conducted in accordance

with IFRS 1 - First-time Adoption of International Financial

Reporting Standards. As an affiliate that became a first-time

adopter later than its parent, the Company chose to measure its

assets and liabilities as the carrying amount in the consolidated

financial statements of Total S.A.

Summary of the Main Impacts on the Q1 17 Income

Statement

Net income (OHADA) 11

Unit-of-production

method - IAS 16 note 1 (3) Exceptional depreciation -

IAS 16 note 1 (3) Site restoration - IAS 16

note 2 (1) Measurement of oil and gas

inventories - IAS 2 note 3 (1) Deferred taxes - IAS

12 note 4 2

Total adjustments

(6)

Net income (IFRS)

5

Notes

In terms of measurement, Q1 17 net income was primarily impacted

by the application of IAS 16 - Property, Plant and Equipment, as

well as by the recognition of deferred taxes.

Note 1 – Property, Plant and Equipment

Development costs for the drilling of development wells and for

the construction of production facilities are capitalized, together

with borrowing costs incurred during the period of construction and

present value of estimated and future costs of asset retirement

obligations. The depletion rate is equal to the ratio between oil

and gas production for the period and proved developed reserves

(unit-of-production method). Previously, the Company determined

depreciation using the straight-line method.

Note 2 – Asset Retirement (Site Restoration)

Under IAS 16 - Property, Plant and Equipment, an item of

property, plant and equipment should initially be recorded at cost.

Cost includes the estimated costs of dismantling and removing the

item and restoring the site on which it is located if such an

obligation exists when the asset is recognized. A corresponding

asset retirement obligation is recorded in liabilities.

Changes in the liability for an asset retirement obligation due

to the passage of time are measured by applying a risk-free

discount rate to the amount of the liability.

Note 3 – Oil and gas inventories

Over- or underliftings of hydrocarbons are valued based on the

entitlement method, under which production is valued at the selling

price at the date of the preparation on of the financial

statements. Previously, any such difference between volumes sold

and entitlement volumes, based on net working interest, was valued

at production cost.

Note 4 – Deferred Taxes

Under the deferred tax method, both current tax expense (or

income) and deferred tax expense (or income) relating to the

current or previous periods are disclosed in the financial

statements.

Current taxes, calculated according to tax regulations, are

recognized in the statement of income and the balance sheet.

Deferred income taxes are recognized on a separate line. In

accordance with IAS 12 – Income Taxes and the “comprehensive

balance sheet method,” deferred income taxes are recorded based on

the temporary differences between the carrying amounts of assets

and liabilities recorded in the balance sheet and their tax bases.

Permanent differences do not give rise to deferred taxes.

1 Including profit oil reverting to the Gabonese Republic as per

production sharing contracts.

Total GabonSociété anonyme

incorporated in Gabon with a Board of Directors and share

capital of $76,500,000Headquarters: Boulevard Hourcq,

Port-Gentil, BP 525, Gabonese

Republicwww.total.gaRegistered in Port-Gentil:

2000 B 00011

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180514005890/en/

Total GabonFlorent Cailletflorent.caillet@total.com

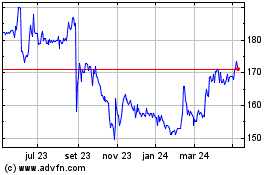

TotalEnergies EP Gabon (EU:EC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

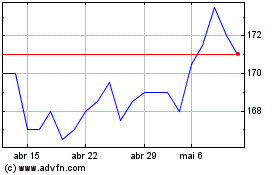

TotalEnergies EP Gabon (EU:EC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025