Goldmoney Inc. (TSX:XAU) (“Goldmoney”) (the “Company”), a

precious metal financial service and technology company, today

announced financial results for the second quarter ended September

30, 2018. All amounts are expressed in Canadian dollars unless

otherwise noted.

Financial Highlights

- Consolidated Revenue of $118.2 million,

stable compared to Q1 2019 despite declining precious metals and

cryptocurrency prices Quarter over Quarter (“QoQ”).

- Adjusted Gross Profit1 of $3.1 million,

an increase of $1 million (51%) Year over Year (“YoY”) over Q2

2018. IFRS Gross Profit of $2.2 million for Q2 2019.

- Non-IFRS Adjusted Loss2 of $2.9

million. IFRS Loss of $4.5 million for Q2 2019.

- Gross Margin increased by 68% YoY to

$1.6 million.

- Precious Metal Gross Margin growth

accelerated despite a global and industry-wide slowdown in precious

metals sale, achieving an increase of $0.5 million, or 53% growth

YoY.

- Precious Metals Revenue increased by

$4.7 million (5%) QoQ despite an industry-wide slowdown.

- Cryptocurrency Business revenue of $11

million compared to $17 million in Q1, a decrease of 37%, driven by

sector volume slowdown and a high level of volatility in Bitcoin

price and a decrease in Ethereum (49%) prices QoQ.

- Tangible Common Equity3 of $109

million, a significant increase of $47.9 million (78%) YoY with

strong cash position consisting of $32.2 million in cash, $24.9

million in GIC and $20.2 million in secured loans receivable.

Shareholders’ equity of $165 million at Q2 2019.

- Menē Revenue increased $0.6 million

(43%) QoQ to $2 million despite minimal inventory levels and a $1

million wait list.

- Currency loans totaling $20.2 million

of balance sheet capital extended to users against their pledged

precious metals earning interest rates ranging from 2.75% to

4.69%.

- Corporate precious metal position of

$22.7 million at September 30, 2018 ($.30 per share), reflecting

the company’s commitment to grow long-term precious metal ownership

per share from surplus returns on capital.

- Client assets under custody stable at

$1.62 billion as of September 30, 2018.

Menē Stock Distribution

Goldmoney is pleased to announce a distribution of 3.99 million

Class B subordinate voting shares of Menē Inc. (TSXV:MENE) (“Menē”)

from its holdings to the shareholders of Goldmoney on a pro rata

basis. The distribution of common shares of Menē is payable on

December 7, 2018 to Goldmoney shareholders of record as of the

close of business on November 30, 2018. Each Goldmoney shareholder

will receive approximately 0.0507 Menē shares for each Goldmoney

share. Fractional shares of Menē distributed to shareholders of

Goldmoney will be rounded down to the nearest whole share.

Goldmoney currently holds 79.8 million Class B subordinate

shares of Menē, representing 36.7 per cent of the issued and

outstanding shares of Menē on a non-diluted basis. The distribution

of the shares to Goldmoney shareholders represents the first escrow

release, pursuant to the escrow requirements of the TSX-Venture

Exchange. Goldmoney will make further announcements should the

board of directors determine to make additional distributions of

its Menē Class B subordinate voting shares. The distribution is

being effected as a return of capital. Goldmoney shareholders will

not be required to pay for any Menē shares that they receive under

this distribution, nor will they be required to surrender or

exchange any Goldmoney shares in order to receive the Menē Shares

or to take any other action in connection with the

distribution.

IFRS Consolidated Income Statement

Data

(expressed in $000s)

FY 2019 FY

2018 FY 2017 Q2 Q1 Q4

Q3 Q2 Q1 Q4 Q3 Revenue

118,205 119,839 171,102 149,819 126,274

125,211 131,851 139,149 Fee Revenue 610

575 580 584 645 661 713

633 Gross margin/(loss) 1,611 1,686

2,250 1,903 958 1,320 1,284

1,401

Gross profit(Excludes revaluation of

precious metalsinventories)

3,092 3,321 3,663 9,692 2,042

4,408 2,046 2,138

Gross profit

(Incl. revaluation of precious

metalsinventories)

2,182 3,978 2,486 9,630 2,070

3,701 2,075 1,458

*Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Please visit our SEDAR profile to view the company’s

consolidated financial statements and MD&A.

Statement from the CEO

“Goldmoney Inc. continues to deliver shareholder value

while growing long-term optionality on a rising precious metal

environment. This quarter was no different as we continued to

preserve our balance sheet while demonstrating our Company’s unique

ability to create value organically through the spinoff and listing

of Menē Inc. (TSXV: MENE) on November 6, 2018. Menē, a nascent

direct-to-consumer jewelry brand which now averages over $1 million

of monthly revenues, was an idea that began as an exploratory

venture within Goldmoney two years ago. This idea has now produced

a $60 million windfall (non-IFRS mark to market accounting) for

Goldmoney Inc. shareholders from a $2 million cash investment, and

the leveraging of our existing group infrastructure. To be clear,

even these quarterly financials consolidate, rather than mark to

market, the value of our 79.8 million MENE shares as required by

IFRS accounting standards. This asset however, is very real, as

demonstrated by our decision to distribute 3.99 million shares of

MENE to Goldmoney Inc. shareholders. For the time being, the

remaining stake in MENE is being held for investment purposes and

reclassified effective November 1, 2018 under the equity accounting

method. That means that Menē will no longer be consolidated as a

subsidiary within Goldmoney’s accounts, bringing more clarity to

the group’s core business, opex, capex, and earnings power. We

continue to enhance our core businesses, which generate stable

recurring cash flows and allow us to grow our long-term precious

metal position which now stands at $.30 per outstanding share of

Goldmoney. We are also observing strengthening signs across our

other business lines. Our coin business SchiffGold, has recently

seen significant increases in both sales and profitability, some of

which is visible in this reporting period. Moving forward, we see a

great opportunity in further consolidation of this space and growth

opportunities both organically and through M&A. There are two

things I would like to leave with our shareholders with this

quarter. The first is that I believe you will start to see a

serious transition in terms of capex, opex, professional fees over

the ensuing quarters as we simplify certain pillars of our core

business. I am aiming for our reported, non Menē, cash opex

including professional fees to normalize to no more than $2 million

per quarter in the near future. I know this has been an important

point for many investors. The second is that our operations team

led by Steve Fray and Paul Mennega, have identified significant

cost savings in our business structure which will materialize in

further opex reductions into 2019. These two enhancements to our

activity should result in a clearer picture of the intrinsic value

in our core businesses and allow long-term shareholders to better

calculate the sum-of-parts valuation of Goldmoney Inc., which will

now include: (1) our tangible capital per share (2) our investments

in Menē and Lend & Borrow Trust Company, and (3) the value of

our custody, coin, and cryptocurrency (BlockVault) businesses. The

last item I want to discuss is Goldmoney China. We have determined

to suspend this joint venture for a variety of reasons. The main

reason is due to the Peoples Bank of China requirement announced

after we began this initiative, unilaterally requiring digital gold

bullion sellers to register and deposit a large amount of capital

under a 51%/49% structure with local entities owning the majority.

This rule (“Internet Gold Business Provisional Administrative

Measures” (互联网黄 金业务暂行管理办法) was surprisingly announced in May 11th

of 2018 (6 months after the signing of our JV and the investment of

capital in establishing a Chinese subsidiary). We have been working

with our JV partner to seek economical solutions in light of this

measure. Unfortunately, we have been unable to find a path forward.

We retain our intellectual property assets in China and have capped

our total investment at $1 million. This investment will be written

down over the ensuing quarters unless circumstances change. It is

disappointing to me that China’s central bank has imposed difficult

impediments on the retailing of digital gold and, more importantly,

imposes unfair capital requirements for foreign investors. It was

this fear which regulated our foray into China and why the board

treaded carefully in terms of capital outlays. Over time, we will

continue to take such calculated risks with our capital and

earnings power when we feel there exists a great opportunity to

expand our enterprise. Some risks will succeed as in the case of

Menē, SchiffGold, BlockVault, and some will fail as may be the case

with Goldmoney China. Both successes and failures are shared

equally by all shareholders and management. As the development of

our group and balance sheet show, we are clearly outperforming our

peers and building significant shareholder value in what is a

challenging precious metal environment. Thank you for your

continued support.’” - Roy Sebag, Chairman, President and CEO

Statement from the CFO

“This was a good quarter for Goldmoney Inc. It is important to

remember that these financial results include the consolidation of

Menē Inc. which was in its ramp up phase having been only in its

sixth operating month during the quarter. The good news is that

following the Menē spinoff, our next quarterly financials will

account for Menē as an Equity Method removing the consolidated

balance sheet and revenue volatility. I am proud of the work our

team has done on Menē and believe there exists great potential to

further develop this business. On the Goldmoney Inc. side, this

transition in accounting will better highlight the core business

operations and earnings potential. As Roy Sebag has advised, we are

considering several opportunities to further optimize our core

business structure and look forward to presenting these

achievements in subsequent quarters.” Steve Fray – CFO &

Corporate Secretary

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's unaudited condensed consolidated interim financial

statements for the three and six months ended September 30, 2018

prepared in accordance with International Financial Reporting

Standards ("IFRS") and corresponding management's discussion and

analysis, which are available under the Company's profile on SEDAR

at www.sedar.com.

Conference Call Information

The Company will be hosting its conference call to discuss

earnings, and a general corporate update on, November 14, 2018 at

10 am (EST). The call is open to investors and will be held by Roy

Sebag, CEO of Goldmoney Inc. Steve Fray, CFO of Goldmoney Inc. and

Paul Mennega, COO of Goldmoney Inc.

PARTICIPANT ACCESS CODE: 362764

DIAL-IN-NUMBERS:

Toronto: +1 647 478 7145New York: +1 917 962 0650London: +44 203

769 6819To view additional local dial-in numbers, please click

here.

QUESTIONS:Please note that the conference line will be muted to

all callers. Questions to be answered during the call can be

emailed ahead of time to: ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Adjusted Gross Profit1 is a non IFRS financial measure, also

referred to as Gross profit excluding gain/(loss) on revaluation of

precious metals inventories. This figure excludes from Gross profit

the gain (loss) on revaluation of precious metals inventories.

Non-IFRS Adjusted Profit2 is a non IFRS financial measure. This

figure excludes from IFRS Net Income the impact of non-cash items,

including the amortization of intangible assets and stock-based

compensation. Refer to the MD&A for a detailed breakdown of

these items.

Tangible Common Equity3 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2018.

About Goldmoney Inc.

Goldmoney Inc., a financial service company traded on the

Toronto Stock Exchange (TSX:XAU), is a global leader in precious

metal investment services and the world’s largest precious metals

payment network. Safeguarding nearly $1.6 billion in assets for

clients located in more than 150 countries, Goldmoney is focused on

a singular mission to make precious metals-backed savings

accessible to all. Powered by Goldmoney’s patented technology, the

Goldmoney® Holding is an online account that enables clients to

invest, earn, or spend gold, silver, platinum, palladium and

cryptocurrencies that are securely stored in insured vaults in

seven countries. All bullion assets are fully allocated and

physically redeemable property. Goldmoney Wealth Limited is

regulated by the Jersey Financial Services Commission (JFSC) as a

Money Services Business. Goldmoney Network is a reporting entity to

the Financial Transactions and Reports Analysis Centre of Canada

(FINTRAC), and is registered with the Financial Crimes Enforcement

Network (FinCEN) in the U.S. For more information about Goldmoney,

visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. (the “Company”)

believes, expects or anticipates will or may occur in the future,

is forward-looking information. Forward-looking information does

not constitute historical fact but reflects the current

expectations the Company regarding future results or events based

on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available

on SEDAR. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181114005304/en/

Media and Investor Relations inquiries:Renee WeiDirector

of Global CommunicationsGoldmoney

Inc.renee.wei@goldmoney.comorSteve FrayChief Financial

OfficerGoldmoney Inc.+1-647-499-6748

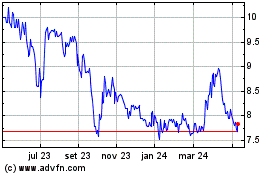

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

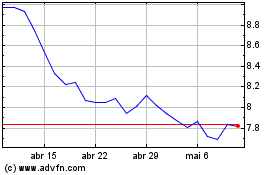

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024