Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the quarter ended

December 31, 2018 (the Company’s third quarter of its fiscal

year-end of March 31, 2019). All amounts are expressed in Canadian

dollars unless otherwise noted.

Quarterly Highlights

- Consolidated Revenue of $84 million, a

21% increase Quarter-over-Quarter.

- IFRS Net Income of $28.6 million ($0.37

per share), a quarterly record for the Company.

- Non-IFRS Adjusted Gain1 of $28.4

million, a quarterly record for the Company.

- Currency loans totaling $20.4 million

of balance sheet capital extended to borrowers against their

pledged precious metals earning interest rates ranging from 3.55%

to 5.05%.

- Corporate precious metal position of

$15.5 million at December 31, 2018 as directly owned precious

metals. An additional $11.9 million gold and platinum loans are

extended to Menē Inc. at quarter end.

- Total balance sheet precious metal

exposure of $27.4 million as of December 31, 2018, a new Company

record, reflecting the Company’s long-term commitment to grow

precious metal ownership per share.

- Non-Balance Sheet Client assets under

custody stable at $1.82 billion.

- Tangible Common Equity2 of $131.9

million, a new Company record.

Menē Stock Exchange Listing

On October 30, 2018, Menē Inc. completed its reverse takeover

transaction with Amador Gold Corp. and separation from Goldmoney.

On November 6, 2018, Menē Inc.’s subordinate voting shares (the

“Class B Shares”) were listed on the TSX Venture Exchange under the

symbol: MENE. On December 7, 2018, Goldmoney distributed 3,989,947

million Class B Shares to the shareholders of Goldmoney on a

pro-rata basis.

Menē Inc.’s public listing, the appointment of additional

independent directors to the Menē board, and the decision by

Goldmoney’s directors to distribute 3,989,947 Class B subordinate

voting shares of Menē pro rata to the shareholders of Goldmoney,

resulted in a loss of control and a change in IFRS accounting

treatment to investment in associate. This change in accounting

treatment contributed a $31.8 million gain to Goldmoney’s quarterly

results in Q3 2019.

Goldmoney currently holds approximately 76.6 million Class B

Shares, representing a 33% of the total issued and outstanding

shares of Menē on a non-diluted basis. The Class B Shares held by

Goldmoney will be marked to market on Goldmoney’s balance sheet in

subsequent quarters.

IFRS Consolidated Income Statement Data (expressed in $000s

except loss per share)

FY 2019 FY

2018 FY 2017 Q3 Q2

Q1 Q4 Q3 Q2 Q1 Q4

Revenue1 84,029 69,550 63,794

98,448 85,158 77,185 79,282 82,500 Fee

Revenue 581 610 575 580

584 645 661 713 Gross margin/(loss)

1,566 1,611 1,686 2,250 1,903

958 1,320 1,284 Gross profit excl. revaluation

of precious metals inventories 2,749 3,092

3,321 3,286 9,692 2,648 4,403

1,996 Gross profit Incl. revaluation of precious metals

inventories 4,152 2,182 3,978

5,178 9,630 2,676 3,695 2,075

(1)

In accordance with IFRS, the Company has prospectively changed its

revenue accounting policy and has provided retrospective

application. The Company restated revenue as net basis instead of

gross for fees from exchange services. Transfer of fiat currency to

the customer and receipt by the Company of precious metals, crypto

assets or other fiat currency, were treated as an exchange service

(net basis), instead of revenue from the sale of the fiat currency

(gross basis). There is no impact to gross margin and net income.

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Please visit our SEDAR profile to view the Company’s

consolidated financial statements and MD&A.

Statement from the CEO

“We are pleased to report a record quarter not only in

IFRS earnings and tangible common equity, but also in total assets

under management. When combining the tangible assets on our balance

sheet with our non-balance sheet assets under custody, our group

has crossed the $2 billion mark in total assets under management or

custody. When considering that over 90% of these assets are

precious metals, one can appreciate that we are very well exposed

economically to rising precious metal prices. I am pleased with

this result and look forward to further growing our long-term

economic exposure to precious metals and tangible assets. Menē Inc.

is becoming an incredible business, having delivered Goldmoney a

substantial return on our $2 million investment from only two years

ago. From where I sit, the future of Menē Inc. appears very bright

and I believe the business can scale to substantial revenue in a

few years and produce significant operating margins and profits.

Companies within the same industry as Menē generally trade at a

multiple to sales of 4-7 times during their growth years (e.g.

Warby Parker, FarFetch, Moncler, Canada Goose) and I believe that

Menē is no different than any of those businesses in terms of the

quality of the brand which is being built. The Goldmoney.com

business continues to be well run by COO Paul Mennega who is

improving and optimizing the core business offering. In this 2019

year we will see a clearer focus on the part of separating Menē

from Goldmoney from an accounting perspective. While this quarter

was a good first step, there were still significant operating

expenditures associated with Menē Inc. during the quarter. Schiff

Gold continues to perform extremely well, and we are seeing

increased synergies from the combination of Goldmoney.com and

SchiffGold, primarily in the physical precious metal redemption

space. We would like to thank our shareholders for their continued

support and confidence. We believe our corporation will continue to

deliver long-term shareholder value which is now well apparent

through our financial results.” - Roy Sebag, Chairman and

Chief Executive Officer

Statement from the CFO

“This was a great quarter for Goldmoney Inc. It is important to

remember that these quarterly results consolidate Menē Inc until

the end of October, which as a relatively recent start-up is still

in its ramp up phase. The good news is that following the Menē

spinoff, our next quarterly financials will account for Menē as an

associate, thereby removing its revenue and expenses from

Goldmoney’s consolidated balance sheet. I am proud of the work our

team has done on Menē and believe there exists great potential to

further develop this business. This transition in accounting will

better highlight Goldmoney’s core business operations and earnings

potential. As our CEO, Roy Sebag has advised, we are considering

several opportunities to further optimize our core business

structure, and we look forward to presenting these achievements in

future quarters.” Steve Fray – CFO & Corporate

Secretary

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's unaudited condensed consolidated interim financial

statements for the three and six months ended September 30, 2018

prepared in accordance with International Financial Reporting

Standards ("IFRS") and the corresponding management's discussion

and analysis, which are available under the Company's profile on

SEDAR at www.sedar.com.

Investor Relations Questions

As is our Company’s tradition, we only host two conference calls

per year. Our next call will be held on the reporting date for our

Year End results. Investors with interim questions may send them

to: ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure.

This figure excludes from IFRS Net Income the impact of non-cash

items, including the amortization of intangible assets and

stock-based compensation. Refer to the MD&A for a detailed

breakdown of these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Adjusted Gross Profit3 is a non IFRS financial measure,

also referred to as Gross profit excluding gain/(loss) on

revaluation of precious metals inventories. This figure excludes

from Gross profit the gain (loss) on revaluation of precious metals

inventories.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2018.

About Goldmoney Inc.

Goldmoney Inc. (TSX: XAU) is a precious metal focused investment

company. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal investment, custody and

storage, jewelry, coin retailing, and lending. Goldmoney manages

and oversees in excess of $1.8 billion in assets for clients around

the world. The company’s operating subsidiaries include:

Goldmoney.com, Menē Inc. (TSXV: MENĒ), SchiffGold.com, and Lend

& Borrow Trust. Through these businesses and other investment

activities, Goldmoney gains long-term exposure to precious metals.

For more information about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available

on SEDAR. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190214005256/en/

Media and Investor Relations inquiries:Renee WeiDirector

of Global CommunicationsGoldmoney

Inc.renee.wei@goldmoney.comSteve FrayChief Financial

OfficerGoldmoney Inc.+1 647 499 6748

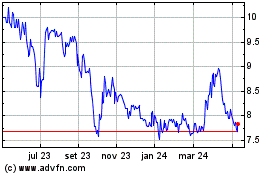

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

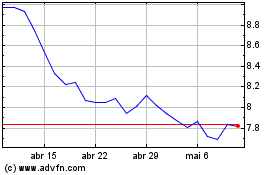

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024