Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the quarter and

fiscal year ended March 31, 2019. All amounts are expressed in

Canadian dollars unless otherwise noted.

Financial Highlights

- Record Annual Net and Comprehensive Income of $22.7 million, an

increase of $17 million (300%) Year-over-Year (“YoY”).

- Record Annual Net Income of $21.7 million compared to $2.6

million for FY 2018, a 734% increase. Net and Diluted Earnings Per

Share of $0.28.

- IFRS Consolidated Annual Revenue of $281.5 million, a decrease

of 17% YoY as the precious metal sector experienced more volatility

and the Company exited the cryptocurrency sector in Q4 2019.

- IFRS Annual Gross Profit of $12.4 million.

- Non-IFRS Adjusted Annual Gain of $23.2 million. IFRS Annual

Operating Loss of $11.7 million.

- Schiff Gold Revenue of $90.7 million, a 24% growth compared to

FY 2018. Schiff Gold also achieved a 11% growth in Gross Margin and

82% increase in Operating Income YoY.

- Menē Revenue increased by $2.8 million up to October 31, 2018,

when Menē became an independent publicly listed corporation on the

TSX Venture Exchange.

- Significant growth in Tangible Capital to $131.8 million, an

increase of $37.5 million, or 40% as compared to $94.2 million at

March 31, 2018.

- Currency Loans totaling $28.9 million of balance sheet capital

extended to users against their pledged precious metals, earning

interest rates ranging from 3.55% to 5.05%.

- Corporate Precious Metal Position of $18.3 million, a 15% YoY

increase.

- Client Asset Under Custody stable at $1.75 billion as at March

31, 2019.

Operational Highlights

- Completed the spin-off of Menē Inc. (“Menē”), which started

trading on the TSX Venture Exchange under ticker symbol MENE on

November 6, 2018.

- Distributed 3,990,000 Menē Class B subordinate voting shares to

shareholders of Goldmoney on a pro rata basis.

- Menē raised $30 million in growth capital with Canaccord

Genuity and a strategic lender.

- Launched Goldmoney Active Trader, a real-time precious metals

trading and analysis platform that offers advanced trading tools,

limit buy and sell orders and transparent open order books.

- Unveiled Goldmoney Checkout, a payment integration partnership

that allows Goldmoney Clients to pay for purchases at Mene.com with

precious metal or fiat currency in their Goldmoney Holding.

- Introduced Goldmoney Physical, a new e-commerce platform that

allows clients to take delivery of existing Goldmoney Holding

balances as precious metal coins and bars via Schiff Gold.

- Announced the decision to formally exit cryptocurrency

business.

IFRS Consolidated Income Statement

Data

(expressed in $000s except loss per

share)

FY 2019

FY 2018

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1

Revenue1

64,171

84,029

69,550

63,794

98,448

85,158

77,185

79,282

Fee Revenue

591

580

610

575

580

584

645

661

Gross margin/(loss)

1,393

1,566

1,611

1,686

2,250

1,903

958

1,320

Gross profit excl. revaluation of precious

metals inventories

2,782

2,749

3,092

3,321

3,663

9,692

1,971

2,080

Gross profit Incl. revaluation of precious

metals inventories

2,069

4,152

2,182

3,978

2,108

10,008

1,999

1,372

- In accordance with IFRS, the Company has prospectively changed

its revenue accounting policy and has provided retrospective

application. The Company restated revenue as net basis instead of

gross for fees from exchange services. Transfer of fiat currency to

the customer and receipt by the Company of precious metals, crypto

assets or other fiat currency, were treated as an exchange service

(net basis), instead of revenue from the sale of the fiat currency

(gross basis). There is no impact to gross margin and net

income.

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Please visit our SEDAR profile to view the Company’s

consolidated financial statements and MD&A.

Statement from the CEO:

The 2019 fiscal year was Goldmoney Inc.’s most successful ever.

On a purely financial basis, we have grown our tangible net worth

by nearly $37.5 million, or 40%, over last year. This result has

been achieved even though the precious metal industry has been in a

period of severe decline. It can be attributed to the innovative

and entrepreneurial approach we take towards our mission of

broadening gold ownership. Such was the case with the founding,

development, and ultimate launch of Menē, our 24-karat

direct-to-consumer jewelry brand.

Additionally, our success can be attributed to our disciplined

capital management, which has led towards a new high-water mark in

precious metal ownership per share. As of March 31, 2019, Goldmoney

Inc. had direct balance sheet exposure to $47.2 million worth of

physical precious metals via direct ownership and precious metal

loans. This exposure was well-timed, and positions us for

significant gains in the quarters to come—especially in light of

gold’s recent surge post the reporting date.

Another factor that, in my view, has contributed towards our

success is our unrelenting focus on safeguarding client assets,

and, consistent with that focus, our steadfast brand equity. These

days, Goldmoney spends relatively little money marketing our

service, and yet we see hundreds of new clients per week and

millions of dollars in inflows coming organically from clients

around the world. We are extremely proud of this natural

positioning of dominance that we occupy within the precious metal

industry and seek to ensure that our position is maintained over

time.

We continue to incur atypical regulatory costs, and we see a

severe disconnect between what the cryptocurrency and Silicon

Valley worlds put forward as the future of fintech and the

regulatory realities we all face. Our group has significant pent-up

innovation that we would love to deploy in the years to come. Our

ideas and our overarching thesis have been timely. At this stage,

our ability to execute has been demonstrated.

As was the case with the formulation and development of Menē, we

continue to actively incubate internal exploratory ventures. These

ideas may follow our present business lines, while other ideas may

be consistent with our group ethos—albeit in an entirely different

sphere. The ideas typically involve significant intellectual

property and technology, with the assembly of teams to design a

proprietary proof-of-concept. Additional details will be disclosed

as warranted when the concepts are further developed.

The last item I would like to discuss is the recent resurgence

of precious metal prices. Things appear to be picking up

significantly, and it is my belief that 2019 and 2020 will be very

good years for our core businesses. In the five years since

founding BitGold, all of our work has ultimately been done in the

expectation of capitalizing on a rising precious metal price

environment. Let us all hope that the time has come.

I would like to thank the Goldmoney and Menē teams around the

world for all their hard work in 2019. This was a very important

transition year for us, but you all delivered, and for that you

should be very proud. I would further like to specifically thank

Alessandro Premoli, Steve Fray, and Paul Mennega for their

excellent performance and dedication towards our group businesses

in fiscal 2019. – Roy Sebag, Chairman, President and CEO.

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's consolidated financial statements for the year ended

March 31, 2019 and prepared in accordance with International

Financial Reporting Standards ("IFRS") and the corresponding

management's discussion and analysis, which are available under the

Company's profile on SEDAR at www.sedar.com.

Conference Call Information

In lieu of a conference call, shareholders of Goldmoney are

encouraged to submit questions to management by emailing

ir@goldmoney.com. The Company will periodically publish responses

to selected questions received in order to allow all investors

ongoing access to information about Goldmoney’s strategy,

operations, and business plans.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure. This

figure excludes from IFRS Net Income the impact of non-cash items,

including the amortization of intangible assets and stock-based

compensation. Refer to the MD&A for a detailed breakdown of

these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Adjusted Gross Profit3 is a non IFRS financial measure, also

referred to as Gross profit excluding gain/(loss) on revaluation of

precious metals inventories. This figure excludes from Gross profit

the gain (loss) on revaluation of precious metals inventories.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2019.

About Goldmoney Inc.

Goldmoney Inc. (TSX: XAU) is a precious metal focused investment

company. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal investment, custody and

storage, jewelry, coin retailing, and lending. Goldmoney manages

and oversees in excess of $1.75 billion in assets for clients

around the world. The company’s operating subsidiaries include:

Goldmoney.com, Menē Inc. (TSXV: MENĒ), SchiffGold.com, and Lend

& Borrow Trust. Through these businesses and other investment

activities, Goldmoney gains long-term exposure to precious metals.

For more information about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

SEDAR. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190625005354/en/

Media and Investor Relations inquiries: Renee Wei

Director of Global Communications Goldmoney Inc.

renee.wei@goldmoney.com Steve Fray Chief Financial Officer

Goldmoney Inc. +1 647 499 6748

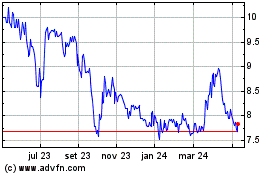

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

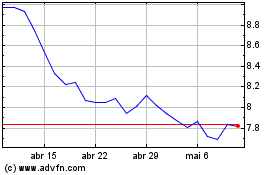

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024