Purchase and exercise of warrants adds to

Menē’s working capital

Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney”), a

precious metal financial service and technology company, and Menē

Inc. (TSX-V:MENE) (US:MENEF) (“Menē”), an online 24-karat

jewelry brand, today announced that Goldmoney has agreed to

increase its equity stake in Menē Inc.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190703005104/en/

Goldmoney has agreed to purchase from Roy Sebag, the Chief

Executive Officer of Menē and Chief Executive Officer of Goldmoney,

12,259,002 Class A common share purchase warrants (the

“Warrants”) for aggregate gross proceeds of $1.00 (the

“Warrant Purchase Transaction”). Each whole Warrant entitles

the holder to purchase one Class A common share of Menē (“Class

A Share”) for the payment of $0.10 per share until July 11,

2020.

Upon closing of the Warrant Purchase Transaction, Goldmoney will

exercise the Warrants, providing Menē with $1,225,900 of additional

working capital. As additional consideration for the Warrant

Purchase Transaction, Goldmoney has agreed to reduce the payable

Menē owes to it by $1,824,100.

Goldmoney and Menē are pleased to enter into this investment and

payment arrangement to further increase the equity stake of

Goldmoney in Menē. The Warrant Purchase Transaction is subject to

regulatory approval, including the approvals of the Toronto Stock

Exchange and the TSX Venture Exchange.

Related Party Transaction

The Warrant Purchase Transaction is a related party transaction

within the meaning of Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”); however, minority approval requirements under MI

61-101 do not apply pursuant to section 5.7(a) as the consideration

for the Warrants do not exceed 25% of the market capitalization of

either Mene or Goldmoney. Moreover, Goldmoney and Mene are exempted

from the formal valuation requirements under section 5.4 of MI

61-101 pursuant to section 5.5(a) thereof. Each independent

director of Mene and Goldmoney have approved the Warrant Purchase

Transaction between Goldmoney and Roy Sebag and there has been no

contrary view or abstention by any independent director. Upon

conversion of the Warrants into Class A Shares, Goldmoney will have

ownership, control or direction over 76,773,053 Class B common

shares of Mene (“Class B Shares”) and 12,259,002 Class A

Shares (representing 56% and 11.4% of the issued and outstanding of

each class of Mene shares, respectively).

Early Warning Disclosure

Goldmoney does not currently own, control or have direction over

any Class A Shares. Upon closing of the Warrant Purchase

Transaction, Goldmoney will hold 12,259,002 Warrants or 11.4% of

the issued and outstanding Class A Shares on a partially-diluted

basis before exercise, and 11.4% on a non-diluted basis after

exercise. The Class A Shares were acquired by Goldmoney for

investment purposes, and depending on market and other conditions,

Goldmoney may from time to time in the future increase or decrease

their ownership in, control or direction over securities of the

Mene through market transactions, private agreements, or otherwise.

For the purposes of this notice, the address of Goldmoney is 334

Adelaide Street West, Toronto, Ontario M5V 1R4.

In satisfaction of the requirements of the National Instrument

62-104 - Take-Over Bids And Issuer Bids and National Instrument and

62-103 - The Early Warning System and Related Take-Over Bid and

Insider Reporting Issues, an early warning report respecting the

acquisition of Warrants by Goldmoney will be filed under Mene’s

SEDAR Profile at www.sedar.com upon closing of the Warrant Purchase

Transaction.

About Goldmoney Inc.

Goldmoney Inc. (TSX:XAU) is a precious metal focused company

that safeguards $1.8 billion of assets owned by clients located in

over 150 countries. The company’s activities include: sale and

purchase of precious metals and their storage through

Goldmoney.com, online jewelry retailing through Mene.com

(TSX-V:MENE), coin and bar sales and purchases through

SchiffGold.com, and gold and silver collateralized lending and

borrowing through LendBorrowTrust.com. Through these businesses

Goldmoney provides its shareholders with long-term exposure to the

precious metals. For more information about Goldmoney, visit

goldmoney.com.

About Menē Inc.

Menē crafts pure 24 karat gold and platinum jewelry that is

transparently sold by gram weight. Through mene.com, customers may

buy jewelry, monitor the value of their collection over time, and

sell or exchange their pieces by gram weight at prevailing market

prices. Menē was founded by Roy Sebag and Diana Widmaier-Picasso

with a mission to restore the relationship between jewelry and

savings. Menē empowers consumers by marrying innovative technology,

timeless design, and pure precious metals to create beautifully

crafted jewelry that endures as a store of value.

For more information about Menē, visit mene.com.

Neither the TSX, the TSX-V nor their Regulation Services

Providers (as that term is defined in the policies of the TSX

Venture Exchange and the TSX Company Manual) accept responsibility

for the adequacy or accuracy of this release.

Forward‐Looking Statements – Goldmoney

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

www.sedar.com. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

Forward-Looking Statements - Menē

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Menē Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: the Company’s objectives,

goals or future plans in respect of the use of proceeds; global

economic climate; dilution; the Company’s limited operating

history; future capital needs and uncertainty of additional

financing; the competitive nature of the industry; currency

exchange risks; the need for the Company to manage its planned

growth and expansion; the effects of product development and need

for continued technology and manufacturing change; protection of

proprietary rights; the effect of government regulation and

compliance on the Company and the industry; network security risks;

the ability of the Company to maintain properly working systems;

theft and risk of physical harm to personnel; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital;

volatile securities markets impacting security pricing unrelated to

operating performance; and, those risks set out in the Company’s

disclosure documents available on www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company undertakes no obligation to update or

revise any forward-looking information, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190703005104/en/

Media and Investor Relations Inquiries for Goldmoney: Renee

Wei Director of Global Communications Goldmoney Inc. +1 647 494

0296 renee.wei@goldmoney.com

Steve Fray Chief Financial Officer Goldmoney Inc. +1 647

499 6748

Media and Investor Relations Inquiries for Menē: Renee

Wei Head of Investor Relations Menē Inc. +1 647 494 0296

ir@mene.com

Robert Lee Chief Financial Officer Menē Inc.

robert@mene.com

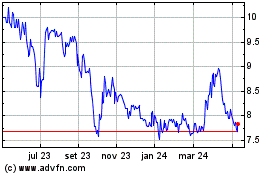

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

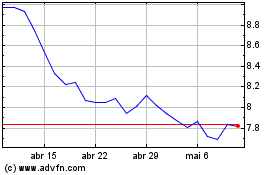

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024