Crédit Agricole CIB closes the first Green Loan for Trinity, who becomes the first railcar lessor in North America to issue ...

10 Fevereiro 2021 - 12:25PM

Business Wire

Crédit Agricole CIB is Green Loan Coordinator for Trinity

Industries Leasing Company’s (“TILC”) first Green Loan.

On February 8, 2021, Crédit Agricole CIB, acting as Green Loan

Coordinator, closed the Green Loan amendment of the non-recourse

senior secured term loan for Trinity Rail Leasing 2017 LLC (“TRL

2017”). The facility was initially a $663MM 7-year non-recourse

senior secured term loan dated November 2018 and has been upsized

by $225MM in July 2020. TRL 2017 is a wholly-owned subsidiary of

Trinity Industries Leasing Company, which is ultimately

wholly-owned by Trinity Industries, Inc. This is the first Green

Loan issued by TILC following the publication of its Green

Financing Framework and the first Green Loan for a railcar lessor

in North America.

Earlier this year, Crédit Agricole CIB acted as Green

Structuring Advisor for TILC which published its Green Financing

Framework on January 25, 2021. The Green Financing Framework

enables TILC to issue Green Financing Instruments, including green

non-recourse ABS bonds and Green Loans, supported by Green Eligible

Assets. TILC’s term loan issued by TRL 2017 is aligned with TILC’s

Green Financing Framework.

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Credit Agricole Group, the 12th largest banking group worldwide

in terms of tier 1 capital (The Banker, July 2020). Nearly 8,400

employees across Europe, the Americas, Asia-Pacific, the Middle

East and Africa support the Bank's clients, meeting their financial

needs throughout the world. Crédit Agricole CIB offers its large

corporate and institutional clients a range of products and

services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For many years Crédit Agricole CIB has been committed to

sustainable development. The Bank was the first French bank to sign

the Equator Principles in 2003. It has also been a pioneer in Green

Bond markets with the arrangement of public transactions from 2012

for a wide array of issuers (supranational banks, corporates, local

authorities, banks) and was one of the co-drafter of Green Bond

Principles and of the Social Bond Guidance. Relying on the

expertise of a dedicated sustainable banking team and on the strong

support of all bankers, Crédit Agricole CIB is one of the most

active banks in the Green bonds market.

For more information, please visit www.ca-cib.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210210005657/en/

Press contact:

Jenna Lee Head of Communications for the Americas (212) 261-7328

jenna.lee@ca-cib.com

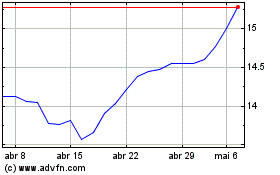

Credit Agricole (EU:ACA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Credit Agricole (EU:ACA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024