Slate Office REIT Announces Voting Results from 2021 Meeting of Unitholders & Posts Q1 2021 Earnings Call Transcript & Invest...

14 Maio 2021 - 9:00AM

Business Wire

Slate Office REIT (TSX: SOT.UN) (the "REIT"), an owner and

operator of North American office real estate, announced today that

each of the trustee nominees listed in the management information

circular of the REIT dated March 25, 2021 were elected as trustees

of the REIT at the annual meeting of unitholders held on May 13,

2021 (the “AGM”). Voting results for the individual trustees of the

REIT are as follows:

Name of Nominee

Voted For

%

Voted Withheld

%

Monty Baker

12,944,803

75.05%

4,304,038

24.95%

Lori-Ann Beausoleil

12,593,010

73.01%

4,655,831

26.99%

Nora Duke

12,551,050

72.77%

4,697,791

27.24%

Thomas Farley

12,945,316

75.05%

4,303,525

24.95%

Meredith Michetti

12,600,898

73.05%

4,647,943

26.95%

Blair Welch

12,900,853

74.79%

4,347,988

25.21%

Brady Welch

12,918,557

74.90%

4,330,284

25.11%

The resolution to re-appoint KPMG LLP as the auditors of the

REIT for the ensuing year and authorizing the trustees to fix the

remuneration to be paid to the auditors was approved by 95.78% of

the votes.

The special resolution to amend the REIT’s declaration of trust

for the purposes of (i) increasing the quorum requirement for

unitholder meetings, (ii) amending the advance notice provisions

and (iii) amending the investment guidelines in order to allow for

investments in Europe and making certain other consequential

amendments related thereto was approved by 72.45% of the votes.

Final results on all matters voted upon at the AGM will be filed

with the Canadian securities regulatory authorities and will be

available on the REIT’s SEDAR profile at www.sedar.com.

Q1 2021 Earnings Call Transcript and Investor Update

Slate Office REIT’s Q1 2021 earnings call transcript and

investor update are now available on the REIT’s website and can be

accessed by visiting the following links:

- Slate Office REIT – Q1 2021 earnings call transcript

- Slate Office REIT – Q1 2021 investor update

About Slate Office REIT (TSX: SOT.UN)

Slate Office REIT is an owner and operator of North American

office real estate. The REIT owns interests in and operates a

portfolio of 34 strategic and well-located real estate assets

across Canada's major population centres and includes two assets in

downtown Chicago, Illinois. 60% of the REIT’s portfolio is

comprised of government or credit rated tenants. The REIT acquires

quality assets at a discount to replacement cost and creates value

for unitholders by applying hands-on asset management strategies to

grow rental revenue, extend lease term and increase occupancy.

Visit slateofficereit.com to learn more.

About Slate Asset Management

Slate Asset Management is a leading real estate focused

alternative investment platform with approximately $6.5 billion in

assets under management. Slate is a value-oriented manager and a

significant sponsor of all of its private and publicly traded

investment vehicles, which are tailored to the unique goals and

objectives of its investors. The firm's careful and selective

investment approach creates long-term value with an emphasis on

capital preservation and outsized returns. Slate is supported by

exceptional people, flexible capital and a demonstrated ability to

originate and execute on a wide range of compelling investment

opportunities. Visit slateam.com to learn more.

Forward-Looking Statements

Certain information herein constitutes “forward-looking

information” as defined under Canadian securities laws which

reflect management’s expectations regarding objectives, plans,

goals, strategies, future growth, results of operations,

performance, business prospects and opportunities of the REIT. The

words “plans”, “expects”, “does not expect”, “scheduled”,

“estimates”, “intends”, “anticipates”, “does not anticipate”,

“projects”, “believes”, or variations of such words and phrases or

statements to the effect that certain actions, events or results

“may”, “will”, “could”, “would”, “might”, “occur”, “be achieved”,

or “continue” and similar expressions identify forward-looking

statements. Such forward-looking statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SOT-BT

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210514005112/en/

For Further Information Investor Relations +1 416 644

4264 ir@slateam.com

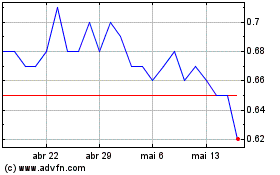

Slate Office REIT (TSX:SOT.UN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Slate Office REIT (TSX:SOT.UN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025