Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the

“Company”), a precious metal financial service and technology

company, today announced financial results for the second quarter

ended September 30, 2021. All amounts are expressed in Canadian

dollars unless otherwise noted.

Quarterly Highlights

- Quarterly Gross Profit of $1.7 million, a decrease of 84%

Year-over-Year (“YoY”).

- Quarterly Gross Profit excluding revaluation loss on precious

metals of $4.5 million, a decrease of 53% YoY.

- Fee Revenue decreased by 11% YoY to $1.6 million.

- Net and Comprehensive Loss of $2.9 million, a $10.9 million

(136%) decrease YoY.

- Basic and Diluted Earnings per share of ($0.04).

- Revenue of $69.0 million, a decrease of 72% YoY.

- Goldmoney.com Gross Profit decreased $7.3 million or 89% YoY

and Operating Income decreased $9.6 million or 150% YoY

- SchiffGold Revenue decreased $66.3 million or 60% YoY, and

Operating Income decreased $0.9 million or 102% YoY.

- Investee Company Menē Inc. (TSXV:MENE) continued to grow its

client and revenue base, reporting Quarterly Revenue of $5.8

million, or 67% increase YoY, for its Quarter ended June 30,

2021.

- Corporate Metal Position consisting of Coins, Bullion, and

Bullion Denominated Loan increased by $6.2 million, or 13% from

March 31, 2021, to $53.7 million as at September 30, 2021.

- Goldmoney.com Group Client Assets of $2.1 billion as at

September 30, 2021.

- Tangible Capital decreased 2% QoQ to $125.0 million.

Business Highlights

- On October 7, 2021, Totenpass Inc. ("Totenpass"), a 60% owned

subsidiary of Goldmoney Inc., announced the launch of its digital

storage drive solution in beta. Totenpass allows for the permanent

storage of precious digital data, thereby eliminating any future

dependence on the internet and the vast amounts of energy required

presently to store content.

- The Company successfully transitioned its operations to Canada

in June 2021 and has effectively discontinued all operating

activity in Jersey during Q2 2022. The Company expects to realize

the full benefit of expected cost savings and efficiencies in the

subsequent reporting periods.

IFRS Consolidated Income

Statement Data

($000s, except earnings per share)

FY 2022

FY 2021

FY 2020

Q

Q1

Q4

Q3

Q2

Q1

Q4

Q3

Revenue

69,013

94,706

139,709

97,592

243,609

173,500

164,441

108,161

Gross margin

2,845

3,977

2,453

3,401

7,566

5,981

3,232

2,188

Fee revenue

1,585

1,412

1,844

2,905

1,776

2,351

2,489

719

Interest income

100

103

211

195

217

239

374

461

Gross profit Excl. revaluation of precious

metals inventories

4,530

5,492

4,508

6,501

9,558

8,570

6,095

3,368

Gross profit Incl. revaluation of precious

metals inventories

1,661

6,167

2,146

4,917

10,421

10,615

6,999

4,088

Net income (loss)

(3,284)

951

(5,947)

4,041

7,509

6,049

(7,892)

(2,958)

Basic earnings (loss) per share

(0.04)

0.01

(0.08)

0.05

0.10

0.08

(0.10)

(0.04)

Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the MD&A

Statement from Roy Sebag, Chairman and Chief Executive

Officer:

Last quarter, I discussed the important milestone which our

group achieved in exiting and transitioning from our Jersey

operations. I had also noted that the financial impact from this

important development would be fully captured in the subsequent two

quarters. In this past quarter (Fiscal Q2 2022), we can see the

final charges associated with the unwinding of the Jersey business

throughout our financial statements. When we report our next

quarter (Fiscal Q3 2022), investors will be able to analyse our

improved business model and perceive with significant clarity into

our long-term operational expenditures and earnings power.

I would like now to turn to another essential aspect of

Goldmoney Inc. that I believe long-term shareholders should be

aware of when thinking of our company, its results and its future

prospects. As a company that is, for the most part, entirely

focused on the precious metals industry, it is necessary that our

operating results be viewed within the wider context of the

industry. Irrespective of our ability to outperform industry trends

over the long-run due to our innovative business model, it is

nevertheless to be naturally expected that our core activity of

precious metal retailing (both via online accounts and coins) will

be tethered to the state and health of the wider industry. We must

also consider another feature of our company when examining the

quarterly results, and that is our growing precious metal position.

The accounting treatment of this position requires that we mark

these positions to market, even when we do not sell; as such, this

position will naturally fluctuate alongside the precious metal

markets. As I mentioned in the prior shareholder letter, our Board

of Directors has made the wise decision to grow our precious metal

position over time from our earnings, thereby pursuing a return on

metal weight strategy as the guiding metric for our company’s

performance. We must consider the results of this quarter in the

light of these wider features of our parent industry in addition to

the one-off final charges associated with the Jersey exit. There

was a decline in top-line revenue and trading activity on the

platform because of the attenuation of the precious metal markets.

Similarly, the decline of precious metal prices is the primary

cause of the mark-to-market loss on our precious metal position of

nearly $3 million.

Before moving onto the topic of our growth businesses, I would

like to articulate my opinion of this quarter from my perspective

as a long-term shareholder. First, the weakness of the precious

metal market this past quarter does not cause me any great concern.

I see it as a normal feature of the dynamics of the wider industry

which we tend to see from time to time. Precious metals have always

been and will continue to remain in great demand by both investors

and industry in the future. Moreover, I do not believe that even

the novel turn to cryptocurrencies will have any significant impact

on the sustained demand for precious metals. With regard to this

point, I am further consoled by the fact that, in spite of such a

weak quarter, our core business performed well, excluding the

movement of our precious metal position and the one-time costs

associated with the Jersey exit. Second, I pay little attention to

mark-to-market fluctuations in our precious metal position, as I

remain convinced that this position will appreciate in fiat money

terms over the long-run, especially in the face of rising

inflation. It is important that during this quarter, in spite of

the declines in mark-to-market movements, we still grew our

precious metal position by weight; likewise, we will continue to

grow our precious metal position by weight year-over-year. In

short, it is my opinion that this quarter gives the appearance of

looking far worse than it actually is, and that the health of our

business as well as our ability to generate sustainable earnings

remains wholly intact.

Turning to the subject of our growth businesses, Menē continued

to perform exceptionally well, reporting another strong quarter.

Note that Menē does not seem to be directly correlatable to the

overall movements in the precious metal industry. This is a

promising indicator that Menē is growing organically by disrupting

the jewelry industry. Menē now enters its most important and

lucrative period of the year, the holiday season, and it is

prepared and well-stocked with a record amount of inventory. We

hope that Menē will close this year with record revenues and

impressive year-over-year growth figures.

Our second growth business, Totenpass, has now finally moved

from the R&D phase to Beta launch. We are optimistic about what

we have seen so far in response to this highly unique business.

Customers are testifying to the infinitely interesting

possibilities of the Totenpass and some have reported use cases

that have already expanded our own understanding of the product’s

capability. This is only the first test of establishing a good and

sustainable business. We are not yet certain if Totenpass will

succeed, although I believe this will become more evident over the

course of 2022-2023. We will continue to notify shareholders of the

development of Totenpass and will begin to report its financial

results as they become material.

I would like to thank Paul Mennega and Mark Olson for their

excellent leadership this quarter. I would also like to thank our

clients and shareholders for their continued trust in our company,

its mission, and its services.

Financial Information and IFRS Standards

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's consolidated financial statements for the quarter ended

September 30, 2021 and prepared in accordance with International

Financial Reporting Standards ("IFRS") and the corresponding

management's discussion and analysis, which are available under the

Company's profile on SEDAR at www.sedar.com.

Investor Questions

Shareholders of Goldmoney are encouraged to submit questions to

management by emailing ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Tangible Capital is a non-IFRS measure. This figure excludes

from total shareholder equity (i) intangibles, and (ii) goodwill,

and is useful to demonstrate the tangible capital employed by the

business.

Gross profit excluding gain/loss on revaluation of inventories

is a non-IFRS measure, calculated as gross profit less gain/(loss)

on revaluation of precious metals. The closest comparable IFRS

financial measure is gross profit. Fluctuations in the value of its

precious metal inventories caused by fluctuations in market prices

are included in gross profit. Management believes that excluding

such fluctuations more clearly illustrates the Company’s business

operations.

Non-IFRS Adjusted Gain (Loss) is a non-IFRS measure, defined as

total comprehensive income (loss) adjusted for non-cash and

non-core items which include, but is not limited to, revaluation of

precious metal inventories, stock-based compensation, depreciation

and amortization, foreign exchange fluctuations and gains and

losses on investments.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the quarter ended September 30, 2021.

About Goldmoney Inc.

Goldmoney Inc. (TSX: XAU) is a precious metal focused global

business. Through its ownership of various operating subsidiaries,

the company is engaged in precious metal sales to its clients,

including arranging delivery and storage of precious metals for its

clients, coin retailing, and lending. Goldmoney clients located in

over 150 countries hold approximately $2.1 billion in precious

metal assets. The company’s operating subsidiaries include:

Goldmoney.com, SchiffGold.com and Totenpass. In addition to the

Company’s principal business segments, the Company holds a

significant interest in Menē Inc., which crafts pure 24-karat gold

and platinum investment jewelry that is sold by gram weight.

Through these businesses and other investment activities, Goldmoney

gains long-term exposure to precious metals. For more information

about Goldmoney, visit goldmoney.com.

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. believes, expects or

anticipates will or may occur in the future, is forward-looking

information. Forward-looking information does not constitute

historical fact but reflects the current expectations the Company

regarding future results or events based on information that is

currently available. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties, both general and specific, that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking information will not occur. Such forward-looking

information in this release speak only as of the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company’s operating history; history of operating losses;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; precious metal trading risks;

and volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company’s most recently filed annual information form, available on

SEDAR. Although the Company has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211109005758/en/

Media and Investor Relations inquiries: Mark Olson Chief

Financial Officer Goldmoney Inc. mark.olson@goldmoney.com

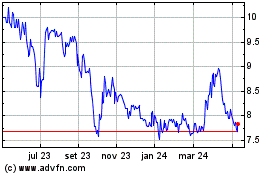

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

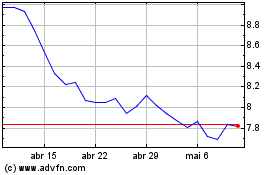

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025