Goldmoney Completes Successful Closure of Its Jersey Operations

07 Janeiro 2022 - 11:30AM

Business Wire

In its Third Quarter 2021 Earnings Report released on February

9, 2021, Goldmoney Inc. (the “Company”) disclosed the plan to

restructure its operations by transferring its activities from

Jersey, Channel Islands to achieve cost efficiencies, which the

Company projected to complete during fiscal year 2022. More

recently in its June 23, 2021 Annual Letter to Shareholders, the

Company announced it had successfully ceased business in Jersey,

with customers having the choice of moving their relationship to

the Canadian or United Kingdom offices.

As we near six months since the closure of our Jersey

operations, the benefits to the Company’s shareholders and clients

are significant:

- Through the elimination of redundancies in staffing,

facilities, and IT, we expect to recover within 12 months all the

costs related to the closure of the Jersey operations, and

thereafter benefit from structural savings close to $4 million each

year in the future.

- Our Treasury team has achieved lower operating costs with

economies of scale from consolidating our supplier and vaulting

relationships.

- By moving our primary Relationship Management Team to Canada

and adding additional contact options to the Goldmoney Holding, we

have improved our response times and client satisfaction.

The closure of the Jersey office was completed on schedule in

September. Subsequently, the Jersey Financial Services Commission

(“JFSC”) approached the Company in relation to a matter that had

occurred within the Jersey-based subsidiary during the 2016 to 2018

period. To resolve this matter, the JFSC proposed that Goldmoney

would not be permitted to operate in Jersey for a period of ten

years, should it choose to re-establish a Jersey office. Having

made in January 2021 the commercial decision to close its

operations in Jersey, thereby making any plans to return there

unlikely, the Company considered its alternative courses of action

and decided it was in the best interests of its shareholders to

accept the JFSC’s proposal.

With these matters now behind us, and with the significant

realised savings that closing our Jersey operations is now

providing, management looks forward to focusing our entrepreneurial

energies on delivering long-term value to our shareholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220107005296/en/

Mark Olson, +1 (647) 250-7170

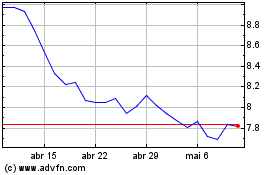

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

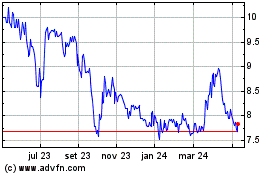

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025