Rio Tinto releases fourth quarter production results

17 Janeiro 2022 - 6:23PM

Business Wire

Rio Tinto Chief Executive Jakob Stausholm said: “In 2021 we

continued to experience strong demand for our products while

operating conditions remained challenging, including due to

prolonged COVID-19 disruptions. Despite this, we progressed a

number of our projects, including the Pilbara replacement mines,

underlining the resilience of the business and the commitment and

flexibility of our people, communities and host governments. We are

seeing some initial positive results from the implementation of the

Rio Tinto Safe Production System, which we will significantly ramp

up in 2022, as we continue to work hard to improve our operational

performance to become the best operator.

“In the fourth quarter we set a new direction for the company

and announced a number of partnerships focused on decarbonising the

value chain for our products, including green steel. We also

entered into a binding agreement to acquire the Rincon lithium

project in Argentina, which is strongly aligned with our strategy.

These actions will ensure we continue to deliver attractive returns

to shareholders, invest in sustaining and growing our portfolio,

and progress our ambition to net-zero carbon emissions."

Production*

Quarter 4

2021

vs Q4

2020

vs Q3

2021

Full Year

2021

vs FY

2020

Pilbara iron ore shipments (100% basis)

(Mt)

84.1

-5%

+1%

321.6

-3%

Pilbara iron ore production (100%

basis) (Mt)

84.1

-2%

+1%

319.7

-4%

Bauxite (Mt)

13.1

-2%

-6%

54.3

-3%

Aluminium (kt)

757

-7%

-2%

3,151

-1%

Mined Copper (kt)

132

0%

+6%

494

-7%

Titanium dioxide slag (kt)

228

-16%

+9%

1,014

-9%

IOC iron ore pellets & concentrate

(Mt)

2.5

-9%

+15%

9.7

-6%

*Rio Tinto share unless otherwise stated

2021 operational highlights and other key

announcements

- The safety and well-being of our employees and contractors

remains our priority. Fatigue, labour shortages and other pressures

from COVID-19 have heightened the safety risk in day-to-day

operations and remind us that there is no room for complacency. We

experienced our third consecutive year with no fatalities at our

managed operations. We are working hard with our partners to

achieve the same results at our non-managed assets and marine

operations.

- Pilbara iron ore production of 319.7 million tonnes (100%

basis) was 4% lower than 2020. This is due to above average

rainfall in the first half of the year, cultural heritage

management and delays in growth and brownfield mine replacement

tie-in projects. Pilbara shipments in 2021 were 321.6 million

tonnes (100% basis), 3% lower than 2020, and included elevated

levels of SP10 product as a result of delays in growth and

brownfield mine replacement tie-in projects.

- Bauxite production of 54.3 million tonnes was 3% lower than

2020 due to severe wet weather in the first quarter impacting

system stability throughout the year, equipment reliability issues

and overruns on planned shutdowns at our Pacific operations.

- Aluminium production of 3.2 million tonnes was 1% lower than

2020 due to reduced capacity at our Kitimat smelter in British

Columbia following the strike which commenced in July 2021. The

labour union and employees have reached an agreement with

controlled restart in 2022.

- Mined copper production of 494 thousand tonnes was 7% lower

than 2020 due to lower recoveries and throughput at Escondida as a

result of the prolonged impact of COVID-19, partly offset by higher

recoveries and grades at Oyu Tolgoi in Mongolia and Kennecott in

the US.

- Titanium dioxide slag production of 1,014 thousand tonnes was

9% lower than 2020 as a result of community disruptions and

subsequent curtailment of operations at Richards Bay Minerals (RBM)

coupled with unplanned maintenance and equipment reliability issues

at Rio Tinto Fer et Titane (RTFT) in Canada. On 24 August, RBM

resumed operations following stabilisation of the security

situation, supported by the national and provincial government, as

well as substantive engagement with host communities and their

traditional authorities.

- Production of pellets and concentrate at Iron Ore Company of

Canada (IOC) was 6% lower than 2020 due to prolonged labour and

equipment availability issues impacting product feed and various

other operational challenges throughout the year.

- At the Jadar lithium-borate project in Serbia, as a result of

delays in the approval of the Exploitation Field Licence (EFL),

which is a prerequisite to publish the Environmental Impact

Assessment (EIA) and commence the consultation process, we are

revising development timelines. Based on current estimates and

subject to receiving all relevant approvals, permits and licences,

first saleable production is expected to be no earlier than 2027

(previously 2026).

- In the fourth quarter, we entered into several partnerships to

accelerate decarbonising our own business and the value chains we

operate in. In November, we announced the ELYSIS joint venture

successfully produced aluminium without any direct greenhouse gas

emissions from commercial-size cells.

- On 20 October, we outlined the actions being taken to

strengthen the business and improve performance. We unveiled a

longer-term strategy to ensure we thrive in a decarbonising world

and continue to deliver attractive shareholder returns, in line

with our policy.

- This year, we initiated the Rio Tinto Safe Production System

(RTSPS) at five pilot sites, focusing on sustainably unlocking

capacity across the system. We are already seeing returns in the

first year of rollout including a significant improvement at the

Kennecott concentrator since the July deployment compared to the

previous 12 months performance. A significantly larger programme is

planned for 2022, subject to COVID-19 constraints, with the RTSPS

rollout of up to 30 deployments at 15 sites as well as up to 80

rapid improvement projects which aim at improving targeted

bottlenecks.

- On 28 October, we issued $1.25 billion 30-year fixed rate

SEC-registered bonds priced at 2.75%. The proceeds of the new

issuance were used to fund the early redemption and extinguishment

of the company’s $1.20 billion 3.75% bonds due to mature in June

2025.

- On 19 December, we announced the Board of Directors had

selected Dominic Barton to succeed Simon Thompson as the new Chair.

Dominic will join the Board with effect from 4 April 2022 and be

appointed to the role of Chair at the conclusion of the Rio Tinto

Limited annual general meeting on 5 May 2022.

- On 21 December, we announced we had entered into a binding

agreement to acquire the Rincon lithium project in Argentina from

Rincon Mining for $825 million. Rincon is one of the largest

undeveloped lithium brine projects in the world, located in the

heart of the lithium triangle in Salta Province.

- Our guidance assumes development of the pandemic does not lead

to government-imposed restrictions and widespread protracted cases

related to new highly contagious variants with high severity, which

could result in a significant number of our production critical

workforce and contractor base being unable to work due to illness

and/or isolation requirements. This risk extends to prolonged

interruption of service from a key partner or supplier which could

lead to severely constrained operational activity of a key asset or

project. This risk is exacerbated globally by tight labour markets

and supply chain delays.

- All figures in this report are unaudited. All currency figures

in this report are US dollars, and comments refer to Rio Tinto’s

share of production, unless otherwise stated.

The full fourth quarter production results are available

here

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

LEI: 213800YOEO5OQ72G2R82 Classification: 3.1 Additional

regulated information required to be disclosed under the laws of a

Member State

Category: General

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220117005238/en/

Please direct all enquiries to

media.enquiries@riotinto.com Media Relations, UK

Illtud Harri M +44 7920 503 600 David Outhwaite M +44

7787 597 493 Media Relations, Americas Matthew Klar T

+1 514 608 4429 Investor Relations, UK Menno Sanderse

M: +44 7825 195 178

David Ovington M +44 7920 010 978 Clare Peever M +44

7788 967 877 Rio Tinto plc 6 St James’s Square London SW1Y

4AD United Kingdom T +44 20 7781 2000 Registered in England No.

719885 Media Relations, Australia Jonathan Rose M +61

447 028 913 Matt Chambers M +61 433 525 739 Jesse

Riseborough M +61 436 653 412 Investor Relations,

Australia Natalie Worley M +61 409 210 462 Amar

Jambaa M +61 472 865 948 Rio Tinto Limited Level 7, 360

Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404

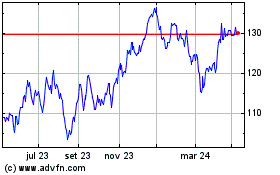

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

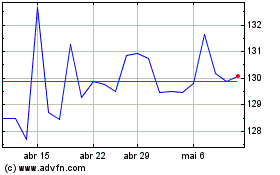

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025