Rio Tinto, Turquoise Hill Resources (TRQ) and the Government of

Mongolia have reached an agreement that will move the Oyu Tolgoi

(OT) project forward, resetting the relationship between the

partners and increasing the value the project delivers for

Mongolia.

As a result, the OT Board, comprised of representatives of Rio

Tinto, TRQ and Erdenes Oyu Tolgoi (EOT) which is wholly owned by

the Government of Mongolia, has unanimously approved commencement

of underground operations. This step unlocks the most valuable part

of the mine and is expected to begin in the coming days, with first

sustainable production expected in the first half of 2023.

Project budget, funding and agreements As part of a

comprehensive package, TRQ will waive the $2.4 billion1 EOT carry

account loan in full, comprising the amount of common share

investments in OT LLC funded by TRQ on behalf of EOT to build the

project to date, plus accrued interest.

The Parliament of Mongolia has approved a resolution (Resolution

103) that resolves the outstanding issues that have been subject to

negotiations with the Government of Mongolia over the last two

years in relation to addressing Parliament Resolution 92 (December

2019).

With this approval, the Parliament of Mongolia has required that

certain measures be completed in order for Resolution 92 to be

considered formally implemented. To date, conditions relating to

the following measures have been addressed: (i) the waiving of the

carry account loan; (ii) the improved cooperation with EOT; (iii)

the implementation of measures to monitor OT underground

development financing mechanisms and enhance ESG matters; (iv) the

approval of the Electricity Supply Agreement; and (v) the

establishment of a funding structure at OT that does not incur

additional loan financing prior to sustainable production for Panel

0 (expected in the first half of 2023). Rio Tinto continues to work

with the Government of Mongolia and TRQ to finalise the remaining

outstanding measures of Resolution 92, namely the formal

termination of the Oyu Tolgoi Mine Development and Financing Plan

(UDP) and resolution of the outstanding OT LLC tax arbitration.

An updated funding plan has been agreed to address TRQ’s current

estimated remaining funding requirement for the OT Underground

Project. Until sustainable underground production is achieved, OT

will be funded by cash on hand and rescheduling of existing debt

repayments, together with a pre-paid copper concentrate sales

agreement with TRQ. This is in line with restrictions on debt

financing contained in Resolution 103, passed on 30 December

2021.

Rio Tinto and TRQ have amended the Heads of Agreement signed in

April 2021 to ensure they appropriately fund OT. The capital

forecast for the project is $6.925 billion, including $175 million

of known COVID-19 impacts to the end of 20212. Forecasted remaining

undergound capital expenditure is approximately $1.8 billion. A

reforecast will be undertaken during H1 2022 to determine a revised

cost and schedule estimate that will reflect:

- any further COVID-19 impacts;

- any additional time-based impacts and market price escalation

arising from resequencing due to 2021 budget constraints (as a

result of the OT Board not approving the capital budget uplift at

the time the Definitive Estimate was finalised); and

- updated risk ranging reflecting the latest project execution

risks.

The key elements under the amended Heads of Agreement

include:

- pursuing the rescheduling of principal repayments of existing

OT project finance to potentially reduce the OT funding requirement

by up to $1.7 billion;

- seeking to raise up to $500 million of senior supplemental debt

at OT from selected international financial institutions which

could be put in place after sustainable underground production is

achieved;

- Rio Tinto providing a co-lending project finance facility to OT

of up to $750 million to be made available after sustainable

underground production is achieved (with up to $300 million of such

amount being available under a short-term secured advance directly

to TRQ pending such co-lending); and

- TRQ agreeing to conduct equity or rights offerings of up to

$1.5 billion (with an initial offering of at least $650 million by

no later than 31 August 2022).

The re-profiling of the existing OT project finance and any

additional senior supplemental debt at OT will be subject to

availability and terms and conditions being acceptable to Rio Tinto

and TRQ.

Power The OT Board has also approved the signing of an

Electricity Supply Agreement to provide OT with a long-term source

of power from the Mongolian grid, under terms already agreed with

the Government of Mongolia. In meeting OT’s commitment to sourcing

power domestically, Rio Tinto will work with the Government to

support long-term renewable energy generation in support of the

Mongolian grid. The Government of Mongolia and OT are in

constructive discussions with the Inner Mongolia Power

International Cooperation Company (IMPIC) for an extension of

current power import arrangements beyond the current agreement of

July 2023. IMPIC have indicated their support for an extension and

commercial terms are being finalised.

Luvsannamsrain Oyun-Erdene, the Prime Minister of Mongolia,

said, “The commencement of Oyu Tolgoi underground mining operations

demonstrates to the world that Mongolia can work together with

investors in a sustainable manner and become a trusted partner. As

part of our “New Recovery Policy”, I am happy to express Mongolia’s

readiness to work actively and mutually beneficially with global

investors and partners.”

Rio Tinto Chief Executive Jakob Stausholm, said, “We would like

to thank the Government of Mongolia for their commitment to working

productively with Rio Tinto and TRQ to reach this crucial

agreement, that will see one of the world’s largest copper growth

projects move forward and firmly establish Mongolia as a global

investment destination. This agreement represents a reset of our

relationship and resolves historical issues between the OT project

partners. We strongly believe in the future of this country and I

am personally committed to ensuring that the people of Mongolia

benefit strongly from OT along with our shareholders.”

“I have visited Mongolia twice in the last few months and I

cannot help but be proud of what has been achieved by our

workforce, hand-in-hand with communities, suppliers and other

partners. I would like to thank the many thousands of people

involved for what they have achieved.”

“The OT underground development will consolidate Rio Tinto’s

position as a leading global supplier of copper at a time when

demand is increasing, driven by its role in enabling

decarbonisation and electrification in the race to net zero. We

will also explore additional opportunities to decarbonise the OT

operations, including sourcing renewable power.”

Steve Thibeault, Interim Chief Executive Officer of Turquoise

Hill Resources, commented, “Today is a landmark day for Turquoise

Hill and a major milestone in the development of the Oyu Tolgoi

underground development project. We are very excited to be starting

work on the undercut, which is critical to unlocking the immense

potential of this world-class, high grade deposit for the benefit

of all stakeholders. Following the agreements with the Government

of Mongolia and the Amended Heads of Agreement with Rio Tinto being

put in place, we now have greater certainty and confidence to

complete construction of this once-in-a-generation mine that, when

finished, is expected to be one of the largest copper producing

mines in the world and a generator of vast economic value and

employment in Mongolia and of returns for our shareholders for

years to come. I want to thank the Government of Mongolia for its

commitment to securing a balanced agreement that helps to advance

the project while ensuring that all stakeholders including the

people of Mongolia truly benefit from the development of this

resource. This agreement says a lot about the positive environment

for foreign investment in the country.”

By 2030 OT is expected to be the fourth largest copper mine in

the world. It is a complex greenfield project comprising an

underground block cave mine and copper concentrator as well as an

open pit mine which has been successfully operating for almost ten

years. It is also one of the most modern, safe, sustainable and

water-efficient operations globally, with a workforce which is more

than 96 per cent Mongolian. Since 2010, OT has spent a total of

$13.4 billion in-country, including $3.6 billion of taxes, fees and

other payments to the state budget. The size and quality of this

Tier 1 asset provides additional expansion options, which could see

production sustained for many decades.

Notes to Editors At peak production, OT is expected to

operate in the first quartile of the copper cash cost curve3. OT is

expected to produce around 500,000 tonnes of copper per year on

average from 2028 to 2036 from the open pit and underground, and an

average of around 350,000 tonnes for a further five years4,

compared to 163,000 tonnes in 20215. The underground Ore Reserve

has an average copper grade of 1.52 per cent, which is more than

three times higher than the open pit Ore Reserve, and contains 0.31

grammes per tonne of gold.6

Rio Tinto Canadian early warning disclosure Rio Tinto

currently beneficially owns 102,196,643 common shares of TRQ,

representing approximately 50.8% of the issued and outstanding

common shares of TRQ. Rio Tinto also has anti-dilution rights that

permit it to acquire additional securities of TRQ so as to maintain

its proportionate equity interest in TRQ from time to time.

As the subscription price for any TRQ equity or rights offering

is not determinable at this time, the number of TRQ common shares

Rio Tinto will beneficially own following closing of any such

equity or rights offering cannot be determined at this time.

Except in connection with such equity or rights offerings, Rio

Tinto has no present intention of acquiring additional securities

of TRQ. Depending upon its evaluation of the business, prospects

and financial condition of TRQ, the market for TRQ’s securities,

general economic and tax conditions and other factors, Rio Tinto

may directly or indirectly acquire or sell some or all of the

securities of TRQ.

This announcement is authorised for release to the market by,

and a copy of the related early warning report may be obtained from

Rio Tinto’s Group Company Secretary.

Additional disclosures This press release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities. Any offers, solicitations or offers to buy, or any

sales of securities will be made in accordance with registration

requirements under applicable law.

Forward-looking statements This press release includes

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical facts included in this report, including,

without limitation, those regarding capital and funding

requirements, are forward-looking statements. The words “intend”,

“forecast”, “project”, “anticipate”, “estimate”, “plan”,

“believes”, “expects”, “may”, “should”, “will”, “target”, “pursue”,

“seek” or similar expressions, commonly identify such

forward-looking statements. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. These

forward-looking statements speak only as of the date of this press

release. Rio Tinto and TRQ each expressly disclaims any obligation

or undertaking (except as required by applicable law, the UK

Listing Rules, the Disclosure Guidance and Transparency Rules of

the Financial Conduct Authority and the Listing Rules of the

Australian Securities Exchange) to release publicly any updates or

revisions to any forward-looking statement contained herein to

reflect any change in their respective expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based.

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82 Classification: 3.1. Additional

regulated information required to be disclosed under the laws of a

Member State.

Category: Oyu Tolgoi

1Financial reporting impact of waiver Rio Tinto’s accounting

treatment for its share in the carry account loan is explained in

note 1 (xii) on page 221 and note 32 (l) on page 264 of the 2020

Annual Report. Prior to the waiver agreement, the carry account was

expected to be repaid via a pledge over EOT’s share of future OT

common share dividends. For this reason, and because the

arrangement is between TRQ and EOT rather than with OTLLC itself,

both the principal and interest are treated as transactions with

owners acting in their capacity as owners. Consequently, the carry

account is currently recorded as a reduction in the share of equity

attributable to non-controlling interests, resulting in an increase

to the effective interest in OT attributable to owners of Rio

Tinto. The carry account is not classified as a loan receivable in

the Group Balance Sheet, and there is no interest income shown in

the Group Income Statement; accumulation of interest on the carry

account increases the share of profit attributable to Rio Tinto as

it is accrued.

Waiving the carry account loan increases EOT’s economic share

arising through entitlement to cash flows from future dividends of

OT. In the 2022 Group Accounts, there will be no Income Statement

charge for loan forgiveness or write-off as a result of the waiver,

and net assets and liabilities for OT included in the Group Balance

sheet remain unchanged. There is no exchange of cash or other

financial assets between parties and there will be no change to the

underlying free cash flows of the OT operations and development

project. A reallocation of the net asset value allocation between

the owners of OT will be recorded in the Group Statement of Changes

in Equity for 2022 by reducing equity attributable to owners of Rio

Tinto and increasing equity attributable to non-controlling

interests.

2These estimates exclude any impacts of delays to work schedules

caused by restricted approved budgets since the start of 2021. This

impact, and the impact of any ongoing COVID-19 impacts will be

assessed following the commencement of underground operations with

further updates provided to the market in due course. Panels 1 and

2 studies will be ongoing throughout 2022. Further study work is

also underway to assess the extraction methodology and ultimate

recovery of the Panel 0 recoverable pillars.

3 Wood Mackenzie copper equivalent cash cost curve (Q4 2021)

4 The 500ktpa target (stated as recovered metal) for the Oyu

Tolgoi underground and open pit mines is underpinned 17 per cent by

Proved Ore Reserves and 83 per cent by Probable Ore Reserves for

the years 2028-2036. The 350ktpa production target for the

following 5 years is underpinned 18 per cent by Proved Ore Reserves

and 82 per cent by Probable Ore Reserves. These production targets

have been scheduled from current mine designs by Competent Persons

in accordance with the requirements of the Australasian Code for

Reporting of Exploration Results, Minerals Resources and Ore

Reserves, 2012 Edition (the JORC code).

5 Rio Tinto Fourth Quarter Operations Review, published 17

January 2022.

6 This information in relation to the underground Ore Reserves

was previously reported in the release to the ASX dated 16 December

2020. The Competent Persons responsible for reporting the Ore

Reserves were Ferrin Prince and Mark Bixley, Competent Persons, who

are a Member and Fellow respectively of The Australasian Institute

of Mining and Metallurgy. Rio Tinto is not aware of any new

information or data that materially affects these Ore Reserve

estimates and confirms that all material assumptions and technical

parameters underpinning the estimates continue to apply and have

not materially changed. The form and context in which the Competent

Persons’ findings are presented have not been materially modified

from the release dated 16 December 2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220123005103/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, UK

Illtud Harri M +44 7920 503 600

David Outhwaite M +44 7787 597 493

Media Relations, Australia

Jonathan Rose M +61 447 028 913

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Media Relations, Americas

Matthew Klar T +1 514 608 4429

Investor Relations, UK

Menno Sanderse M: +44

7825 195 178

David Ovington M +44 7920 010 978

Clare Peever M +44 7788 967 877

Investor Relations, Australia

Natalie Worley M +61 409 210 462

Amar Jambaa M +61 472 865 948

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom

T +44 20 7781 2000 Registered in England No. 719885

Rio Tinto Limited

Level 7, 360 Collins Street Melbourne 3000 Australia

T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404

riotinto.com

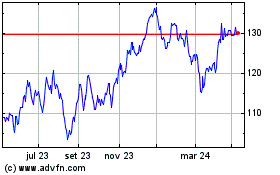

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

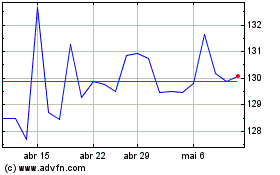

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025