Rio Tinto announces record financial results and total dividend of 1,040 US cents per share for 2021, a 79% payout

23 Fevereiro 2022 - 2:50AM

Business Wire

Rio Tinto Chief Executive Jakob Stausholm said: "Our people have

continued to safely run our world-class assets and are working hard

to improve our operational performance, despite challenging

operating conditions from prolonged COVID-19 disruptions. The

recovery of the global economy, driven by industrial production,

resulted in significant price strength for our major commodities,

which we were able to capture, achieving record financial results

with free cash flow of $17.7 billion and underlying earnings of

$21.4 billion, after taxes and government royalties of $13.0

billion. This enables us to pay our highest total dividend ever of

1,040 US cents per share, including a 247 US cents per share

special dividend, representing a 79% payout.

"With the launch of our new strategy, we have set a new

direction for Rio Tinto to thrive in a decarbonising world. We have

a portfolio that is well positioned, and are targeting disciplined

investment in commodities that will see strong demand in the coming

decades. Our agenda is an ambitious, multi-year journey which we

are determined to deliver and we have already taken the first

steps, with underground operations under way following the Oyu

Tolgoi agreement and a binding agreement to acquire the Rincon

lithium project in Argentina. We continue to evolve and deepen the

way we engage and interact with all stakeholders as we work hard to

generate and strengthen relationships wherever we operate. Our

actions will ensure we continue to deliver attractive returns to

shareholders, invest in sustaining and growing our portfolio, and

make a broader contribution to society, particularly in relation to

the drive to net-zero carbon emissions."

At year end

2021

2020

Change

Net cash generated from operating

activities (US$ millions)

25,345

15,875

60%

Purchases of property, plant and equipment

and intangible assets (US$ millions)

7,384

6,189

19%

Free cash flow1 (US$ millions)

17,664

9,407

88%

Consolidated sales revenue (US$

millions)

63,495

44,611

42%

Underlying EBITDA1 (US$ millions)

37,720

23,902

58%

Profit after tax attributable to owners of

Rio Tinto (net earnings) (US$ millions)

21,094

9,769

116%

Underlying earnings per share1 (EPS) (US

cents)

1,321

770

72%

Ordinary dividend per share (US cents)

793.0

464.0

71%

Special dividend per share (US cents)

247.0

93.0

166%

Total dividend per share (US cents)

1,040.0

557.0

87%

Net cash / (debt)1 (US$ millions)

1,576

(664)

Underlying return on capital employed

(ROCE)1

44%

27%

1 This financial performance indicator is

a non-GAAP alternative performance measure ("APM"). It is used

internally by management to assess the performance of the business

and is therefore considered relevant to readers of this document.

It is presented here to give more clarity around the underlying

business performance of the Group’s operations. APMs are reconciled

to directly comparable IFRS financial measures on pages 78 to 86.

Our financial results are prepared in accordance with International

Financial Reporting Standards (IFRS) - see page 35 for further

information. Footnotes are set out in full on page 8.

- Safety continues to be our first priority: our managed

operations were fatality-free for a third successive year. The

all-injury frequency rate deteriorated slightly to 0.40: fatigue,

labour shortages and other pressures from COVID-19 have heightened

the safety risk in day-to-day operations and we recognise that

there is no room for complacency.

- On 1 February 2022, we published a comprehensive external

review of our workplace culture, commissioned as part of our

commitment to ensure sustained cultural change across our global

operations. The review is part of the work being undertaken by our

Everyday Respect task force, which was launched in March 2021 to

better understand, prevent and respond to harmful behaviours in the

workplace. We will implement all recommendations from the

report.

- We continue to focus on rebuilding our relationships with

Traditional Owners across our global operations. In September we

published an interim report on our Communities and Social

Performance commitments showing our progress. At the end of 2021,

the relationship between the Puutu Kunti Kurrama and Pinikura

(PKKP) leadership and Rio Tinto Iron Ore is constructive and

considered. An agreement on a co-management of Country approach and

appropriate remedy for the destruction of Juukan Gorge is

substantially progressed.

- On 14 February 2022, we announced an agreement with the

Yinhawangka Aboriginal Corporation on a new co-designed management

plan to ensure the protection of significant social and cultural

heritage values as part of our proposed development of the Western

Range iron ore project in the Pilbara region of Western Australia.

The Social, Cultural Heritage Management Plan is the result of

strong collaboration over the past year between the Yinhawangka

people and Rio Tinto including "on-Country" visits, archaeological

and ethnographic surveys and workshops. As a result, the mine has

been designed to reduce impacts on social and cultural heritage

values. We submitted the plan to Western Australia’s Environmental

Protection Authority on 1 February 2022, as part of our submission

regarding the Greater Paraburdoo Iron Ore Hub Proposal.

- In October, we unveiled a longer term strategy to ensure we

thrive in a decarbonising world, while continuing to pay attractive

dividends, in line with our shareholder returns policy. To achieve

this, we will accelerate our own decarbonisation, grow in materials

enabling the global energy transition and develop products and

services that help our customers to decarbonise, through our key

enablers of becoming best operator, excelling in development,

achieving an impeccable ESG performance and strengthening our

social licence to operate.

- To deliver our strategy, we set a new target to reduce our

Scope 1 and 2 carbon emissions by 50% by 2030, more than tripling

our previous target, and are bringing forward our 15% reduction in

emissions to 2025 (previously 2030), supported by an estimated $7.5

billion of direct investments between 2022 and 2030. These projects

deliver a range of economic outcomes but in aggregate are value

accretive at a very modest carbon price. Most importantly, they

safeguard the integrity of our assets over the longer term and

reduce the risk profile of our cash flows. We are accelerating our

activity in the Pilbara and expanding our tenure for potential wind

and solar sites.

- Following the comprehensive agreement announced on 25 January

2022, underground operations are now under way at the Oyu Tolgoi

copper/gold project in Mongolia. The agreement will move the

project forward, reset the relationship between the partners and

unlock the most valuable part of the mine, with first sustainable

production expected in the first half of 2023.

- In line with our rigorous approach to capital allocation, we

made significant progress with our Battery Minerals portfolio in

2021, signing a binding agreement to acquire the Rincon lithium

project in Argentina. We also committed funding for the Jadar

lithium-borates project in Serbia, subject to receiving all

relevant approvals, permits and licences. In January 2022, the

Government of Serbia cancelled the Spatial Plan for the Jadar

project and required all related permits to be revoked. We are

disappointed by this announcement and are committed to exploring

all options and are reviewing the legal basis of the decision and

the implications for our activities and people in Serbia.

- To achieve our ambition of becoming the best operator, we

initiated the Rio Tinto Safe Production System at five pilot sites

in 2021, focusing on sustainably unlocking capacity. We are already

seeing returns, including a significant improvement at the

Kennecott concentrator since deployment in July. We are planning a

more extensive programme in 2022, subject to COVID-19 constraints,

with up to 30 deployments at 15 sites and up to 80 rapid

improvement projects, targeting bottlenecks.

The 2021 full year results release is available here

This announcement is authorised for release to the market by Rio

Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220221005524/en/

media.enquiries@riotinto.com riotinto.com

Media Relations, UK

Illtud Harri M +44 7920 503 600

David Outhwaite M +44 7787 597 493

Media Relations, Americas

Matthew Klar T +1 514 608 4429

Media Relations, Australia

Jonathan Rose M +61 447 028 913

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Investor Relations, UK

Menno Sanderse M: +44

7825 195 178

David Ovington M +44 7920 010 978

Clare Peever M +44 7788 967 877

Investor Relations, Australia

Amar Jambaa M +61 472 865 948

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom

T +44 20 7781 2000 Registered in England No. 719885

Rio Tinto Limited

Level 7, 360 Collins Street Melbourne 3000 Australia

T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404

Category: General

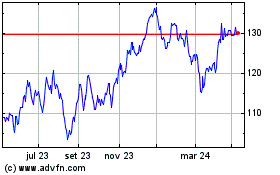

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

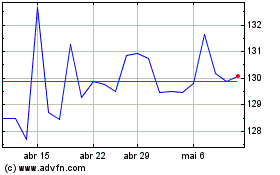

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025