Sequa Petroleum N.V. and Partners Have Reached an Agreement to Acquire 10% of Block 15/06 in Angola from Sonangol P&P Through Sungara Energies Limited, a New African Entity

28 Abril 2022 - 4:00AM

Business Wire

Regulatory News:

Sequa Petroleum N.V. (“SPNV”) is pleased to announce that

Sungara Energies Limited (“Sungara”) has entered into an agreement

with Sonangol Pesquisa E Produção, S.A. (“Sonangol P&P”) to

purchase a 10% participating interest in Block 15/06, 40%

participating interest in Block 23 (with operatorship), and 35%

participating interest in Block 27 (the “Transaction”). Sungara is

jointly owned by three partners: the National Petroleum Corporation

of Namibia’s subsidiary NAMCOR Exploration and Production

(Proprietary) Limited (“Namcor”), Petrolog Energies Limited

(“Petrolog”, a company affiliated with African multinational

Petrolog Group), and SPNV’s subsidiary Sequa Petroleum UK Limited

(“Sequa”).

Sungara is a new entity with a focus on Sub-Saharan African

upstream oil and gas, combining world-class technical expertise

with local capability and commitment, able to operate and develop

oil and gas assets throughout the region in line with the highest

standards of integrity, quality, governance and responsibility.

Concurrent with the Transaction, NAMCOR, Petrolog and Sequa have

signed a shareholder agreement relating to their interests in

Sungara, with equal terms and shareholdings in Sungara for each

partner. A general meeting of shareholders of SPNV will be convened

to approve its entering into the Sungara partnership.

The Block 15/06 Joint Venture comprises Eni (operator, 36.84%),

Sonangol P&P (36.84%) and SSI Fifteen Limited (26.32%). Block

15/06 is one of the most prolific blocks in deepwater offshore

Angola with current oil production of more than 100,000 barrels per

day through two large floating production and storage facilities.

Following successful exploration and appraisal in the past several

years, an ongoing development programme is forecasted to increase

production in the medium term beyond 150,000 barrels per day. The

block has further upside potential which may materialise following

future exploration, appraisal and development activity.

Sungara’s 10% participating interest in Block 15/06 provides it

with current production of more than 10,000 barrels of oil per day,

forecasted to grow beyond 15,000 barrels per day in the medium

term, 75 million barrels reserves and resources, and further upside

potential. Offshore exploration Blocks 23 and 27 also provide

upside value. The consideration for the Transaction is ca. USD 500

million which includes a contingent payment of up to USD 50

million. The Transaction is planned to be funded by Sungara through

a combination of equity contributions from each of the Sungara

partners and third party debt. The economic effective date of the

Transaction is April 2022 and completion, subject to customary

conditions and approvals, is planned to occur in 2022.

Cautionary notice

This press release may contain information that qualifies as

inside information within the meaning of Article 7(1) of the EU

Market Abuse Regulation. This communication may contain

forward-looking statements. All statements other than statements of

historical facts may be forward-looking statements. Words such as

possibly and expected or other similar words or expressions are

typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and

other factors that are difficult to predict and that may cause

actual results of SPNV to differ materially from future results

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, risks relating to the

SPNV’s ability to engage a depositary and a listing agent, generate

positive cash flows, general economic conditions, turbulences in

the global credit markets and the economy, geopolitical events and

other factors discussed in SPNV’s public filings and other

disclosures. Forward-looking statements reflect the current views

of the SPNV’s management and assumptions based on information

currently available to SPNV’s management. Forward-looking

statements speak only as of the date they are made, and the SPNV

does not assume any obligation to update such statements, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220428005517/en/

Jacob Broekhuijsen Chief Executive Officer Sequa Petroleum N.V.

info@sequa-petroleum.com

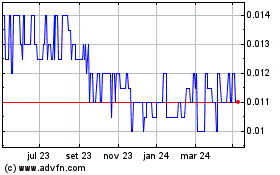

Sequa Petroleum NV (EU:MLSEQ)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

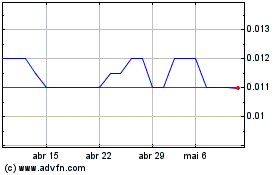

Sequa Petroleum NV (EU:MLSEQ)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025