Real Matters Announces Amendment to Normal Course Issuer Bid

06 Maio 2022 - 8:30AM

Business Wire

Real Matters Inc. (“Real Matters” or the “Company”) (TSX: REAL)

today announced that the Toronto Stock Exchange (“TSX”) has

approved an amendment to the Company’s current Normal Course Issuer

Bid (“NCIB”) to increase the number of common shares that the

Company may purchase for cancellation from 6,000,000 common shares

(approximately 7.8% of the 76,489,997 common shares in the public

float as at May 31, 2021) to 7,648,999 common shares (representing

10.0% of the 76,489,997 common shares in the public float as at May

31, 2021). No other terms of the NCIB have changed.

The Company believes that the prevailing share price for its

common shares does not currently reflect its underlying value such

that the purchase of common shares for cancellation represents an

attractive opportunity to return value to the Company’s common

shareholders.

Since commencement of the NCIB, Real Matters has purchased for

cancellation 4,147,256 common shares at a weighted average price of

$11.78. The Company’s previously approved NCIB commenced on June

11, 2021 and was amended on November 24, 2021. The further amended

NCIB will commence on May 10, 2022 and will continue until June 10,

2022, or such earlier date as the Company has acquired the maximum

number of common shares permitted under the NCIB or spent C$70

million. The Company has allocated up to C$70 million towards the

purchase of common shares under the NCIB, of which C$48,860,512 has

been spent to date, leaving C$21,139,488 available for purchases.

The actual number of common shares purchased by the Company under

the NCIB and the timing of such purchases will be determined by the

Company. Subject to certain prescribed exceptions, daily purchases

under the further amended NCIB will continue to be limited to a

maximum of 153,956 common shares, which is 25% of the average daily

trading volume of the Company’s common shares for the six months

ended May 31, 2021 (being 615,827 common shares).

Purchases under the NCIB will continue to be made through the

facilities of the TSX and alternative Canadian trading systems at

the prevailing market price at the time of acquisition. All common

shares purchased will be cancelled.

Real Matters previously entered into an automatic share purchase

plan (the “Plan”) with National Bank Financial Inc. to allow for

the purchase of common shares under the NCIB at times when the

Company would not ordinarily be active in the market due to its own

internal trading blackout periods, insider trading rules or

otherwise. The Plan will continue to apply to the further amended

NCIB.

FORWARD-LOOKING INFORMATION

This Press Release contains “forward-looking information” within

the meaning of applicable Canadian securities laws, including

statements relating to the Company’s belief regarding the intrinsic

value of its common shares. Words such as “could”, “forecast”,

“target”, “may”, “will”, “would”, “expect”, “anticipate”,

“estimate”, “intend”, “plan”, “seek”, “believe”, “likely” and

“predict” and variations of such words and similar expressions are

intended to identify such forward-looking information, although not

all forward-looking information contains these identifying

words.

The forward-looking information in this press release includes

statements which reflect the current expectations of management

based on information currently available to management. Although

the Company believes that these expectations are reasonable, these

statements by their nature involve risks and uncertainties and

should not be read as a guarantee of the occurrence or timing of

any future events, performance or results. A comprehensive

discussion of the factors which could cause results or events to

differ from current expectations can be found in the “Risk Factors”

section of our Annual Information Form for the year ended September

30, 2021, which is available on SEDAR at www.sedar.com.

Readers are cautioned not to place undue reliance on the

forward-looking information, which reflect our expectations only as

of the date of this Press Release. Except as required by law, we do

not undertake to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise.

About Real Matters

Real Matters is a leading network management services provider

for the mortgage lending and insurance industries. Real Matters’

platform combines its proprietary technology and network management

capabilities with tens of thousands of independent qualified field

professionals to create an efficient marketplace for the provision

of mortgage lending and insurance industry services. Our clients

include top 100 mortgage lenders in the U.S. and some of the

largest insurance companies in North America. We are a leading

independent provider of residential real estate appraisals to the

mortgage market and a leading independent provider of title and

mortgage closing services in the U.S. Headquartered in Markham

(ON), Real Matters has principal offices in Buffalo (NY),

Middletown (RI) and Scottsdale (AZ). Real Matters is listed on the

Toronto Stock Exchange under the symbol REAL. For more information,

visit www.realmatters.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220506005112/en/

For more information: Lyne Beauregard Vice President,

Investor Relations and Corporate Communications Real Matters

lbeauregard@realmatters.com 416.994.5930

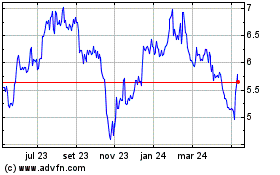

Real Matters (TSX:REAL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

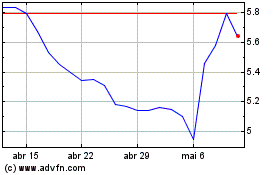

Real Matters (TSX:REAL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025