Massachusetts Court Rules that Eaton Vance and its Fund Trustees Violated Federal Law by Stripping Shareholders’ Voting Rights

25 Janeiro 2023 - 3:00PM

Business Wire

Saba Capital Comments on Court’s Decision to

Uphold the Investment Company Act, A Win for Closed-End Fund

Shareholders

Saba Capital Management, L.P. and certain associated parties

(collectively “Saba” or “we”) today commented on the outcome of the

lawsuit brought in the Suffolk County Superior Court in

Massachusetts (the “Court”) by four closed-end funds advised by

Eaton Vance – the Eaton Vance Senior Income Trust (NYSE: EVF),

Eaton Vance Senior Floating-Rate Trust (NYSE: EFR), Eaton Vance

Floating-Rate Income Trust (NYSE: EFT) and Eaton Vance

Limited-Duration Fund (NYSE: EVV) (the “Funds”) – and the following

fund trustees: Thomas E. Faust, Jr., Mark R. Fetting, Cynthia E.

Frost, George J. Gorman, Valerie A. Mosley, William H. Park, Helen

F. Peters, Keith Quinton, Marcus L. Smith, Susan J. Sutherland and

Scott E. Wennerholm.

On July 15, 2020, Eaton Vance sued for declaratory judgement on

the validity of its actions to strip away voting rights from

closed-end fund shareholders through the adoption of a Control

Share Amendment to its bylaws. On January 21, 2023, the Court

issued a summary judgement ruling in favor of Saba and invalidating

Eaton Vance’s control share provision as a violation of the

Investment Company Act. In its ruling, the Court agreed with the

2022 ruling by the United States District Court for the Southern

District of New York in a prior lawsuit Saba brought against Nuveen

that found the restrictive use of control share bylaws to violate

federal law.

Michael D’Angelo, Partner and General Counsel of Saba,

commented:

“The Court’s ruling is an important win for closed-end fund

shareholders as it upholds the Investment Company Act and the

protection it provides for the voting rights of every shareholder.

Not only does the ruling rescind Eaton Vance’s control share

provision, but it puts all closed-end funds on notice that any

attempts to entrench trustees and investment advisors that violate

the law will not be tolerated. Eaton Vance used this illegal

amendment to strip voting rights in order to facilitate the

approval of new investment advisory agreements needed in connection

with the sale of Eaton Vance to Morgan Stanley. Had the law not

been broken, we believe the significant losses suffered by

shareholders could have been mitigated.”

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, the Firm is a pioneer of credit relative value

strategies and capital structure arbitrage. The Firm is

headquartered in New York City. Learn more at

www.sabacapital.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230125005602/en/

Longacre Square Partners Greg Marose / Kate Sylvester,

646-386-0091 gmarose@longacresquare.com /

ksylvester@longacresquare.com

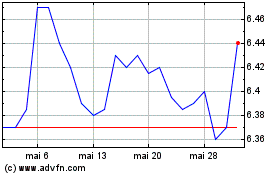

Eaton Vance Senior Income (NYSE:EVF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Eaton Vance Senior Income (NYSE:EVF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024