false

0001070732

DEF 14A

0001070732

2024-08-23

2024-08-23

0001070732

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

Eaton Vance Senior Income Trust

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a6(i)(1) and 0-11

Eaton Vance Senior Income Trust

August 23, 2024

Eaton Vance Senior Income Trust

One Post Office Square

Boston, Massachusetts 02109

August 23, 2024

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders

(the “Annual Meeting”) of Eaton Vance Senior Income Trust (the “Fund”), which will be held at the principal office

of the Fund, One Post Office Square, Boston, Massachusetts 02109, on Wednesday, October 9, 2024 at 11:30 a.m. (Eastern Time).

At the Annual Meeting, you will be asked to consider the election

of Trustees of the Fund. The enclosed proxy statement contains additional information.

I hope that you will be able to attend the Annual Meeting. Whether

or not you plan to attend and regardless of the number of shares you own, it is important that your shares be represented. I urge you

to complete, sign and date the enclosed proxy card and return it in the enclosed postage-paid envelope as soon as possible to ensure that

your shares are represented at the Annual Meeting.

| |

Sincerely, |

| |

|

| |

/s/ Kenneth A. Topping |

| |

Kenneth A. Topping |

| |

President |

YOUR VOTE IS IMPORTANT - PLEASE RETURN YOUR PROXY

CARD PROMPTLY.

It is important that your shares be represented at the Annual Meeting.

Whether or not you plan to attend, you are requested to complete, date, sign and return the applicable enclosed proxy card as soon as

possible. You may withdraw your proxy if you attend the Annual Meeting and desire to vote at the Annual Meeting.

Eaton Vance Senior Income Trust

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be Held on Wednesday, October 9, 2024: The Notice of Annual Meeting of Shareholders, Proxy Statement,

Proxy Card(s) and Shareholder Report are available on the Eaton Vance website at https://funds.eatonvance.com/closed-end-fund-and-term-trust-documents.php.

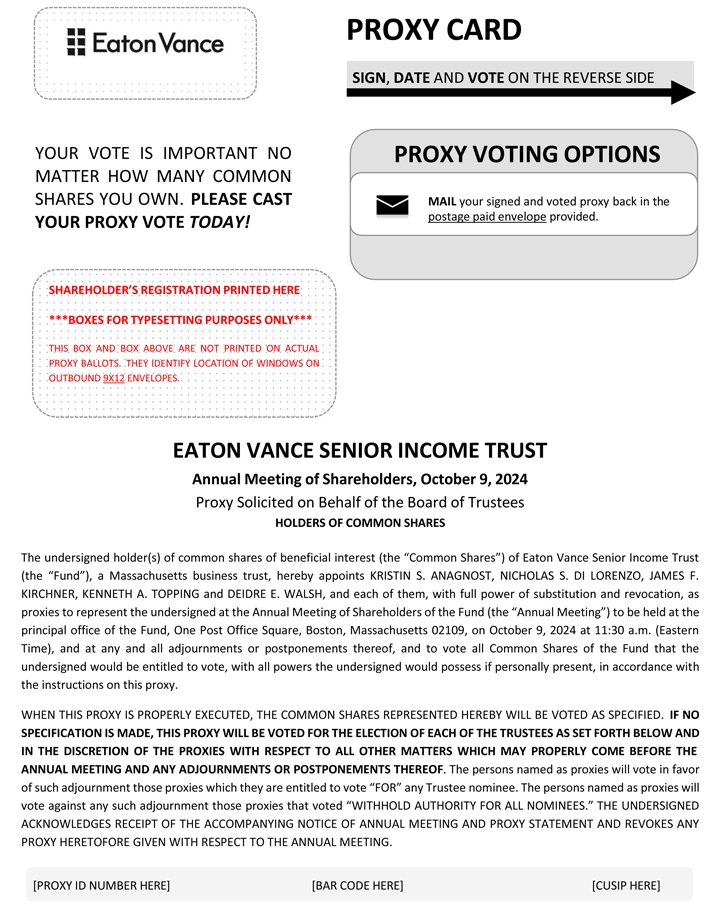

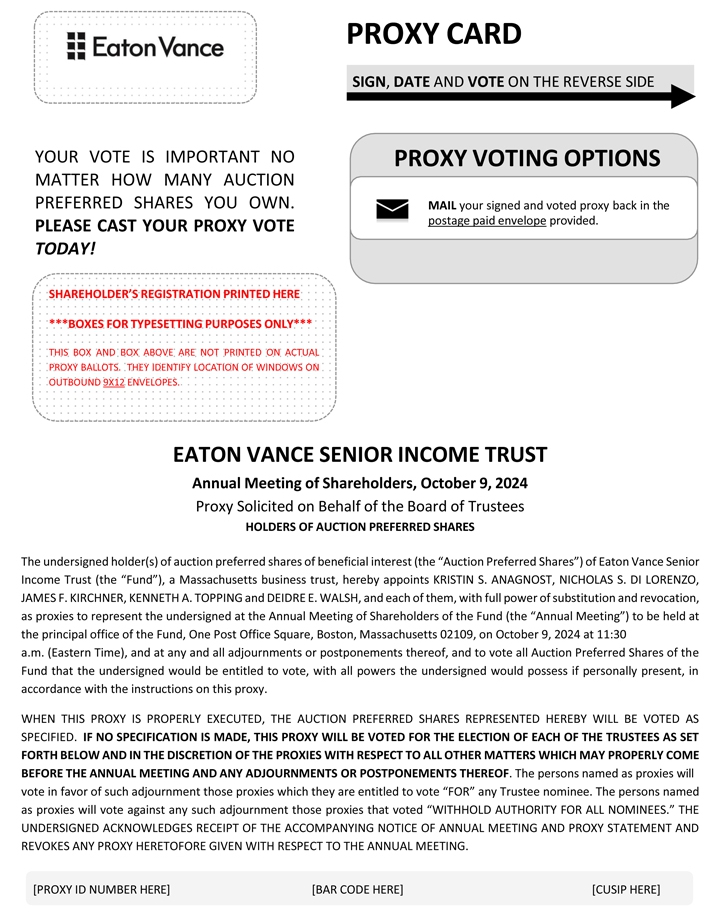

The Annual Meeting of Shareholders of Eaton Vance Senior Income Trust,

a Massachusetts business trust, will be held at the principal office of the Fund, One Post Office Square, Boston, Massachusetts 02109,

on Wednesday, October 9, 2024 at 11:30 a.m. (Eastern Time) (the “Annual Meeting”), for the following purposes:

| |

(1) |

To elect Trustees of the Fund as outlined below: |

| |

|

a. |

three Class II Trustees, Mark R. Fetting, Keith Quinton and Scott E. Wennerholm, to be elected by the holders of the Fund’s Common Shares and Auction Preferred Shares, voting together as a single class. |

| |

(2) |

To consider and act upon any other matters that may properly come before the Annual Meeting and any adjourned or postponed session thereof. |

Any such vote FOR or AGAINST the proposal will also authorize the

persons named as proxies to vote accordingly FOR or AGAINST any such adjournment of the Annual Meeting of Shareholders.

The Board of Trustees of the Fund has fixed the

close of business on July 30, 2024 as the record date for the determination of the shareholders of the Fund entitled to notice of and

to vote at the Annual Meeting and any adjournments or postponements thereof.

| |

By Order of the Board of Trustees of the Fund |

| |

|

| |

/s/

Nicholas S. Di Lorenzo |

| |

Nicholas S. Di Lorenzo |

| |

Secretary |

August 23, 2024

Boston, Massachusetts

IMPORTANT

Shareholders can help the Board of Trustees of the Fund avoid

the necessity and additional expense to the Fund of further solicitations by promptly returning the enclosed proxy. The enclosed addressed

envelope requires no postage if mailed in the United States and is intended for your convenience.

Eaton Vance Senior Income Trust

One Post Office Square

Boston, Massachusetts 02109

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation

of proxies by the Board of Trustees of Eaton Vance Senior Income Trust (the “Fund”). The proxies will be voted at the Annual

Meeting of Shareholders of the Fund and at any adjournments or postponements thereof (the “Annual Meeting”). The Annual Meeting

will be held on Wednesday, October 9, 2024 at 11:30 a.m. (Eastern Time) at the principal office of the Fund, One Post Office Square, Boston,

Massachusetts 02109, as discussed further herein. The Annual Meeting will be held for the purposes set forth in the accompanying notice.

This proxy statement and the enclosed proxy cards are first being sent or given to shareholders on or about August 23, 2024.

The Board of Trustees of the Fund (the “Board” or the

“Board of Trustees”) has fixed the close of business on July 30, 2024 as the record date for the determination of the shareholders

entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. As of July 30, 2024, there were

17,860,558 common shares of beneficial interest, $0.01 par value per share (“Common Shares”), and 1,504 Auction Preferred

Shares, $0.01 par value per share, liquidation preference $25,000 per share (“APS”), of the Fund outstanding. See “Proxy

Solicitation, Tabulation and Voting Requirements” below for additional information. To the knowledge of the Fund, based on Schedules

13D and 13G pursuant to Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended, one or more shareholders owns 5%

or more of the Fund’s Common Shares and/or APS. Information relating to such shareholders can be found on Exhibit B. Also as of

July 30, 2024, to the Fund’s knowledge: (i) no other shareholder owned 5% or more of the outstanding Common Shares and/or APS of

the Fund, and (ii) the Trustees and executive officers of the Fund, individually and as a group, owned beneficially less than 1% of the

outstanding Common Shares and/or APS of the Fund.

Shareholders as of the close of business on the record date of July

30, 2024, are entitled to attend and vote at the Annual Meeting. All properly executed proxies received prior to the Annual Meeting will

be voted at the Annual Meeting. Each proxy will be voted in accordance with its instructions; if no instruction is given, an executed

proxy will authorize the persons named on the proxy card enclosed as proxies, or any of them, to vote FOR the election of each Trustee.

An executed proxy delivered to the Fund is revocable by the person giving it, prior to its exercise, by a signed writing filed with the

Fund’s Secretary, by executing and delivering a later dated proxy, or by attending the Annual Meeting and voting the shares at the

Annual Meeting. Merely attending the Annual Meeting will not revoke a previously executed proxy. If you hold Fund shares through an intermediary

(such as a broker, bank,

adviser or custodian), please consult with the intermediary regarding

your ability to revoke voting instructions after they have been provided.

If you are a record holder of Fund shares and plan to attend the Annual

Meeting, you must show a valid photo identification (such as a driver’s license) to gain admission to the Annual Meeting. Please

call 1-800-262-1122 for information on how to obtain directions to be able to attend and vote at the Annual Meeting.

If you hold Fund shares through an intermediary and plan to attend

and vote at the Annual Meeting, you will be required to show a valid photo identification and your authority to vote your shares (referred

to as a “legal proxy”) to gain admission to the Annual Meeting. As described above, you must contact your intermediary to

obtain a legal proxy for your shares.

PROPOSAL 1. ELECTION OF TRUSTEES

The Fund’s Agreement and Declaration of Trust provides that

a majority of the Trustees shall fix the number of the entire Board and that such number shall be at least two and no greater than fifteen.

The Board has fixed the number of Trustees at ten. Under the terms of the Fund’s Agreement and Declaration of Trust, the Board of

Trustees is divided into three classes, each class having a term of three years to expire on the date of the third Annual Meeting following

its election.

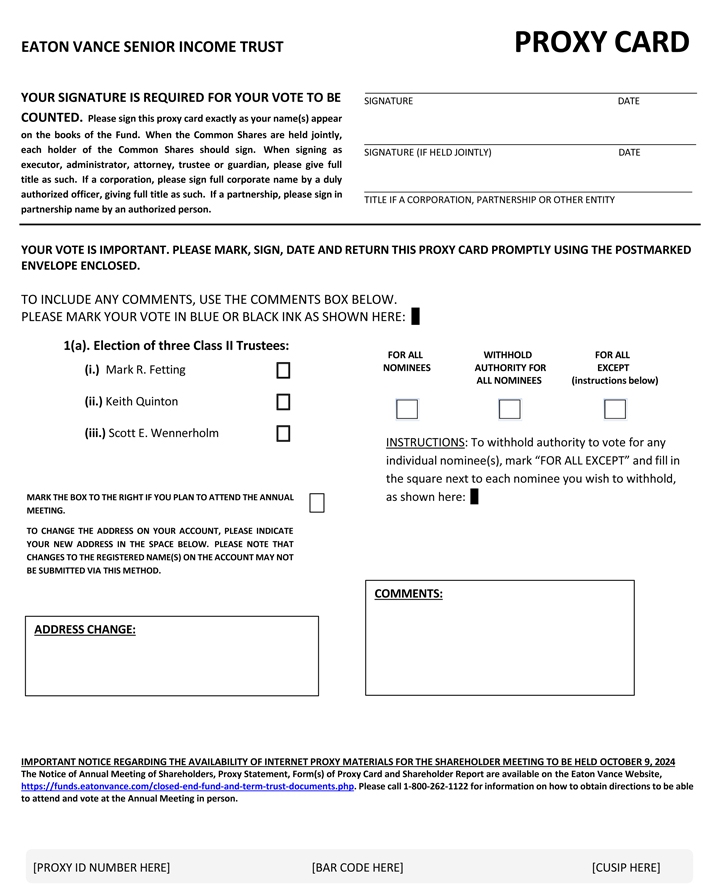

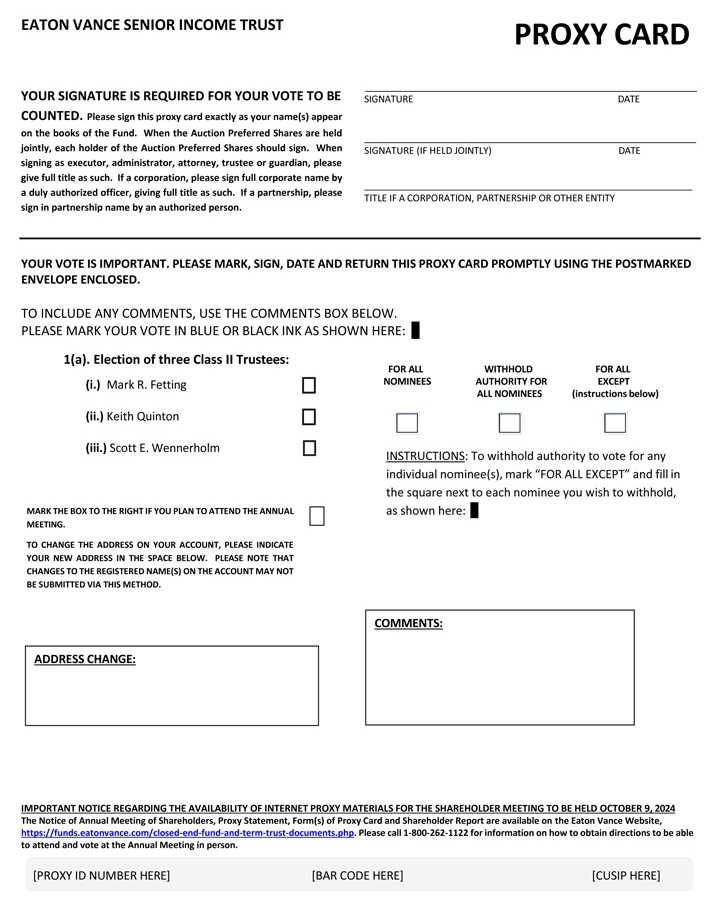

Proxies will be voted for the election of the following nominees:

| |

a. |

three Class II Trustees, Mark R. Fetting, Keith Quinton, and Scott E. Wennerholm to be elected by the holders of the Fund’s Common Shares and APS, voting together as a single class. |

The Board of Trustees recommends that shareholders vote FOR the election

of the Trustee nominees of the Fund.

Each nominee is currently serving as a Trustee of the Fund and has

consented to continue to so serve. In the event that a nominee is unable to serve for any reason (which is not now expected) when the

election occurs, the accompanying proxy will be voted for such other person or persons as the Board of Trustees may recommend. Election

of Trustees is non-cumulative. Shareholders do not have appraisal rights in connection with the proposal in this proxy statement.

Each nominee shall be elected by the affirmative vote of a plurality

of the shares of the Fund entitled to vote. Proxies cannot be voted for a greater number of persons than the number of nominees named.

No nominee is a party adverse to the Fund or any of its affiliates in any material pending legal proceeding, nor does any nominee have

an interest materially adverse to such Fund.

Under the terms of the Fund’s Amended and Restated By-Laws (the

“By-Laws”), the holders of the Fund’s APS are entitled as a class, to the exclusion of the holders of the Fund’s

Common Shares, to elect two Trustees of the Fund. There are no Trustees nominated for election by holders of the Fund's APS at this meeting.

The Fund’s By-Laws further provide for the election of the other nominees named above by the holders of the Fund’s Common

Shares and APS, voting together as a single class.

The following table presents certain information regarding the current

Trustees of the Fund, including the principal occupations of each such person for at least the last five years.(1)

Name and Year of

Birth |

|

Fund

Position(s) |

|

Trustee Since(1) |

|

Current Term

Expiring |

|

Principal Occupation(s) During Past

Five Years

and Other Relevant Experience |

|

Other Directorships

Held

During Last Five

Years |

| Noninterested Trustees |

|

|

|

|

|

|

|

|

|

|

ALAN C. BOWSER

1962 |

|

Trustee |

|

2023 |

|

Class III Trustee until 2025. |

|

Private investor. Formerly, Co-Head of the Americas Region, Chief Diversity Officer, Partner and Member of the Operating Committee at Bridgewater Associates, an asset management firm (2011-2023). Formerly, Managing Director and Head of Investment Services at UBS Wealth Management Americas (2007-2010). Formerly, Managing Director and Head of Client Solutions, Citibank Private Bank (1999-2007). |

|

Independent Director of Stout Risius Ross (a middle market professional services advisory firm) (since 2021). |

MARK R. FETTING

1954 |

|

Trustee |

|

2016 |

|

Class II Trustee until 2024. |

|

Private investor. Formerly held various positions at Legg Mason, Inc. (investment management firm) (2000-2012), including President, Chief Executive Officer, Director and Chairman (2008-2012), Senior Executive Vice President (2004-2008) and Executive Vice President (2001-2004). Formerly, President of Legg Mason family of funds (2001-2008). Formerly, Division President and Senior Officer of Prudential Financial Group, Inc. and related companies (investment management firm) (1991-2000). |

|

None |

CYNTHIA E. FROST

1961 |

|

Trustee |

|

2014 |

|

Class I Trustee until 2026. |

|

Private investor. Formerly, Chief Investment Officer of Brown University (university endowment) (2000-2012). Formerly, Portfolio Strategist for Duke Management Company (university endowment manager) (1995-2000). Formerly, Managing Director, Cambridge Associates (investment consulting company) (1989-1995). Formerly, Consultant, Bain and Company (management consulting firm) (1987-1989). Formerly, Senior Equity Analyst, BA Investment Management Company (1983-1985). |

|

None |

GEORGE J. GORMAN

1952 |

|

Chairperson of the Board and Trustee |

|

2021 (Chairperson) and 2014 (Trustee) |

|

Class III Trustee until 2025. |

|

Principal at George J. Gorman LLC (consulting firm). Formerly, Senior Partner at Ernst & Young LLP (a registered public accounting firm) (1974-2009). |

|

None |

VALERIE A. MOSLEY

1960 |

|

Trustee |

|

2014 |

|

Class I Trustee until 2026.(2) |

|

Chairwoman and Chief Executive Officer of Valmo Ventures (a consulting and investment firm). Founder of Upward Wealth, Inc., dba BrightUp, a fintech platform. Formerly, Partner and Senior Vice President, Portfolio Manager and Investment Strategist at Wellington Management Company, LLP (investment management firm) (1992-2012). Formerly, Chief Investment Officer, PG Corbin Asset Management (1990-1992). Formerly worked in institutional corporate bond sales at Kidder Peabody (1986-1990). |

|

Director of DraftKings, Inc. (digital sports entertainment and gaming company) (since September 2020). Director of Envestnet, Inc. (provider of intelligent systems for wealth management and financial wellness) (since 2018). Formerly, Director of Dynex Capital, Inc. (mortgage REIT) (2013-2020) and Director of Groupon, Inc. (e-commerce provider) (2020-2022). |

KEITH QUINTON

1958 |

|

Trustee |

|

2018 |

|

Class II Trustee until 2024. |

|

Private investor, researcher and lecturer. Formerly, Independent Investment Committee Member at New Hampshire Retirement System (2017-2021). Formerly, Portfolio Manager and Senior Quantitative Analyst at Fidelity Investments (investment management firm) (2001-2014). |

|

Formerly, Director (2016-2021) and Chairman (2019-2021) of New Hampshire Municipal Bond Bank. |

MARCUS L. SMITH

1966 |

|

Trustee |

|

2018 |

|

Class III Trustee until 2025. |

|

Private investor and independent corporate director. Formerly, Chief Investment Officer, Canada (2012-2017), Chief Investment Officer, Asia (2010-2012), Director of Asian Research (2004-2010) and portfolio manager (2001-2017) at MFS Investment Management (investment management firm). |

|

Director of First Industrial Realty Trust, Inc. (an industrial REIT) (since 2021). Director of MSCI Inc. (global provider of investment decision support tools) (since 2017). Formerly, Director of DCT Industrial Trust Inc. (logistics real estate company) (2017-2018). |

NANCY WISER STEFANI

1967 |

|

Trustee |

|

2022 |

|

Class III Trustee until 2025.(2) |

|

Formerly, Executive Vice President and the Global Head of Operations at Wells Fargo Asset Management (2011-2021). |

|

None |

SUSAN J. SUTHERLAND

1957 |

|

Trustee |

|

2015 |

|

Class I Trustee until 2026. |

|

Private investor. Director of Ascot Group Limited and certain of its subsidiaries (insurance and reinsurance) (since 2017). Formerly, Director of Hagerty Holding Corp. (insurance) (2015-2018) and Montpelier Re Holdings Ltd. (insurance and reinsurance) (2013-2015). Formerly, Associate, Counsel and Partner at Skadden, Arps, Slate, Meagher & Flom LLP (law firm) (1982-2013). |

|

Formerly, Director of Kairos Acquisition Corp. (insurance/InsurTech acquisition company) (2021-2023). |

SCOTT E. WENNERHOLM

1959 |

|

Trustee |

|

2016 |

|

Class II Trustee until 2024. |

|

Private investor. Formerly, Trustee at Wheelock College (postsecondary institution) (2012-2018). Formerly, Consultant at GF Parish Group (executive recruiting firm) (2016-2017). Formerly, Chief Operating Officer and Executive Vice President at BNY Mellon Asset Management (investment management firm) (2005-2011). Formerly, Chief Operating Officer and Chief Financial Officer at Natixis Global Asset Management (investment management firm) (1997-2004). Formerly, Vice President at Fidelity Investments Institutional Services (investment management firm) (1994-1997). |

|

None |

| (1) | Year first appointed to serve as Trustee for a fund in the Eaton Vance family of funds. Each Trustee has served continuously since

appointment unless indicated otherwise. |

| (2) | Elected or nominated to be elected by holders of the Fund’s

APS. |

Each current Trustee listed above is a Trustee that is not an “interested

person” of the Fund, as that term is used in the Investment Company Act of 1940, as amended (the “1940 Act”) (each,

a “noninterested Trustee”), and served as a trustee of 127 funds within the Eaton Vance fund complex as of July 30, 2024 (including

both funds and portfolios in a hub and spoke structure). The address of each Trustee is One Post Office Square, Boston, Massachusetts

02109.

Each Trustee holds office until the Annual Meeting for the year in

which his or her term expires and until his or her successor is elected and qualified, subject to a prior death, resignation, retirement,

disqualification or removal. Under the terms of the Fund’s current Trustee retirement policy, a noninterested Trustee must retire

and resign as a Trustee on the earlier of: (i) the first day of July following his or her 74th birthday; or (ii), with limited

exception, December 31st of the 20th year in which he or she has served as a Trustee. However, if such retirement

and resignation would cause the Fund to be out of compliance with Section 16 of the 1940 Act, or any other regulations or guidance of

the Securities and Exchange Commission (“SEC”), then such retirement and resignation will not become effective until such

time as action has been taken for the Fund to be in compliance with Section 16 of the 1940 Act and any other regulations or guidance of

the SEC.

Share Ownership by Trustee

As of July 30, 2024, Mr. Quinton beneficially owned $10,001-$50,000

of the Fund's equity securities. As of July 30, 2024, no other Trustees beneficially owned the Fund's equity securities. The following

table shows, as of July 30, 2024, the dollar range of equity securities

beneficially owned by each Trustee in all registered investment companies advised or administered by Eaton Vance (the “Eaton Vance

family of funds”) overseen by the Trustee, which may include shares, if any, deemed to be beneficially owned by a noninterested

Trustee through a deferred compensation plan.

| |

Name of Trustee |

Aggregate Dollar Range of Equity

Securities Beneficially Owned in Funds

Overseen by Trustee in the

Eaton Vance Family of Funds |

| Noninterested Trustees |

|

| |

Alan C. Bowser |

Over $100,000 |

| |

Mark R. Fetting |

Over $100,000 |

| |

Cynthia E. Frost |

Over $100,000 |

| |

George J. Gorman |

Over $100,000 |

| |

Valerie A. Mosley |

Over $100,000 |

| |

Keith Quinton |

Over $100,000 |

| |

Marcus L. Smith |

Over $100,000 |

| |

Nancy Wiser Stefani |

Over $100,000 |

| |

Susan J. Sutherland |

Over $100,000 |

| |

Scott E. Wennerholm |

Over $100,000 |

Board Meetings and Committees

The Board has general oversight responsibility with respect to the

business and affairs of the Fund. The Board has engaged an investment adviser and (if applicable) a sub-adviser (collectively, the “adviser”)

to manage the Fund. The Fund’s investment adviser also serves as administrator of the Fund. The Board is responsible for overseeing

such adviser and administrator and other service providers to the Fund. The Board is currently composed of ten noninterested Trustees.

In addition to six regularly scheduled meetings per year, the Board holds special meetings or informal conference calls to discuss specific

matters that may require action prior to the next regular meeting. As discussed below, the Board has established six committees to assist

the Board in performing its oversight responsibilities.

The Board has appointed a noninterested Trustee to serve in the role

of Chairperson. The Chairperson’s primary role is to participate in the preparation of the agenda for meetings of the Board and

the identification of information to be presented to the Board with respect to matters to be acted upon by the Board. The Chairperson

also presides at all meetings of the Board and acts as a liaison with service providers, officers, attorneys, and other Board members

generally between meetings. The Chairperson may perform such other functions as may be requested by the Board from time to time. In addition,

the Board may appoint a noninterested Trustee to serve in the role of Vice-Chairperson. The Vice-Chairperson has the power and authority

to perform any or all of the duties and responsibilities of the Chairperson in the absence of the Chairperson and/or as requested by the

Chairperson. Except for any duties specified herein or pursuant to the Fund’s Declaration of Trust or

By-Laws, the designation of Chairperson or Vice-Chairperson does not

impose on such noninterested Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed

on such person as a member of the Board, generally.

The Fund is subject to a number of risks, including, among others,

investment, compliance, operational, and valuation risks. Risk oversight is part of the Board’s general oversight of the Fund and

is addressed as part of various activities of the Board and its Committees. As part of its oversight of the Fund, the Board directly,

or through a Committee, relies on and reviews reports from, among others, Fund management, the adviser/administrator, the principal underwriter,

the Chief Compliance Officer (the “CCO”), and other Fund service providers responsible for day-to-day oversight of Fund investments,

operations and compliance to assist the Board in identifying and understanding the nature and extent of risks and determining whether,

and to what extent, such risks can or should be mitigated. The Board also interacts with the CCO and with senior personnel of the adviser/administrator,

the principal underwriter and other Fund service providers and provides input on risk management issues during meetings of the Board and

its Committees. Each of the adviser/administrator, the principal underwriter and the other Fund service providers has its own independent

interest and responsibilities in risk management, and its policies and methods for carrying out risk management functions will depend,

in part, on its individual priorities, resources and controls. It is not possible to identify all of the risks that may affect the Fund

or to develop processes and controls to eliminate or mitigate their occurrence or effects. Moreover, it is necessary to bear certain risks

(such as investment-related risks) to achieve the Fund’s goals.

The Board, with the assistance of management and with input from the

Board’s various committees, reviews investment policies and risks in connection with its review of Fund performance. The Board has

appointed a Fund CCO who oversees the implementation and testing of the Fund’s compliance program and reports to the Board regarding

compliance matters for the Fund and its principal service providers. In addition, as part of the Board’s periodic review of the

advisory, subadvisory (if applicable), distribution and other service provider agreements, the Board may consider risk management aspects

of their operations and the functions for which they are responsible. With respect to valuation, the Board approves and periodically reviews

valuation policies and procedures applicable to valuing the Fund’s shares. The administrator and the adviser are responsible for

the implementation and day-to-day administration of these valuation policies and procedures and provide reports to the Audit Committee

of the Board and the Board regarding these and related matters. In addition, the Audit Committee of the Board or the Board receives reports

periodically from the independent public accounting firm for the Fund regarding tests performed by such firm on the valuation of all securities,

as well as with respect to other risks associated with registered investment companies. Reports received from service providers, legal

counsel and the independent public accounting firm assist the Board in performing its oversight function.

The Fund’s By-Laws set forth specific qualifications to serve

as a Trustee. The Charter of the Governance Committee also sets forth certain factors that the Committee may take into account in considering

noninterested Trustee candidates. In general, no one factor is decisive in the selection of an individual to join the Board. Among the

factors the Board considers when concluding that an individual should serve on the Board are the following: (i) knowledge in matters relating

to the mutual fund industry; (ii) experience as a director or senior officer of public companies; (iii) educational

background; (iv) reputation for high ethical standards

and professional integrity; (v) specific financial, technical or other expertise possessed by the individual or other experience or background

of the individual, and the extent to which such expertise, experience or background would complement the Board members’ existing

mix of skills, core competencies and qualifications and diversity of experiences and background; (vi) perceived ability to contribute

to the ongoing functions of the Board, including the ability and commitment to attend meetings regularly and work collaboratively with

other members of the Board; (vii) the ability to qualify as a noninterested Trustee for purposes of the 1940 Act and any other actual

or potential conflicts of interest involving the individual and the Fund; and (viii) such other factors as the Board determines to be

relevant in light of the existing composition of the Board and any anticipated vacancies.

Among the attributes or skills common to all Board

members are their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively

with the other members of the Board, management, sub-advisers, other service providers, counsel and independent registered public accounting

firms, and to exercise effective and independent business judgment in the performance of their duties as members of the Board. Each Board

member’s ability to perform his or her duties effectively has been attained through the Board member’s business, consulting,

public service and/or academic positions and through experience from service as a member of the Boards of the Eaton Vance family of funds

(“Eaton Vance Fund Boards”) (and/or in other capacities, including for any predecessor funds), public companies, or non-profit

entities or other organizations as set forth below. Each Board member’s ability to perform his or her duties effectively also has

been enhanced by his or her educational background, professional training, and/or other life experiences.

In respect of each current member

of the Board, the individual’s substantial professional accomplishments and experience, including in fields related to the operations

of registered investment companies, were a significant factor in the determination that the individual should serve as a member of the

Board. The following is a summary of each Board member’s particular professional experience and additional considerations that

contributed to the Board’s conclusion that he or she should serve as a member of the Board:

Alan C. Bowser. Mr. Bowser has served as a Board member of

the Eaton Vance open-end funds since 2022 and of the Eaton Vance closed-end funds since 2023. Mr. Bowser has over 25 years of experience

in the financial services industry, most of which has been dedicated to leading investment advisory teams serving institutions, family

offices, and ultra-high net worth individuals in the U.S. and Latin America. From 2011-2023, Mr. Bowser served in several capacities at

Bridgewater Associates, an asset management firm, including most recently serving as Chief Diversity Officer and Co-Head of the Americas

Region in addition to being a Partner and a member of the Operating Committee. Prior to joining Bridgewater Associates, he was Managing

Director and Head of Investment Services at UBS Wealth Management Americas from 2007 to 2010 and, before that, Managing Director and Head

of Client Solutions for the Latin America Division at the Citibank Private Bank from 1999 to 2007. Mr. Bowser has been an Independent

Director of Stout Risius Ross since 2021, a founding Board Member and current Board Chair of the Black Hedge Fund Professionals Network

and has served on the Boards of the Robert Toigo Foundation, the New York Urban League, the University of

Pennsylvania, and as Vice Chairman of the Greater Miami Chamber of

Commerce Task Force on Ethics. In 2020, he was recognized as one of the top 100 “EMPower Ethnic Minority Executive Role Models”

and in 2022 he was recognized by Business Insider magazine as one of 14 “Diversity Trailblazers” making corporate America

more inclusive.

Mark R. Fetting. Mr. Fetting has served as a member of the

Eaton Vance Fund Boards since 2016 and is the Chairperson of the Contract Review Committee. He has over 30 years of experience in the

investment management industry as an executive and in various leadership roles. From 2000 through 2012, Mr. Fetting served in several

capacities at Legg Mason, Inc., including most recently serving as President, Chief Executive Officer, Director and Chairman from 2008

to his retirement in 2012. He also served as a Director/Trustee and Chairman of the Legg Mason family of funds from 2008-2012 and Director/Trustee

of the Royce family of funds from 2001-2012. From 2001 through 2008, Mr. Fetting also served as President of the Legg Mason family of

funds. From 1991 through 2000, Mr. Fetting served as Division President and Senior Officer of Prudential Financial Group, Inc. and related

companies. Early in his professional career, Mr. Fetting was a Vice President at T. Rowe Price and served in leadership roles within the

firm’s mutual fund division from 1981-1987.

Cynthia E. Frost. Ms. Frost has served as a member of the Eaton

Vance Fund Boards since 2014. From 2000 through 2012, Ms. Frost was the Chief Investment Officer of Brown University, where she oversaw

the evaluation, selection and monitoring of the third party investment managers who managed the university’s endowment. From 1995

through 2000, Ms. Frost was a Portfolio Strategist for Duke Management Company, which oversaw Duke University’s endowment. Ms. Frost

also served in various investment and consulting roles at Cambridge Associates from 1989-1995, Bain and Company from 1987-1989 and BA

Investment Management Company from 1983-1985. She serves as a member of the investment committee of The MCNC Endowment.

George J. Gorman. Mr. Gorman has served as a member of the

Eaton Vance Fund Boards since 2014 and is the Independent Chairperson of the Board. From 1974 through 2009, Mr. Gorman served in various

capacities at Ernst & Young LLP, including as a Senior Partner in the Asset Management Group (from 1988) specializing in managing

engagement teams responsible for auditing mutual funds registered with the SEC, hedge funds and private equity funds. Mr. Gorman also

has experience serving as an independent trustee of other mutual fund complexes, including the Bank of America Money Market Funds Series

Trust from 2011-2014 and the Ashmore Funds from 2010-2014.

Valerie A. Mosley. Ms. Mosley has served as a member

of the Eaton Vance Fund Boards since 2014 and is the Chairperson of the Governance Committee. In 2020 she founded Upward Wealth, Inc.,

doing business as BrightUp, a fintech platform focused on helping everyday workers grow their net worth and reinforce their self-worth.

From 1992 through 2012, Ms. Mosley served in several capacities at Wellington Management Company, LLP, an investment management firm,

including as a Partner, Senior Vice President, Portfolio Manager and Investment Strategist. Ms. Mosley also served as Chief Investment

Officer at PG Corbin Asset Management from 1990-1992 and worked in institutional corporate bond sales at Kidder Peabody from 1986-1990.

She is a Director of Envestnet, Inc., a provider of intelligent systems for wealth management and financial wellness and DraftKings, Inc.,

a digital sports entertainment and gaming company. In addition, she is also a board member of Caribou Financial, Inc., an auto loan refinancing

company. Ms. Mosley previously served as a

Director of Dynex Capital, Inc., a mortgage REIT from 2013-2020, a

Director of Progress Investment Management Company, a manager of emerging managers, until 2020, and a Director of Groupon, Inc., an e-commerce

platform from 2020-2022. She serves as a trustee or board member of several major non-profit organizations and endowments.

Keith Quinton. Mr. Quinton has served as a member of the Eaton

Vance Fund Boards since 2018 and is the Chairperson of the Ad Hoc Committee for Closed-End Fund Matters. He had over thirty years of experience

in the investment industry before retiring from Fidelity Investments in 2014. Prior to joining Fidelity, Mr. Quinton was a vice president

and quantitative analyst at MFS Investment Management from 2000-2001. From 1997 through 2000, he was a senior quantitative analyst at

Santander Global Advisors and, from 1995 through 1997, Mr. Quinton was senior vice president in the quantitative equity research department

at Putnam Investments. Prior to joining Putnam Investments, Mr. Quinton served in various investment roles at Eberstadt Fleming, Falconwood

Securities Corporation and Drexel Burnham Lambert, where he began his career in the investment industry as a senior quantitative analyst

in 1983. Mr. Quinton served as an Independent Investment Committee Member of the New Hampshire Retirement System, a five member committee

that manages investments based on the investment policy and asset allocation approved by the board of trustees (2017-2021), and as a Director

(2016-2021) and Chairman (2019-2021) of the New Hampshire Municipal Bond Bank.

Marcus L. Smith. Mr. Smith has served as a member of

the Eaton Vance Fund Boards since 2018 and is the Chairperson of the Portfolio Management Committee. Mr. Smith has been a Director of

First Industrial Realty Trust, Inc., a fully integrated owner, operator and developer of industrial real estate, since 2021, where he

serves on the Investment and Nominating/Corporate Governance Committees. Since 2017, Mr. Smith has been a Director of MSCI Inc., a leading

provider of investment decision support tools worldwide, where he serves as Chair of the Audit Committee and a member of the Strategy

& Finance Committee. From 2017 through 2018, he served as a Director of DCT Industrial Trust Inc., a leading logistics real estate

company, where he served as a member of the Nominating and Corporate Governance and Audit Committees. From 1994 through 2017, Mr.

Smith served in several capacities at MFS Investment Management, an investment management firm, where he managed the MFS Institutional

International Fund for 17 years and the MFS Concentrated International Fund for 10 years. In addition to his portfolio management

duties, Mr. Smith served as Chief Investment Officer, Canada from 2012-2017, Chief Investment Officer, Asia from 2010-2012, and Director

of Asian Research from 2005-2010. Prior to joining MFS, Mr. Smith was a senior consultant at Andersen Consulting (now known as Accenture)

from 1988-1992. Mr. Smith served as a United States Army Reserve Officer from 1987-1992. He was also a trustee of the University

of Mount Union from 2008-2020 and served on the Boston advisory board of the Posse Foundation from 2015-2021. Mr. Smith currently sits

on the Harvard Medical School Advisory Council on Education, the Board of Directors for Facing History and Ourselves and is a Trustee

of the Core Knowledge Foundation.

Nancy Wiser Stefani. Ms. Stefani has served as a member of

the Eaton Vance Fund Boards since 2022. She also serves as a corporate Director for Rimes Technologies, a data management company based

in London (since 2022). Ms. Stefani has over 30 years of experience in the investment management and financial services industry. From

2011-2021, Ms. Stefani served as an Executive

Vice President and the Global Head of Operations at Wells Fargo Asset

Management, where she oversaw operations and governance matters. In the role of governance, Ms. Stefani served as chairman of the board

for the Wells Fargo Asset Management United Kingdom and Luxembourg legal entities as well as the Luxembourg funds. Additionally, Ms. Stefani

served as the Treasurer for the Wells Fargo Funds from 2012-2021. Prior to joining Wells Fargo Asset Management, Ms. Stefani served as

Chief Operating Officer and Chief Compliance Officer for two registered asset management companies where she oversaw all non-investment

activities. She currently serves on the University of Minnesota Foundation Board of Trustees (since 2022) and previously served on several

other non-profit boards including her alma mater Providence College Business Advisory board, Boston Scores and the National Black

MBA Advisory board.

Susan J. Sutherland. Ms. Sutherland has served as a member

of the Eaton Vance Fund Boards since 2015 and is the Chairperson of the Compliance Reports and Regulatory Matters Committee. She is also

a Director of Ascot Group Limited and certain of its subsidiaries. Ascot Group Limited, through its related businesses including Syndicate

1414 at Lloyd’s of London, is a leading global underwriter of specialty property and casualty insurance and reinsurance. In addition,

Ms. Sutherland was a Director of Kairos Acquisition Corp. from 2021 until its dissolution in 2023, which had concentrated on acquisition

and business combination efforts within the insurance and insurance technology (also known as “InsurTech”) sectors. Ms. Sutherland

was also a Director of Montpelier Re Holdings Ltd., a global provider of customized reinsurance and insurance products, from 2013 until

its sale in 2015 and of Hagerty Holding Corp., a leading provider of specialized automobile and marine insurance from 2015-2018. From

1982 through 2013, Ms. Sutherland was an associate, counsel and then a partner in the Financial Institutions Group of Skadden, Arps, Slate,

Meagher & Flom LLP, where she primarily represented U.S. and international insurance and reinsurance companies, investment banks and

private equity firms in insurance-related corporate transactions. In addition, Ms. Sutherland has also served as a board member of prominent

non-profit organizations.

Scott E. Wennerholm. Mr. Wennerholm has served as a member

of the Eaton Vance Fund Boards since 2016 and is the Chairperson of the Audit Committee. He has over 30 years of experience in the financial

services industry in various leadership and executive roles. Mr. Wennerholm served as Chief Operating Officer and Executive Vice President

at BNY Mellon Asset Management from 2005-2011. He also served as Chief Operating Officer and Chief Financial Officer at Natixis Global

Asset Management from 1997-2004 and was a Vice President at Fidelity Investments Institutional Services from 1994-1997. In addition, Mr.

Wennerholm served as a Trustee at Wheelock College, a postsecondary institution from 2012-2018.

During the fiscal year ended June 30, 2024, the Trustees of the Fund

met ten times. The Board of Trustees has several standing Committees, including the Audit Committee, the Contract Review Committee, the

Governance Committee, the Portfolio Management Committee, the Compliance Reports and Regulatory Matters Committee and the Ad Hoc Committee

for Closed-End Fund Matters. The Audit Committee met eight times, the Contract Review Committee met three times, the Governance Committee

met two times, the Portfolio Management Committee met six times, the Compliance Reports and Regulatory Matters Committee met seven times

and the Ad Hoc Committee for Closed-End Fund Matters met five times during such period. Each Trustee attended at least 75%

of the Board and Committee meetings on which he or she serves. None

of the Trustees attended the Fund’s 2023 Annual Meeting of Shareholders.

Each Committee of the Board of Trustees of the Fund is comprised of

only noninterested Trustees. The respective duties and responsibilities of these Committees remain under the continuing review of the

Governance Committee and the Board.

Messrs. Wennerholm (Chairperson), Gorman and Quinton and Ms. Stefani

are members of the Audit Committee. The Board has designated Messrs. Gorman and Wennerholm, each a noninterested Trustee, as “audit

committee financial experts” as that term is defined in the applicable SEC rules. Each Audit Committee member is independent under

applicable listing standards of the New York Stock Exchange. The purposes of the Audit Committee are to (i) oversee the Fund’s accounting

and financial reporting processes, its internal control over financial reporting, and, as appropriate, the internal control over financial

reporting of certain service providers; (ii) oversee or, as appropriate, assist Board oversight of the quality and integrity of the Fund’s

financial statements and the independent audit thereof; (iii) oversee, or, as appropriate, assist Board oversight of, the Fund’s

compliance with legal and regulatory requirements that relate to the Fund’s accounting and financial reporting, internal control

over financial reporting and independent audits; (iv) approve, prior to appointment, the engagement and, when appropriate, replacement

of the independent auditors, and, if applicable, nominate independent auditors to be proposed for shareholder ratification in any proxy

statement of the Fund; (v) evaluate the qualifications, independence and performance of the independent registered public accounting firm

and the audit partner in charge of leading the audit; and (vi) prepare, as necessary, audit committee reports consistent with the requirements

of applicable SEC and stock exchange rules for inclusion in the proxy statement for the Annual Meeting of Shareholders of the Fund. The

Fund’s Board of Trustees has adopted a written charter for its Audit Committee, a copy of which is attached as Exhibit A. The Audit

Committee’s Report is set forth below under “Additional Information.”

Messrs. Fetting (Chairperson), Bowser, Gorman, Quinton, Smith and

Wennerholm and Mses. Frost, Mosley, Stefani and Sutherland are members of the Contract Review Committee. The purposes of the Contract

Review Committee are to consider, evaluate and make recommendations to the Board concerning the following matters: (i) contractual arrangements

with each service provider to the Fund, including advisory, sub-advisory, transfer agency, custodial and fund accounting, distribution

services (if any) and administrative services; (ii) any and all other matters in which any of the Fund’s service providers (including

Eaton Vance or any affiliated entity thereof) has an actual or potential conflict of interest with the interests of the Fund or its shareholders;

and (iii) any other matter appropriate for review by the noninterested Trustees, unless the matter is within the responsibilities of other

Committees of the Board.

Messrs. Smith (Chairperson), Bowser and Wennerholm and Mses. Frost

and Mosley are members of the Portfolio Management Committee. The purposes of the Portfolio Management Committee are to: (i) assist the

Board in its oversight of the portfolio management process employed by the Fund and its investment adviser and sub-adviser(s), if applicable,

relative to the Fund’s stated objective(s), strategies and restrictions; (ii) assist the Board in its oversight of the trading policies

and procedures and risk management techniques applicable to the Fund; and (iii) assist the Board in its monitoring of

the performance results of all funds, giving special attention to

the performance of certain funds that it or the Board of Trustees identifies from time to time.

Mses. Sutherland (Chairperson) and Stefani and Messrs. Fetting and

Quinton are members of the Compliance Reports and Regulatory Matters Committee. The purposes of the Compliance Reports and Regulatory

Matters Committee are to: (i) assist the Board in its oversight role with respect to compliance issues and certain other regulatory matters

affecting the Fund; (ii) serve as a liaison between the Board of Trustees and the Fund’s CCO; and (iii) serve as a “qualified

legal compliance committee” within the rules promulgated by the SEC.

Messrs. Quinton (Chairperson) and Fetting and Ms. Sutherland are members

of the Ad Hoc Committee for Closed-End Fund Matters. The purpose of the Ad Hoc Committee for Closed-End Fund Matters is to consider, evaluate

and make recommendations to the Board with respect to issues specifically related to Eaton Vance Closed-End Funds.

Mses. Mosley (Chairperson), Frost, Stefani and Sutherland and Messrs.

Bowser, Fetting, Gorman, Quinton, Smith and Wennerholm are members of the Governance Committee. Each Governance Committee member is independent

under applicable listing standards of the New York Stock Exchange. The purpose of the Governance Committee is to consider, evaluate and

make recommendations to the Board with respect to the structure, membership and operation of the Board and the Committees thereof, including

the nomination and selection of noninterested Trustees and a Chairperson of the Board and the compensation of such persons.

The Fund’s Board has adopted a written charter

for its Governance Committee, a copy of which is available on the Eaton Vance website, https://www.eatonvance.com/closed-end-fund-and-term-trust-documents.php. The Governance Committee identifies candidates by obtaining referrals from such sources as it deems appropriate, which may

include current Trustees, management of the Fund, counsel and other advisors to the Trustees, and shareholders of the Fund who submit

recommendations in accordance with the procedures described in the Committee’s charter. In no event shall the Governance Committee

consider as a candidate to fill any vacancy an individual recommended by management of the Fund, unless the Governance Committee has

invited management to make such a recommendation. The Governance Committee will, when a vacancy exists, consider a nominee for Trustee

recommended by a shareholder, provided that such recommendation is submitted in writing to the Fund’s Secretary at the principal

executive office of the Fund. Such recommendations must be accompanied by biographical and occupational data on the candidate (including

whether the candidate would be an “interested person” of the Fund), a written consent by the candidate to be named as a nominee

and to serve as Trustee if elected, record and ownership information for the recommending shareholder with respect to the Fund, and a

description of any arrangements or understandings regarding recommendation of the candidate for consideration. The Governance Committee’s

procedures for evaluating candidates for the position of noninterested Trustee are set forth in an appendix to the Committee’s

charter.

The Governance Committee does not have a formal policy to consider

diversity when identifying candidates for the position of noninterested Trustee. Rather, as a matter of practice, the Committee considers

the overall diversity of the Board’s composition when identifying candidates. Specifically, the Committee considers how a particular

candidate could be expected to contribute to overall

diversity in the backgrounds, skills and experiences of the Board’s

members and thereby enhance the effectiveness of the Board. Six of the ten currently serving independent Trustees bring gender and/or

racial diversity to the Board. In addition, as part of its annual self-evaluation, the Board has an opportunity to consider the diversity

of its members, including specifically whether the Board’s members have the right mix of characteristics, experiences and skills.

The results of the self-evaluation are considered by the Governance Committee in its decision-making process with respect to candidates

for the position of noninterested Trustee.

Communications with the Board of Trustees

Shareholders wishing to communicate with the Board may do so by sending

a written communication to the Chairperson of the Board of Trustees, the Chairperson of any Committee of the Board of Trustees or to the

noninterested Trustees as a group, at the following address: One Post Office Square, Boston, Massachusetts 02109, c/o the Secretary of

the Fund.

Remuneration of Trustees

Each noninterested Trustee is compensated for his or her services

according to a fee schedule adopted by the Board of Trustees, and receives a fee that consists of an annual retainer and a committee service

component. The Fund pays each noninterested Trustee a pro rata share, as described below, of: (i) an annual retainer of $315,000; (ii)

an additional annual retainer of $150,000 for serving as the Chairperson of the noninterested Trustees; (iii) an additional annual retainer

of $82,500 for Committee Service; (iv) an additional annual retainer of $15,000 for serving on four or more Committees, not including

the Ad Hoc Committee; (v) an additional annual retainer of $35,000 for serving as the Governance Committee Chairperson, the Audit Committee

Chairperson, the Compliance Committee Chairperson, the Contract Review Committee Chairperson or the Portfolio Management Committee Chairperson

(to be split evenly in the event of Co-Chairpersons); (vi) the Chairperson of an Ad Hoc Committee will receive $5,000 for any six-month

period the Ad Hoc Committee is in existence and meets, with the six-month periods being October 1 through March 31 and April 1 through

September 30; and (vii) out-of-pocket expenses. The pro rata share paid by the Fund is based on the Fund’s average net assets as

a percentage of the average net assets of all the funds in the Eaton Vance family of funds. During the fiscal year ended June 30, 2024,

the noninterested Trustees of the Fund earned the following compensation in their capacities as Trustees of the Fund. For the calendar

year ended December 31, 2023, the noninterested Trustees earned the following compensation in their capacities as members of the Eaton

Vance Fund Boards(1):

| Name of Trustee |

Total

Compensation

from Fund |

Total Compensation

from Fund and

Fund Complex(1) |

| Alan C. Bowser |

$975 |

$374,906 |

| Mark R. Fetting |

$1,063 |

$422,500 |

| Cynthia E. Frost |

$975 |

$396,250 |

| George J. Gorman |

$1,351 |

$537,500 |

| Valerie A. Mosley |

$1,063(2) |

$422,500(3) |

| Keith Quinton |

$1,044 |

$407,500 |

| Name of Trustee |

Total

Compensation

from Fund |

Total Compensation

from Fund and

Fund Complex(1) |

| Marcus L. Smith |

$1,063 |

$418,750 |

| Nancy Wiser Stefani |

$1,013 |

$402,500 |

| Susan J. Sutherland |

$1,069 |

$422,500 |

| Scott E. Wennerholm |

$1,100 |

$437,500 |

| (1) | As of July 30, 2024, the Eaton Vance fund complex consists of 127 registered investment companies or series thereof. The compensation

schedule disclosed above reflects the current compensation schedule, which may not have been in place for the Fund’s full fiscal

year ended June 30, 2024 or the full calendar year ended December 31, 2023. Amounts do not include expenses reimbursed to Trustees for

attending Board meetings, which in the aggregate amounted to $95,050 for the calendar year ended December 31, 2023. |

| (2) | Includes $76 of deferred compensation. |

| (3) | Includes $30,000 of deferred compensation. |

Trustees of the Fund who are not affiliated with Eaton Vance may elect

to defer receipt of all or a percentage of their annual fees in accordance with the terms of a Trustees Deferred Compensation Plan (the

“Deferred Compensation Plan”). Under the Deferred Compensation Plan, an eligible Trustee may elect to have his or her deferred

fees invested in the shares of one or more funds in the Eaton Vance family of funds, and the amount paid to the Trustees under the Deferred

Compensation Plan will be determined based upon the performance of such investments. Deferral of Trustees’ fees in accordance with

the Deferred Compensation Plan will have a negligible effect on the assets, liabilities, and net income of a participating Fund, and will

not obligate the Fund to retain the services of any Trustee or obligate the Fund to pay any particular level of compensation to the Trustee.

The Fund does not have a pension or retirement plan for its Trustees.

The Board recommends that shareholders vote FOR the election of the

Trustee nominees of the Fund.

OTHER MATTERS

The Board knows of no business other than that identified in Proposal

1 of the Notice of Annual Meeting of Shareholders that will be presented for consideration. If any other matters are properly presented,

it is the intention of the persons named as proxies to vote on such matters in accordance with their judgment.

NOTICE TO BANKS AND BROKER/DEALERS

The Fund has previously solicited all nominee and broker/dealer accounts

as to the number of additional proxy statements required to supply owners of shares. Should additional proxy material be required for

beneficial owners, please call 1-866-745-0272, send an email to corporateservices@equiniti.com or forward such requests to EQ Fund Solutions,

LLC, P.O. Box 500, Newark, NJ 07101.

ADDITIONAL INFORMATION

Audit Committee Report

The Audit Committee reviews and discusses the audited financial statements

with Fund management. The Audit Committee also discusses with the independent registered public accounting firm the matters required to

be discussed by SAS 61 (Communication with Audit Committees), as modified or supplemented. The Audit Committee receives the written disclosures

and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence

Discussions with Audit Committees), as modified or supplemented, and discusses with the independent registered public accounting firm

their independence.

Based on the review and discussions referred to above, the Audit Committee

recommended to the Board of Trustees that the audited financial statements be included in the Fund’s annual report to shareholders

for filing with the SEC. As mentioned, the Audit Committee is currently comprised of Messrs. Wennerholm (Chairperson), Gorman and Quinton

and Ms. Stefani.

Auditors, Audit Fees and All Other Fees

The Board members, including a majority of the noninterested Trustees,

of the Fund have selected Deloitte & Touche LLP (“Deloitte”), 200 Berkeley Street, Boston, Massachusetts 02116, as the

independent registered public accounting firm for the Fund. Representatives of Deloitte are not expected to be present at the Annual Meeting,

but have been given the opportunity to make a statement if they desire to do so and will be available should any matter arise requiring

their presence.

The following table presents the aggregate fees billed for the two

fiscal years ended June 30, 2024 and 2023 by the Fund’s independent registered public accounting firm for professional services

rendered for the audit of the Fund’s annual financial statements and fees billed for other services rendered by the independent

registered public accounting firm during these periods.

| |

June 30, 2024 |

June 30, 2023 |

| Audit Fees |

$79,800 |

$81,500 |

| Audit-Related Fees(1) |

0 |

0 |

| Tax Fees(2) |

0 |

0 |

| All Other Fees(3) |

0 |

0 |

| Total |

$79,800 |

$81,500 |

| (1) | Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance

of the audit of the Fund’s financial statements and are not reported under the category of audit fees and specifically include

fees for the performance of certain agreed-upon procedures relating to the Fund’s revolving credit agreement. |

| (2) | Tax fees consist of the aggregate fees billed for professional services rendered by the independent registered public accounting firm

relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation and other related tax

compliance/planning matters. |

| (3) | All other fees consist of the aggregate fees billed for products and services provided by the Fund’s independent registered

public accounting firm other than audit, audit-related, and tax services. |

No services described in the table above were approved by the Fund’s

Audit Committee pursuant to the “de minimis exception” set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

The Fund’s Audit Committee has adopted policies and procedures

relating to the pre-approval of services provided by the Fund’s independent registered public accounting firm (the “Pre-Approval

Policies”). The Pre-Approval Policies establish a framework

intended to assist the Audit Committee in the proper discharge of its pre-approval responsibilities. As a general matter, the Pre-Approval

Policies (i) specify certain types of audit, audit-related, tax, and other services determined to be pre-approved by the Audit Committee;

and (ii) delineate specific procedures governing the mechanics of the pre-approval process, including the approval and monitoring of audit

and non-audit service fees. Unless a service is specifically pre-approved under the Pre-Approval Policies, it must be separately pre-approved

by the Audit Committee. The Pre-Approval Policies and the types of audit and non-audit services pre-approved therein must be reviewed

and ratified by the Fund’s Audit Committee at least annually. The Fund’s Audit Committee maintains full responsibility for

the appointment, compensation, and oversight of the work of the Fund’s independent registered public accounting firm.

The following table presents (i) the aggregate non-audit fees (i.e.,

fees for audit-related, tax, and other services) billed for services rendered to the Fund by the Fund’s independent registered public

accounting firm for two fiscal years ended June 30, 2024 and 2023, and (ii) the aggregate non-audit fees (i.e., fees for audit-related,

tax, and other services) billed by the Fund’s independent registered public accounting firm for services rendered to Eaton Vance

and any entity controlling, controlled by or under common control with Eaton Vance that provides ongoing services to the Fund for two

fiscal years ended June 30, 2024 and 2023.

| |

June 30, 2024 |

June 30, 2023 |

| Fund |

$0 |

$0 |

| Eaton Vance |

$18,490 |

$0 |

The Fund’s Audit Committee has considered whether the provision

by the Fund’s independent registered public accounting firm of non-audit services to the Fund’s investment adviser, as well

as any of its affiliates that provide ongoing services to the Fund, that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation

S-X is compatible with maintaining the independent registered public accounting firm’s independence.

Officers of the Fund

The officers of the Fund and their length of service

are set forth below. The officers of the Fund hold indefinite terms of office. Because of their positions with Eaton Vance Management

(“Eaton Vance”) and their ownership of Morgan Stanley stock, the officers of the Fund will benefit from any advisory and/or

administration fees paid by the Fund to Eaton Vance. Each officer affiliated with Eaton Vance may hold a position with other Eaton Vance

affiliates that is comparable to his or her position with Eaton Vance listed below.

| Name and Year of Birth(1) |

|

Fund Position(s) |

|

Officer Since(2) |

|

Principal Occupation(s) During Past Five Years(3) |

KENNETH A. TOPPING

1966 |

|

President |

|

2023 |

|

Vice President and Chief Administrative Officer of Eaton Vance and Boston Management and Research (“BMR”) and Chief Operating Officer for Public Markets at MSIM. Officer of 107 registered investment companies managed by Eaton Vance or BMR. Also Vice President of Calvert Research and Management (“CRM”) since 2021. Formerly, Chief Operating Officer for Goldman Sachs Asset Management ‘Classic’ (2009-2020). |

DEIDRE E. WALSH

1971 |

|

Vice President and Chief Legal Officer |

|

2021 |

|

Vice President of Eaton Vance and BMR. Officer of 127 registered investment companies managed by Eaton Vance or BMR. Also Vice President of CRM and officer of 46 registered investment companies advised or administered by CRM since 2021. |

JAMES F. KIRCHNER

1967 |

|

Treasurer |

|

2007 |

|

Vice President of Eaton Vance and BMR. Officer of 127 registered investment companies managed by Eaton Vance or BMR. Also Vice President of CRM and officer of 46 registered investment companies advised or administered by CRM since 2016. |

NICHOLAS S. DI LORENZO

1987 |

|

Secretary |

|

2022 |

|

Officer of 127 registered investment companies managed by Eaton Vance or BMR. Formerly, associate (2012-2021) and counsel (2022) at Dechert LLP. |

LAURA T. DONOVAN

1976 |

|

Chief Compliance Officer |

|

2024 |

|

Vice President of Eaton Vance and BMR. Officer of 127 registered investment companies managed by Eaton Vance or BMR. |

| (1) | The business address of each officer is One Post Office Square, Boston, Massachusetts 02109. |

| (2) | Year first elected to serve as officer of a fund in the Eaton Vance family of funds when the officer has served continuously. Otherwise,

year of most recent election as an officer of a fund in the Eaton Vance family of funds. Titles may have changed since initial election. |

| (3) | Includes both funds and portfolios in a hub and spoke structure. |

Investment Adviser and Administrator

Eaton Vance, with its principal office at One Post Office Square,

Boston, Massachusetts 02109, serves as the investment adviser and administrator to the Fund. Eaton Vance is an indirect, wholly owned

subsidiary of Morgan Stanley.

Distributor

Eaton Vance Distributors, Inc. serves as the distributor for the Common

Shares of the Fund through various specified transactions, including at-the-market offerings pursuant to Rule 415 under the Securities

Act of 1933, as amended, subject to various conditions. Eaton Vance Distributors, Inc. is located at One Post Office Square, Boston, Massachusetts

02109.

Proxy Solicitation, Tabulation and Voting Requirements

The expense of preparing, printing and mailing this Proxy Statement

and enclosures and the costs of soliciting proxies on behalf of the Board of the Fund will be borne by the Fund. Proxies will be solicited

by mail and may be solicited in person or by telephone or facsimile by officers of the Fund, by personnel of its administrator, Eaton

Vance, by the transfer agent, Equiniti Trust Company, LLC, by broker-dealer firms, or by a professional solicitation organization. The

expenses associated with the solicitation of these proxies and with any further proxies will be borne by the Fund. A written proxy may

be delivered to the Fund or its transfer agent prior to the Annual Meeting by facsimile machine, graphic communication equipment or similar

electronic transmission. The Fund will reimburse banks, broker-dealer firms, and other persons holding shares registered in their names

or in the names of their nominees, for their expenses incurred in sending proxy material to and obtaining proxies from

the beneficial owners of such shares. Total estimated proxy solicitation

costs are approximately $9,500.

All proxy cards solicited by the Board that are properly executed

and received by the Secretary prior to the Annual Meeting, and which are not revoked, will be voted at the Annual Meeting. Shares represented

by such proxies will be voted in accordance with the instructions thereon. If no specification is made on the proxy card with respect

to Proposal 1, it will be voted FOR the matters specified on the proxy card. All shares that are voted and votes to ABSTAIN will be counted

towards establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted

and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.) Accordingly, abstentions

and broker non-votes, which will be treated as shares that are present at the Annual Meeting but which have not been voted, will assist

the Fund in obtaining a quorum but will have no effect on the outcome of Proposal 1.

A quorum requires the presence, in person or by proxy, of a majority

of the outstanding shares of the Fund entitled to vote. In the event that a quorum is not present at the Annual Meeting, or if a quorum

is present at the Annual Meeting but sufficient votes by the shareholders of the Fund FOR the Proposal set forth in the Notice of this

Annual Meeting are not received by that time on October 9, 2024, the persons named as proxies may propose one or more adjournments of

the Annual Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of

a majority of the shares present in person or by proxy at the session of the Annual Meeting to be adjourned. The persons named as proxies

will vote FOR such adjournment those proxies which they are entitled to vote FOR any Trustee nominee. They will vote against any such

adjournment those proxies that voted “WITHHOLD AUTHORITY FOR ALL NOMINEES” (sometimes referred to as abstentions). The costs

of any such additional solicitation and of any adjourned session will be borne by the Fund.

Pursuant to the Fund’s By-Laws, with respect to any election

of Trustees other than a contested election, a nominee must receive the affirmative vote of a plurality of votes cast at any meeting at

which a quorum is present to be elected. A plurality means that the Trustee nominee receiving the greatest number of votes will be elected.

With respect to a contested election, a nominee must receive the affirmative vote of a majority of the Fund’s shares outstanding

and entitled to vote with respect to such nominee in order to be elected. The By-Laws define a “contested election” as any

election of Trustees in which the number of persons validly nominated for election as Trustees with respect to a given class or classes

of Fund shares exceeds the number of Trustees to be elected with respect to such class or classes. See Proposal 1 for the vote required

to elect Trustees at the Annual Meeting.

Delinquent Section 16(a) Reports

Based solely upon a review of the copies of the forms received by

the Fund, all of the Trustees and officers of the Fund, Eaton Vance and its affiliates, and any person who owns more than ten percent

of the Fund’s outstanding securities have complied with the filings required under Section 16(a) of the Exchange Act regarding ownership

of shares of the Fund for the Fund’s most recent fiscal year end. Alan C. Bowser, Trustee of the Fund, submitted a Form

3 filing after its due date for the fiscal year ended June 30, 2023. No transactions were reported on this form.

The Fund will furnish without charge a copy of its most recent

Annual and Semi-Annual Reports to any shareholder upon request. Shareholders desiring to obtain a copy of such reports should call 1-866-745-0272,

send an email to corporateservices@equiniti.com or write to the Fund c/o EQ Fund Solutions, LLC, P.O. Box 500, Newark, NJ 07101. Please

note that only one Annual or Semi-Annual Report or this proxy statement or Notice of Internet Availability of Proxy Materials may be delivered

to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. Shareholder reports

are also available on the Eaton Vance website at https://funds.eatonvance.com/closed-end-fund-and-term-trust-documents.php.

SHAREHOLDER PROPOSALS

To be considered for presentation at the Fund’s 2025 Annual

Meeting of Shareholders, a shareholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act must be received at the Fund’s

principal office c/o the Secretary of the Fund on or before April 25, 2025. Written notice of a shareholder proposal submitted outside

of the processes of Rule 14a-8 must be delivered to the Fund’s principal office c/o the Secretary of the Fund no later than the

close of business on July 11, 2025 and no earlier than the close of business on June 11, 2025. In order to be included in the Fund’s

proxy statement and form of proxy, a shareholder proposal must comply with all applicable legal requirements. Timely submission of a proposal

does not guarantee that such proposal will be included.

EXHIBIT A

EATON VANCE FUNDS

AUDIT COMMITTEE CHARTER

I. Purposes of the Committee.

The Board of Trustees or Directors (the “Board”) of each

registered investment company or series thereof advised by Eaton Vance Management or its affiliate, Boston Management and Research (collectively,

“Eaton Vance”) (each, a “Fund,” and collectively, the “Funds”), has established an Audit Committee

of the Board (the “Committee”) and has approved this Charter for the operation of the Committee. The purposes of the Committee

are as follows:

| 1. | To oversee each Fund’s accounting and financial reporting processes, its internal control over financial reporting, and, as

appropriate, the internal control over financial reporting of certain service providers; |

| 2. | To oversee or, as appropriate, assist the Board in its oversight of the quality and integrity of the Funds’ financial statements

and the independent audits thereof; |

| 3. | To oversee or, as appropriate, assist the Board in its oversight of the Funds’ compliance with legal and regulatory requirements

that relate to the Funds’ accounting and financial reporting, internal control over financial reporting, independent audits, and

valuation of investments; |

| 4. | To approve prior to appointment the engagement and, when appropriate, replacement of the independent registered public accountants

(“independent auditors”), and, if applicable, nominate independent auditors to be proposed for shareholder ratification in

any proxy statement of a Fund; |

| 5. | To evaluate or, as appropriate, assist the Board in its evaluation of the qualifications, independence and performance of the independent

auditors and the audit partner in charge of leading the audit; and |

| 6. | To prepare, as necessary, such audit committee reports as are required to be prepared by applicable Securities and Exchange Commission

(“SEC”), NYSE American LLC (“NYSE American,” formerly NYSE MKT LLC) and New York Stock Exchange rules, for inclusion

in the proxy statement for the annual meeting of shareholders of a Fund. |

The primary function of the Committee is oversight. The Committee

is not responsible for managing the Funds or for performing tasks that are delegated to the officers of any Fund, any investment adviser

to a Fund, the custodian of a Fund, and other service providers for the Funds, including the independent auditors, and nothing in this

Charter shall be construed to reduce the responsibilities or liabilities of management or the Funds’ service providers. It is management’s

responsibility to maintain appropriate systems for accounting and internal control over financial reporting. Specifically, management

is responsible for: (1) the preparation, presentation and integrity of the financial statements of each Fund; (2) the maintenance of appropriate

accounting and financial reporting principles and policies; and (3) the maintenance of internal control over financial reporting and other

procedures designed to assure compliance with accounting standards

and related laws and regulations. The independent auditors are responsible for planning and carrying out an audit consistent with applicable

legal and professional standards and the terms of their engagement letter, and shall report directly to the Committee. In performing its

oversight function, the Committee shall be entitled to rely upon advice and information that it receives in its discussions and communications

with management, the independent auditors and such experts, advisors and professionals as may be consulted by the Committee.

II. Composition of the Committee.

The Committee shall be comprised of at least three members appointed

by the Board, which shall also determine the number and term, if any, of such members, in each case upon the recommendation of the Governance

Committee of the Board. All members of the Committee shall be Trustees or Directors who are not “interested persons” (as defined

in the Investment Company Act of 1940, as amended (the “1940 Act”)) of any Fund or of the investment adviser, sub-adviser

or principal underwriter of any Fund (each, an “Independent Trustee,” and collectively, the “Independent Trustees”).

In the event that a resignation, retirement, removal or other event or circumstance causes the number of Committee members to fall below

the minimum set forth above, the Committee shall nevertheless be authorized to take any and all actions otherwise permitted under this

Charter pending the appointment, within a reasonable time, of one or more Independent Trustees to fill the vacancy created thereby.

The following requirements shall also be satisfied with respect to

the membership and composition of the Committee:

| 1. | each member of the Committee shall have no material relationship that would interfere with the exercise of his or her independent

judgment; |

| 2. | no member of the Committee shall receive any compensation from a Fund except compensation for service as a member or Chairperson of