NIKE, Inc. (NYSE:NKE) today reported fiscal 2023 financial

results for its third quarter ended February 28, 2023.

- Third quarter reported revenues were $12.4 billion, up 14

percent compared to the prior year and up 19 percent on a

currency-neutral basis*

- NIKE Direct sales were $5.3 billion, up 17 percent on a

reported basis and up 22 percent on a currency-neutral basis

- NIKE Brand Digital sales increased 20 percent on a reported

basis, or 24 percent on a currency-neutral basis

- Wholesale revenues grew 12 percent on a reported basis and 18

percent on a currency-neutral basis

- Gross margin decreased 330 basis points to 43.3 percent

- Diluted earnings per share for the quarter was $0.79, down 9

percent

“NIKE’s strong results in the third quarter offer continued

proof of the success of our Consumer Direct Acceleration strategy,”

said John Donahoe, President and CEO, NIKE, Inc. “Fueled by

compelling product innovation, deep relationships with consumers

and a digital advantage that fuels brand momentum, our proven

playbook allows us to navigate volatility as we create value and

drive long-term growth.”**

Matthew Friend, Executive Vice President and Chief Financial

Officer, said, “NIKE’s brand distinction and strong execution

continue to create separation in the marketplace. We have made

tremendous progress on inventory as we position NIKE for

sustainable and more profitable growth.”**

Third Quarter Income Statement Review

- Revenues for NIKE, Inc. increased 14 percent to $12.4

billion compared to the prior year and were up 19 percent on a

currency-neutral basis.

- Revenues for the NIKE Brand were $11.8 billion, up 14 percent

on a reported basis and up 19 percent on a currency-neutral basis,

with double-digit growth in North America, EMEA and APLA. Greater

China grew 1 percent on a currency-neutral basis despite a

challenging December following the shift in the country’s COVID-19

policies. On a reported basis, revenues for Greater China declined

8 percent.

- Revenues for Converse were $612 million, up 8 percent on a

reported basis and up 12 percent on a currency-neutral basis, led

by double-digit growth across all channels in North America,

partially offset by declines in Asia.

- Gross margin decreased 330 basis points to 43.3 percent,

primarily due to higher markdowns to liquidate inventory; continued

unfavorable changes in net foreign currency exchange rates; higher

product input costs and elevated freight and logistics costs;

partially offset by strategic pricing actions.

- Selling and administrative expense increased 15 percent

to $4.0 billion.

- Demand creation expense was $0.9 billion, up 8 percent,

primarily due to advertising and marketing.

- Operating overhead expense increased 17 percent to $3.0

billion, primarily due to wage-related expenses and NIKE Direct

variable costs.

- The effective tax rate for the quarter was 16.0 percent

and substantially consistent compared to 16.4 percent for the same

period last year.

- Net income was $1.2 billion, down 11 percent compared to

prior year, and Diluted earnings per share was $0.79,

decreasing 9 percent.

February 28, 2023 Balance Sheet Review

- Inventories for NIKE, Inc. were $8.9 billion, up 16

percent compared to the prior year period, primarily driven by

higher product input costs and elevated freight costs.

- Cash and equivalents and short-term investments were

$10.8 billion, down approximately $2.7 billion from last year, as

cash provided by operations was more than offset by share

repurchases, cash dividends and capital expenditures.

Shareholder Returns

NIKE continues to have a strong track record of investing to

fuel growth and consistently increasing returns to shareholders,

including 21 consecutive years of increasing dividend payouts. In

the third quarter, NIKE returned approximately $2.0 billion to

shareholders, including:

- Dividends of $528 million, up 9 percent from the prior

year.

- Share repurchases of $1.5 billion, reflecting 12.9

million retired shares as part of the four-year, $18 billion

program approved by the Board of Directors in June 2022. As of

February 28, 2023, a total of 32.0 million shares have been

repurchased under the program for a total of approximately $3.4

billion.

Conference Call

NIKE, Inc. management will host a conference call beginning at

approximately 2:00 p.m. PT on March 21, 2023, to review fiscal

third quarter results. The conference call will be broadcast live

via the Internet and can be accessed at http://investors.nike.com.

For those unable to listen to the live broadcast, an archived

version will be available at the same location through

approximately 9:00 p.m. PT, April 11, 2023.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world's leading

designer, marketer and distributor of authentic athletic footwear,

apparel, equipment and accessories for a wide variety of sports and

fitness activities. Converse, a wholly-owned NIKE, Inc. subsidiary

brand, designs, markets and distributes athletic lifestyle

footwear, apparel and accessories. For more information, NIKE,

Inc.’s earnings releases and other financial information are

available on the Internet at http://investors.nike.com. Individuals

can also visit http://about.nike.com/en/newsroom and follow

@NIKE.

*

See additional information in the

accompanying Divisional Revenues table regarding this non-GAAP

financial measure.

**

The marked paragraphs contain

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially. These risks

and uncertainties are detailed from time to time in reports filed

by NIKE with the U.S. Securities and Exchange Commission (SEC),

including Forms 8-K, 10-Q and 10-K.

NIKE, Inc.

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

THREE MONTHS ENDED

%

NINE MONTHS ENDED

%

(In millions, except per share data)

2/28/2023

2/28/2022

Change

2/28/2023

2/28/2022

Change

Revenues

$

12,390

$

10,871

14

%

$

38,392

$

34,476

11

%

Cost of sales

7,019

5,804

21

%

21,695

18,500

17

%

Gross profit

5,371

5,067

6

%

16,697

15,976

5

%

Gross margin

43.3

%

46.6

%

43.5

%

46.3

%

Demand creation expense

923

854

8

%

2,968

2,789

6

%

Operating overhead expense

3,036

2,584

17

%

9,035

7,980

13

%

Total selling and administrative

expense

3,959

3,438

15

%

12,003

10,769

11

%

% of revenues

32.0

%

31.6

%

31.3

%

31.2

%

Interest expense (income), net

(7

)

53

—

22

165

—

Other (income) expense, net

(58

)

(94

)

—

(283

)

(235

)

—

Income before income taxes

1,477

1,670

-12

%

4,955

5,277

-6

%

Income tax expense

237

274

-14

%

916

670

37

%

Effective tax rate

16.0

%

16.4

%

18.5

%

12.7

%

NET INCOME

$

1,240

$

1,396

-11

%

$

4,039

$

4,607

-12

%

Earnings per common share:

Basic

$

0.80

$

0.88

-9

%

$

2.59

$

2.91

-11

%

Diluted

$

0.79

$

0.87

-9

%

$

2.57

$

2.85

-10

%

Weighted average common shares

outstanding:

Basic

1,543.8

1,579.0

1,556.7

1,581.1

Diluted

1,564.8

1,610.7

1,574.4

1,615.8

Dividends declared per common share

$

0.340

$

0.305

$

0.985

$

0.885

NIKE, Inc.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

February 28,

February 28,

% Change

(Dollars in millions)

2023

2022

ASSETS

Current assets:

Cash and equivalents

$

6,955

$

8,704

-20

%

Short-term investments

3,847

4,763

-19

%

Accounts receivable, net

4,513

3,827

18

%

Inventories

8,905

7,700

16

%

Prepaid expenses and other current

assets

1,815

1,968

-8

%

Total current assets

26,035

26,962

-3

%

Property, plant and equipment, net

4,939

4,806

3

%

Operating lease right-of-use assets,

net

2,834

2,959

-4

%

Identifiable intangible assets, net

277

291

-5

%

Goodwill

281

284

-1

%

Deferred income taxes and other assets

3,928

3,275

20

%

TOTAL ASSETS

$

38,294

$

38,577

-1

%

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term debt

$

500

$

—

—

Notes payable

14

—

—

Accounts payable

2,675

2,770

-3

%

Current portion of operating lease

liabilities

435

455

-4

%

Accrued liabilities

5,594

5,391

4

%

Income taxes payable

330

202

63

%

Total current liabilities

9,548

8,818

8

%

Long-term debt

8,925

9,418

-5

%

Operating lease liabilities

2,692

2,784

-3

%

Deferred income taxes and other

liabilities

2,598

2,748

-5

%

Redeemable preferred stock

—

—

—

Shareholders’ equity

14,531

14,809

-2

%

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

38,294

$

38,577

-1

%

NIKE, Inc.

DIVISIONAL REVENUES

(Unaudited)

% Change Excluding Currency

Changes1

% Change Excluding Currency

Changes1

THREE MONTHS ENDED

%

NINE MONTHS ENDED

%

(Dollars in millions)

2/28/2023

2/28/2022

Change

2/28/2023

2/28/2022

Change

North America

Footwear

$

3,322

$

2,532

31

%

31

%

$

11,090

$

8,648

28

%

28

%

Apparel

1,419

1,207

18

%

18

%

4,598

4,117

12

%

12

%

Equipment

172

143

20

%

21

%

565

473

19

%

20

%

Total

4,913

3,882

27

%

27

%

16,253

13,238

23

%

23

%

Europe, Middle East &

Africa

Footwear

2,011

1,569

28

%

39

%

6,086

5,358

14

%

30

%

Apparel

1,094

1,083

1

%

10

%

3,528

3,444

2

%

18

%

Equipment

141

127

11

%

20

%

454

426

7

%

22

%

Total

3,246

2,779

17

%

26

%

10,068

9,228

9

%

25

%

Greater China

Footwear

1,496

1,554

-4

%

5

%

4,099

4,238

-3

%

4

%

Apparel

461

548

-16

%

-8

%

1,228

1,588

-23

%

-17

%

Equipment

37

58

-36

%

-31

%

111

160

-31

%

-26

%

Total

1,994

2,160

-8

%

1

%

5,438

5,986

-9

%

-2

%

Asia Pacific & Latin

America

Footwear

1,141

1,005

14

%

20

%

3,313

2,914

14

%

24

%

Apparel

407

394

3

%

9

%

1,255

1,181

6

%

18

%

Equipment

53

62

-15

%

-12

%

167

178

-6

%

3

%

Total

1,601

1,461

10

%

15

%

4,735

4,273

11

%

22

%

Global Brand Divisions2

12

41

-71

%

-69

%

44

54

-19

%

-17

%

TOTAL NIKE BRAND

11,766

10,323

14

%

19

%

36,538

32,779

11

%

19

%

Converse

612

567

8

%

12

%

1,841

1,753

5

%

10

%

Corporate3

12

(19

)

—

—

13

(56

)

—

—

TOTAL NIKE, INC. REVENUES

$

12,390

$

10,871

14

%

19

%

$

38,392

$

34,476

11

%

19

%

TOTAL NIKE BRAND

Footwear

$

7,970

$

6,660

20

%

25

%

$

24,588

$

21,158

16

%

24

%

Apparel

3,381

3,232

5

%

10

%

10,609

10,330

3

%

10

%

Equipment

403

390

3

%

8

%

1,297

1,237

5

%

12

%

Global Brand Divisions2

12

41

-71

%

-69

%

44

54

-19

%

-17

%

TOTAL NIKE BRAND REVENUES

$

11,766

$

10,323

14

%

19

%

$

36,538

$

32,779

11

%

19

%

1 The percent change has been calculated

using actual exchange rates in use during the comparative prior

year period and is provided to enhance the visibility of the

underlying business trends by excluding the impact of translation

arising from foreign currency exchange rate fluctuations, which is

considered a non-GAAP financial measure. Management uses this

non-GAAP financial measure when evaluating the Company's

performance, including when making financial and operating

decisions. Additionally, management believes this non-GAAP

financial measure provides investors with additional financial

information that should be considered when assessing the Company’s

underlying business performance and trends. References to this

measure should not be considered in isolation or as a substitute

for other financial measures calculated and presented in accordance

with U.S. GAAP and may not be comparable to similarly titled

non-GAAP measures used by other companies.

2 Global Brand Divisions revenues include

NIKE Brand licensing and other miscellaneous revenues that are not

part of a geographic operating segment.

3 Corporate revenues primarily consist of

foreign currency hedge gains and losses related to revenues

generated by entities within the NIKE Brand geographic operating

segments and Converse, but managed through the Company’s central

foreign exchange risk management program.

NIKE, Inc.

EARNINGS BEFORE INTEREST AND

TAXES1

(Unaudited)

THREE MONTHS ENDED

%

NINE MONTHS ENDED

%

(Dollars in millions)

2/28/2023

2/28/2022

Change

2/28/2023

2/28/2022

Change

North America

$

1,190

$

967

23

%

$

4,064

$

3,636

12

%

Europe, Middle East & Africa

785

713

10

%

2,750

2,394

15

%

Greater China

702

784

-10

%

1,754

2,054

-15

%

Asia Pacific & Latin America

485

478

1

%

1,470

1,347

9

%

Global Brand Divisions2

(1,160

)

(975

)

-19

%

(3,573

)

(3,033

)

-18

%

TOTAL NIKE BRAND1

2,002

1,967

2

%

6,465

6,398

1

%

Converse

164

168

-2

%

526

504

4

%

Corporate3

(696

)

(412

)

-69

%

(2,014

)

(1,460

)

-38

%

TOTAL NIKE, INC. EARNINGS BEFORE

INTEREST AND TAXES1

1,470

1,723

-15

%

4,977

5,442

-9

%

EBIT margin1

11.9

%

15.8

%

13.0

%

15.8

%

Interest expense (income), net

(7

)

53

—

22

165

—

TOTAL NIKE, INC. INCOME BEFORE INCOME

TAXES

$

1,477

$

1,670

-12

%

$

4,955

$

5,277

-6

%

1 The Company evaluates the performance of

individual operating segments based on earnings before interest and

taxes (commonly referred to as “EBIT”), which represents Net income

before Interest expense (income), net and Income tax expense. EBIT

margin is calculated as EBIT divided by total NIKE, Inc. Revenues.

Total NIKE Brand EBIT, Total NIKE, Inc. EBIT and EBIT margin are

considered non-GAAP financial measures. Management uses these

non-GAAP financial measures when evaluating the Company's

performance, including when making financial and operating

decisions. Additionally, management believes these non-GAAP

financial measures provide investors with additional information

that should be considered when assessing the Company’s underlying

business performance and trends. References to EBIT and EBIT margin

should not be considered in isolation or as a substitute for other

financial measures calculated and presented in accordance with U.S.

GAAP and may not be comparable to similarly titled non-GAAP

measures used by other companies.

2 Global Brand Divisions primarily

represent demand creation and operating overhead expense, including

product creation and design expenses that are centrally managed for

the NIKE Brand, as well as costs associated with NIKE Direct global

digital operations and enterprise technology. Global Brand

Divisions revenues include NIKE Brand licensing and other

miscellaneous revenues that are not part of a geographic operating

segment.

3 Corporate consists primarily of

unallocated general and administrative expenses, including expenses

associated with centrally managed departments; depreciation and

amortization related to the Company’s corporate headquarters;

unallocated insurance, benefit and compensation programs, including

stock-based compensation; and certain foreign currency gains and

losses, including certain hedge gains and losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230321005914/en/

Investor Contact: Paul Trussell investor.relations@nike.com

Media Contact: KeJuan Wilkins media.relations@nike.com

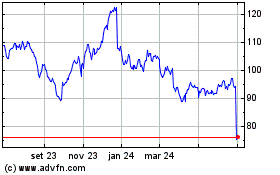

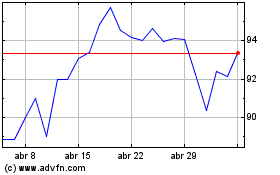

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024