AM Best has affirmed the Financial Strength Rating (FSR)

of A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term

ICR) of “a” (Excellent) of Aetna Life Insurance Company (ALIC)

(Hartford, CT) and the other members of Aetna Health & Life

Group, which are operating entities of Aetna Inc. (Aetna) and

wholly owned subsidiaries of CVS Health Corporation (CVS Health)

[NYSE: CVS]. The outlook of the FSR is stable, while the outlook of

the Long-Term ICR is positive. (Please see below for a detailed

listing of the companies.)

Concurrently, AM Best has affirmed the FSR of A (Excellent) and

the Long-Term ICRs of “a” (Excellent) of Texas Health + Aetna

Health Insurance Company, as well as Texas Health + Aetna Health

Plan Inc. Both companies are domiciled in Arlington, TX, and

collectively referred to as Texas Health Aetna. In addition, AM

Best has affirmed the FSR of A (Excellent) and the Long-Term ICR of

“a” (Excellent) of Allina Health and Aetna Insurance Company (St.

Louis Park, MN). Texas Health Aetna and Allina Health and Aetna

Insurance Company are joint ventures with subsidiaries of Aetna

Inc. The outlook of these Credit Ratings (ratings) is stable.

The ratings of Aetna Health & Life Group reflect its balance

sheet strength, which AM Best assesses as very strong, as well as

its strong operating performance, favorable business profile and

appropriate enterprise risk management (ERM).

The positive outlook on the Long-Term ICR for Aetna Health &

Life Group reflects the strengthening of its risk-adjusted

capitalization, which remains at the strongest level, as measured

by Best Capital Adequacy Ratio (BCAR). Capital expansion in recent

years has been supported by strong earnings and lower dividends

paid to the parent. The growth of its absolute level of capital and

surplus exceeded premium growth, a trend that has been continuing

over the last few years. Additionally, the share of high-risk

investments –commercial mortgage loans and BA assets –continued to

decrease further contributing to improved risk-adjusted

capitalization.

The balance sheet strength is supported by good overall

liquidity measures, which is further enhanced by the access to the

Federal Home Loan Bank of Boston, borrowing at the largest

insurance company within the Aetna Health & Life Group, Aetna

Life Insurance Company. Furthermore, the quality of capital is good

as the group does not have any debt.

Premium development over the last three years has been driven by

the expansion of Aetna’s government business in Medicare Advantage

(MA) and Medicaid, which composed three quarters of total

membership through year-end 2022. Medicaid’s double-digit growth

over the last two years is attributed to the relaxation of

eligibility checks, known as redeterminations, which have been

suspended until April 2023. Medicaid enrollment is expected to

moderate during 2023 and into early 2024. However, with Aetna’s

expansion in the individual public health exchanges during 2022,

the contraction in Medicaid might be offset partially by growth in

the individual segment. Premium growth has impacted operating

earnings trends favorably over the last three years. While claims

experience has fluctuated, resulting in improved loss ratios in the

early stages of the COVID-19 pandemic in 2020 before increasing in

2021 due to higher-than-expected COVID-19-related medical costs,

overall profitability metrics have improved. Despite the recent

volatility, which was largely attributable to COVID-19, the Aetna

Health & Life Group has reported underwriting and net income of

$2 billion in each of the last five years, with one-year return on

equity (ROE) exceeding 20% and one-year operating return on revenue

(ROR) in the 5-7% range.

Aetna remains one of the leading players in the managed care

markets throughout the United States. While Aetna’s government

segments have experienced significant membership growth, the

company remains competitive in its other segments. The relationship

with CVS Health adds a competitive advantage, as some Aetna

insurance products emphasize affiliated MinuteClinic as a low-cost

provider of primary care services.

The ratings of Aetna Health & Life Group reflect the

ultimate parent, CVS Health, and an expectation of elevated

leverage due to the recently announced acquisitions. The financial

leverage at CVS Health has declined to 41% at year-end 2022 as part

of the organization’s deleveraging efforts. However, financial

leverage is expected to increase during 2023 as CVS Health is

expected to finance a portion of two recently announced

acquisitions, Signify Health and Oak Street Health, which are both

expected to close this year. Goodwill to shareholders equity

exceeded 100% at year-end 2022, which is likely to increase upon

the close of Signify Health and Oak Street Health. While AM Best

recognizes that these acquisitions are part of the organization’s

health care services strategy, as with any transaction there is

execution risk.

The ratings of Texas Health Aetna reflect its balance sheet

strength, which AM Best assesses as strong, as well as its adequate

operating performance, limited business profile, appropriate ERM

and support of its parents. During 2022, the joint venture’s

risk-adjusted capitalization improved, supported by net income of

approximately $10 million. Marking the first year of profits, net

income was supported by underwriting gains and lower amortization

of intangibles.

The ratings of Allina Health and Aetna Insurance Company reflect

its balance sheet strength, which AM Best assesses as adequate, as

well as its marginal operating performance, limited business

profile, appropriate ERM and support of its parents. The joint

venture’s net results continue to be negative as the amortization

of intangibles exceeded underwriting income. However, underwriting

results in 2022 were positive for the first time since inception,

primarily driven by growth in its Medicare segment.

The FSR of A (Excellent) and the Long-Term ICRs of “a”

(Excellent) have been affirmed, with a stable outlook for the FSR

and a positive outlook for the Long-Term ICR, for the following

members of Aetna Health & Life Group:

- Aetna Life Insurance Company

- Aetna Health and Life Insurance Company

- Aetna Life & Casualty (Bermuda) Ltd.

- Aetna Health Inc. (a Connecticut corporation)

- Aetna Health Inc. (a Florida corporation)

- Aetna Health Inc. (a Georgia corporation)

- Aetna Health Inc. (a New Jersey corporation)

- Aetna Health Inc. (a New York corporation)

- Aetna Health Inc. (a Maine Corporation)

- Aetna Health Inc. (a Pennsylvania corporation)

- Aetna Health Inc. (a Texas corporation)

- Aetna Health Inc. (LA)

- Aetna Health Insurance Company

- Aetna Health Insurance Company of New York

- Aetna Better Health of Florida, Inc.

- Aetna Health of California Inc.

- Aetna Health of Iowa Inc.

- Aetna Health of Utah Inc.

- Aetna Dental of California Inc.

- Aetna Dental Inc. (a New Jersey corporation)

- Aetna Dental Inc. (a Texas corporation)

- American Continental Insurance Company

- Accendo Insurance Company

- Continental Life Insurance Company of Brentwood, Tennessee

- Coventry Health and Life Insurance Company

- Aetna Better Health of Michigan, Inc.

- Aetna Better Health of Missouri LLC

- Coventry Health Care of Illinois, Inc.

- Coventry Health Care of Kansas, Inc.

- Coventry Health Care of Missouri, Inc.

- Coventry Health Care of Nebraska, Inc.

- Coventry Health Care of Virginia, Inc.

- Coventry Health Care of West Virginia, Inc.

- First Health Life & Health Insurance Company

- HealthAssurance Pennsylvania, Inc.

- SilverScript Insurance Company

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2023 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230329005802/en/

Antonietta Iachetta Senior Financial Analyst +1

908 439 2200, ext. 5792 antonietta.iachetta@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 439 2200, ext. 5159

christopher.sharkey@ambest.com

Sally Rosen Senior Director +1 908 439 2200,

ext. 5280 sally.rosen@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 439 2200, ext. 5098 al.slavin@ambest.com

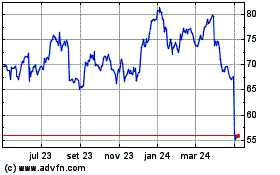

CVS Health (NYSE:CVS)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

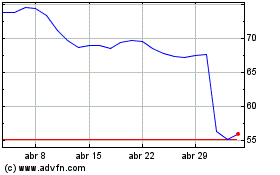

CVS Health (NYSE:CVS)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025