- WHP Global will Acquire the Bonobos Brand

- EXPR will Acquire the Bonobos Operating Assets and Operate

the Bonobos eCommerce, Guideshop and Wholesale Businesses in the

U.S. Under an Exclusive Long-Term Licensing Agreement with WHP

Global

Fashion apparel retailer Express, Inc. (NYSE: EXPR) (the

“Company” or “EXPR”) and global brand management firm, WHP Global

(“WHP”), today announced a definitive agreement to acquire menswear

brand Bonobos, Inc. (“Bonobos”) from Walmart Inc. (“Walmart”). This

is the first acquisition to be made jointly by WHP Global and EXPR

since finalizing their strategic partnership earlier this year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230413005808/en/

(Photo: Business Wire)

Bonobos, founded in 2007 and acquired by Walmart in 2017,

distinguished itself in the menswear category based on product fit,

customer experience and the innovative Guideshop retail model, and

the business has delivered strong, consistent growth.

“Our strategic roadmap to transform EXPR to create shareholder

value includes achieving profitable growth in our core Express

business – which is our first priority – optimizing our omnichannel

platform, and accelerating our growth and profitability through our

partnership with WHP Global,” said Tim Baxter, EXPR Chief Executive

Officer.

“Bonobos is delivering double-digit sales growth and we plan to

continue that momentum while also realizing operating synergies and

other economies of scale. This is a compelling addition to our

brand portfolio, and I expect the transaction will be accretive to

operating income and free cash flow positive in fiscal 2023,”

continued Baxter.

WHP Global and EXPR have great admiration for the Bonobos team,

led by CEO John Hutchison who will become Brand President of

Bonobos and report to Tim Baxter after the transaction closes.

Bonobos will remain at its current headquarters in New York.

"Bonobos is an ideal first acquisition for our new partnership

with EXPR and will be a terrific addition to our fashion vertical.

Post-closing, WHP Global’s portfolio will include more than 10

powerful consumer brands approaching $7 billion in total retail

sales,” said Yehuda Shmidman, WHP Global Chairman and Chief

Executive Officer.

“This is an exciting moment for Bonobos as we embark on the next

phase of our growth. Born a digitally native vertical brand, we

plan to build on our strength in eCommerce and customer loyalty,

leverage EXPR’s expertise in omnichannel retailing and scale

through WHP Global’s partnerships in licensing and distribution,”

said Bonobos CEO John Hutchison.

This transaction is expected to provide the following strategic

and financial benefits:

- Presents opportunity to unlock additional growth for the

Bonobos brand. EXPR plans to leverage its strength in men’s to

address underpenetrated categories, and its strength in marketing

to drive greater awareness and customer acquisition.

- Expands EXPR brand portfolio to accelerate growth and

profitability. Bonobos will be the third brand in the EXPR

portfolio, joining Express and UpWest. It is expected to be

accretive to operating income and free cash flow positive in fiscal

2023, accelerating our sales growth and profitability.

- Achieves synergies and efficiencies through EXPR fully

integrated omnichannel operating platform. EXPR expects to

leverage its platform to drive financial efficiencies, operational

synergies and additional economies of scale across Production &

Sourcing, Logistics, Real Estate, Technology, and other areas of

its existing and new businesses.

Transaction Details

WHP Global and EXPR have entered into a definitive agreement

with Walmart Inc. to acquire Bonobos, Inc. for a combined purchase

price of $75 million.

WHP Global will acquire the Bonobos brand for a purchase price

of $50 million. EXPR will acquire the operating assets and assume

the related liabilities of the Bonobos business for a purchase

price of $25 million. Concurrent with the closing of the

transaction, WHP Global and EXPR will enter into an exclusive

long-term license agreement with multiple renewal options granting

EXPR the right to use the intellectual property acquired by WHP

Global for the operation of the Bonobos business in the U.S. in

exchange for EXPR’s payment of a royalty fee to WHP Global.

The transaction is expected to close in EXPR’s second fiscal

quarter of 2023, subject to customary closing conditions. An

investor presentation relating to the transaction will be available

at www.express.com/investor at approximately 4:15 p.m. ET on April

13, 2023.

Moelis & Company LLC is serving as financial advisor and

Kirkland & Ellis LLP is serving as legal advisor to EXPR on

this transaction. Goodwin Procter LLP is serving as legal advisor

to WHP Global.

About EXPR

EXPR is a fashion retail company whose business includes an

omnichannel operating platform, physical and online stores, and a

multi-brand portfolio that includes Express and UpWest. The Express

brand launched in 1980 with the idea that style, quality and value

should all be found in one place. Today, Express is a brand with a

purpose - We Create Confidence. We Inspire Self-Expression. -

powered by a styling community. UpWest launched in 2019 with a

purpose to Provide Comfort for People & Planet.

The Company has approximately 540 Express retail and Express

Factory Outlet stores in the United States and Puerto Rico, the

express.com online store and the Express mobile app; and 13 UpWest

retail stores and the UpWest.com online store. EXPR is traded on

the NYSE under the symbol EXPR. For more information about our

Company, please visit www.express.com/investors and for more

information about our brands, please visit www.express.com or

www.upwest.com.

About WHP Global

WHP Global is a leading New York based firm that acquires global

consumer brands and invests in high-growth distribution channels

including digital commerce platforms and global expansion. WHP owns

ANNE KLEIN®, JOSEPH ABBOUD®, JOE'S JEANS®, WILLIAM RAST®, ISAAC

MIZRAHI®, LOTTO®, TOYS"R"US®, BABIES"R"US®, and a 60% interest in

the EXPRESS® brand. Collectively the brands generate over USD $6.5

billion in global retail sales. The company also owns WHP+, a

turnkey direct to consumer digital e-commerce platform and WHP

SOLUTIONS, a sourcing agency based in Asia. For more information,

please visit www.whp-global.com.

EXPR Forward-Looking Statements

Certain statements are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to (1) with respect

to the contemplated acquisition of Bonobos, financial estimates,

statements regarding the expected timing of the closing of the

transaction, benefits or effects of the acquisition, including

operating results, financial efficiencies, and operational

synergies, post-acquisition plans, objectives, expectations and

intentions, and (2) statements regarding Express, Inc.’s (the

“Company”, “we”, “our” or “us”) strategy, plans, and initiatives,

including, but not limited to, results expected from such strategy,

plans, and initiatives. You can identify these forward-looking

statements by the use of words in the future tense and statements

accompanied by words such as “outlook,” “indicator,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“scheduled,” “estimates,” “anticipates,” “opportunity,” “leads” or

the negative version of these words or other comparable words.

Forward-looking statements are based on our current expectations

and assumptions, which may not prove to be accurate. These

statements are not guarantees and are subject to risks,

uncertainties, and changes in circumstances that are difficult to

predict, and significant contingencies, many of which are beyond

the Company's control. Many factors could cause actual results to

differ materially and adversely from these forward-looking

statements. Among these factors are, with respect to the

contemplated acquisition of Bonobos: (1) the occurrence of any

event, change or other circumstance that could give rise to a

termination of the transaction agreement, (2) the risk that any of

the closing conditions to the acquisition may not be satisfied in a

timely manner or at all, (3) failure to realize the benefits of the

acquisition, and (4) the effect of the announcement of the

transaction on the ability of Bonobos to retain customers and key

personnel and to maintain relationships with suppliers, and on

their operating results and businesses generally, and more

generally, (1) changes in consumer spending and general economic

conditions; (2) the COVID-19 pandemic and any future impact on our

business operations, store traffic, employee availability,

financial condition, liquidity and cash flow; (3) geopolitical

risks, including impacts from the ongoing conflict between Russia

and Ukraine and increased tensions between China and Taiwan; (4)

our ability to operate our business efficiently, manage capital

expenditures and costs, and obtain financing when required; (5) our

ability to identify and respond to new and changing fashion trends,

customer preferences, and other related factors; (6) fluctuations

in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, and inventory levels; (7) customer traffic at

malls, shopping centers, and at our stores; (8) competition from

other retailers; (9) our dependence on a strong brand image; (10)

our ability to adapt to changing consumer behavior and develop and

maintain a relevant and reliable omnichannel experience for our

customers, including our efforts to optimize our omnichannel

platform through our partnership with WHP Global; (11) the failure

or breach of information systems upon which we rely; (12) our

ability to protect customer data from fraud and theft; (13) our

dependence upon third parties to manufacture all of our

merchandise; (14) changes in the cost of raw materials, labor, and

freight; (15) supply chain or other business disruption, including

as a result of the coronavirus; (16) our dependence upon key

executive management; (17) our ability to execute our growth

strategy, EXPRESSway Forward, including engaging our customers and

acquiring new ones, executing with precision to accelerate sales

and profitability, creating great product and reinvigorating our

brand; (18) our substantial lease obligations; (19) our reliance on

third parties to provide us with certain key services for our

business; (20) impairment charges on long-lived assets; (21) claims

made against us resulting in litigation or changes in laws and

regulations applicable to our business; (22) our inability to

protect our trademarks or other intellectual property rights which

may preclude the use of our trademarks or other intellectual

property around the world; (23) restrictions imposed on us under

the terms of our asset-based loan facility, including restrictions

on the ability to effect share repurchases; (24) changes in tax

requirements, results of tax audits, and other factors that may

cause fluctuations in our effective tax rate; (25) changes in

tariff rates; (26) natural disasters, extreme weather, public

health issues, including pandemics, fire, acts of terrorism or war

and other events that cause business interruption; and (27) risks

related to our partnership with WHP Global.

These factors should not be construed as exhaustive and should

be read in conjunction with the additional information concerning

these and other factors in the Company’s filings with the

Securities and Exchange Commission. We undertake no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events, or otherwise, except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230413005808/en/

EXPR Contacts

Investors Greg Johnson gjohnson@express.com

614-474-4890

Media Sarah Gordon SHADOW sgordon@weareshadow.com

212-927-0277 x4077

WHP Global Contact

Jaime Cassavechia EJ Media Group jaime@ejmediagroup.com

646-701-7041

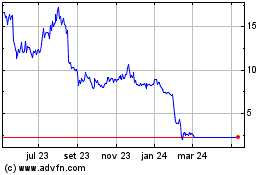

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

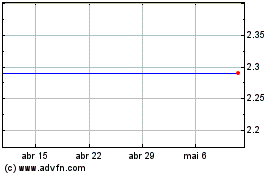

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025