Salesforce (NYSE:CRM),

Informatica (NYSE:INFA) – Salesforce has withdrawn

from negotiations to acquire Informatica due to disagreements over

terms, according to Reuters. The discussions were in advanced

stages, with a potential price of around $30 per share for

Informatica, which has clients such as Unilever and Deloitte.

Salesforce shares rose 3.4%, while Informatica shares fell 6.2%, in

pre-market trading.

Tesla (NASDAQ:TSLA) – Tesla has reduced prices

in several markets, including the USA, China, and Germany, in

response to falling sales and competition. Elon Musk stated that

prices vary to meet demand. Tesla also reduced the price of the

Full Self-Driving (FSD) software to $8,000 in the USA, with Elon

Musk reinforcing his commitment to autonomous driving. Musk bets

that the FSD will be an important revenue source, despite

regulatory challenges. Musk postponed his visit to India, including

a meeting with Prime Minister Narendra Modi, due to urgent issues

at Tesla. The decision follows a tumultuous week, with staff

reductions and financial challenges.

Li Auto (NASDAQ:LI) – Following Tesla’s price

cuts in its lineup in China, possibly initiating a new price war

with Li Auto, which responded with immediate discounts. Li Auto cut

prices by 6-7%, with its SUV L7 now starting at $41,700 (301,800

yuan). Li Auto’s shares, traded in the United States, recorded a

7.3% drop in pre-market trading.

Apple (NASDAQ:AAPL) – Apple is close to

receiving EU antitrust regulators’ approval to open its tap-and-go

mobile payment system to competitors, after adjusting terms. This

would end a four-year investigation, potentially avoiding a

significant fine. Apple’s proposal to share NFC technology will be

reviewed by May.

Alphabet (NASDAQ:GOOGL) – On Friday, Google

announced the revocation of minimum wage and benefits requirements

for U.S. suppliers, aligning with practices of other companies and

clarifying its role as an employer. This change follows recent

labor disputes and regulatory pressures. Additionally, the Japanese

antitrust regulator accuses Google of limiting competition by

blocking Yahoo Japan’s access to mobile advertising technology,

compromising competition. Alphabet agreed to grant access, but

Japanese authorities continue to monitor the situation, reserving

the right to reopen the investigation.

Cisco Systems (NASDAQ:CSCO) – Cisco Systems is

adopting a new security strategy, using artificial intelligence to

protect computing systems. Its Hypershield service automates

security tasks, such as vulnerability patches and updates, aiming

to protect against cyberattacks, while preparing the infrastructure

for the AI revolution.

Nvidia (NASDAQ:NVDA) – Nvidia was showing a

2.6% increase in pre-market trading. On Friday, the shares of the

artificial intelligence chip company fell 10%, marking the largest

percentage drop in a single day since March 16, 2020, according to

Dow Jones Market Data. This resulted in a $212 billion reduction in

Nvidia’s market value, representing the largest single-day market

value decline for the company.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – Options investors in Taiwan Semiconductor

Manufacturing Co. are pessimistic due to the chip maker’s

conservative guidance and doubts about the future of artificial

intelligence trade. While put options are increasing, suggestions

of recovery also emerge, indicating uncertainty about the future

direction of the shares.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer shares showed a 3.4% increase in pre-market trading,

after suffering a 23% drop on Friday, when the artificial

intelligence hardware company announced it would release its

earnings on April 30, but did not provide preliminary results for

the fiscal third quarter. This disappointed investors who were

expecting a positive update from the company, especially since in

January, 11 days before the earnings announcement, Super Micro had

significantly raised its profit and sales outlook.

Warner Bros Discovery (NASDAQ:WBD) – The annual

compensation for CEO David Zaslav of Warner Bros Discovery

increased nearly 27%, to $49.7 million in 2023, according to an SEC

document. The increase reflects the company’s shift to prioritize

debt reduction and free cash flow, driven by an 86% jump in free

cash flow, to $6.16 billion. Although it is an increase from 2022,

it still falls short of his record compensation of $246.5 million

in 2021.

PepsiCo (NASDAQ:PEP) – PepsiCo, a key customer

of Tesla, made initial payments for 100 Tesla Semi trucks in 2017,

aiming to transport its products. However, only 36 out of the 100

trucks have been used to this month, highlighting Tesla’s

challenges in the electric truck market.

Honda Motor (NYSE:HMC) – Honda announced an

investment of $807.74 million (4.2 billion reais) in its Itirapina

plant, Brazil, by 2030, aiming to develop a hybrid-flex

vehicle.

Embraer (NYSE:ERJ) – Embraer announced the

delivery of 25 aircraft in the first quarter of 2024, including

seven commercial planes and 18 executive jets, representing a 67%

increase compared to the previous year. The company recorded a firm

order book of $21.1 billion, its highest level in seven years.

Embraer forecasts delivering between 72 to 80 commercial aircraft

and between 125 to 135 executive jets this year.

Albemarle (NYSE:ALB), Cummins

(NYSE:CMI), Siemens Energy (USOTC:SIEGY) –

Albemarle, Cummins, and Siemens Energy are among the companies that

obtained tax credits under the U.S. Inflation Reduction Act.

Thirty-five projects, spanning electrical grid improvements and

electric vehicles, received a total of $1.93 billion in credits.

This boost is crucial for accelerating the transition to clean and

renewable energies, vital for achieving global climate goals.

Albemarle will receive $9.4 million to support lithium carbonate

production, Cummins obtained $10.6 million for electrolyzers in

Minnesota, while Siemens Energy received $18.3 million for its

first power transformer factory in the USA.

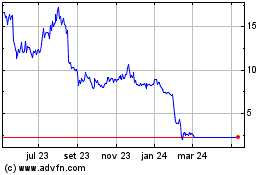

Express (NYSE:EXPR) – The fashion retailer

Express filed for Chapter 11 bankruptcy in the USA, planning to

close more than 100 stores. With assets and liabilities estimated

between $1 billion and $10 billion, the company appointed Mark

Still as the new CFO and will close Express and UpWest stores as

part of the process.

Nike (NYSE:NKE) – Nike plans to lay off

approximately 740 employees at its global headquarters in Oregon,

as part of an effort to contain costs following a revenue decline

anticipated for the first half of the fiscal year 2025. This

follows a previously announced cost-reduction plan.

Lululemon Athletica (NASDAQ:LULU) – Lululemon

Athletica will close its distribution center in Washington and lay

off more than 100 employees by the end of the year, as part of a

business restructuring due to slowing demand in North America. Some

employees will be relocated to other facilities.

UBS Group AG (NYSE:UBS) – UBS plans to cut

costs and jobs in five phases after acquiring Credit Suisse,

starting in June, according to the SonntagsZeitung. The program

aims to save over $10 billion. It is estimated that up to 35,000

jobs could be affected globally, with up to 60% of former Credit

Suisse employees being laid off.

Wells Fargo (NYSE:WFC) – Wells Fargo faces

charges of sexual discrimination in a lawsuit filed by Michal

Leavitt, a bond saleswoman. She alleges that the bank denied

salaries and promotions available to men, creating a sexist work

environment.

Coinbase Global (NASDAQ:COIN),

Robinhood Markets (NASDAQ:HOOD) – Shares of

Coinbase Global recorded a 3.3% increase, while those of Robinhood

Markets rose 1.3%, driven by an increase in Bitcoin value following

the event known as halving on Friday. Bitcoin, the world’s leading

cryptocurrency, was trading at $65,900 on Monday morning,

representing a 1.7% increase over the last 24 hours.

Blackstone (NYSE:BX) – Blackstone made an offer

of about $1.5 billion to acquire the Hipgnosis Songs

Fund (LSE:SONG), outbidding Concord. Blackstone is the

majority owner of the fund’s investment advisor, holding music

rights of artists like Shakira and Red Hot Chili Peppers.

UnitedHealth Group (NYSE:UNH) – CEO of

UnitedHealth, Andrew Witty, will testify in a U.S. House

subcommittee on May 1st, addressing a cyberattack on its technology

unit. The hack at Change Healthcare, on February 21st, disrupted

payments to doctors and healthcare units across the country for a

month.

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025