Non-Dilutive Funding to Accelerate Development

of Artificial Intelligence Driven Handheld DeepView®

Spectral MD Holdings, Ltd. (AIM: SMD) (“Spectral MD” or the

“Company”), an artificial intelligence (AI) company focused on

medical diagnostics for faster and more accurate treatment

decisions in wound care, announces today that it has received a $4

million award from the Medical Technology Enterprise Consortium

(MTEC). The MTEC is a 501(c)(3) biomedical consortium collaborating

with the U.S. Army Medical Material Development Activity (USAMMDA).

This award will provide non-dilutive funding to support military

battlefield burn evaluation via a handheld DeepView®, DeepView

SnapShot M.

The funding will build upon work performed initially under an

award of $1.1 million from the U.S. Department of Defense and will

support the continued development of a fully portable device. The

handheld DeepView SnapShot M would enable injuries to be triaged

quickly and accurately on the battlefield so that those with more

severe burn injuries can be prioritized for evacuation. The

development of the handheld device closely aligns with MTEC’s

mission of facilitating prototype advancement of technologies that

protect, treat, and optimize the health and performance of U.S.

military service personnel.

“The unpredictability of severe burn injuries designates this

wound type as a complex critical care problem in both military and

civilian populations. Military conflict zones are often in remote

locations, meaning that an accurate and immediate burn assessment

is paramount for effective treatment and appropriate intervention,”

remarked Dr. Lauren Palestrini, Ph.D., MTEC Chief Scientific

Officer. “Developing the DeepView SnapShot M for remote

applications enables medical providers to accurately inform triage,

evacuation, and resourcing decisions, contributing to reduced

surgical burden, and soldier return-to-duty.”

“We are honored to receive this award to support the military

with the continued development of our DeepView® technology, taking

overall non-dilutive government funding commitments received to

nearly $130 million,” commented Wensheng Fan, CEO of Spectral

MD. “This funding will further Spectral MD’s innovation within

the burn indication and support the continued development of our

handheld digital burn assessment tool. We look forward to

partnering with MTEC to advance our AI-driven diagnostic technology

as we work toward FDA submission for the burn indication.

Ultimately, we anticipate that our DeepView SnapShot M will

transform wound care in many limited-access areas, including first

responder, disaster preparedness and acute care emergency

settings.”

The views expressed in this news release/article are those of

the authors and may not reflect the official policy or position of

the U.S. Department of the Army, U.S. Department of Defense, or the

U.S. Government.

About Spectral MD

Spectral MD is a predictive AI company focused on medical

diagnostics for faster and more accurate treatment decisions in

wound care for burn, DFU, and future clinical applications. At

Spectral MD, we are a dedicated team of forward-thinkers striving

to revolutionize the management of wound care by “Seeing the

Unknown”® with our DeepView® Wound Diagnostics System. The

Company’s DeepView® platform is the only predictive diagnostic

device that offers clinicians an objective and immediate assessment

of a wound’s healing potential prior to treatment or other medical

intervention. With algorithm-driven results that substantially

exceed the current standard of care, Spectral MD’s diagnostic

platform is expected to provide faster and more accurate treatment

insight, significantly improving patient care and clinical

outcomes. For more information, visit the Company at:

www.spectralmd.com.

As announced on April 11, 2023, Spectral MD Holdings has entered

into a business combination agreement to combine with Rosecliff

Acquisition Corp I (“Rosecliff”, Nasdaq: RCLF), a special purpose

acquisition company listed on Nasdaq.

About U.S. Army Medical Research and Development

Command

The U.S. Army Medical Research and Development Command is the

Army's medical materiel developer, with responsibility for medical

research, development, and acquisition. USAMRDC produces medical

solutions for the battlefield with a focus on various areas of

biomedical research, including military infectious diseases, combat

casualty care, military operational medicine, medical, chemical,

and biological defense. https://mrdc.amedd.army.mil/

About MTEC

The Medical Technology Enterprise Consortium is a 501(c)(3)

biomedical technology consortium that is internationally dispersed,

collaborating with multiple government agencies under a 10-year

renewable Other Transaction Agreement with the U.S. Army Medical

Research and Development Command. The consortium focuses on the

development of medical solutions that protect, treat, and optimize

the health and performance of U.S. service members and civilians.

To find out more about MTEC, visit mtec-sc.org.

About USAMMDA

The U.S. Army Medical Materiel Development Activity is a

subordinate command of the U.S. Army Medical Research and

Development Command, under the Army Futures Command. As the premier

developer of world-class military medical capabilities, USAMMDA is

responsible for developing and delivering critical products

designed to protect and preserve the lives of Warfighters across

the globe. These products include drugs, vaccines, biologics,

devices, and medical support equipment intended to maximize

survival of casualties on the battlefield.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 (“MAR”). Upon the publication of this announcement via

Regulatory Information Service (“RIS”), this inside information is

now considered to be in the public domain.

Additional Information and Where to Find It

This press release is provided for informational purposes only

and contains information with respect to a proposed business

combination among Spectral MD, Rosecliff, Ghost Merger Sub I Inc.,

a wholly-owned subsidiary of Rosecliff, and Ghost Merger Sub II

LLC, a wholly-owned subsidiary of Rosecliff (the “Transaction”). In

connection with the proposed Transaction, Rosecliff intends to file

with the U.S. Securities and Exchange Commission (the "SEC") a

registration statement on Form S-4, which will include a proxy

statement to be sent to Rosecliff stockholders and a prospectus for

the registration of Rosecliff securities in connection with the

proposed Transaction (as amended from time to time, the

“Registration Statement”). A full description of the proposed

Transaction is expected to be provided in the Registration

Statement filed by Rosecliff with the SEC. Rosecliff's

stockholders, investors and other interested persons are advised to

read, when available, the Registration Statement as well as other

documents filed with the SEC, as these documents will contain

important information about Rosecliff, Spectral MD, and the

proposed Transaction. If and when the Registration Statement is

declared effective by the SEC, the proxy statement/prospectus and

other relevant documents for the proposed Transaction will be

mailed to stockholders of Rosecliff as of a record date to be

established for voting on the proposed Transaction. Rosecliff

investors and stockholders will also be able to obtain copies of

the proxy statement/prospectus and other documents filed with the

SEC, without charge, once available, at the SEC's website at

www.sec.gov.

Participants in the Solicitation

Rosecliff, Spectral MD and certain of their respective

directors, executive officers, other members of management and

employees may, under SEC rules, be deemed participants in the

solicitation of proxies from Rosecliff's stockholders with respect

to the proposed Transaction. Investors and security holders may

obtain more detailed information regarding the names and interests

in the proposed Transaction of Rosecliff's directors and officers

in Rosecliff's filings with the SEC, including, when filed with the

SEC, the preliminary proxy statement and the amendments thereto,

the definitive proxy statement, and other documents filed with the

SEC, including the Registration Statement, when available. Such

information with respect to Spectral MD’s directors and executive

officers will also be included in the proxy statement.

No Offer or Solicitation

This press release and the information contained herein do not

constitute (i) (a) a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

proposed Transaction or (b) an offer to sell or the solicitation of

an offer to buy any security, commodity or instrument or related

derivative, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction or (ii) an offer or

commitment to lend, syndicate or arrange a financing, underwrite or

purchase or act as an agent or advisor or in any other capacity

with respect to any transaction, or commit capital, or to

participate in any trading strategies. No offer of securities in

the United States or to or for the account or benefit of U.S.

persons (as defined in Regulation S under the U.S. Securities Act

of 1933 (the “Securities Act”)) shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act, or an exemption therefrom. Investors should consult with their

counsel as to the applicable requirements for a purchaser to avail

itself of any exemption under the Securities Act.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. This includes, without limitation, all statements regarding

(i) the proposed Transaction, including statements regarding

anticipated timing of the proposed Transaction, (ii) the use of the

MTEC award, (iii) the use of the current award, (iv) development of

DeepView® technology and tools, (v) transformation of wound care in

limited-access areas, (vi) innovation within burn indication, and

(vii) the continued partnership with MTEC. Generally, statements

that are not historical facts, including statements concerning our

possible or assumed future actions, business strategies, events or

results of operations, are forward-looking statements. These

statements may be preceded by, followed by or include the words

“believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,”

“will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or

“intends” or similar expressions. Such forward-looking statements

involve risks and uncertainties that may cause actual events,

results or performance to differ materially from those indicated by

such statements. These forward-looking statements are expressed in

good faith, and Rosecliff and Spectral MD believe there is a

reasonable basis for them. However, there can be no assurance that

the events, results or trends identified in these forward-looking

statements will occur or be achieved. Forward-looking statements

speak only as of the date they are made, and neither Rosecliff nor

Spectral MD is under any obligation, and expressly disclaim any

obligation, to update, alter or otherwise revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law.

Forward-looking statements are inherently subject to risks,

uncertainties and assumptions. In addition to risk factors

previously disclosed in Rosecliff’s reports filed with the SEC and

those identified elsewhere in this press release, the following

factors, among others, could cause actual results to differ

materially from forward-looking statements or historical

performance: (i) risks associated with product development and

regulatory review, including the time, expense and uncertainty of

obtaining clearance, approval or De Novo classification for

Spectral MD’s DeepView technology, (ii) Spectral MD’s ability to

obtain additional funding when needed and its dependence on

government funding, (iii) expectations regarding Spectral MD’s

strategies and future financial performance, including its future

business plans or objectives, prospective performance and

opportunities and competitors, revenues, products and services,

pricing, operating expenses, market trends, liquidity, cash flows

and uses of cash, capital expenditures, and Spectral MD’s ability

to invest in growth initiatives and pursue acquisition

opportunities; (iv) the risk that the proposed Transaction may not

be completed in a timely manner at all, which may adversely affect

the price of Rosecliff’s securities; (v) the failure to satisfy the

conditions to the consummation of the proposed Transaction,

including the adoption of the business combination agreement by the

stockholders of Rosecliff and the shareholders of Spectral MD, and

the receipt of certain governmental and regulatory approvals; (vi)

the lack of third party valuation in determining whether or not to

pursue the proposed Transaction; (vii) the ability to regain

compliance with Nasdaq Capital Market listing requirements and to

maintain listing, or for the Combined Company to be listed, on the

Nasdaq Capital Market; (viii) the occurrence of any event, change

or other circumstances that could give rise to the termination of

the business combination agreement; (ix) the outcome of any legal

proceedings that may be instituted against Rosecliff or Spectral MD

following announcement of the proposed Transaction; (x) the

inability to complete the proposed Transaction due to, among other

things, the failure to obtain Rosecliff stockholder approval on the

expected terms and schedule and the risk that regulatory approvals

required for the proposed Transaction are not obtained or are

obtained subject to conditions that are not anticipated; (xi) the

risk that the proposed Transaction may not be completed by

Rosecliff’s business combination deadline and the potential failure

to obtain an extension of the business combination deadline; (xii)

the effect of the announcement or pendency of the proposed

Transaction on Spectral MD’s business relationships, operating

results, and business generally; (xiii) volatility in the price of

Rosecliff’s securities due to a variety of factors, including

changes in the competitive and regulated industries in which

Rosecliff plans to operate or Spectral MD operates, variations in

operating performance across competitors, changes in laws and

regulations affecting Rosecliff's or Spectral MD’s business,

Spectral MD’s inability to implement its business plan or meet or

exceed its financial projections and changes in the combined

capital structure; (xiv) Rosecliff’s ability to raise capital as

needed; (xv) the ability to implement business plans, forecasts,

and other expectations after the completion of the proposed

Transaction and identify and realize additional opportunities;

(xvi) the risk that the announcement and consummation of the

proposed Transaction disrupts Spectral MD’s current operations and

future plans; (xvii) the ability to recognize the anticipated

benefits of the proposed Transaction; (xviii) unexpected costs

related to the proposed Transaction; (xix) the amount of any

redemptions by existing holders of the Rosecliff common stock being

greater than expected; (xx) limited liquidity and trading of

Rosecliff’s securities; (xxi) geopolitical risk and changes in

applicable laws or regulations; (xxii) the possibility that

Rosecliff and/or Spectral MD may be adversely affected by other

economic, business, and/or competitive factors; (xxiii) operational

risk; and (xxiv) changes in general economic conditions, including

as a result of the COVID-19 pandemic. The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

“Risk Factors” sections of the Rosecliff’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, and the other documents filed

by Rosecliff from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements.

Readers are cautioned not to put undue reliance on

forward-looking statements, and neither Rosecliff nor Spectral MD

assumes any obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by securities and

other applicable laws. Neither Rosecliff nor Spectral MC gives any

assurance that it will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230418006199/en/

Spectral MD Holdings, Ltd. Christine Marks VP of

Marketing and Commercialization IR@Spectralmd.com

SP Angel Corporate Finance LLP (NOMAD and Joint Broker for

Spectral MD) Stuart Gledhill / Harry Davies-Ball (Corporate

Finance) Vadim Alexandre / Rob Rees (Sales & Broking) +44 (0)20

3470 0470

The Equity Group Inc. (US Investor Relations) Devin

Sullivan dsullivan@equityny.com 212-836-9608

Walbrook PR Ltd (UK Media & Investor Relations) Paul

McManus / Louis Ashe-Jepson /Alice Woodings

spectralMD@walbrookpr.com +44 (0)20 7933 8780

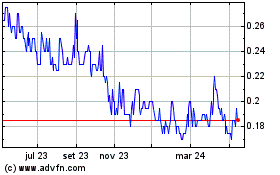

Strategic Metals (TSXV:SMD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

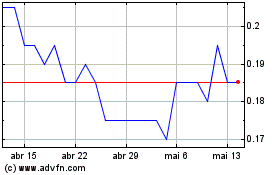

Strategic Metals (TSXV:SMD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024