Chimera Investment Corporation (NYSE:CIM) today announced its

financial results for the first quarter ended March 31, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230504005387/en/

Financial Highlights:

- 1ST QUARTER GAAP NET INCOME OF $0.17 PER DILUTED COMMON

SHARE

- 1ST QUARTER EARNINGS AVAILABLE FOR DISTRIBUTION(1) OF $0.13 PER

DILUTED COMMON SHARE.

- GAAP BOOK VALUE OF $7.41 PER COMMON SHARE

Business Highlights:

First Quarter

- Settled $547 million of seasoned re-performing residential

mortgage loans.

- Sponsored $586 million CIM 2023-R1 Securitization, $134 million

CIM 2023-NR1 securitization and $447 million CIM 2023-R2

securitization.

- Committed to purchase approximately $487 million of

non-qualifying investor owned residential mortgage loans and $162

million seasoned re-performing residential mortgage loans.

- Purchased and closed on $52 million of business purpose

loans.

- Reduced our recourse financing exposure by $237 million and

replaced it with non-recourse financing.

Post Quarter

- Sponsored $236 million CIM 2023-I1 securitization, $451 million

CIM 2023-R3 securitization, $67 million CIM 2023-NR2, and $394

million CIM 2023-R4 securitization which further reduced our

recourse leverage.

- Settled $236 million of non-qualifying investor owned

residential mortgage loans and $160 million seasoned re-performing

residential mortgage loans.

“This quarter Chimera committed to purchase $1.25 billion of

diversified mortgage loans, completed three securitizations,

reduced recourse leverage by $237 million, and generated a 2% total

economic return. Since the quarter ended, including a

securitization we expect to close later today, we have completed

four securitizations, reduced our RPL loan warehouse exposure to

zero, and reduced our recourse leverage by a further $400 million,

all in a very challenging environment,” said Phillip Kardis, CEO.

“We remain optimistic about our future. Our ability to execute loan

purchases and securitizations highlights the overall strength of

Chimera’s franchise value.”

(1) Earnings available for distribution per adjusted diluted

common share is a non-GAAP measure. See additional discussion on

page 6.

Other Information

Chimera Investment Corporation is a publicly traded real estate

investment trust, or REIT, that is primarily engaged in the

business of investing directly or indirectly through its

subsidiaries, on a leveraged basis, in a diversified portfolio of

mortgage assets, including residential mortgage loans, Non-Agency

RMBS, Agency CMBS, Agency RMBS, and other real estate related

securities.

CHIMERA INVESTMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

(dollars in thousands, except

share and per share data)

(Unaudited)

March 31, 2023

December 31, 2022

Cash and cash equivalents

$

232,392

$

264,600

Non-Agency RMBS, at fair value (net of

allowance for credit losses of $10 million and $7 million,

respectively)

1,140,776

1,147,481

Agency MBS, at fair value

263,743

430,944

Loans held for investment, at fair

value

12,382,047

11,359,236

Accrued interest receivable

73,022

61,768

Other assets

97,582

133,866

Derivatives, at fair value

14,199

4,096

Total assets (1)

$

14,203,761

$

13,401,991

Liabilities:

Secured financing agreements ($4.5 billion

and $4.7 billion pledged as collateral, respectively, and includes

$371 million and $374 million at fair value, respectively)

$

3,195,322

$

3,434,765

Securitized debt, collateralized by

Non-Agency RMBS ($271 million and $276 million pledged as

collateral, respectively)

77,742

78,542

Securitized debt at fair value,

collateralized by Loans held for investment ($10.7 billion and

$10.0 billion pledged as collateral, respectively)

7,507,228

7,100,742

Payable for investments purchased

660,047

9,282

Accrued interest payable

31,487

30,696

Dividends payable

63,880

64,545

Accounts payable and other liabilities

18,668

16,616

Total liabilities (1)

$

11,554,374

$

10,735,188

Commitments and Contingencies (See Note

16)

Stockholders' Equity:

Preferred Stock, par value of $0.01 per

share, 100,000,000 shares authorized:

8.00% Series A cumulative redeemable:

5,800,000 shares issued and outstanding, respectively ($145,000

liquidation preference)

$

58

$

58

8.00% Series B cumulative redeemable:

13,000,000 shares issued and outstanding, respectively ($325,000

liquidation preference)

130

130

7.75% Series C cumulative redeemable:

10,400,000 shares issued and outstanding, respectively ($260,000

liquidation preference)

104

104

8.00% Series D cumulative redeemable:

8,000,000 shares issued and outstanding, respectively ($200,000

liquidation preference)

80

80

Common stock: par value $0.01 per share;

500,000,000 shares authorized, 232,093,167 and 231,824,192 shares

issued and outstanding, respectively

2,321

2,318

Additional paid-in-capital

4,320,803

4,318,388

Accumulated other comprehensive income

224,755

229,345

Cumulative earnings

4,096,308

4,038,942

Cumulative distributions to

stockholders

(5,995,172

)

(5,922,562

)

Total stockholders' equity

$

2,649,387

$

2,666,803

Total liabilities and stockholders'

equity

$

14,203,761

$

13,401,991

(1) The Company's consolidated statements of financial condition

include assets of consolidated variable interest entities, or VIEs,

that can only be used to settle obligations and liabilities of the

VIE for which creditors do not have recourse to the primary

beneficiary (Chimera Investment Corporation). As of March 31, 2023,

and December 31, 2022, total assets of consolidated VIEs were

$10,494,798 and $10,199,266, respectively, and total liabilities of

consolidated VIEs were $7,196,538 and $6,772,125, respectively.

CHIMERA INVESTMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(dollars in thousands, except

share and per share data)

(Unaudited)

For the Quarters Ended

March 31, 2023

March 31, 2022

Net interest income:

Interest income (1)

$

189,250

$

202,175

Interest expense (2)

119,615

64,473

Net interest income

69,635

137,702

Increase/(decrease) in provision for

credit losses

3,062

240

Other investment gains

(losses):

Net unrealized gains (losses) on

derivatives

(8,551

)

—

Realized gains (losses) on derivatives

(34,134

)

—

Periodic interest cost of swaps, net

2,819

—

Net gains (losses) on derivatives

(39,866

)

—

Net unrealized gains (losses) on financial

instruments at fair value

64,592

(370,167

)

Net realized gains (losses) on sales of

investments

(5,264

)

—

Gains (losses) on extinguishment of

debt

2,309

—

Other investment gains (losses)

117

—

Total other gains (losses)

21,888

(370,167

)

Other expenses:

Compensation and benefits

10,491

11,353

General and administrative expenses

5,778

5,711

Servicing and asset manager fees

8,417

9,291

Transaction expenses

6,409

3,804

Total other expenses

31,095

30,159

Income (loss) before income

taxes

57,366

(262,864

)

Income tax expense (benefit)

—

(70

)

Net income (loss)

$

57,366

$

(262,794

)

Dividends on preferred stock

18,438

18,408

Net income (loss) available to common

shareholders

$

38,928

$

(281,202

)

Net income (loss) per share available

to common shareholders:

Basic

$

0.17

$

(1.19

)

Diluted

$

0.17

$

(1.19

)

Weighted average number of common

shares outstanding:

Basic

231,994,620

237,012,702

Diluted

235,201,614

237,012,702

(1) Includes interest income of consolidated VIEs of $139,902

and $131,066 for the quarters ended March 31, 2023 and 2022,

respectively. (2) Includes interest expense of consolidated VIEs of

$60,152 and $42,491 for the quarters ended March 31, 2023 and 2022,

respectively.

CHIMERA INVESTMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

share and per share data)

(Unaudited)

For the Quarters Ended

March 31, 2023

March 31, 2022

Comprehensive income (loss):

Net income (loss)

$

57,366

$

(262,794

)

Other comprehensive income:

Unrealized gains (losses) on

available-for-sale securities, net

(5,905

)

(40,955

)

Reclassification adjustment for net

realized losses (gains) included in net income

1,315

—

Other comprehensive income (loss)

(4,590

)

(40,955

)

Comprehensive income (loss) before

preferred stock dividends

$

52,776

$

(303,749

)

Dividends on preferred stock

$

18,438

$

18,408

Comprehensive income (loss) available

to common stock shareholders

$

34,338

$

(322,157

)

Earnings available for distribution

Earnings available for distribution is a non-GAAP measure and is

defined as GAAP net income excluding unrealized gains or losses on

financial instruments carried at fair value with changes in fair

value recorded in earnings, realized gains or losses on the sales

of investments, gains or losses on the extinguishment of debt,

interest expense on long term debt, changes in the provision for

credit losses, other gains or losses on equity investments, and

transaction expenses incurred. In addition, stock compensation

expense charges incurred on awards to retirement eligible employees

is reflected as an expense over a vesting period (36 months) rather

than reported as an immediate expense.

Earnings available for distribution is the Economic net interest

income, reduced by compensation and benefits expenses (adjusted for

awards to retirement eligible employees), general and

administrative expenses, servicing and asset manager fees, income

tax benefits or expenses incurred during the period, as well as the

preferred dividend charges. Economic net interest income is a

non-GAAP financial measure that equals GAAP net interest income

adjusted for interest expense on long term debt, net periodic

interest cost of interest rate swaps and excludes interest earned

on cash. See a reconciliation of Economic net interest income to

the most relevant GAAP measure below.

We view Earnings available for distribution as one measure of

our investment portfolio's ability to generate income for

distribution to common stockholders. Earnings available for

distribution is one of the metrics, but not the exclusive metric,

that our Board of Directors uses to determine the amount, if any,

of dividends on our common stock. Other metrics that our Board of

Directors may consider when determining the amount, if any, of

dividends on our common stock include (among others) REIT taxable

income, dividend yield, book value, cash generated from the

portfolio, reinvestment opportunities and other cash needs. In

addition, Earnings available for distribution is different than

REIT taxable income and the determination of whether we have met

the requirement to distribute at least 90% of our annual REIT

taxable income (subject to certain adjustments) to our stockholders

in order to maintain qualification as a REIT is not based on

Earnings available for distribution. Therefore, Earnings available

for distribution should not be considered as an indication of our

REIT taxable income, a guaranty of our ability to pay dividends, or

as a proxy for the amount of dividends we may pay. We believe

Earnings available for distribution as described above helps us and

investors evaluate our financial performance period over period

without the impact of certain transactions. Therefore, Earnings

available for distribution should not be viewed in isolation and is

not a substitute for net income or net income per basic share

computed in accordance with GAAP. In addition, our methodology for

calculating Earnings available for distribution may differ from the

methodologies employed by other REITs to calculate the same or

similar supplemental performance measures, and accordingly, our

Earnings available for distribution may not be comparable to the

Earnings available for distribution reported by other REITs.

The following table provides GAAP measures of net income and net

income per diluted share available to common stockholders for the

periods presented and details with respect to reconciling the line

items to Earnings available for distribution and related per

average diluted common share amounts. Earnings available for

distribution is presented on an adjusted dilutive shares basis.

Certain prior period amounts have been reclassified to conform to

the current period's presentation.

For the Quarters Ended

March 31, 2023

December 31, 2022

September 30, 2022

June 30, 2022

March 31, 2022

(dollars in thousands, except per

share data)

GAAP Net income (loss) available to

common stockholders

$

38,928

$

78,716

$

(204,583

)

$

(179,765

)

$

(281,202

)

Adjustments:

Net unrealized (gains) losses on financial

instruments at fair value

(64,592

)

(112,026

)

239,513

239,246

370,167

Net realized (gains) losses on sales of

investments

5,264

39,443

37,031

—

—

(Gains) losses on extinguishment of

debt

(2,309

)

—

—

2,897

—

Increase (decrease) in provision for

credit losses

3,062

3,834

(1,534

)

4,497

240

Net unrealized (gains) losses on

derivatives

8,551

10,171

(10,307

)

1,618

—

Realized gains (losses) on derivatives

34,134

561

—

—

—

Transaction expenses

6,409

3,274

2,341

6,727

3,804

Stock Compensation expense for retirement

eligible awards

2,141

(309

)

(310

)

(309

)

723

Other investment (gains) losses

(117

)

2,383

462

(980

)

—

Earnings available for

distribution

$

31,471

$

26,047

$

62,613

$

73,931

$

93,732

GAAP net income (loss) per diluted

common share

$

0.17

$

0.34

$

(0.88

)

$

(0.76

)

$

(1.19

)

Earnings available for distribution per

adjusted diluted common share

$

0.13

$

0.11

$

0.27

$

0.31

$

0.39

The following tables provide a summary of the Company’s MBS

portfolio at March 31, 2023 and December 31, 2022.

March 31, 2023

Principal or Notional

Value at Period-End (dollars in thousands)

Weighted Average Amortized

Cost Basis

Weighted Average Fair

Value

Weighted Average

Coupon

Weighted Average Yield at

Period- End (1)

Non-Agency RMBS

Senior

$

1,135,367

$

46.07

65.63

5.4%

16.8%

Subordinated

603,192

49.69

47.54

3.2%

6.7%

Interest-only

3,049,186

5.29

3.57

0.6%

5.8%

Agency RMBS

Interest-only

406,985

4.59

3.65

0.5%

7.2%

Agency CMBS

Project loans

132,718

101.69

94.78

4.2%

4.0%

Interest-only

2,441,039

5.59

5.04

0.7%

3.1%

(1) Bond Equivalent Yield at period end.

December 31, 2022

Principal or Notional Value at

Period-End (dollars in thousands)

Weighted Average Amortized

Cost Basis

Weighted Average Fair

Value

Weighted Average

Coupon

Weighted Average Yield at

Period- End (1)

Non-Agency RMBS

Senior

$

1,153,458

$

46.09

$

66.05

5.3%

16.4%

Subordinated

611,206

49.79

46.94

3.1%

6.8%

Interest-only

3,114,930

5.14

3.17

0.7%

5.3%

Agency RMBS

Interest-only

409,940

4.58

3.70

0.9%

5.0%

Agency CMBS

Project loans

302,685

101.85

95.62

4.3%

4.1%

Interest-only

2,669,396

5.23

4.73

0.7%

3.4%

(1) Bond Equivalent Yield at period end.

At March 31, 2023 and December 31, 2022, the secured financing

agreements collateralized by MBS and Loans held for investment had

the following remaining maturities and borrowing rates.

March 31, 2023

December 31, 2022

(dollars in thousands)

Principal (1)

Weighted Average Borrowing

Rates

Range of Borrowing

Rates

Principal (1)

Weighted Average Borrowing

Rates

Range of Borrowing

Rates

Overnight

$

—

N/A

N/A

$

—

N/A

NA

1 to 29 days

$

613,425

6.42%

5.10% - 7.60%

$

493,918

4.66%

3.63% - 6.16%

30 to 59 days

383,381

6.12%

4.95% - 7.19%

762,768

6.14%

4.60% - 7.34%

60 to 89 days

211,194

5.67%

5.00% - 6.92%

225,497

6.04%

4.70% - 7.12%

90 to 119 days

74,203

5.90%

5.90% - 5.90%

43,180

6.54%

5.50% - 6.70%

120 to 180 days

373,651

6.78%

5.88% - 7.72%

401,638

5.88%

5.57% - 6.92%

180 days to 1 year

318,258

6.38%

6.18% - 6.91%

402,283

6.06%

5.63% - 6.64%

1 to 2 years

850,563

10.75%

8.54% - 13.98%

251,286

13.98%

13.98% - 13.98%

2 to 3 years

—

—%

0.00% - 0.00%

480,022

8.07%

8.07% - 8.07%

Greater than 3 years

381,474

5.16%

5.10% - 6.50%

382,839

5.14%

5.10% - 6.07%

Total

$

3,206,149

7.36%

$

3,443,431

6.61%

(1) The outstanding balance for secured financing agreements in

the table above is net of $6 million and $1 million of deferred

financing cost as of March 31, 2023 and December 31, 2022,

respectively.

The following table summarizes certain characteristics of our

portfolio at March 31, 2023 and December 31, 2022.

March 31, 2023

December 31, 2022

GAAP Leverage at period-end

4.1:1

4.0:1

GAAP Leverage at period-end (recourse)

1.2:1

1.3:1

March 31, 2023

December 31, 2022

March 31, 2023

December 31, 2022

Portfolio Composition

Amortized Cost

Fair Value

Non-Agency RMBS

7.0%

7.5%

8.3%

8.9%

Senior

3.8%

4.0%

5.4%

5.9%

Subordinated

2.1%

2.3%

2.1%

2.2%

Interest-only

1.1%

1.2%

0.8%

0.8%

Agency RMBS

0.1%

0.1%

0.1%

0.1%

Interest-only

0.1%

0.1%

0.1%

0.1%

Agency CMBS

2.0%

3.3%

1.8%

3.2%

Project loans

1.0%

2.3%

0.9%

2.2%

Interest-only

1.0%

1.0%

0.9%

1.0%

Loans held for investment

90.9%

89.1%

89.8%

87.8%

Fixed-rate percentage of portfolio

96.7%

96.5%

95.9%

95.6%

Adjustable-rate percentage of

portfolio

3.3%

3.5%

4.1%

4.4%

Economic Net Interest Income

Our Economic net interest income is a non-GAAP financial measure

that equals GAAP net interest income adjusted for net periodic

interest cost of interest rate swaps and excludes interest earned

on cash. For the purpose of computing economic net interest income

and ratios relating to cost of funds measures throughout this

section, interest expense includes net payments on our interest

rate swaps, which is presented as a part of Net gains (losses) on

derivatives in our Consolidated Statements of Operations. Interest

rate swaps are used to manage the increase in interest paid on

secured financing agreements in a rising rate environment.

Presenting the net contractual interest payments on interest rate

swaps with the interest paid on interest-bearing liabilities

reflects our total contractual interest payments. We believe this

presentation is useful to investors because it depicts the economic

value of our investment strategy by showing all components of

interest expense and net interest income of our investment

portfolio. However, Economic net interest income should not be

viewed in isolation and is not a substitute for net interest income

computed in accordance with GAAP. Where indicated, interest

expense, adjusting for any interest earned on cash, is referred to

as Economic interest expense. Where indicated, net interest income

reflecting net periodic interest cost of interest rate swaps and

any interest earned on cash, is referred to as Economic net

interest income.

The following table reconciles the Economic net interest income

to GAAP net interest income and Economic interest expense to GAAP

interest expense for the periods presented.

GAAP Interest Income

GAAP Interest Expense

Periodic Interest Cost of

Interest Rate Swaps

Interest Expense on Long Term

Debt

Economic Interest Expense

GAAP Net Interest Income

Periodic Interest Cost of

Interest Rate Swaps

Other (1)

Economic Net Interest Income

For the Quarter Ended March 31, 2023

$

189,250

$

119,615

$

(2,819

)

$

—

$

116,796

$

69,635

$

2,819

$

(3,035

)

$

69,419

For the Quarter Ended December 31,

2022

$

187,286

$

106,891

$

1,629

$

—

$

108,520

$

80,395

$

(1,629

)

$

(1,867

)

$

76,899

For the Quarter Ended September 30,

2022

$

188,303

$

83,464

$

122

$

—

$

83,586

$

104,839

$

(122

)

$

(540

)

$

104,177

For the Quarter Ended June 30, 2022

$

195,357

$

78,467

$

—

$

—

$

78,467

$

116,890

$

—

$

(81

)

$

116,809

For the Quarter Ended March 31, 2022

$

202,175

$

64,473

$

—

$

—

$

64,473

$

137,702

$

—

$

(18

)

$

137,684

(1) Primarily interest income on cash and cash equivalents.

The table below shows our average earning assets held, interest

earned on assets, yield on average interest earning assets, average

debt balance, economic interest expense, economic average cost of

funds, economic net interest income, and net interest rate spread

for the periods presented.

For the Quarter Ended

March 31, 2023

December 31, 2022

March 31, 2022

(dollars in thousands)

(dollars in thousands)

(dollars in thousands)

Average Balance

Interest

Average

Yield/Cost

Average Balance

Interest

Average

Yield/Cost

Average Balance

Interest

Average

Yield/Cost

Assets:

Interest-earning assets (1):

Agency RMBS

$

18,692

$

322

6.9

%

$

31,542

$

346

4.4

%

$

113,723

$

253

0.9

%

Agency CMBS

307,846

2,957

3.8

%

441,421

4,291

3.9

%

559,478

22,870

16.4

%

Non-Agency RMBS

990,721

30,098

12.2

%

1,013,693

29,304

11.6

%

1,310,359

45,675

13.9

%

Loans held for investment

12,334,025

152,838

5.0

%

12,075,239

151,478

5.0

%

11,599,206

133,359

4.6

%

Total

$

13,651,284

$

186,215

5.5

%

$

13,561,895

$

185,419

5.5

%

$

13,582,766

$

202,157

6.0

%

Liabilities and stockholders' equity:

Interest-bearing liabilities

(2):

Secured financing agreements

collateralized by:

Agency RMBS

$

4,095

$

52

5.1

%

$

4,547

$

46

4.0

%

$

20,342

$

31

0.6

%

Agency CMBS

252,102

2,956

4.7

%

358,914

3,464

3.9

%

435,545

270

0.2

%

Non-Agency RMBS

762,989

16,063

8.4

%

788,795

13,275

6.7

%

817,261

5,448

2.7

%

Loans held for investment

2,189,967

34,839

6.4

%

1,971,144

33,776

6.9

%

1,948,974

12,839

2.6

%

Securitized debt

8,049,843

62,886

3.1

%

8,056,913

57,959

2.9

%

7,870,127

45,885

2.3

%

Total

$

11,258,996

$

116,796

4.1

%

$

11,180,313

$

108,520

3.9

%

$

11,092,249

$

64,473

2.3

%

Economic net interest income/net

interest rate spread

$

69,419

1.4

%

$

76,899

1.6

%

$

137,684

3.7

%

Net interest-earning assets/net

interest margin

$

2,392,288

2.0

%

$

2,381,582

2.3

%

$

2,490,517

4.1

%

Ratio of interest-earning assets to

interest bearing liabilities

1.21

1.21

1.22

(1) Interest-earning assets at amortized

cost

(2) Interest includes periodic net

interest cost on swaps

The table below shows our Net Income and Economic net interest

income as a percentage of average stockholders' equity and Earnings

available for distribution as a percentage of average common

stockholders' equity. Return on average equity is defined as our

GAAP net income (loss) as a percentage of average equity. Average

equity is defined as the average of our beginning and ending

stockholders' equity balance for the period reported. Economic Net

Interest Income and Earnings available for distribution are

non-GAAP measures as defined in previous sections.

Return on Average Equity

Economic Net Interest

Income/Average Equity *

Earnings available for

distribution/Average Common Equity

(Ratios have been annualized)

For the Quarter Ended March 31, 2023

8.63%

10.45%

7.28%

For the Quarter Ended December 31,

2022

14.61%

11.56%

6.02%

For the Quarter Ended September 30,

2022

(26.47)%

14.81%

13.30%

For the Quarter Ended June 30, 2022

(20.45)%

14.81%

13.29%

For the Quarter Ended March 31, 2022

(29.72)%

15.57%

14.38%

* Excludes long term debt expense.

The following table presents changes to Accretable Discount (net

of premiums) as it pertains to our Non-Agency RMBS portfolio,

excluding premiums on interest-only investments, during the

previous five quarters.

For the Quarters Ended

(dollars in thousands)

Accretable Discount (Net of

Premiums)

March 31, 2023

December 31, 2022

September 30, 2022

June 30, 2022

March 31, 2022

Balance, beginning of period

$

176,635

$

207,812

$

241,391

$

258,494

$

333,546

Accretion of discount

(11,663

)

(11,128

)

(12,989

)

(17,408

)

(19,470

)

Purchases

—

—

—

—

—

Sales

—

(17,935

)

—

—

—

Elimination in consolidation

—

—

—

—

(60,361

)

Transfers from/(to) credit reserve,

net

(7,719

)

(2,114

)

(20,590

)

305

4,779

Balance, end of period

$

157,253

$

176,635

$

207,812

$

241,391

$

258,494

Disclaimer

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Actual results

may differ from expectations, estimates and projections and,

consequently, readers should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“target,” “assume,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believe,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause actual results to differ

materially from expected results, including, among other things,

those described in our most recent Annual Report on Form 10-K, and

any subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, under the caption “Risk Factors.” Factors that could

cause actual results to differ include, but are not limited to: our

business and investment strategy; our ability to accurately

forecast the payment of future dividends on our common and

preferred stock, and the amount of such dividends; our ability to

determine accurately the fair market value of our assets;

availability of investment opportunities in real estate-related and

other securities, including our valuation of potential

opportunities that may arise as a result of current and future

market dislocations; effect of a pandemic or other national or

international crisis on real estate market, financial markets and

our Company, including the impact on the value, availability,

financing and liquidity of mortgage assets; changes in the value of

our investments, including negative changes resulting in margin

calls related to the financing of our assets; changes in interest

rates and mortgage prepayment rates; prepayments of the mortgage

and other loans underlying our mortgage-backed securities, or RMBS,

or other asset-backed securities, or ABS; rates of default,

delinquencies or decreased recovery rates on our investments;

general volatility of the securities markets in which we invest;

our ability to maintain existing financing arrangements and our

ability to obtain future financing arrangements; our ability to

effect our strategy to securitize residential mortgage loans; our

ability to consummate proposed transactions; interest rate

mismatches between our investments and our borrowings used to

finance such purchases; effects of interest rate caps on our

adjustable-rate investments; the degree to which our hedging

strategies may or may not protect us from interest rate volatility;

the impact of and changes to various government programs; impact of

and changes in governmental regulations, tax law and rates,

accounting guidance, and similar matters; market trends in our

industry, interest rates, the debt securities markets or the

general economy; estimates relating to our ability to make

distributions to our stockholders in the future; our understanding

of our competition; availability of qualified personnel; our

ability to maintain our classification as a real estate investment

trust, or, REIT, for U.S. federal income tax purposes; our ability

to maintain our exemption from registration under the Investment

Company Act of 1940, as amended, or 1940 Act; our expectations

regarding materiality or significance; and the effectiveness of our

disclosure controls and procedures.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Chimera does not undertake or accept any obligation to release

publicly any updates or revisions to any forward-looking statement

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is based.

Additional information concerning these and other risk factors is

contained in Chimera’s most recent filings with the Securities and

Exchange Commission (SEC). All subsequent written and oral

forward-looking statements concerning Chimera or matters

attributable to Chimera or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

above.

Readers are advised that the financial information in this press

release is based on Company data available at the time of this

presentation and, in certain circumstances, may not have been

audited by the Company’s independent auditors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005387/en/

Investor Relations 888-895-6557 www.chimerareit.com

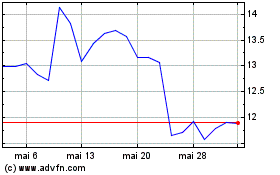

Chimera Investment (NYSE:CIM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Chimera Investment (NYSE:CIM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025