Great-West Lifeco to Allocate Initial $25

Billion of AUM to Franklin Templeton, Expanding Long-Term

Relationship with the Power Group of Companies

Great-West Lifeco to Become Long-Term Strategic

Shareholder of Franklin Resources, Inc.

Franklin Templeton to Acquire Putnam

Investments

Adds Complementary Investment Capabilities with

Strong Performance

Accelerates Franklin Templeton’s Growth in the

Retirement Sector and Significantly Increases Franklin Templeton’s

Defined Contribution AUM to Approximately $90 Billion

Franklin Resources, Inc. [NYSE:BEN], a global investment

management organization operating as Franklin Templeton, today

announced a strategic partnership with Power Corporation of Canada

(“Power” and, together with its subsidiaries, the “Power Group of

Companies”) [TSX:POW] and Great-West Lifeco, Inc. (“Great-West”)

[TSX:GWO]. The Power Group of Companies including Great-West and

IGM Financial (“IGM”) [TSX:IGM] are leaders in the global

insurance, retirement, asset management and wealth management

sectors and have collective assets under management and/or

administration (“AUM/AUA”) of approximately $2.1 trillion1.

Great-West includes Empower in the US as well as Canada Life in

Canada and Irish Life in Europe. IGM encompasses subsidiaries

Mackenzie Financial and IG Wealth Management and also has

investments in Rockefeller Capital Management and China Asset

Management Co.

As a foundation of the partnership, Franklin Templeton has

entered into a definitive agreement to acquire Putnam Investments

(“Putnam”) from Great-West for approximately $925 million2 of

primarily equity consideration. Great-West will become a long-term

strategic shareholder in Franklin Resources, Inc., with an

approximate 6.2% stake, consistent with Great-West’s continuing

commitment to asset management.

Great-West will provide an initial long-term asset allocation of

$25 billion to Franklin Templeton’s specialist investment managers

within 12 months of closing with that amount expected to increase

over the next several years. The strategic partnership aligns with

Franklin Templeton’s focus to further grow insurance client assets,

and significantly broadens the relationship between Franklin

Templeton and the Power Group of Companies in key areas of

retirement, asset management and wealth management.

Founded in 1937, Putnam is a global asset management firm with

$136 billion3 in AUM as of April 2023. Putnam has offices in

Boston, London, Munich, Tokyo, Singapore and Sydney. Putnam’s

complementary capabilities and track record of strong investment

performance accelerates Franklin Templeton’s growth in the

retirement markets by increasing its defined contribution AUM and

expanding its insurance assets, while adding further scale and

efficiency to Franklin Templeton’s mutual fund platform. Consistent

with Franklin Templeton’s previous acquisitions, the execution plan

is designed to minimize disruption to Putnam’s investment teams and

client relationships.

“This is a compelling transaction for Franklin Templeton, and we

are excited about the numerous opportunities that will be unlocked

by this long-term strategic partnership with the Power Group of

Companies including Great-West,” said Jenny Johnson, President and

CEO of Franklin Templeton. “Power and Great-West are global leaders

across financial services, particularly in the wealth, insurance

and retirement channels. With outstanding investment performance,

Putnam will add complementary capabilities to our existing

specialist investment managers to meet the varied needs of our

clients and will increase Franklin Templeton’s defined contribution

AUM. We are pleased to welcome Great-West as a strategic investor,

along with the impressive team at Putnam.”

“Franklin Templeton is a leading global asset management firm,

whose business model is well-positioned to build upon the

investment and distribution strengths of Putnam,” said R. Jeffrey

Orr, Chair of Great-West, and President and CEO of Power. “We are

pleased to enter a partnership with Franklin Templeton that will be

mutually beneficial to clients and our respective businesses.”

“This transaction furthers Great-West’s strategy of building

strategic partnerships with best-in-class asset managers to support

our client’s retirement, insurance, and wealth management needs,”

said Paul Mahon, President and CEO of Great-West. "Franklin

Templeton’s scale and breadth, together with Putnam’s capabilities,

will drive positive outcomes for our companies, our clients, and

our investors.”

“Critical to this transaction is the strong alignment between

our organizations. We share a client-centric culture, a core belief

in active management, a collaborative and research-based investment

approach, and a long-held commitment to fundamental investment

principles,” said Robert Reynolds, President and CEO of Putnam. “We

look forward to joining Franklin Templeton in this next phase of

our growth, as we come together to serve our clients, upholding our

commitment to them and their needs.”

Transaction Details

The transaction is structured to maintain Franklin Templeton’s

financial flexibility and enhance continued investment across the

firm. Franklin Templeton will pay approximately $825 million2 in

stock consideration up-front at closing and $100 million in cash

180 days after closing for 100% of Putnam. Franklin Resources, Inc.

will issue 33.3 million shares of its common stock to Great-West,

26.2 million of these shares, representing 4.9% of Franklin

Resources, Inc.’s outstanding common stock, are subject to a 5-year

lock-up, and the remaining shares are subject to a 180-day

lock-up.

In addition, Franklin Templeton will pay up to $375 million in

contingent consideration tied to revenue growth targets from the

partnership.

The transaction is expected to be modestly accretive to run-rate

adjusted EPS by the end of the first year after closing, inclusive

of cost synergies and is anticipated to close in the fourth

calendar quarter of 2023, subject to customary closing

conditions.

An investor presentation on the transaction is available via

investors.franklintempleton.com.

Ardea Partners LP served as lead financial advisor and

Broadhaven Capital Partners LLC provided financial advice to

Franklin Templeton. Willkie Farr & Gallagher LLP served as

legal counsel.

1. As of 03/31/23 per Power Corp. of Canada 1Q 2023 Report,

exchange rate between CAD / USD as of 03/31/23 per FactSet. 2.

Based on stock price as of close of May 30, 2023. Includes

approximately $825mm of Franklin Resources common stock plus $100mm

to be paid in cash 180 days after close. 3. Excludes $33 billion

AUM of PanAgora, which is not a party to the transaction.

Conference Call Information

Executives from Franklin Templeton to lead a live teleconference

today at 9:00 a.m. Eastern Time. Access to the teleconference will

be available via investors.franklinresources.com or by dialing (+1)

888-886-7786 in North America or (+1) 416-764-8658 in other

locations using access code 59788741. A replay of the

teleconference can also be accessed by calling (+1) 877-674-7070 in

North America or (+1) 416-764-8692 in other locations using access

code 788741# through Wednesday, June 7, 2023, or via

investors.franklinresources.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 155 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With offices in more than 30 countries and

approximately 1,300 investment professionals, the California-based

company has over 75 years of investment experience and

approximately $1.4 trillion in assets under management as of April

30, 2023. For more information, please visit

franklinresources.com.

About Power Corporation of Canada

Power Corporation is an international management and holding

company that focuses on financial services in North America, Europe

and Asia. Its core holdings are leading insurance, retirement,

wealth management and investment businesses, including a portfolio

of alternative asset investment platforms. To learn more, visit

www.PowerCorporation.com.

About Great-West Lifeco Inc.

Great-West Lifeco is an international financial services holding

company with interests in life insurance, health insurance,

retirement and investment services, asset management and

reinsurance businesses. We operate in Canada, the United States and

Europe under the brands Canada Life, Empower, Putnam Investments,

and Irish Life. At the end of 2022, our companies had approximately

31,000 employees, 234,500 advisor relationships, and thousands of

distribution partners – all serving over 38 million customer

relationships across these regions. Great-West Lifeco trades on the

Toronto Stock Exchange (TSX) under the ticker symbol GWO and is a

member of the Power Corporation group of companies. To learn more,

visit greatwestlifeco.com.

About Putnam Investments

Founded in 1937, Putnam Investments is a global money management

firm with over 85 years of investment experience. At the end of

January 2023, Putnam had over US$170 billion in assets under

management. Putnam has offices in Boston, London, Munich,

Singapore, Sydney and Tokyo. For more information, visit

putnam.com.

Forward-Looking Statements

Statements in this press release that are not historical facts

are “forward-looking statements” within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. When used in this

press release, words or phrases generally written in the future

tense and/or preceded by words such as “will,” “may,” “could,”

“expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,”

“estimate,” “preliminary” or other similar words are

forward-looking statements.

Various forward-looking statements in this press release relate

to the strategic relationship between Franklin Resources, Inc.

(“Franklin”), Great-West, the Power Group of Companies and the

acquisition by Franklin of Putnam from Great-West including

regarding expected growth, client and stockholder benefits, key

assumptions, timing of closing of the transaction, revenue

realization, financial benefits or returns, accretion and

integration costs. Forward-looking statements involve a number of

known and unknown risks, uncertainties and other important factors,

some of which are listed below, that could cause actual results and

outcomes to differ materially from any future results or outcomes

expressed or implied by such forward-looking statements. Important

transaction related and other risk factors that may cause such

differences include: (i) the occurrence of any event, change or

other circumstances that could give rise to the termination of the

acquisition agreement or the strategic relationship; (ii) the

transaction closing conditions may not be satisfied in a timely

manner or at all, including due to the failure to obtain regulatory

and client approvals; (iii) the announcement and pendency of the

acquisition may disrupt Putnam’s business operations (including the

threatened or actual loss of employees, clients or suppliers); (iv)

Franklin, Putnam or Power Group of Companies could experience

financial or other setbacks if the transaction or strategic

relationship encounters unanticipated problems; and (v) anticipated

benefits of the acquisition or the strategic relationship,

including the realization of revenue, accretion, and financial

benefits or returns, may not be fully realized or may take longer

to realize than expected.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors that may cause

actual results and outcomes to differ materially from any future

results or outcomes expressed or implied by such forward-looking

statements, including market and volatility risks, investment

performance and reputational risks, global operational risks,

competition and distribution risks, third-party risks, technology

and security risks, human capital risks, cash management risks, and

legal and regulatory risks. For a detailed discussion of other risk

factors, please refer to Power’s and Great-West’s recent filings,

which are available for viewing at www.sedar.com, and Franklin’s

recent filings with the U.S. Securities and Exchange Commission

(“SEC”), including, without limitation, those discussed under the

headings “Risk Factors” and “Quantitative and Qualitative

Disclosures About Market Risk” in Franklin’s most recent Annual

Report on Form 10-K and subsequent periodic and current

reports.

Any forward-looking statement made in this press release speaks

only as of the date on which it is made. Factors or events that

could cause actual results to differ may emerge from time to time,

and it is not possible for us to predict all of them. Franklin,

Putnam and Power Group undertake no obligation to publicly update

any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230531005507/en/

Investor Relations: Selene Oh, (650) 312-4091,

selene.oh@franklintempleton.com Corporate Communications: Matt

Walsh, (650) 312-2245, matthew.walsh@franklintempleton.com Lisa

Gallegos, (510) 910-2023, lisa.gallegos@franklintempleton.com

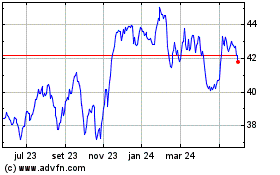

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

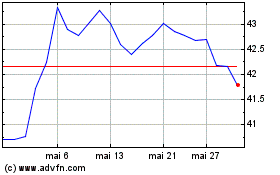

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024