ISO 13485 Certification Recommended and

Anticipated in Q3 2023

Spectral MD Holdings, Ltd. (AIM: SMD), an artificial

intelligence (AI) company focused on medical diagnostics for faster

and more accurate treatment decisions in wound care, announces it

has completed the quality management ISO 13485 certification audit

for the manufacture and distribution of its DeepView® Wound Imaging

System. ISO 13485 certification has now been recommended and is

anticipated in Q3 2023. The completion of the audit validates

Spectral MD's commitment to meeting the highest standards of

quality, reliability, and safety in the medical device

industry.

ISO 13485 is an internationally recognized quality standard that

specifies requirements for a quality management system used by an

organization demonstrating its ability to provide medical devices

and related services that consistently meet strict customer and

regulatory requirements. The comprehensive audit of the Company’s

quality management system was undertaken by an Independent

Registrar.

Niko Pagoulatos, Chief Operating Officer of Spectral MD,

said: “The completion of the ISO 13485 certification audit is a

strong endorsement of the quality standards we set at Spectral MD.

Once received, it will help us achieve our goal of maintaining

compliance with US and global laws and regulations that govern the

medical device industry. This is a vital certification as we

continue our preparations to enter the commercial phase across

DeepView®’s Burn and Diabetic Foot Ulcer indications.”

About Spectral MD

Spectral MD is a predictive AI company focused on medical

diagnostics for faster and more accurate treatment decisions in

wound care for burn, DFU, and future clinical applications. At

Spectral MD, we are a dedicated team of forward-thinkers striving

to revolutionize the management of wound care by “Seeing the

Unknown”® with our DeepView® Wound Diagnostics System. The

Company’s DeepView® platform is a predictive diagnostic device that

offers clinicians an objective and immediate assessment of a

wound’s healing potential prior to treatment or other medical

intervention. With algorithm-driven results that have a goal of

substantially exceeding the current standard of care in the future,

Spectral MD’s diagnostic platform is expected to provide faster and

more accurate treatment insight and improve patient care while

reducing healthcare costs. For more information, visit the Company

at: www.spectralmd.com.

As announced on April 11, 2023, Spectral MD Holdings has entered

into a business combination agreement to combine with Rosecliff

Acquisition Corp I (“Rosecliff”, Nasdaq: RCLF), a special purpose

acquisition company listed on Nasdaq.

Additional Information and Where to Find It

This press release is provided for informational purposes only

and contains information with respect to a proposed business

combination among Spectral MD, Rosecliff, Ghost Merger Sub I Inc.,

a wholly-owned subsidiary of Rosecliff and Ghost Merger Sub II LLC,

a wholly-owned subsidiary of Rosecliff (the “Transaction”). In

connection with the proposed Transaction, Rosecliff filed with the

U.S. Securities and Exchange Commission (the "SEC") a registration

statement on Form S-4, which includes a preliminary proxy

statement/prospectus (as amended from time to time, the

“Registration Statement”). A full description of the proposed

Transaction has been included in the Registration Statement filed

by Rosecliff with the SEC. Rosecliff's stockholders, investors and

other interested persons are advised to read the Registration

Statement as well as other documents that have been filed or will

be filed with the SEC, as these documents will contain important

information about Rosecliff, Spectral MD, and the proposed

Transaction. The Registration Statement has not yet been declared

effective by the SEC. If and when the Registration Statement is

declared effective by the SEC, the proxy statement/prospectus and

other relevant documents for the proposed Transaction will be

mailed to stockholders of Rosecliff as of a record date to be

established for voting on the proposed Transaction. Rosecliff

investors and stockholders will also be able to obtain copies of

the proxy statement/prospectus and other documents filed with the

SEC, without charge, once available, at the SEC's website at

www.sec.gov.

Participants in the Solicitation

Rosecliff, Spectral MD and certain of their respective

directors, executive officers, other members of management and

employees may, under SEC rules, be deemed participants in the

solicitation of proxies from Rosecliff's stockholders with respect

to the proposed Transaction. Investors and security holders may

obtain more detailed information regarding the names and interests

in the proposed Transaction of Rosecliff's directors and officers

in Rosecliff's filings with the SEC, including Rosecliff’s

definitive proxy statement, the Registration Statement and other

documents filed with the SEC. Such information with respect to

Spectral MD’s directors and executive officers has also been

included in the Registration Statement.

No Offer or Solicitation

This press release and the information contained herein do not

constitute (i) (a) a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

proposed Transaction or (b) an offer to sell or the solicitation of

an offer to buy any security, commodity or instrument or related

derivative, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction or (ii) an offer or

commitment to lend, syndicate or arrange a financing, underwrite or

purchase or act as an agent or advisor or in any other capacity

with respect to any transaction, or commit capital, or to

participate in any trading strategies. No offer of securities in

the United States or to or for the account or benefit of U.S.

persons (as defined in Regulation S under the U.S. Securities Act

of 1933 (the “Securities Act”) shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act, or an exemption therefrom. Investors should consult with their

counsel as to the applicable requirements for a purchaser to avail

itself of any exemption under the Securities Act.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. This includes, without limitation, all statements regarding

(i) the proposed Transaction with Rosecliff, including statements

regarding anticipated timing of the proposed Transaction, (ii)

redemptions of Rosecliff common stock, (iii) valuation of the

proposed Transaction, (iv) the closing of the proposed Transaction,

(v) the ability to regain compliance with Nasdaq Capital Market

listing requirements and to maintain listing, or for the Combined

Company to be listed, on the Nasdaq Capital Market, (vi) Rosecliff

and Spectral MD’s managements’ expectations and expected synergies

of the proposed Transaction and the Combined Company, (vii) the use

of proceeds from the proposed Transaction, (viii) potential

government contracts, and (ix) expected beneficial outcomes and

synergies of the proposed Transaction, (x) Spectral MD’s U.S.

government contracts and future awards, (xi) FDA, CE and UKCA

regulatory submissions and approvals, (xii) target markets of burn

wounds and diabetic foot ulcers, (xiii) possible competitors, (xiv)

future clinical indications and use of BARDA, (xv) potential PIPE

transaction and amount raised, (xvi) future applications of

Spectral MD products, (xvii) potential indications and areas of

interest supported by BARDA, (xviii) future and pending U.S. patent

applications and foreign and international patent applications,

(xvix) the AIM delisting and its effects for U.K. Spectral MD

shareholders, (xxx) the development of DeepView® technology and

tools; (xxxi) the effectiveness of the DeepView® platform in

assessing burn wounds, (xxxii) the reliability of any studies

performed by Spectral MD, and (xxxiii) the completion of any

certifications. Generally, statements that are not historical

facts, including statements concerning our possible or assumed

future actions, business strategies, events or results of

operations, are forward-looking statements. These statements may be

preceded by, followed by or include the words “believes,”

“estimates,” “expects,” “projects,” “forecasts,” “may,” “will,”

“should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends”

or similar expressions. Such forward-looking statements involve

risks and uncertainties that may cause actual events, results or

performance to differ materially from those indicated by such

statements. These forward-looking statements are expressed in good

faith, and Spectral MD and Rosecliff believe there is a reasonable

basis for them. However, there can be no assurance that the events,

results or trends identified in these forward-looking statements

will occur or be achieved. Forward-looking statements speak only as

of the date they are made, and neither Spectral MD nor Rosecliff is

under any obligation, and expressly disclaim any obligation, to

update, alter or otherwise revise any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by law.

Forward-looking statements are inherently subject to risks,

uncertainties and assumptions. In addition to risk factors

previously disclosed in Rosecliff’s reports filed with the SEC and

those identified elsewhere in this press release, the following

factors, among others, could cause actual results to differ

materially from forward-looking statements or historical

performance: (i) risks associated with product development and

regulatory review, including the time, expense and uncertainty of

obtaining clearance, approval or De Novo classification for

Spectral MD’s DeepView technology, (ii) Spectral MD’s ability to

obtain additional funding when needed and its dependence on

government funding, (iii) expectations regarding Spectral MD’s

strategies and future financial performance, including its future

business plans or objectives, prospective performance and

opportunities and competitors, revenues, products and services,

pricing, operating expenses, market trends, liquidity, cash flows

and uses of cash, capital expenditures, and Spectral MD’s ability

to invest in growth initiatives and pursue acquisition

opportunities; (iv) the risk that the proposed Transaction may not

be completed in a timely manner at all, which may adversely affect

the price of Rosecliff’s securities; (v) the failure to satisfy the

conditions to the consummation of the proposed Transaction,

including the adoption of the business combination agreement by the

stockholders of Rosecliff and the stockholders of Spectral MD, and

the receipt of certain governmental and regulatory approvals; (vi)

the lack of third party valuation in determining whether or not to

pursue the proposed Transaction; (vii) the ability of Rosecliff to

regain compliance with Nasdaq Capital Market listing requirements

and to maintain listing, or for the Combined Company to be listed,

on the Nasdaq Capital Market; (viii) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the business combination agreement; (ix) the outcome

of any legal proceedings that may be instituted against Rosecliff

or Spectral MD following announcement of the proposed Transaction;

(x) the risk that the proposed Transaction may not be completed by

Rosecliff’s business combination deadline and the potential failure

to obtain an extension of the business combination deadline; (xi)

the effect of the announcement or pendency of the proposed

Transaction on Spectral MD’s business relationships, operating

results, and business generally; (xii) volatility in the price of

Rosecliff’s securities due to a variety of factors, including

changes in the competitive and regulated industries in which

Rosecliff plans to operate or Spectral MD operates, variations in

operating performance across competitors, changes in laws and

regulations affecting Rosecliff's or Spectral MD’s business,

Spectral MD’s inability to implement its business plan or meet or

exceed its financial projections and changes in the combined

capital structure; (xiii) Rosecliff’s ability to raise capital as

needed; (ixv) the ability to implement business plans, forecasts,

and other expectations after the completion of the proposed

Transaction and identify and realize additional opportunities; (xv)

the risk that the announcement and consummation of the proposed

Transaction disrupts Spectral MD’s current operations and future

plans; (xvi) the ability to recognize the anticipated benefits of

the proposed Transaction; (xvii) unexpected costs related to the

proposed Transaction; (xviii) the amount of any redemptions by

existing holders of the Rosecliff common stock being greater than

expected; (xix) limited liquidity and trading of Rosecliff’s

securities; (xx) geopolitical risk and changes in applicable laws

or regulations; (xxi) the possibility that Rosecliff and/or

Spectral MD may be adversely affected by other economic, business,

and/or competitive factors; (xxii) operational risk; and (xxiii)

changes in general economic conditions, including as a result of

the COVID-19 pandemic. The foregoing list of factors is not

exhaustive. You should carefully consider the foregoing factors and

the other risks and uncertainties described in the “Risk Factors”

sections of the Rosecliff’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, the Registration Statement and the other

documents filed by Rosecliff from time to time with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

Readers are cautioned not to put undue reliance on

forward-looking statements, and neither Spectral MD nor Rosecliff

assumes any obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by securities and

other applicable laws. Neither Spectral MD nor Rosecliff gives any

assurance that it will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230615449953/en/

Spectral MD Holdings, Ltd. Christine Marks, VP of

Marketing and Commercialization IR@Spectralmd.com

SP Angel Corporate Finance LLP (NOMAD and Joint Broker for

Spectral MD) Stuart Gledhill / Harry Davies-Ball (Corporate

Finance) Vadim Alexandre / Rob Rees (Sales & Broking) Tel: +44

(0)20 3470 0470

The Equity Group Inc. (US Investor Relations) Devin

Sullivan, Managing Director dsullivan@equityny.com Tel:

212-836-9608

Walbrook PR Ltd (UK Media & Investor Relations) Paul

McManus / Louis Ashe-Jepson /Alice Woodings

spectralmd@walbrookpr.com Tel: +44 (0)20 7933 8780

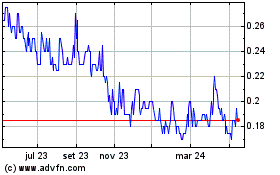

Strategic Metals (TSXV:SMD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

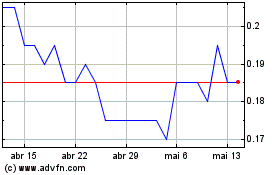

Strategic Metals (TSXV:SMD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024