Arconic Corporation (NYSE: ARNC) (“Arconic” or the “Company”)

announced today that its shareholders have voted at a special

meeting of Arconic shareholders (the "Special Meeting") to approve

the Company's pending acquisition by funds managed by affiliates of

Apollo (NYSE: APO) including a minority investment from funds

managed by affiliates of Irenic Capital Management. Under the terms

of the merger agreement, Arconic shareholders will receive $30.00

per share in cash for every share of Arconic common stock they own

immediately prior to the effective time of the merger.

At the Special Meeting, approximately 99% of the shares voted

were voted in favor of the merger, which represented approximately

76% of the total outstanding shares of Arconic common stock as of

June 12, 2023, the record date for the Special Meeting.

Assuming timely satisfaction of necessary closing conditions,

the transaction is expected to close in the third quarter of

2023.

The final voting results on the proposals voted on at the

Special Meeting will be set forth in a Form 8-K filed by Arconic

with the U.S. Securities and Exchange Commission.

About Arconic Corporation

Arconic Corporation (NYSE: ARNC), headquartered in Pittsburgh,

Pennsylvania, is a leading provider of aluminum sheet, plate, and

extrusions, as well as innovative architectural products, that

advance the ground transportation, aerospace, building and

construction, industrial and packaging end markets. For more

information: www.arconic.com.

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade to private equity with a focus on three investing

strategies: yield, hybrid, and equity. For more than three decades,

our investing expertise across our fully integrated platform has

served the financial return needs of our clients and provided

businesses with innovative capital solutions for growth. Through

Athene, our retirement services business, we specialize in helping

clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of March 31, 2023, Apollo had

approximately $598 billion of assets under management. To learn

more, please visit www.apollo.com.

About Irenic

Irenic Capital Management was formed in 2021. The firm invests

across the capital structure in unique special situation

opportunities. To learn more, please visit www.irenicmgmt.com.

Dissemination of Company Information

Arconic intends to make future announcements regarding Company

developments and financial performance through its website at

www.arconic.com.

Forward-Looking Statements

This release contains statements that relate to future events

and expectations and, as such, constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “intends,”

“may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,”

“targets,” “will,” “would,” or other words of similar meaning. All

statements that reflect the Company’s expectations, assumptions,

projections, beliefs or opinions about the future, other than

statements of historical fact, are forward-looking statements,

including, without limitation, statements, relating to the

condition of, or trends or developments in, the ground

transportation, aerospace, building and construction, industrial,

packaging and other end markets; the Company’s future financial

results, operating performance, working capital, cash flows,

liquidity and financial position; cost savings and restructuring

programs; the Company’s strategies, outlook, business and financial

prospects; share repurchases; costs associated with pension and

other post-retirement benefit plans; projected sources of cash

flow; potential legal liability; the impact of inflationary price

pressures; and the potential impact of public health epidemics or

pandemics, including the COVID-19 pandemic. These statements

reflect beliefs and assumptions that are based on the Company’s

perception of historical trends, current conditions and expected

future developments, as well as other factors the Company believes

are appropriate in the circumstances. Forward-looking statements

are not guarantees of future performance, and actual results may

differ materially from those indicated by these forward-looking

statements due to a variety of risks, uncertainties and changes in

circumstances, many of which are beyond the Company’s control. Such

risks and uncertainties include, but are not limited to: (i)

continuing uncertainty regarding the impact of the COVID-19

pandemic on our business and the businesses of our customers and

suppliers; (ii) deterioration in global economic and financial

market conditions generally; (iii) unfavorable changes in the end

markets we serve; (iv) the inability to achieve the level of

revenue growth, cash generation, cost savings, benefits of our

management of legacy liabilities, improvement in profitability and

margins, fiscal discipline, or strengthening of competitiveness and

operations anticipated or targeted; (v) adverse changes in discount

rates or investment returns on pension assets; (vi) competition

from new product offerings, disruptive technologies, industry

consolidation or other developments; (vii) the loss of significant

customers or adverse changes in customers’ business or financial

condition; (viii) manufacturing difficulties or other issues that

impact product performance, quality or safety or timely delivery;

(ix) the impact of pricing volatility in raw materials and

inflationary pressures on our costs of production, including

energy; (x) a significant downturn in the business or financial

condition of a key supplier or other supply chain disruptions; (xi)

challenges to or infringements on our intellectual property rights;

(xii) the inability to successfully implement or to realize the

expected benefits of strategic initiatives or projects; (xiii) the

inability to identify or successfully respond to changing trends in

our end markets; (xiv) the impact of potential cyber attacks and

information technology or data security breaches; (xv)

geopolitical, economic, and regulatory risks relating to our global

operations, including compliance with U.S. and foreign trade and

tax laws and other regulations, potential expropriation of

properties located outside the U.S., sanctions, tariffs, embargoes,

and renegotiation or nullification of existing agreements; (xvi)

the outcome of contingencies, including legal proceedings,

government or regulatory investigations, and environmental

remediation and compliance matters; (xvii) the impact of the

ongoing conflict between Russia and Ukraine on economic conditions

in general and on our business and operations, including sanctions,

tariffs, and increased energy prices; (xviii) the timing, receipt

and terms and conditions of any required governmental and

regulatory approvals of the proposed transaction that could reduce

anticipated benefits or cause the parties to abandon the proposed

transaction; (xix) the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into pursuant to the proposed transaction; (xx)

the risk that the parties to the merger agreement may not be able

to satisfy the conditions to the proposed transaction in a timely

manner or at all; (xxi) risks related to disruption of management

time from ongoing business operations due to the proposed

transaction; (xxii) the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of the Company’s common stock; (xxiii) the risk of any unexpected

costs or expenses resulting from the proposed transaction; (xxiv)

the risk of any litigation relating to the proposed transaction;

(xxv) the risk that the proposed transaction and its announcement

could have an adverse effect on the ability of the Company to

retain customers and retain and hire key personnel and maintain

relationships with customers, suppliers, employees, stockholders

and other business relationships and on its operating results and

business generally; and (xxvi) the other risk factors summarized in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022 and other documents filed by the Company with the

SEC. The above list of factors is not exhaustive or necessarily in

order of importance. Market projections are subject to the risks

discussed above and in this release, and other risks in the market.

The statements in this release are made as of the date set forth

above, even if subsequently made available by the Company on its

website or otherwise. The Company disclaims any intention or

obligation to update any forward-looking statements, whether in

response to new information, future events, or otherwise, except as

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725721973/en/

Investor Contact Shane Rourke (412) 315-2984

Investor.Relations@arconic.com

Media Contact Tracie Gliozzi (412) 992-2525

Tracie.Gliozzi@arconic.com

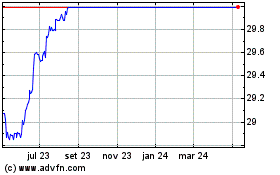

Arconic (NYSE:ARNC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Arconic (NYSE:ARNC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024