NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES

InterRent Real Estate Investment Trust (TSX-IIP.UN)

(“InterRent” or the “REIT”) today reported financial

results for the second quarter ended June 30, 2023.

Operational and Financial Highlights:

- Same Property and Total Portfolio occupancy for June 2023 were

95.4%, an increase of 30 basis points compared to the same period

last year.

- Average Monthly Rent (“AMR”) of $1,531 for the Total Portfolio

and $1,523 for the same property portfolio, an increase of 6.8% and

6.5% year-over-year (“YoY”) respectively.

- Same Property Net Operating Income (“NOI”) for Q2 was $38.3

million, an increase of $5.0 million or 15.0% YoY.

- Total Portfolio NOI was $39.1 million, an increase of $5.6

million, or 16.8% YoY.

- NOI margin for the Same Property Portfolio and Total Portfolio

were 66.3%, reflecting increases of 300 bps YoY.

- Funds from Operations (“FFO”) of $19.6 million, a 3.7% increase

from Q2 2022. FFO per unit (diluted) of $0.134, an increase of 2.3%

YoY.

- Adjusted Funds from Operations (“AFFO”) of $16.9 million, an

increase of 3.8% YoY, and AFFO per unit (diluted) of $0.116, an

increase of 2.7% YoY.

- Strong financial position with $282 million of available

liquidity with Debt-to-Gross Book Value (“GBV”) of 37.7%.

- Committed to sell a 54-suite property in Ottawa, Ontario for a

sale price of $11.5 million, exceeding IFRS value.

- Purchased 26,300 units under the Normal Course Issuer Bid

(“NCIB”), and subsequent to the quarter, purchased 130,900 units

under an Automatic Unit Purchase Plan (“AUPP”), representing a

total of 157,200 units at a weighted average per-unit price of

$12.71.

Brad Cutsey, President and CEO of InterRent REIT, commented on

the results:

“We’re pleased to report on another solid quarter marked by

back-to-back double-digit NOI growth and sustained expansion of NOI

margins. AMR growth remained steady across our core markets,

benefitting from the robust industry fundamentals that are showing

no signs of slowing down. Our capital recycling program is now in

motion, as we are committed to sell a non-strategic property at a

price higher than its IFRS value. We continue to explore capital

recycling opportunities and have identified various assets that

could potentially provide net proceeds of over $75 million. While

the completion of such transactions is subject to various factors

and cannot be assured, we are confident that our well-defined

disposition strategy will strengthen our balance sheet, help fund

further growth opportunities, and allow us to continue to be active

in our NCIB.”

Selected Consolidated InformationIn

$000’s, except per Unit amounts and other non-financial data

3 Months Ended June 30,

2023

3 Months Ended June 30,

2022

Change

Total suites

12,709(1)

12,573(1)

+1.1%

Average rent per suite (June)

$

1,531

$

1,433

+6.8%

Occupancy rate (June)

95.4

%

95.1

%

+30 bps

Proportionate operating revenues

$

58,963

$

52,845

+11.6%

Proportionate net operating income

(NOI)

$

39,068

$

33,446

+16.8%

NOI %

66.3

%

63.3

%

+300 bps

Same Property average rent per suite

(June)

$

1,523

$

1,430

+6.5%

Same Property occupancy rate (June)

95.4

%

95.1

%

+30 bps

Same Property proportionate operating

revenues

$

57,787

$

52,662

+9.7%

Same Property proportionate NOI

$

38,334

$

33,322

+15.0%

Same Property NOI %

66.3

%

63.3

%

+300 bps

Net Income

$

36,786

$

77,607

-52.6%

Funds from Operations (FFO)

$

19,584

$

18,880

+3.7%

FFO per weighted average unit -

diluted

$

0.134

$

0.131

+2.3%

Adjusted Funds from Operations (AFFO)

$

16,877

$

16,262

+3.8%

AFFO per weighted average unit -

diluted

$

0.116

$

0.113

+2.7%

Distributions per unit

$

0.0900

$

0.0855

+5.3%

Adjusted Cash Flow from Operations

(ACFO)

$

20,627

$

16,648

+23.9%

Proportionate Debt-to-GBV

37.7

%

37.3

%

+40 bps

Interest coverage (rolling 12 months)

2.37x

3.19x

-0.82x

Debt service coverage (rolling 12

months)

1.54x

1.82x

-0.28x

(1) Represents 12,041 (2022 - 11,965) suites fully owned by the

REIT, 1,214 (2022 - 1,214) suites owned 50% by the REIT, and 605

(2022 - nil) suites owned 10% by the REIT.

Disciplined portfolio growth underpinned by industry

fundamentals

As of June 30, 2023, InterRent had proportionate ownership in

12,709 suites, up 1.1% from 12,573 as of June 2022. Including

properties that the REIT owns in its joint ventures, InterRent

owned or managed 13,860 suites at June 30, 2023. At 95.4%, the June

2023 occupancy rate in InterRent’s same property and total

portfolios improved 30 bps over June 2022. Total portfolio

occupancy is 140 bps lower than March 2023, and same property

occupancy is 150 bps lower, this is due to seasonal fluctuations

and is in line with the long-term average for June. AMR growth

across the total portfolio was 6.8% for June 2023 as compared to

June 2022, while same property AMR increased by an impressive 6.5%

for the same period.

With record setting immigration in 2022 and continuing ambitious

federal targets for 2023, strong leasing demand continues to drive

AMR growth and strong occupancy numbers, resulting in total

portfolio operating revenue growth of 11.6% over Q2 2022. Within

the same property portfolio, these same factors have grown

operating revenues by 9.7% compared to Q2 2022. NOI margin

expansion for the overall portfolio and same property portfolio

both accelerated to 300 basis points, reaching 66.3% during the

quarter.

Strong debt profile, focused on optimizing mortgages

Financing costs in Q2 2023 came in at $15.0 million, compared to

$10.4 million in Q2 last year, reflecting the impact from the Bank

of Canada’s interest rate increases between March of 2022 and June

of 2023.

Weighted average cost of mortgage debt increased marginally from

March 2023 to 3.43%, and variable rate exposure ended the quarter

at 5%, a marginal increase from 4% at the prior quarter but

decreased substantially from the same period last year at 14%. The

REIT has continued to actively manage its mortgage ladder, with its

share of CMHC insured mortgages at 83%, consistent with March

2023.

Debt-to-GBV was at 37.7%, an increase of 40 basis points year

over year and a decrease of 30 basis points when compared to March.

With a conservative debt-to-GBV and $282 million of available

liquidity, the REIT has significant financial flexibility for

future capital programs, development opportunities and

acquisitions.

Net income affected by fair value adjustments

Net income for the quarter was $36.8 million, a decrease of

$40.8 million compared to Q2 2022. This decrease was primarily due

to a $20.4 million difference in fair value adjustments of

investment properties (moving from a $27.8 million gain to a $7.4

million gain). These fair value adjustments reflect an expansion of

capitalization rates during the year. The REIT’s weighted average

capitalization rate used across the portfolio at the end of Q2 2023

was 4.07%, an expansion of 3 basis points from Q1 2023, driven by

greater cap rate increase in the suburban Other Ontario region.

The decrease in net income during Q2 2023 is also attributable

to a $21.1 million drop in unrealized gain on financial liabilities

(a $10.1 million gain compared to a $31.2 million gain during the

same period last year).

FFO increased 3.7% from last year to $19.6 million and on a per

unit basis increased 2.3% to $0.134. AFFO during the quarter

increased 3.8% to $16.9 million, and on a per unit basis increased

2.7% on a per unit basis to $0.116.

Momentum at the Slayte remains strong

The Slayte development in Ottawa, the REIT’s first office

conversion project, has reached the final stages of its interior

construction. Located near LRT lines and steps to the Parliament,

the building has captured considerable attention. The lease rate

has surpassed 60% and the REIT is optimistic that the leasing

momentum will continue throughout the rest of the leasing

season.

Conference Call

Management will host a webcast and conference call to discuss

these results and current business initiatives on Wednesday, August

2, 2023 at 10:00 AM EST. The webcast will be accessible at:

https://www.interrentreit.com/2023-q2-results. A replay will be

available for 7 days after the webcast at the same link. The

telephone numbers for the conference call are 1-888-396-8049 (toll

free) and 416-764-8646 (international). No access code

required.

About InterRent

InterRent REIT is a growth-oriented real estate investment trust

engaged in increasing Unitholder value and creating a growing and

sustainable distribution through the acquisition and ownership of

multi-residential properties.

InterRent's strategy is to expand its portfolio primarily within

markets that have exhibited stable market vacancies, sufficient

suites available to attain the critical mass necessary to implement

an efficient portfolio management structure, and offer

opportunities for accretive acquisitions.

InterRent's primary objectives are to use the proven industry

experience of the Trustees, Management and Operational Team to: (i)

grow both funds from operations per Unit and net asset value per

Unit through investments in a diversified portfolio of

multi-residential properties; (ii) provide Unitholders with

sustainable and growing cash distributions, payable monthly; and

(iii) maintain a conservative payout ratio and balance sheet.

*Non-GAAP Measures

InterRent prepares and releases unaudited quarterly and audited

consolidated annual financial statements prepared in accordance

with IFRS (GAAP). In this and other earnings releases, as a

complement to results provided in accordance with GAAP, InterRent

also discloses and discusses certain non-GAAP financial measures,

including Proportionate Results, Gross Rental Revenue, NOI, Same

Property results, Repositioned Property results, FFO, AFFO, ACFO

and EBITDA. These non-GAAP measures are further defined and

discussed in the MD&A dated August 2, 2023, which should be

read in conjunction with this press release. Since Proportionate

Results, Gross Rental Revenue, NOI, Same Property results,

Repositioned Property results, FFO, AFFO, ACFO and EBITDA are not

determined by GAAP, they may not be comparable to similar measures

reported by other issuers. InterRent has presented such non-GAAP

measures as Management believes these measures are relevant

measures of the ability of InterRent to earn and distribute cash

returns to Unitholders and to evaluate InterRent's performance.

These non-GAAP measures should not be construed as alternatives to

net income (loss) or cash flow from operating activities determined

in accordance with GAAP as an indicator of InterRent's

performance.

Cautionary Statements

The comments and highlights herein should be read in conjunction

with the most recently filed annual information form as well as our

consolidated financial statements and management’s discussion and

analysis for the same period. InterRent’s publicly filed

information is located at www.sedar.com.

This news release contains “forward-looking statements” within

the meaning applicable to Canadian securities legislation.

Generally, these forward-looking statements can be identified by

the use of forward-looking terminology such as “plans”,

“anticipated”, “expects” or “does not expect”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates” or “does not anticipate”, or “believes”, or

variations of such words and phrases or state that certain actions,

events or results “may”, “could”, “would”, “might” or “will be

taken”, “occur” or “be achieved”. InterRent is subject to

significant risks and uncertainties which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward looking statements contained in this

release. A full description of these risk factors can be found in

InterRent’s most recently publicly filed information located at

www.sedar.com. InterRent cannot assure investors that actual

results will be consistent with these forward looking statements

and InterRent assumes no obligation to update or revise the forward

looking statements contained in this release to reflect actual

events or new circumstances.

The Toronto Stock Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230802961942/en/

For further information: Renee Wei Director of Investor

Relations & Sustainability renee.wei@interrentreit.com

www.interrentreit.com

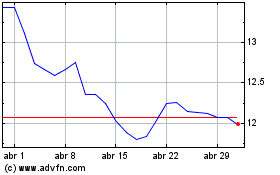

InterRent Real Estate In... (TSX:IIP.UN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

InterRent Real Estate In... (TSX:IIP.UN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024