- Packaging System placement up 3.1% year over year to

approximately 140,700 machines at June 30, 2023

- Net revenue for the second quarter decreased 5.6% year over

year to $81.9 million and decreased 7.0% year over year on a

constant currency basis to $84.6 million

- Net loss for the second quarter of $2.1 million compared to

net loss of $11.3 million in the prior period and Adjusted EBITDA

(“AEBITDA”) of $19.0 million up 4.4%, or $0.8 million, year over

year

Ranpak Holdings Corp (NYSE: PACK) (“Ranpak” or “the Company”), a

leading provider of environmentally sustainable, systems-based,

product protection solutions for e-Commerce and industrial supply

chains, today reported its second quarter 2023 financial

results.

“We are pleased to continue to see improvement in our financial

profile as our margins improve faster than anticipated,” said Omar

M. Asali, Chairman and Chief Executive of Ranpak. “Sales for the

quarter were down 5.6% year over year, or 7.0% on a constant

currency basis, as consumers continue to allocate their spend

towards experiences and services rather than goods, and the

European economy remains impacted by the war and inflation. Overall

though, while the volume environment remained challenging, the

improvements in the input cost environment drove gross margin

expansion of more than 400 bps year over year and 900 bps above the

fourth quarter of 2022 to 36.9%, or 37.0% on a constant currency

basis. Gross profit improvement of 6.7%, or 5.4% on a constant

currency basis, and tight spending enabled us to increase Adjusted

EBITDA by 4.4% year over year to $19.0 million on a constant

currency basis. Generally speaking, the environment remains

inconsistent, but we are pleased to see the continued sequential

improvement of Gross Profit and Adjusted EBITDA on a constant

currency basis compared to the fourth quarter of 2022 on similar

levels of sales. The operating leverage that was so painful for us

last year with rising input costs, is finally turning the other

way.”

“In the near term, we are extremely focused on working the

assets that we have and getting returns on the investments we have

made over the past few years. We have state of the art systems and

technology, a full new slate of new product introductions, and

brand new facilities to support our growth ambitions. Our focus

right now is on maximizing cash generation through increased

volumes and minimizing additional spend. With the major projects

behind us, our team is focused mainly on extracting efficiencies

and gaining productivity in those areas that are within our

control. I am confident the volume environment will improve given

the trial activity we are having, but the timing of that recovery

remains unclear given the general macro environment. In the

meantime though, I am pleased with the momentum we are

building.”

Second Quarter 2023 Highlights

- Packaging systems placement increased 3.1% year over year, to

approximately 140,700 machines as of June 30, 2023

- Net revenue decreased 5.6% and decreased 7.0% adjusting for

constant currency

- Net loss of $2.1 million compared to net loss of $11.3

million

- Constant currency AEBITDA1 of $19.0 million for the three

months ended June 30, 2023 is up 4.4%

Net revenue for the second quarter of 2023 was $81.9 million

compared to net revenue of $86.8 million in the second quarter of

2022, a decrease of $4.9 million or 5.6% year over year. Net

revenue was negatively impacted by decreases in cushioning,

void-fill and wrapping, partially offset by increases in other

products. Currency rates contributed a benefit of 1.3%, though

revenue was negatively affected by lower economic activity, the

impact inflationary pressures are having on consumer and corporate

budgets, and increased business sponsoring costs. Cushioning

decreased $1.6 million, or 4.2%, to $36.6 million from $38.2

million; void-fill decreased $3.2 million, or 9.3%, to $31.1

million from $34.3 million; wrapping decreased $1.8 million, or

17.6%, to $8.4 million from $10.2 million; and other sales

increased $1.7 million, or 41.5%, to $5.8 million from $4.1 million

for the second quarter of 2023 compared to the second quarter of

2022. Other net revenue includes automated box sizing equipment and

non-paper revenue from packaging systems installed in the field,

such as systems accessories. The decrease in net revenue is

quantified by a decrease in the volume of sales of our paper

consumable products of approximately 8.7 percentage points (“pp”)

and a 0.1 pp decrease in the price or mix of our paper consumable

products, partially offset by an increase of 2.0 pp in sales of

automated box sizing equipment. Constant currency net revenue was

$84.6 million for the second quarter of 2023, a 7.0% decrease from

constant currency net revenue of $91.0 million for the second

quarter of 2022.

Net revenue in North America for the second quarter of 2023

totaled $32.2 million compared to net revenue in North America of

$34.3 million in the second quarter of 2022. The decrease of $2.1

million, or 6.1%, was primarily attributable to decreases in

wrapping, void-fill, and cushioning, partially offset by an

increase in other sales.

Net revenue in Europe/Asia for the second quarter of 2023

totaled $49.7 million compared to net revenue in Europe/Asia of

$52.5 million in the second quarter of 2022. The decrease of $2.8

million, or 5.3%, was driven by lower void-fill and cushioning,

partially offset by increases in other sales and wrapping. Constant

currency net revenue in Europe/Asia was $52.4 million for the

second quarter of 2023, a $4.3 million, or 7.6%, decrease from

constant currency net revenue of $56.7 million for the second

quarter of 2022.

Year-to-Date 2023 Highlights

- Net revenue decreased 3.7% and decreased 3.1% adjusting for

constant currency

- Net loss of $14.5 million compared to net loss of $25.4

million

- Constant currency AEBITDA of $34.1 million for the six months

ended June 30, 2023 is down 8.6%

Balance Sheet and Liquidity

Ranpak completed the second quarter of 2023 with a strong

liquidity position, including a cash balance of $53.9 million and

no borrowings on its $45 million Revolving Credit Facility. As of

June 30, 2023, the Company had First Lien Term Loan facilities

outstanding consisting of a $250.0 million USD-denominated term

loan and €135.1 million euro-denominated term loan resulting in an

Adjusted EBITDA net leverage ratio of 5.7x based on results on a

constant currency basis through the second quarter of 2023. The

Bank Adjusted EBITDA net leverage ratio was 5.8x through the second

quarter of 2023. The First Lien Term Loan facilities mature in June

2026.

The following table presents Ranpak’s installed base of

protective packaging systems by product line as of June 30, 2023

and 2022:

June 30, 2023

June 30, 2022

Change

% Change

PPS Systems

(in thousands)

Cushioning machines

35.0

35.2

(0.2

)

(0.6

)

Void-Fill machines

83.3

80.0

3.3

4.1

Wrapping machines

22.4

21.3

1.1

5.2

Total

140.7

136.5

4.2

3.1

Conference Call Information

The Company will host a conference call and webcast at 8:30 a.m.

(ET) on Thursday, August 3, 2023. The conference call and earnings

presentation will be webcast live at the following link:

https://events.q4inc.com/attendee/222823856. Investors who cannot

access the webcast may listen to the conference call live via

telephone by dialing (888) 330-2446 or (240) 789-2732 and use the

Conference ID: 8498994.

A telephonic replay of the webcast also will be available

starting at 11:30 a.m. (ET) on Thursday, August 3, 2023 and ending

at 11:59 p.m. (ET) on Thursday, August 10, 2023. To listen to the

replay, please dial (800) 770-2030 or (647) 362-9199 and use the

passcode: 8498994.

Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Our forward-looking statements

include, but are not limited to, statements regarding our or our

management team’s expectations, hopes, beliefs, intentions or

strategies regarding the future. Statements that are not historical

facts, including statements about the parties, perspectives and

expectations, are forward-looking statements. In addition, any

statements that refer to estimates, projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements in this news release

include, for example, statements about our expectations around the

future performance of the business, including our forward-looking

guidance.

The forward-looking statements contained in this news release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us taking into account

information currently available to us. There can be no assurance

that future developments affecting us will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond our control) or

other assumptions that may cause actual results or performance to

be materially different from those expressed or implied by these

forward-looking statements. These risks include, but are not

limited to: (i) our inability to secure a sufficient supply of

paper to meet our production requirements; (ii) the impact of the

price of kraft paper on our results of operations; (iii) our

reliance on third party suppliers; (iv) the COVID-19 pandemic, the

Russia and Ukraine conflict, and associated responses; (v) the high

degree of competition in the markets in which we operate; (vi)

consumer sensitivity to increases in the prices of our products;

(vii) changes in consumer preferences with respect to paper

products generally; (viii) continued consolidation in the markets

in which we operate; (ix) the loss of significant end-users of our

products or a large group of such end-users; (x) our failure to

develop new products that meet our sales or margin expectations;

(xi) our future operating results fluctuating, failing to match

performance or to meet expectations; (xii) our ability to fulfill

our public company obligations; (xiii) our exposure to changes in

interest rates; and (xiv) other risks and uncertainties indicated

from time to time in filings made with the SEC.

Should one or more of these risks or uncertainties materialize,

they could cause our actual results to differ materially from the

forward-looking statements. We are not undertaking any obligation

to update or revise any forward-looking statements whether as a

result of new information, future events or otherwise. You should

not take any statement regarding past trends or activities as a

representation that the trends or activities will continue in the

future. Accordingly, you should not put undue reliance on these

statements.

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Statements of Operations

and Comprehensive Income

(Loss)

(in millions, except share and

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Paper revenue

$

63.3

$

70.2

$

127.6

$

136.4

Machine lease revenue

12.7

12.5

25.5

24.7

Other revenue

5.9

4.1

10.0

8.2

Net revenue

81.9

86.8

163.1

169.3

Cost of goods sold

51.7

58.5

105.4

116.4

Gross profit

30.2

28.3

57.7

52.9

Selling, general and administrative

expenses

16.3

30.3

43.5

60.0

Depreciation and amortization expense

8.1

8.0

16.1

16.2

Other operating expense, net

1.4

1.4

2.6

1.9

Income (loss) from operations

4.4

(11.4

)

(4.5

)

(25.2

)

Interest expense

5.9

4.9

11.6

9.9

Foreign currency (gain) loss

0.7

(2.3

)

0.9

(2.9

)

Other non-operating income, net

(0.4

)

-

(0.7

)

-

Loss before income tax expense

(benefit)

(1.8

)

(14.0

)

(16.3

)

(32.2

)

Income tax expense (benefit)

0.3

(2.7

)

(1.8

)

(6.8

)

Net loss

$

(2.1

)

$

(11.3

)

$

(14.5

)

$

(25.4

)

Two-class method

Loss per share

Basic

$

(0.03

)

$

(0.14

)

$

(0.18

)

$

(0.31

)

Diluted

$

(0.03

)

$

(0.14

)

$

(0.18

)

$

(0.31

)

Class A – earnings (loss) per share

Basic

$

(0.03

)

$

(0.14

)

$

(0.18

)

$

(0.31

)

Diluted

$

(0.03

)

$

(0.14

)

$

(0.18

)

$

(0.31

)

Class C – earnings (loss) per share

Basic

$

(0.03

)

$

(0.14

)

$

(0.17

)

$

(0.31

)

Diluted

$

(0.03

)

$

(0.14

)

$

(0.17

)

$

(0.31

)

Weighted average number of shares

outstanding – Class A and C

Basic

82,432,158

81,943,235

82,285,291

81,759,372

Diluted

82,432,158

81,943,235

82,285,291

81,759,372

Other comprehensive income (loss), before

tax

Foreign currency translation

adjustments

$

(0.5

)

$

(11.7

)

$

2.6

$

(14.5

)

Interest rate swap adjustments

(1.0

)

2.7

(3.1

)

10.8

Cross-currency swap adjustments

(0.7

)

4.2

(1.7

)

4.3

Total other comprehensive income

(loss), before tax

(2.2

)

(4.8

)

(2.2

)

0.6

Provision (benefit) for income taxes

related to other comprehensive income (loss)

(0.4

)

1.7

(1.2

)

3.7

Total other comprehensive income

(loss), net of tax

(1.8

)

(6.5

)

(1.0

)

(3.1

)

Comprehensive loss, net of tax

$

(3.9

)

$

(17.8

)

$

(15.5

)

$

(28.5

)

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Balance Sheets

(in millions, except share

data)

June 30, 2023

December 31, 2022

Assets

Current assets

Cash and cash equivalents

$

53.9

$

62.8

Accounts receivable, net

34.8

33.0

Inventories, net

22.4

25.0

Income tax receivable

4.6

2.1

Prepaid expenses and other current

assets

23.3

16.7

Total current assets

139.0

139.6

Property, plant and equipment, net

127.8

124.0

Operating lease right-of-use assets,

net

21.2

6.0

Goodwill

448.4

446.7

Intangible assets, net

358.9

372.1

Deferred tax assets

0.6

0.6

Other assets

42.7

44.5

Total assets

$

1,138.6

$

1,133.5

Liabilities and Shareholders'

Equity

Current liabilities

Accounts payable

$

24.6

$

24.3

Accrued liabilities and other

16.6

10.6

Current portion of long-term debt

2.4

1.3

Operating lease liabilities, current

2.7

2.0

Deferred revenue

2.7

0.9

Total current liabilities

49.0

39.1

Long-term debt

394.3

391.7

Deferred tax liabilities

79.5

80.8

Derivative instruments

5.4

3.7

Operating lease liabilities,

non-current

18.6

4.0

Other liabilities

1.6

1.4

Total liabilities

548.4

520.7

Commitments and contingencies – Note

13

Shareholders' equity

Class A common stock, $0.0001 par,

200,000,000 shares authorized at June 30, 2023 and December 31,

2022

Shares issued and outstanding: 79,547,780

and 79,086,372 at June 30, 2023 and December 31, 2022,

respectively

-

-

Convertible Class C common stock, $0.0001

par, 200,000,000 shares authorized at June 30, 2023 and December

31, 2022

Shares issued and outstanding: 2,921,099

at June 30, 2023 and December 31, 2022

-

-

Additional paid-in capital

697.2

704.3

Accumulated deficit

(111.2

)

(96.7

)

Accumulated other comprehensive income

4.2

5.2

Total shareholders' equity

590.2

612.8

Total liabilities and shareholders'

equity

$

1,138.6

$

1,133.5

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Statements of Cash Flows

(in millions)

Six Months Ended June

30,

2023

2022

Cash Flows from Operating

Activities

Net loss

$

(14.5

)

$

(25.4

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

33.0

36.6

Amortization of deferred financing

costs

0.9

0.7

Loss on disposal of fixed assets

0.8

0.2

Deferred income taxes

(0.3

)

(4.4

)

Amortization of initial value of interest

rate swap

(0.9

)

(0.4

)

Currency (gain) loss on foreign

denominated debt and notes payable

0.8

(2.6

)

Amortization of restricted stock units

(6.7

)

14.1

Amortization of cloud-based software

implementation costs

1.5

-

Changes in operating assets and

liabilities:

Increase in receivables, net

(1.5

)

(2.4

)

(Increase) decrease in inventory

2.8

(10.3

)

Increase in prepaid expenses and other

assets

(3.5

)

(4.4

)

Increase (decrease) in accounts

payable

1.5

(1.1

)

Increase (decrease) in accrued

liabilities

2.3

(6.1

)

Change in other assets and liabilities

0.4

(10.8

)

Net cash provided by (used in)

operating activities

16.6

(16.3

)

Cash Flows from Investing

Activities

Capital expenditures:

Converter equipment

(11.0

)

(17.1

)

Other capital expenditures

(14.2

)

(5.7

)

Total capital expenditures

(25.2

)

(22.8

)

Patent and trademark expenditures

-

(1.0

)

Net cash used in investing

activities

(25.2

)

(23.8

)

Cash Flows from Financing

Activities

Proceeds from equipment financing

1.9

-

Financing costs of debt facilities

(0.2

)

-

Principal payments on term loans

(1.1

)

(0.8

)

Payments on finance lease liabilities

(0.8

)

(0.4

)

Tax payments for withholdings on

stock-based awards distributed

(0.5

)

(2.5

)

Net cash used in financing

activities

(0.7

)

(3.7

)

Effect of Exchange Rate Changes on

Cash

0.4

(0.9

)

Net Decrease in Cash and Cash

Equivalents

(8.9

)

(44.7

)

Cash and Cash Equivalents, beginning of

period

62.8

103.9

Cash and Cash Equivalents, end of

period

$

53.9

$

59.2

Non-GAAP Financial Data

In this press release, we present Earnings Before Interest,

Taxes, Depreciation and Amortization (“EBITDA”) and constant

currency EBITDA and constant currency adjusted EBITDA (“Constant

currency AEBITDA”), which are non-GAAP financial measures. We have

included EBITDA, constant currency EBITDA and constant currency

AEBITDA because they are key measures used by our management and

Board of Directors to understand and evaluate our operating

performance and trends, to prepare and approve our annual budget

and to develop short- and long-term operational plans. In

particular, the exclusion of certain expenses in calculating

EBITDA, constant currency EBITDA and constant currency AEBITDA can

provide a useful measure for period-to-period comparisons of our

primary business operations.

However, EBITDA, constant currency EBITDA and constant currency

AEBITDA have limitations as analytical tools, and you should not

consider them in isolation or as substitutes for analysis of our

results as reported under GAAP. In particular, EBITDA, constant

currency EBITDA and constant currency AEBITDA should not be viewed

as substitutes for, or superior to, net income (loss) prepared in

accordance with GAAP as a measure of profitability or liquidity.

Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and EBITDA, constant currency EBITDA and constant

currency AEBITDA do not reflect all cash capital expenditure

requirements for such replacements or for new capital expenditure

requirements;

- EBITDA, constant currency EBITDA and constant currency AEBITDA

do not reflect changes in, or cash requirements for, our working

capital needs;

- constant currency AEBITDA does not consider the potentially

dilutive impact of equity-based compensation;

- EBITDA, constant currency EBITDA and constant currency AEBITDA

do not reflect the impact of the recording or release of valuation

allowances or tax payments that may represent a reduction in cash

available to us;

- constant currency AEBITDA does not take into account any

restructuring and integration costs;

- constant currency EBITDA and constant currency AEBITDA are

presented on a constant currency basis and give effect to the

impact of currency fluctuations; and

- other companies, including companies in our industry, may

calculate EBITDA, constant currency EBITDA and constant currency

AEBITDA differently, which reduces their usefulness as comparative

measures.

EBITDA — EBITDA is a non-GAAP financial measure that we

calculate as net income (loss), adjusted to exclude: benefit from

(provision for) income taxes; interest expense; and depreciation

and amortization.

Constant currency EBITDA — Constant currency EBITDA is a

non-GAAP financial measure that we present on a constant currency

basis and we calculate as net income (loss), adjusted to exclude:

benefit from (provision for) income taxes; interest expense; and

depreciation and amortization.

Constant currency AEBITDA — Constant currency AEBITDA is

a non-GAAP financial measure that we present on a constant currency

basis and calculate as net income (loss), adjusted to exclude:

benefit from (provision for) income taxes; interest expense;

depreciation and amortization; stock-based compensation expense;

and, in certain periods, certain other income and expense items; as

further adjusted to reflect the performance of the business on a

constant currency basis.

We present constant currency EBITDA and constant currency

AEBITDA on a constant currency basis because it allows a better

insight into the performance of our businesses that operate in

currencies other than our reporting currency. Before consolidation,

our Europe/Asia financial data is derived in Euros. To calculate

the adjustment that we apply to present constant currency EBITDA

and constant currency AEBITDA on a constant currency basis, we

multiply this Euro-derived data by 1.15 to reflect an exchange rate

of 1 Euro to 1.15 U.S. dollars (“USD”), which we believe is a

reasonable exchange rate to use to give a stable depiction of the

business without currency fluctuations between periods, to

calculate Europe/Asia data in constant currency USD. We believe

that using an exchange rate of 1.15 is reasonable because it

approximates the average exchange rate of the Euro to USD over the

past five years. In addition, we include certain other unaudited,

non-GAAP constant currency data for the three and six months ended

June 30, 2023 and 2022. This data is based on our historical

financial statements, adjusted (where applicable) to reflect a

constant currency presentation between periods for the convenience

of readers. We reconcile this data to our GAAP data for the same

period for the three and six months ended June 30, 2023 and

2022.

This press release also includes forecasts for certain non-GAAP

metrics. We are unable to provide a reconciliation of our forecast

of net revenue on a constant currency basis for 2023 to a forecast

of net revenue on a GAAP basis without unreasonable effort

primarily because we are unable to forecast with reasonable

certainty the associated currency impact. In addition, a

reconciliation of our forecast for constant currency AEBITDA for

2023 to GAAP net income cannot be provided without unreasonable

effort because we are unable to forecast with reasonable certainty

several of the items necessary to calculate such comparable GAAP

measure, including asset impairments, integration related expenses,

reorganizations and discontinued operations related expenses, legal

settlement costs, constant currency adjustments, as well as other

unusual or non-recurring gains or losses. These items are

uncertain, depend on various factors, and could be material to our

results computed in accordance with GAAP. We believe the inherent

uncertainties in reconciling such non-GAAP measures for projected

periods to the most comparable GAAP measures would make the

forecasted comparable GAAP measures difficult to predict with

reasonable certainty or reliability.

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation and Comparison of GAAP

Statement of Income Data to Non-GAAP EBITDA and Constant Currency

AEBITDA

For the Second Quarter of 2023 and

2022

Please refer to our discussion and

definitions of Non-GAAP financial measures

Three Months Ended June

30,

2023

2022

$ Change

% Change

Net revenue

$

81.9

$

86.8

$

(4.9

)

(5.6

)

Cost of goods sold

51.7

58.5

(6.8

)

(11.6

)

Gross profit

30.2

28.3

1.9

6.7

Selling, general and administrative

expenses

16.3

30.3

(14.0

)

(46.2

)

Depreciation and amortization expense

8.1

8.0

0.1

1.3

Other operating expense, net

1.4

1.4

-

-

Income (loss) from operations

4.4

(11.4

)

15.8

(138.6

)

Interest expense

5.9

4.9

1.0

20.4

Foreign currency gain

0.7

(2.3

)

3.0

(130.4

)

Other non-operating income, net

(0.4

)

-

(0.4

)

―

Loss before income tax benefit

(1.8

)

(14.0

)

12.2

(87.1

)

Income tax expense (benefit)

0.3

(2.7

)

3.0

(111.1

)

Net loss

(2.1

)

(11.3

)

9.2

(81.4

)

Depreciation and amortization expense –

COS

8.6

9.8

(1.2

)

(12.2

)

Depreciation and amortization expense –

D&A

8.1

8.0

0.1

1.3

Interest expense

5.9

4.9

1.0

20.4

Income tax expense (benefit)

0.3

(2.7

)

3.0

(111.1

)

EBITDA(1)

20.8

8.7

12.1

139.1

Adjustments(2):

Unrealized (gain) loss translation

0.6

(2.3

)

2.9

(126.1

)

Non-cash impairment losses

0.5

0.2

0.3

150.0

M&A, restructuring, severance

1.3

1.1

0.2

18.2

Amortization of restricted stock units

(9.5

)

5.3

(14.8

)

(279.2

)

Amortization of cloud-based software

implementation costs(3)

0.8

0.7

0.1

14.3

Cloud-based software implementation

costs

1.2

2.3

(1.1

)

(47.8

)

SOX remediation costs

2.4

-

2.4

―

Other adjustments

0.1

1.3

(1.2

)

(92.3

)

Constant currency

0.8

0.9

(0.1

)

(11.1

)

Constant Currency AEBITDA(1)

19.0

18.2

0.8

4.4

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation and Comparison of GAAP

Statement of Income Data to Non-GAAP EBITDA and Constant Currency

AEBITDA

For the Six Months Ended June 30, 2023

and 2022

Please refer to our discussion and

definitions of Non-GAAP financial measures

Six Months Ended June

30,

2023

2022

$ Change

% Change

Net revenue

$

163.1

$

169.3

$

(6.2

)

(3.7

)

Cost of goods sold

105.4

116.4

(11.0

)

(9.5

)

Gross profit

57.7

52.9

4.8

9.1

Selling, general and administrative

expenses

43.5

60.0

(16.5

)

(27.5

)

Depreciation and amortization expense

16.1

16.2

(0.1

)

(0.6

)

Other operating expense, net

2.6

1.9

0.7

36.8

Income (loss) from operations

(4.5

)

(25.2

)

20.7

(82.1

)

Interest expense

11.6

9.9

1.7

17.2

Foreign currency gain

0.9

(2.9

)

3.8

(131.0

)

Other non-operating income, net

(0.7

)

-

(0.7

)

―

Loss before income tax benefit

(16.3

)

(32.2

)

15.9

(49.4

)

Income tax benefit

(1.8

)

(6.8

)

5.0

(73.5

)

Net loss

(14.5

)

(25.4

)

10.9

(42.9

)

Depreciation and amortization expense –

COS

16.9

20.4

(3.5

)

(17.2

)

Depreciation and amortization expense –

D&A

16.1

16.2

(0.1

)

(0.6

)

Interest expense

11.6

9.9

1.7

17.2

Income tax benefit

(1.8

)

(6.8

)

5.0

(73.5

)

EBITDA(1)

28.3

14.3

14.0

97.9

Adjustments(2):

Unrealized gain translation

0.8

(2.9

)

3.7

(127.6

)

Non-cash impairment losses

0.9

0.2

0.7

350.0

M&A, restructuring, severance

1.5

1.6

(0.1

)

(6.3

)

Amortization of restricted stock units

(6.7

)

14.1

(20.8

)

(147.5

)

Amortization of cloud-based software

implementation costs(3)

1.5

1.4

0.1

7.1

Cloud-based software implementation

costs

2.4

4.8

(2.4

)

(50.0

)

SOX remediation costs

2.4

-

2.4

―

Other adjustments

1.4

2.5

(1.1

)

(44.0

)

Constant currency

1.6

1.3

0.3

23.1

Constant Currency AEBITDA(1)

34.1

37.3

(3.2

)

(8.6

)

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA

For the Second Quarter of 2023

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Three Months Ended June 30,

2023

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

81.9

$

2.7

$

84.6

Cost of goods sold

51.7

1.6

53.3

Gross profit

30.2

1.1

31.3

Selling, general and administrative

expenses

16.3

0.5

16.8

Depreciation and amortization expense

8.1

0.1

8.2

Other operating expense, net

1.4

-

1.4

Loss from operations

4.4

0.5

4.9

Interest expense

5.9

0.1

6.0

Foreign currency gain

0.7

-

0.7

Other non-operating income, net

(0.4

)

0.4

-

Loss before income tax benefit

(1.8

)

-

(1.8

)

Income tax benefit

0.3

(0.3

)

-

Net loss

$

(2.1

)

$

0.3

$

(1.8

)

Constant currency-effected

add(1):

Depreciation and amortization expense –

COS

8.8

Depreciation and amortization expense –

D&A

8.2

Interest expense

6.0

Income tax benefit

-

Constant currency EBITDA

21.2

Constant currency-effected

adjustments(2):

Unrealized (gain) loss translation

0.7

Non-cash impairment losses

0.5

M&A, restructuring, severance

1.5

Amortization of restricted stock units

(9.6

)

Amortization of cloud-based software

implementation costs(3)

0.8

Cloud-based software implementation

costs

1.3

SOX remediation costs

2.4

Other adjustments

0.2

Constant currency AEBITDA

$

19.0

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA

For the Second Quarter of 2022

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Three Months Ended June 30,

2022

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

86.8

$

4.2

$

91.0

Cost of goods sold

58.5

2.8

61.3

Gross profit

28.3

1.4

29.7

Selling, general and administrative

expenses

30.3

1.0

31.3

Depreciation and amortization expense

8.0

0.1

8.1

Other operating expense, net

1.4

0.5

1.9

Income from operations

(11.4

)

(0.2

)

(11.6

)

Interest expense

4.9

0.1

5.0

Foreign currency gain

(2.3

)

0.2

(2.1

)

Loss before income tax benefit

(14.0

)

(0.5

)

(14.5

)

Income tax benefit

(2.7

)

(0.2

)

(2.9

)

Net loss

$

(11.3

)

$

(0.3

)

$

(11.6

)

Constant currency-effected

add(1):

Depreciation and amortization expense –

COS

10.2

Depreciation and amortization expense –

D&A

8.1

Interest expense

5.0

Income tax benefit

(2.9

)

Constant currency EBITDA

8.8

Constant currency-effected

adjustments(2):

Unrealized gain translation

(2.2

)

Non-cash impairment losses

0.2

M&A, restructuring, severance

1.1

Amortization of restricted stock units

5.3

Amortization of cloud-based software

implementation costs(3)

0.7

Cloud-based software implementation

costs

2.4

Other adjustments

1.9

Constant currency AEBITDA

$

18.2

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA

For the Six Months Ended June 30,

2023

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Six Months Ended June 30,

2023

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

163.1

$

6.3

$

169.4

Cost of goods sold

105.4

3.9

109.3

Gross profit

57.7

2.4

60.1

Selling, general and administrative

expenses

43.5

1.4

44.9

Depreciation and amortization expense

16.1

0.3

16.4

Other operating expense, net

2.6

-

2.6

Loss from operations

(4.5

)

0.7

(3.8

)

Interest expense

11.6

0.2

11.8

Foreign currency gain

0.9

-

0.9

Other non-operating income, net

(0.7

)

0.9

0.2

Loss before income tax benefit

(16.3

)

(0.4

)

(16.7

)

Income tax benefit

(1.8

)

(0.3

)

(2.1

)

Net loss

$

(14.5

)

$

(0.1

)

$

(14.6

)

Constant currency-effected

add(1):

Depreciation and amortization expense –

COS

17.4

Depreciation and amortization expense –

D&A

16.4

Interest expense

11.8

Income tax benefit

(2.1

)

Constant currency EBITDA

28.9

Constant currency-effected

adjustments(2):

Unrealized gain translation

0.9

Non-cash impairment losses

1.0

M&A, restructuring, severance

1.7

Amortization of restricted stock units

(6.7

)

Amortization of cloud-based software

implementation costs(3)

1.6

Cloud-based software implementation

costs

2.4

SOX remediation costs

2.4

Other adjustments

1.9

Constant currency AEBITDA

$

34.1

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA

For the Six Months Ended June 30,

2022

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Six Months Ended June 30,

2022

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

169.3

$

5.6

$

174.9

Cost of goods sold

116.4

3.8

120.2

Gross profit

52.9

1.8

54.7

Selling, general and administrative

expenses

60.0

1.3

61.3

Depreciation and amortization expense

16.2

0.2

16.4

Other operating expense, net

1.9

0.7

2.6

Income from operations

(25.2

)

(0.4

)

(25.6

)

Interest expense

9.9

0.1

10.0

Foreign currency gain

(2.9

)

0.2

(2.7

)

Other non-operating income, net

-

-

-

Loss before income tax benefit

(32.2

)

(0.7

)

(32.9

)

Income tax benefit

(6.8

)

(0.3

)

(7.1

)

Net income

$

(25.4

)

$

(0.4

)

$

(25.8

)

Constant currency-effected

add(1):

Depreciation and amortization expense –

COS

21.0

Depreciation and amortization expense –

D&A

16.4

Interest expense

10.0

Income tax benefit

(7.1

)

Constant currency EBITDA

14.5

Constant currency-effected

adjustments(2):

Unrealized loss translation

(2.8

)

Non-cash impairment losses

0.2

M&A, restructuring, severance

1.6

Amortization of restricted stock units

14.1

Amortization of cloud-based software

implementation costs(3)

1.4

Cloud-based software implementation

costs

5.0

Other adjustments

3.3

Constant currency AEBITDA

$

37.3

(1)

Reconciliations of EBITDA and

constant currency AEBITDA for each period presented are to net

(loss) income, the nearest GAAP equivalent.

(2)

Adjustments are related to

non-cash unusual or infrequent costs such as: effects of non-cash

foreign currency remeasurement or adjustment; impairment of

returned machines; costs associated with the evaluation of

acquisitions; costs associated with executive severance; costs

associated with restructuring actions such as plant rationalization

or realignment, reorganization, and reductions in force; costs

associated with the implementation of the global ERP system; and

other items deemed by management to be unusual, infrequent, or

non-recurring.

(3)

Represents amortization of

capitalized costs related to the implementation of the global ERP

system, which are included in SG&A.

(4)

Effect of Euro constant currency

adjustment to a rate of €1.00 to $1.15 on each line item is as

follows:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net revenue

$

2.7

$

4.2

$

6.3

$

5.6

Cost of goods sold

1.6

2.8

3.9

3.8

Gross profit

1.1

1.4

2.4

1.8

Selling, general and administrative

expenses

0.5

1.0

1.4

1.3

Depreciation and amortization expense

0.1

0.1

0.3

0.2

Other operating expense, net

-

0.5

-

0.7

Loss from operations

0.5

(0.2

)

0.7

(0.4

)

Interest expense (income)

0.1

0.1

0.2

0.1

Foreign currency (gain) loss

-

0.2

-

0.2

Other non-operating income, net

0.4

-

0.9

-

Income (loss) before income tax

benefit

-

(0.5

)

(0.4

)

(0.7

)

Income tax benefit

(0.3

)

(0.2

)

(0.3

)

(0.3

)

Net income (loss)

$

0.3

$

(0.3

)

$

(0.1

)

$

(0.4

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230802218129/en/

Contact for Investors: IR@Ranpak.com

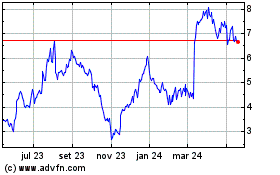

Ranpak (NYSE:PACK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

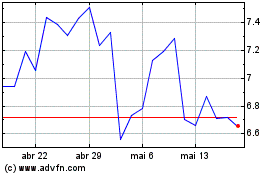

Ranpak (NYSE:PACK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024