Second quarter 2023 net sales and diluted loss

per share expected to be in the range of previously-announced

outlook

Board of Directors authorizes a 1-for-20

reverse stock split

Fashion apparel retailer Express, Inc. (NYSE: EXPR) (the

“Company”) today announced certain preliminary financial results

for the second quarter 2023, including net sales which are expected

to be in the range of its previously-announced outlook of $400

million to $450 million, and diluted loss per share which is

expected to be in the range of its previously-announced outlook of

$0.50 to $0.60.

“We expect second quarter net sales and diluted loss per share

to be within the ranges of our outlook. Net sales for the Express

brand improved sequentially throughout the second quarter driven by

the corrective actions we have taken to address imbalances in our

women’s assortment architecture. These results give us confidence

that we will continue to see improvement in net sales for the

Express brand in the back half of the year,” said Tim Baxter, Chief

Executive Officer. “Additionally, the integration of the Bonobos

brand into our omnichannel platform and its performance are on

track.”

“As we transform EXPR to create shareholder value, we are

committed to driving long-term profitable growth and delivering

positive free cash flow in our core Express business. We are

conducting a comprehensive review of our business model to identify

actions that we believe will meaningfully reduce pre-tax costs and

enable a more efficient and effective organization. Today we are

announcing a goal to deliver $150 million in annualized expense

reductions by 2025 versus 2022 and have already identified and

implemented $80 million for 2023 and $120 million for 2024. In

addition, we are also aggressively pursuing at least $50 million in

gross margin expansion opportunities by leveraging efficiencies in

sourcing, production and the supply chain,” continued Baxter.

In May 2023, the Company announced it had identified and

implemented $65 million of annualized cost reductions for fiscal

2023 versus fiscal 2022. Today the Company announced an additional

$15 million of savings for a total of $80 million in annualized

cost reductions identified and implemented for fiscal 2023. The

annualized cost reductions of $120 million for fiscal 2024 include

a workforce reduction which is expected to generate savings of

approximately $30 million.

Charges associated with the workforce reduction are estimated to

be approximately $5 million and were recognized in the second

quarter of 2023.

The preliminary financial results included in this press release

are unaudited and based on information available to the Company as

of the date of this press release. Our actual financial results for

the second quarter of 2023 may differ (and such differences may be

material) from these preliminary estimates due to the completion of

our financial closing procedures, final adjustments and other

developments that may arise between the date of this press release

and the time that our full financial statements for the second

quarter of 2023 are finalized. As a result, you should not place

undue reliance on these preliminary estimates, as they may differ

materially from our actual results, including as a result of the

factors discussed under “Forward-Looking Statements” below.

1-for-20 Reverse Stock Split

On August 14, 2023, the Board of Directors authorized the

implementation of a 1-for-20 reverse stock split of the Company’s

common stock. The reverse stock split is expected to be effected

after market close on or about August 30, 2023 (the “Effective

Date”), with shares of the Company’s common stock expected to begin

trading on a split-adjusted basis at market open on or about August

31, 2023. Following the reverse stock split, the Company’s common

stock will continue to trade on New York Stock Exchange (NYSE)

under the symbol “EXPR” with the new CUSIP number, 30219E 202. The

implementation of the reverse stock split is expected to regain

compliance with the minimum price criteria set forth in the

continued listing standards of the New York Stock Exchange.

About EXPR

EXPR is a multi-brand fashion retailer whose portfolio includes

Express, Bonobos and UpWest. The Company operates an omnichannel

platform as well as physical and online stores. Grounded in a

belief that style, quality and value should all be found in one

place, Express is a brand with a purpose - We Create Confidence. We

Inspire Self-Expression. - powered by a styling community. Bonobos

is a menswear brand known for exceptional fit and an innovative

retail model. UpWest is an apparel, accessories and home goods

brand with a purpose to Provide Comfort for People &

Planet.

The Company has over 530 Express retail and Express Factory

Outlet stores in the United States and Puerto Rico, the express.com

online store and the Express mobile app; over 60 Bonobos Guideshop

locations and the Bonobos.com online store; and 13 UpWest retail

stores and the UpWest.com online store. EXPR is traded on the NYSE

under the symbol EXPR. For more information about our Company,

please visit www.express.com/investor and for more information

about our brands, please visit www.express.com, www.bonobos.com or

www.upwest.com.

Forward-Looking Statements

Certain statements are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to (1) statements

regarding the Company’s preliminary financial results for the

second quarter of 2023, including estimated net sales and diluted

earnings (loss) per share, and (2) statements regarding the

Company’s workforce reduction and other cost reduction actions,

including, but not limited to, charges associated with the

workforce reduction and the financial benefits (and the timing of

the realization of such benefits) expected from such actions. You

can identify these forward-looking statements by the use of words

in the future tense and statements accompanied by words such as

“outlook,” “indicator,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “scheduled,” “estimates,”

“anticipates,” “opportunity,” “leads” or the negative version of

these words or other comparable words. Forward-looking statements

are based on our current expectations and assumptions, which may

not prove to be accurate. These statements are not guarantees and

are subject to risks, uncertainties, and changes in circumstances

that are difficult to predict, and significant contingencies, many

of which are beyond the Company’s control. Many factors could cause

actual results to differ materially and adversely from these

forward-looking statements. Among these factors are (1) changes in

consumer spending and general economic conditions; (2) the duration

and severity of ongoing negative macroeconomic conditions caused by

the COVID-19 pandemic and their future impact on our business

operations, financial condition, liquidity and cash flow; (3)

geopolitical risks, including impacts from the ongoing conflict

between Russia and Ukraine and increased tensions between China and

Taiwan; (4) our ability to operate our business efficiently, manage

capital expenditures and costs, and obtain financing when required;

(5) our ability to identify and respond to new and changing fashion

trends, customer preferences, and other related factors including

selling through inventory at an appropriate price; (6) fluctuations

in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, inventory levels, and sales mix between stores

and eCommerce; (7) customer traffic at malls, shopping centers, and

at our stores; (8) competition from other retailers; (9) our

dependence on a strong brand image; (10) our ability to adapt to

changing consumer behavior and develop and maintain a relevant and

reliable omni-channel experience for our customers, including our

efforts to optimize our omni-channel platform through our

partnership with WHP Global; (11) the failure or breach of

information systems upon which we rely; (12) our ability to protect

customer data from fraud and theft; (13) our dependence upon third

parties to manufacture all of our merchandise; (14) changes in the

cost of raw materials, labor, and freight; (15) labor shortages and

supply chain disruption; (16) our dependence upon key executive

management; (17) our ability to execute our growth strategy,

EXPRESSway Forward, including, but not limited to, engaging our

customers and acquiring new ones, executing with precision to

accelerate sales and profitability, creating great product and

reinvigorating our brand; (18) our substantial lease obligations;

(19) our reliance on third parties to provide us with certain key

services for our business; (20) impairment charges on long-lived

assets; (21) claims made against us resulting in litigation or

changes in laws and regulations applicable to our business; (22)

our inability to protect our trademarks or other intellectual

property rights which may preclude the use of our trademarks or

other intellectual property around the world; (23) restrictions

imposed on us under the terms of our current credit facility,

including asset based requirements related to inventory levels,

ability to make additional borrowings, and restrictions on the

ability to effect share repurchases; (24) our inability to maintain

compliance with covenants in our current credit facility; (25)

changes in tax requirements, results of tax audits, and other

factors including timing of tax refund receipts, that may cause

fluctuations in our effective tax rate; (26) changes in tariff

rates; (27) natural disasters, extreme weather, public health

issues, including pandemics, fire, acts of terrorism or war and

other events that cause business interruption, (28) risks related

to our strategic partnership with WHP Global; (29) our ability to

realize the expected strategic and financial benefits of the

Bonobos acquisition; (30) our failure to regain compliance with the

continued listing requirements of the New York Stock Exchange, or

any future failure to meet those requirements; and (31) the

financial and other effects of our workforce reduction and other

cost reduction actions. These factors should not be construed as

exhaustive and should be read in conjunction with the additional

information concerning these and other factors in Express, Inc.’s

filings with the Securities and Exchange Commission. We undertake

no obligation to publicly update or revise any forward-looking

statement as a result of new information, future events, or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230817269271/en/

Investor Contact Greg Johnson VP, Investor Relations

gjohnson@express.com 614-474-4890

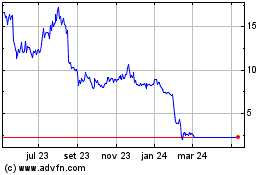

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

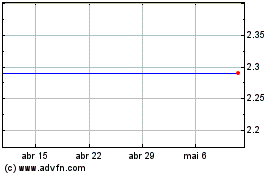

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024