AM Best Places Credit Ratings Under Review With Developing Implications for American Equity Investment Life Insurance Company and Its Subsidiaries

23 Agosto 2023 - 11:31AM

Business Wire

AM Best has placed under review with developing

implications the Financial Strength Rating of A- (Excellent) and

the Long-Term Issuer Credit Ratings (Long-Term ICRs) of “a-”

(Excellent) of American Equity Investment Life Insurance Company

and its subsidiaries, American Equity Investment Life Insurance

Company of New York (Lake Success, NY) and Eagle Life Insurance

Company, collectively referred to as American Equity. Concurrently,

AM Best has placed under review with developing implications the

Long-Term ICR of “bbb-” (Good) of American Equity Investment Life

Holding Company (AEL) [NYSE: AEL] and its Long-Term Issue Credit

Ratings (Long-Term IRs). All companies are domiciled in West Des

Moines, IA, unless otherwise specified. (Please see below for

detailed listing of the Long-Term IRs).

The Credit Rating (rating) actions follow subsequent discussions

between AM Best and American Equity since it was announced in July

2023 that a definitive agreement had been reached whereby

Brookfield Reinsurance Ltd. will acquire all outstanding shares of

common stock of the parent company, AEL, that it does not already

own, in a cash and stock transaction of approximately $4.3 billion.

The sale has been approved by AEL’s board of directors and the

transaction, which is subject to customary closing conditions,

including shareholder and regulatory approvals, is expected to be

completed by the first half of 2024.

Although AM Best commented on July 6, 2023, that the transaction

is expected to have minimal impact on American Equity’s current

strategic plan with continued investment in infrastructure (see

related press release), the current under review with developing

implications status reflects the additional need for AM Best to

further assess the financial and operations impacts of the

acquisition on American Equity’s rating fundamentals, including its

balance sheet strength and business profile. In addition, under the

terms of the merger agreement, payment of dividends on AEL common

stock is expected to be suspended through the closing of the

transaction.

AM Best will continue to closely monitor the transaction and the

impact to the operating insurance entities under AEL. The ratings

will likely remain under review pending completion of the

acquisition, and until AM Best can complete its assessment of

American Equity’s post-acquisition rating fundamentals.

The following Long-Term IRs have been placed under review with

developing implications:

American Equity Investment Life Holding

Company— -- “bbb-” (Good) on $500 million 5% senior unsecured notes

due 2027 -- “bb” (Fair) on $300 million 6.625% perpetual,

non-cumulative preferred stock -- “bb” (Fair) on $400 million 5.95%

perpetual, non-cumulative preferred stock

The following indicative Long-Term IRs under the shelf

registration have been placed under review with developing

implications:

American Equity Investment Life Holding

Company— -- “bbb-” (Good) on senior unsecured debt -- “bb+” (Fair)

on subordinated debt -- “bb” (Fair) on preferred stock

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best's

Credit Ratings. For information on the proper use of Best’s Credit

Ratings, Best’s Performance Assessments, Best’s Preliminary Credit

Assessments and AM Best press releases, please view Guide to Proper

Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2023 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230823470337/en/

Igor Bass Senior Financial Analyst +1 908 882

1646 igor.bass@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Jacqalene Lentz Director +1 908 882 2011

jacqalene.lentz@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

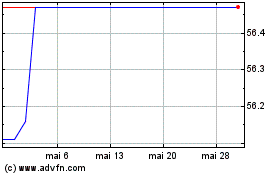

American Equity Investme... (NYSE:AEL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

American Equity Investme... (NYSE:AEL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025