Second quarter 2023 net sales and diluted loss

per share in the range of previously announced outlook

Reiterates plans to realize $120 million in

annualized savings in 2024 and goal to deliver $200 million in

annualized savings by 2025

Bolsters liquidity with new $65 million term

loan

Fashion apparel retailer Express, Inc. (NYSE: EXPR), announced

its financial results for the second quarter of 2023. These

results, which cover the thirteen weeks ended July 29, 2023, are

compared with the thirteen weeks ended July 30, 2022.

On August 30, 2023, the Company implemented a 1-for-20 reverse

stock split. All shares of the Company’s common stock contained in

its consolidated financial statements have been retroactively

adjusted to reflect the reverse stock split, which decreased shares

outstanding from 74.9 million to 3.7 million. As a result of the

reduction in weighted average shares outstanding, the Company's

previously announced second quarter 2023 diluted loss per share

outlook of $0.50 to $0.60 was recast to $10.00 to $12.00. Second

quarter 2023 diluted loss per share of $11.79 was within this

range. Excluding certain restructuring charges, acquisition-related

and integration costs and a non-cash impairment charge, second

quarter 2023 adjusted diluted loss per share of $9.05 was favorable

to this range.

"Second quarter net sales and diluted loss per share were within

the ranges of our outlook and we are gaining momentum. In the

Express brand, we drove significant, sequential improvement each

month driven by a powerful trend change in our women’s and

eCommerce businesses. This momentum continued through Labor Day,"

said Tim Baxter, Chief Executive Officer. "Bonobos sales also

exceeded our expectations, delivered operating income accretive to

our total and is positioned to be a growth engine for EXPR."

"We’ve also taken aggressive action to improve the bottom line.

As a result of the ongoing comprehensive review of our entire

expense structure, we have identified and implemented $80 million

in savings in 2023, $120 million in 2024, and our commitment grows

to $200 million by 2025. In addition to these substantial cost

reductions, we’ve also secured a $65 million term loan, and expect

to receive a $52 million CARES Act refund in the back half of the

year, which bolsters our liquidity and allows us to continue to

invest appropriately in our transformation," continued Baxter.

"We are transforming EXPR to create shareholder value and are

focused on driving long term profitable growth and delivering

positive free cash flow in our core Express business, leveraging

our omnichannel platform to reduce costs, and accelerating our

growth and profitability through our strategic partnership with WHP

Global," concluded Baxter.

Second Quarter 2023 Operating

Results

- Consolidated net sales decreased 6% to $435.3 million from

$464.9 million in the second quarter of 2022,

- Express and UpWest Brands

- Net sales decreased 15% to $394.4 million from $464.9 million

in the second quarter of 2022, with comparable sales down 14% with

significant sequential improvement each month of the quarter

- Comparable retail sales, which includes both Express stores and

eCommerce, were down 13% compared to the second quarter of 2022.

Retail stores comparable sales decreased 21% while eCommerce

comparable sales declined 1%

- Comparable outlet sales decreased 17% compared to the second

quarter of 2022

- Bonobos Brand

- Net sales were $40.9 million and exceeded our expectations

- Gross margin was 23.1% of net sales compared to 33.1% of net

sales in last year's second quarter, a decrease of approximately

1,000 basis points

- Merchandise margin contracted by 680 basis points primarily

driven by increased promotional activity and 310 basis points of

royalty expense related to the joint venture with WHP

- Buying and occupancy expenses as a percent of net sales

deleveraged approximately 320 basis points due to the decline in

comparable sales

- Selling, general, and administrative (SG&A) expenses were

$146.1 million, 33.6% of net sales, versus $143.3 million, 30.8% of

net sales, in last year's second quarter. The deleverage in the

SG&A expense rate was driven by the decline in comparable

sales

- Operating loss was $39.6 million and includes the impact of

$4.7 million in pre-tax restructuring charges, $4.6 million of

acquisition-related and integration costs in connection with the

acquisition of Bonobos and a $1.0 million non-cash impairment

charge. This compares to operating income of $10.4 million in the

second quarter of 2022

- On an adjusted basis, excluding certain restructuring charges,

acquisition-related and integration costs and an impairment charge,

operating loss1 was $29.3 million for the second quarter of

2023

- Income tax expense was $0.6 million at an effective tax rate of

(1.4)%, versus $0.3 million at an effective tax rate of 3.5% during

the second quarter of 2022. The Company's effective tax rate for

the second quarter of 2023 was impacted primarily by the recording

of an additional valuation allowance against the Company's deferred

tax assets

- Net loss was $44.1 million, or $11.79 per diluted share,

compared to net income of $7.0 million, or $2.05 per diluted share,

in the second quarter of 2022.

- On an adjusted basis, excluding certain restructuring charges,

acquisition-related and integration costs and an impairment charge,

net loss1 was $33.8 million, or $9.05 per diluted share, for the

second quarter of 2023

- Earnings before interest, taxes, depreciation, and amortization

(EBITDA)1 was negative $24.7 million, compared to $25.6 million in

the second quarter of 2022.

1 Adjusted operating income (loss), adjusted net income (loss),

adjusted diluted earnings per share and EBITDA are non-GAAP

financial measures. Please see Schedule 4 – Supplemental

Information and the reconciliation contained therein for additional

information concerning these non-GAAP financial measures.

Balance Sheet and Cash Flow

Highlights

- Cash and cash equivalents totaled $58.6 million at the end of

the second quarter of 2023 versus $37.7 million at the end of the

second quarter of 2022 and $65.6 million at the end of the fourth

quarter of 2022

- Inventory was $415.8 million, including $55.7 million of

Bonobos inventory, at the end of the second quarter of 2023, up 20%

compared to $346.2 million at the end of the second quarter of 2022

and up 14% compared to the end of the fourth quarter of 2022

- Total debt was $220.8 million at the end of the second quarter

of 2023 compared to $202.2 million at the end of the second quarter

of 2022 and $122.0 million at the end of the fourth quarter of

2022

- At the end of the second quarter of 2023, $47.5 million

remained available for borrowing under the revolving credit

facility provided by the Company's asset-based loan credit

agreement (the "ABL Credit Agreement")

- Net cash used in operations was $60.8 million for the

twenty-six weeks ended July 29, 2023, compared to net cash used in

operations of $60.8 million for the twenty-six weeks ended July 30,

2022

- Capital expenditures totaled $16.2 million for the twenty-six

weeks ended July 29, 2023, compared to $13.5 million for the

twenty-six weeks ended July 30, 2022

Expense Reduction Initiatives

The Company is continuing to conduct a comprehensive review of

its business model to identify actions that are expected to

meaningfully reduce pre-tax costs and enable a more efficient and

effective organization and has engaged external advisors to assist

in this effort. The Company has a stated goal to deliver over $200

million in annualized savings by 2025 versus 2022.

In May 2023, the Company announced it had identified and

implemented $65 million of annualized cost reductions for fiscal

2023 versus fiscal 2022.

In August 2023, the Company announced an additional $15 million

of savings for a total of $80 million in annualized cost reductions

identified and implemented for fiscal 2023. Also in August 2023,

the company announced and implemented a workforce reduction which

is expected to generate approximately $30 million in annualized

savings. The Company's outlook for the third quarter and full year

2023 includes the pro rata impact of that workforce reduction.

In addition, the Company announced that $120 million in

annualized expense reductions for fiscal 2024 versus 2022 had been

identified and implemented, which are inclusive of the savings

effectuated for fiscal 2023. The Company is also aggressively

pursuing at least $50 million in gross margin expansion

opportunities by leveraging efficiencies in sourcing, production

and the supply chain.

For additional background on the Company's expense reduction

initiatives, please read the announcement press release

here.

New Term Loan

On September 5, 2023, the Company entered into a definitive loan

agreement with ReStore Capital for a $65 million first-in-last-out

asset-based term loan, receiving $32.5 million in gross proceeds

from the term loan upon entering into the agreement, with the

remaining $32.5 million to be received on or before September 13,

2023. The term loan will bear interest at a variable rate based on

the Secured Overnight Financing Rate (“SOFR”) plus an applicable

margin of 10.00%. The term loan will mature on the earlier of (a)

November 26, 2027 and (b) the date of termination of the

commitments under the ABL Credit Agreement.

Kirkland & Ellis LLP served as legal advisor to the Company

in connection with the loan transaction.

2023 Outlook

The Company’s full year outlook remains unchanged and takes into

consideration the persistently challenging macroeconomic and retail

apparel environments, including reduced consumer spending and

increased price sensitivity in discretionary categories.

Third Quarter 2023

The Company expects the following for the third quarter of 2023

compared to the third quarter of 2022:

- Net sales of approximately $460 million to $490 million,

including approximately $50 million in Bonobos net sales

- Gross margin rate to decrease approximately 200 basis points,

including approximately 300 basis points of royalty expense related

to the license agreement with WHP Global, and a positive

approximately 300 basis point benefit from Bonobos

- SG&A expenses as a percent of net sales to leverage

approximately 275 basis points, including approximately 150 basis

point deleverage from Bonobos

- Net interest expense of $6 million

- Effective tax rate of essentially zero percent

- Diluted loss per share of $5.50 to $7.50

- Consolidated inventory to increase by low-double digits with

the addition of Bonobos

Full Year 2023

The Company's full year outlook remains unchanged and it expects

the following for the full year of 2023 compared to the full year

of 2022:

- Net sales of approximately $1.9 billion to $2.0 billion,

including approximately $150 million in Bonobos net sales

- Net interest expense of $20 million

- Effective tax rate of essentially zero percent

- Diluted loss per share of $30.00 to $34.00

- Capital expenditures of approximately $25 million

See Schedule 5 for a discussion of projected real estate

activity.

Conference Call Information

A conference call to discuss second quarter 2023 results is

scheduled for September 6, 2023 at 8:30 a.m. Eastern Time (ET).

Investors and analysts interested in participating in the earnings

call are invited to dial (888) 550-5723 approximately ten minutes

prior to the start of the call. The conference call will also be

webcast live at www.express.com/investor. A telephone replay of

this call will be available beginning at 12:00 p.m. ET on September

6, 2023 until 11:59 p.m. ET on September 13, 2023, and can be

accessed by dialing (800) 770-2030 and entering the replay pin

number 1790468. In addition, an investor presentation of second

quarter 2023 results will be available at www.express.com/investor

at approximately 7:00 a.m. ET on September 6, 2023.

About EXPR

EXPR is a multi-brand fashion retailer whose portfolio includes

Express, Bonobos and UpWest. The Company operates an omnichannel

platform as well as physical and online stores. Grounded in a

belief that style, quality and value should all be found in one

place, Express is a brand with a purpose - We Create Confidence. We

Inspire Self-Expression. - powered by a styling community. Bonobos

is a menswear brand known for exceptional fit and an innovative

retail model. UpWest is an apparel, accessories and home goods

brand with a purpose to Provide Comfort for People &

Planet.

The Company has 530 Express retail and Express factory outlet

stores in the United States and Puerto Rico, the Express.com online

store and the Express mobile app; 60 Bonobos Guideshop locations

and the Bonobos.com online store; and 11 UpWest retail stores and

the UpWest.com online store. EXPR is traded on the NYSE under the

symbol EXPR. For more information about our Company, please visit

www.express.com/investor and for more information about our brands,

please visit www.express.com, www.bonobos.com or

www.upwest.com.

Forward-Looking Statements

Certain statements are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to (1) guidance and

expectations, including statements regarding expected operating

margins, comparable sales, effective tax rates, interest income,

net income, diluted earnings per share, cash tax refunds,

liquidity, EBITDA, free cash flow, eCommerce demand, and capital

expenditures, (2) statements regarding expected store openings,

store closures, store conversions, and gross square footage, (3)

statements regarding the Company's strategy, plans, and

initiatives, including, but not limited to, results expected from

such strategy, plans, and initiatives, (4) statements regarding the

Company’s workforce reduction and other cost reduction actions,

including, but not limited to, charges associated with the

workforce reduction and the financial benefits (and the timing of

the realization of such benefits) expected from such actions, and

(5) the anticipated benefits or effects of the Bonobos acquisition,

including statements regarding operating results, financial

efficiencies, operational synergies, and our plans, objectives,

expectations and intentions related to the acquired assets. You can

identify these forward-looking statements by the use of words in

the future tense and statements accompanied by words such as

“outlook,” “indicator,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “scheduled,” “estimates,”

“anticipates,” “opportunity,” “leads” or the negative version of

these words or other comparable words. Forward-looking statements

are based on our current expectations and assumptions, which may

not prove to be accurate. These statements are not guarantees and

are subject to risks, uncertainties, and changes in circumstances

that are difficult to predict, and significant contingencies, many

of which are beyond the Company's control. Many factors could cause

actual results to differ materially and adversely from these

forward-looking statements. Among these factors are (1) changes in

consumer spending and general economic conditions; (2) the duration

and severity of ongoing negative macroeconomic conditions caused by

the COVID-19 pandemic and their future impact on our business

operations, financial condition, liquidity and cash flow; (3)

geopolitical risks, including impacts from the ongoing conflict

between Russia and Ukraine and increased tensions between China and

Taiwan; (4) our ability to operate our business efficiently, manage

capital expenditures and costs, and obtain financing when required;

(5) our ability to identify and respond to new and changing fashion

trends, customer preferences, and other related factors including

selling through inventory at an appropriate price; (6) fluctuations

in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, inventory levels, and sales mix between stores

and eCommerce; (7) customer traffic at malls, shopping centers, and

at our stores; (8) competition from other retailers; (9) our

dependence on a strong brand image; (10) our ability to adapt to

changing consumer behavior and develop and maintain a relevant and

reliable omni-channel experience for our customers, including our

efforts to optimize our omni-channel platform through our

partnership with WHP Global; (11) the failure or breach of

information systems upon which we rely; (12) our ability to protect

customer data from fraud and theft; (13) our dependence upon third

parties to manufacture all of our merchandise; (14) changes in the

cost of raw materials, labor, and freight; (15) labor shortages and

supply chain disruption; (16) our dependence upon key executive

management; (17) our ability to execute our growth strategy,

EXPRESSway Forward, including, but not limited to, engaging our

customers and acquiring new ones, executing with precision to

accelerate sales and profitability, creating great product and

reinvigorating our brand; (18) our substantial lease obligations;

(19) our reliance on third parties to provide us with certain key

services for our business; (20) impairment charges on long-lived

assets; (21) claims made against us resulting in litigation or

changes in laws and regulations applicable to our business; (22)

our inability to protect our trademarks or other intellectual

property rights which may preclude the use of our trademarks or

other intellectual property around the world; (23) restrictions

imposed on us under the terms of our current credit facility,

including asset based requirements related to inventory levels,

ability to make additional borrowings, and restrictions on the

ability to effect share repurchases; (24) our inability to maintain

compliance with covenants in our current credit facility; (25)

changes in tax requirements, results of tax audits, and other

factors including timing of tax refund receipts, that may cause

fluctuations in our effective tax rate; (26) changes in tariff

rates; (27) natural disasters, extreme weather, public health

issues, including pandemics, fire, acts of terrorism or war and

other events that cause business interruption, (28) risks related

to our strategic partnership with WHP Global; (29) our ability to

realize the expected strategic and financial benefits of the

Bonobos acquisition; (30) our failure to regain compliance with the

continued listing requirements of the New York Stock Exchange, or

any future failure to meet those requirements; and (31) the

financial and other effects of our workforce reduction and other

cost reduction actions, including our inability to realize the

benefits from such actions within the anticipated timeframe. These

factors should not be construed as exhaustive and should be read in

conjunction with the additional information concerning these and

other factors in Express, Inc.'s filings with the Securities and

Exchange Commission. We undertake no obligation to publicly update

or revise any forward-looking statement as a result of new

information, future events, or otherwise, except as required by

law.

Schedule 1

Express, Inc.

Consolidated Balance

Sheets

(In thousands)

(Unaudited)

July 29, 2023

January 28, 2023

July 30, 2022

ASSETS

Current Assets:

Cash and cash equivalents

$

58,581

$

65,612

$

37,667

Receivables, net

18,222

12,374

11,924

Income tax receivable

2,350

1,462

2,229

Inventories

415,810

365,649

346,229

Prepaid royalty

33,581

59,565

—

Prepaid rent

3,755

7,744

6,321

Other

24,554

21,998

22,628

Total current assets

556,853

534,404

426,998

Right of Use Asset, Net

544,873

505,350

546,259

Property and Equipment

1,013,097

1,019,577

989,088

Less: accumulated depreciation

(888,133

)

(886,193

)

(856,324

)

Property and equipment, net

124,964

133,384

132,764

Non-Current Income Tax Receivable

52,278

52,278

52,278

Equity Method Investment

166,210

166,106

—

Other Assets

6,855

6,803

4,656

TOTAL ASSETS

$

1,452,033

$

1,398,325

$

1,162,955

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Short-term lease liability

$

191,554

$

189,006

$

190,324

Accounts payable

232,353

191,386

166,378

Deferred royalty income

9,219

19,852

—

Deferred revenue

39,505

35,543

31,632

Short-term debt

—

—

4,500

Accrued expenses

123,687

105,803

106,087

Total current liabilities

596,318

541,590

498,921

Long-Term Lease Liability

429,557

406,448

456,661

Long-Term Debt

220,750

122,000

197,673

Other Long-Term Liabilities

19,492

20,718

10,213

Total Liabilities

1,266,117

1,090,756

1,163,468

Commitments and Contingencies

Total Stockholders’ Equity (Deficit)

185,916

307,569

(513

)

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

1,452,033

$

1,398,325

$

1,162,955

Schedule 2

Express, Inc.

Consolidated Statements of

Income

(In thousands, except per share

amounts)

(Unaudited)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Net Sales

$

435,344

$

464,919

$

818,601

$

915,704

Cost of Goods Sold, Buying and Occupancy

Costs

334,975

311,218

654,439

630,503

GROSS PROFIT

100,369

153,701

164,162

285,201

Operating Expenses (Income):

Selling, general, and administrative

expenses

146,091

143,278

285,439

284,371

Royalty income

(6,193

)

—

(10,633

)

—

Other operating expense (income), net

42

11

(958

)

(479

)

TOTAL OPERATING EXPENSES

139,940

143,289

273,848

283,892

OPERATING (LOSS) INCOME

(39,571

)

10,412

(109,686

)

1,309

Interest Expense, Net

3,874

3,800

6,817

7,294

Other Income, Net

—

(676

)

—

(876

)

(LOSS) INCOME BEFORE INCOME

TAXES

(43,445

)

7,288

(116,503

)

(5,109

)

Income Tax Expense (Benefit)

611

252

980

(231

)

NET (LOSS) INCOME

$

(44,056

)

$

7,036

$

(117,483

)

$

(4,878

)

EARNINGS PER SHARE:

Basic(1)

$

(11.79

)

$

2.06

$

(31.62

)

$

(1.44

)

Diluted(1)

$

(11.79

)

$

2.05

$

(31.62

)

$

(1.44

)

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic(1)

3,737

3,408

3,715

3,384

Diluted(1)

3,737

3,437

3,715

3,384

1.

All share and per share amounts have been

retrospectively adjusted to reflect the Company’s 1-for-20 reverse

stock split which was effected after the close of market on August

30, 2023.

Schedule 3

Express, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Twenty-Six Weeks Ended

July 29, 2023

July 30, 2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net loss

$

(117,483

)

$

(4,878

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

28,851

30,088

Loss on disposal of property and

equipment

42

21

Impairment of property, equipment and

lease assets

996

—

Share-based compensation

(3,810

)

5,013

Landlord allowance amortization

(154

)

(234

)

Changes in operating assets and

liabilities:

Receivables, net

(3,777

)

(180

)

Income tax receivable

(888

)

(842

)

Prepaid royalty

25,984

—

Inventories

1,132

12,566

Deferred royalty income

(10,633

)

—

Accounts payable, deferred revenue, and

accrued expenses

28,357

(76,673

)

Other assets and liabilities

(9,417

)

(25,690

)

NET CASH USED IN OPERATING

ACTIVITIES

(60,800

)

(60,809

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(16,217

)

(13,494

)

Acquisition, net of cash acquired

(28,300

)

—

Costs related to WHP transaction

(104

)

—

NET CASH USED IN INVESTING

ACTIVITIES

(44,621

)

(13,494

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from borrowings under the

revolving credit facility

205,250

144,000

Repayment of borrowings under the

revolving credit facility

(106,500

)

(69,000

)

Repayment of borrowings under the term

loan facility

—

(2,250

)

Repurchase of common stock for tax

withholding obligations

(360

)

(1,956

)

NET CASH PROVIDED BY FINANCING

ACTIVITIES

98,390

70,794

NET DECREASE IN CASH AND CASH

EQUIVALENTS

(7,031

)

(3,509

)

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

65,612

41,176

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

58,581

$

37,667

Schedule 4

Express, Inc.

Supplemental Information -

Consolidated Statements of Income

Reconciliation of GAAP to

Non-GAAP Financial Measures

(Unaudited)

The Company supplements the reporting of its financial

information determined under United States generally accepted

accounting principles (GAAP) with certain non-GAAP financial

measures: adjusted operating income (loss), adjusted net income

(loss), adjusted diluted earnings per share and EBITDA. Management

strongly encourages investors and stockholders to review the

Company's financial statements and publicly-filed reports in their

entirety and not to rely on any single financial measure.

Adjusted Operating Income (Loss),

Adjusted Net Income (Loss) and Adjusted Diluted Earnings Per

Share

Adjusted operating income (loss), adjusted net income (loss),

and adjusted diluted earnings per share exclude the impact of

certain items that the Company does not believe are directly

related to its underlying operations.

How These Measures Are Useful

The Company believes that these non-GAAP measures provide

additional useful information to assist stockholders in

understanding its financial results and assessing its prospects for

future performance. Management believes adjusted operating income

(loss), adjusted net income (loss), and adjusted diluted earnings

per share are important indicators of the Company's business

performance because they exclude items that may not be indicative

of, or are unrelated to, the Company's underlying operating

results, and may provide a better baseline for analyzing trends in

the business.

Limitations of the Usefulness of These Measures

Because non-GAAP financial measures are not standardized,

adjusted operating income (loss), adjusted net income (loss), and

adjusted diluted earnings per share may differ from similarly

titled measures used by other companies due to different methods of

calculation. These adjusted financial measures should not be

considered in isolation or as a substitute for reported operating

income (loss), net income (loss), or diluted earnings per share.

These non-GAAP financial measures reflect an additional way of

viewing the Company's operations that, when viewed together with

the GAAP results, provide a more complete understanding of the

Company's business. A reconciliation of adjusted operating income

(loss), adjusted net income (loss) and adjusted diluted earnings

per share to the most directly comparable GAAP measure is set forth

below:

Thirteen Weeks Ended July 29,

2023

(in thousands, except per share

amounts)

Operating Loss

Income Tax Impact(a)

Net Loss

Diluted Earnings per

Share

Weighted Average Diluted

Shares Outstanding(e)

Reported GAAP Measure

$

(39,571

)

$

(44,056

)

$

(11.79

)

3,737

Impact of restructuring(b)

4,658

—

4,658

1.25

Acquisition-related and integration

costs(c)

4,595

—

4,595

1.23

Impairment of property, equipment and

lease assets(d)

996

—

996

0.27

Adjusted Non-GAAP Measure

$

(29,322

)

$

(33,807

)

$

(9.05

)

a.

Items tax effected at the applicable

deferred or statutory rate offset by the recording of a non-cash

valuation allowance.

b.

Represents restructuring charges primarily

related to employee severance and benefits of which $2.7 million

was recorded in cost of goods sold, buying and occupancy costs and

$2.0 million was recorded in selling, general and administrative

expenses in the unaudited Consolidated Statements of Income and

Comprehensive Income.

c.

Represents acquisition-related and

integration costs incurred in connection with the acquisition of

Bonobos, which were recorded in selling, general and administrative

expenses in the unaudited Consolidated Statements of Income and

Comprehensive Income.

d.

Represents a non-cash impairment charge

taken against certain long-lived store related assets and right of

use assets, which was recorded in cost of goods sold, buying and

occupancy costs in the unaudited Consolidated Statements of Income

and Comprehensive Income.

e.

Share amount has been retrospectively

adjusted to reflect the Company’s 1-for-20 reverse stock split

which was effected after the close of market on August 30,

2023.

Twenty-Six Weeks Ended July

29, 2023

(in thousands, except per share

amounts)

Operating Loss

Income Tax Impact(a)

Net Loss

Diluted Earnings per

Share

Weighted Average Diluted

Shares Outstanding(e)

Reported GAAP Measure

$

(109,686

)

$

(117,483

)

$

(31.62

)

3,715

Impact of restructuring(b)

4,658

—

4,658

1.25

Acquisition-related and integration

costs(c)

4,595

—

4,595

1.24

Impairment of property, equipment and

lease assets(d)

996

—

996

0.27

Adjusted Non-GAAP Measure

$

(99,437

)

$

(107,234

)

$

(28.87

)

a.

Items tax effected at the applicable

deferred or statutory rate offset by the recording of a non-cash

valuation allowance.

b.

Represents restructuring charges primarily

related to employee severance and benefits of which $2.7 million

was recorded in cost of goods sold, buying and occupancy costs and

$2.0 million was recorded in selling, general and administrative

expenses in the unaudited Consolidated Statements of Income and

Comprehensive Income.

c.

Represents acquisition-related and

integration costs incurred in connection with the acquisition of

Bonobos, which were recorded in selling, general and administrative

expenses in the unaudited Consolidated Statements of Income and

Comprehensive Income.

d.

Represents a non-cash impairment charge

taken against certain long-lived store related assets and right of

use assets, which was recorded in cost of goods sold, buying and

occupancy costs in the unaudited Consolidated Statements of Income

and Comprehensive Income.

e.

Share amount has been retrospectively

adjusted to reflect the Company’s 1-for-20 reverse stock split

which was effected after the close of market on August 30,

2023.

EBITDA

EBITDA is defined as net income (loss) before interest expense

(net of interest income), income tax expense and depreciation and

amortization expense.

How This Measure Is Useful

When used in conjunction with GAAP financial measures, EBITDA is

a supplemental measure of operating performance that the Company

believes is a useful measure to facilitate comparisons to

historical performance. EBITDA is used as a performance measure in

the Company's long-term executive compensation program for purposes

of determining the number of equity awards that are ultimately

earned and is also a metric used in our short-term cash incentive

compensation plan.

Limitations of the Usefulness of This Measure

Because non-GAAP financial measures are not standardized, EBITDA

may differ from similarly titled measures used by other companies

due to different methods of calculation. Presentation of EBITDA is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. Therefore, this measure may not provide a complete

understanding of the Company's performance and should be reviewed

in conjunction with the GAAP financial measures. A reconciliation

of EBITDA to the most directly comparable GAAP measures, is set

forth below:

Thirteen Weeks Ended

Twenty-Six Weeks Ended

(in thousands)

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Net (loss) income

$

(44,056

)

$

7,036

$

(117,483

)

$

(4,878

)

Interest expense, net

3,874

3,800

6,817

7,294

Income tax expense (benefit)

611

252

980

(231

)

Depreciation and amortization

14,875

14,477

29,121

29,213

EBITDA (Non-GAAP Measure)

$

(24,696

)

$

25,565

$

(80,565

)

$

31,398

Schedule 5

Express, Inc.

Real Estate Activity

(Unaudited)

Second Quarter 2023 -

Actual

July 29, 2023 - Actual

Company-Operated

Stores

Opened

Closed

Store Count

Gross Square Footage

Retail Stores

—

(2)

325

Outlet Stores

—

(1)

194

Express Edit Stores

1

—

11

UpWest Stores

1

(3)

11

Bonobos Guideshops

—

—

60

TOTAL

2

(6)

601

4.6 million

Third Quarter 2023 -

Projected

October 28, 2023 -

Projected

Company-Operated

Stores

Opened

Closed

Store Count

Gross Square Footage

Retail Stores

—

—

325

Outlet Stores

1

(1)

194

Express Edit Stores

—

—

11

UpWest Stores

2

—

13

Bonobos Guideshops

—

—

60

TOTAL

3

(1)

603

4.6 million

Full Year 2023 -

Projected

February 3, 2024 -

Projected

Company-Operated

Stores

Opened

Closed

Store Count

Gross Square Footage

Retail Stores

—

(10)

322

Outlet Stores

1

(5)

194

Express Edit Stores

1

—

11

UpWest Stores

3

(4)

12

Bonobos Guideshops

—

(2)

60

TOTAL

5

(21)

599

4.5 million

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230905218567/en/

INVESTOR CONTACT Greg

Johnson VP, Investor Relations gjohnson@express.com (614)

474-4890

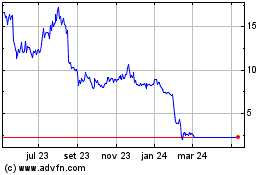

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024