Baikowski: 2023 half-year results

27 Setembro 2023 - 3:45AM

Business Wire

Resilient performance

Regulatory News:

Baikowski (Paris:ALBKK):

“Baikowski®’s revenue was down compared with the particularly

high level of H1 2022, due to a cyclical slowdown in the electronic

market.

This temporary change has no impact on the Group’s roadmap,

which is based on long-term markets that remain resolutely

buoyant.”

Benoît GRENOT – CEO

Consolidated data (in €m)

H1 2023

H1 2022

Change

Revenue

22.9

28.1

-18.4%

EBITDA

% of revenue

5.6

24.6%

7.2

25.7%

-21.8%

-1.1 pt

EBIT (Operating income)

% of revenue

3.6

16.0%

5.5

19.5%

-32.9%

-3.5 pts

Group share of net income

% of revenue

2.4

10.6%

3.9

13.8%

-37.0%

-3.2 pts

Baikowski® confirms first-half 2023 revenue of €22.9 million,

down 18.6% on a like-for-like basis compared with 2022.

After strong growth in 2022, sales to the electronics market,

which has entered a trough in the consumer cycle, have been down

significantly since the second quarter of 2023. This weakness was

partly offset by the strong growth trajectory of the Group’s other

markets, which remain buoyant (aerospace & technical

ceramics).

The Group recorded EBIT of €3.6 million, or 16% of revenue

(including a €0.9 million share of the income of equity-accounted

companies).

With a net financial loss of €0.1 million and a tax expense of

€1.1 million in the six months to the end of June 2023, the Group

share of consolidated net income was €2.4 million for the

period.

As of June 30, 2023, shareholders’ equity (Group share) was

€43.5 million. During the first half of 2023, shareholders’ equity

(Group share) declined by €0.8 million, mainly reflecting the

Group’s net income of €2.4 million, less dividends paid in the

amount of €2.2 million, and an unfavorable translation adjustment

of €1.0 million.

After a good first quarter in 2023, sales to the electronics

market have been trending significantly down. Forecasts of orders

received since the last press release of July 27, 2023 indicate

that this very weak demand will continue into the second half of

the year. Given the longer-than-expected slowdown, the electronics

market is not expected to rebound until 2024. Against this backdrop

of weak demand, the Group will continue its cost discipline in

order to mitigate the sharp decrease in EBITDA margin expected in

2023 compared with 2022.

In markets that remain buoyant and with

considerable scope for new developments, the Group is

confident about its long-term outlook.

Upcoming events: Lyon Pôle Bourse Forum,

September 27, 2023

About Baikowski®: Baikowski® has existed for a hundred

years and is a leading manufacturer of specialist industrial

minerals and, more particularly, of ultra-pure alumina powders and

formulations, as well as other high-quality oxides and composites

such as spinel, ZTA, YAG and cerium for technical ceramic

applications, precision polishing, crystals and additives or

coverings. The quality of Baikowski® products enables the Group to

serve a wide range of high-tech markets (electronics, automotive,

energy, aerospace & defense, medical and watchmaking &

telephony).

Find all the company’s information on:

www.baikowski.com – finance@baikowski.com Euronext: ALBKK – ISIN:

FR0013384369

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230926813827/en/

Financial communication M. Tall +33 (0)1 75 77 54 65

finance@baikowski.com

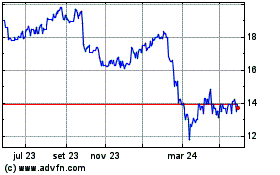

Baikowski (EU:ALBKK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

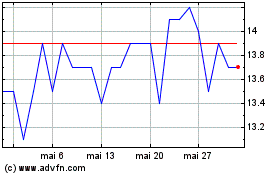

Baikowski (EU:ALBKK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024