- Subscription of €5.7 million representing 95% of the initial

amount

- Cemag Invest and Bpifrance now own respectively 18.0% and 21.6%

of equity and 17.6% and 23.6% of voting rights

Regulatory News:

This press release must not be distributed directly or

indirectly in the United States, Canada, Australia, or Japan.

Advicenne (Euronext Growth® - FR0013296746 - ALDVI), a

pharmaceutical company specializing in the development and

marketing of innovative treatments for people suffering from rare

kidney diseases (the "Company"), announces the results of

the capital increase by issue of new ordinary shares (the “New

Shares”) with the maintenance of the shareholders' preferential

subscription right (the “DPS”) announced on 11 September 2023. This

transaction raised €5.7 million by issuing 2,366,520 New Shares at

a unit price of €2.41.

Philippe Boucheron, Deputy Chief Biotech at Bpifrance

and Chairman of the Board of Directors of Advicenne, stated:

“We wanted to support Advicenne and its entire team, despite the

particularly bad market situation. Investment opportunities in a

commercial company in our sector are rare, especially in France.

The teams were able to develop Sibnayal®, market it and establish

partnerships in Europe. They are now able to develop this product,

greatly drifted, commercially and clinically in new indications, as

well as in the United States. It was important that we were at

their side and alongside other investors, especially Cemag

Invest.”

Reminder of the purpose of the Capital Increase

The gross proceeds of the right issue amounted € 5,703,313.20.

As stated in the presse release issued on September 11, 2023, funds

will be allocated as follows:

- around 40% for the commercial development of Sibnayal®,

particularly in France and the UK, where Advicenne has direct sales

operations ;

- around 40% to optimize the industrial and clinical development

of ADV7103;

- 20% to finance the Company's ongoing operations. Depuy

The Capital Increase was part of financing to enable the Company

reaching operating profitability, may ensure the financing of

Advicenne's anticipated cash requirements until the first quarter

of 2025.

Didier Laurens, Chief Executive Officer, added: “I

would like to thank all of our long-standing shareholders,

including Bpifrance Investissement and Cemag Invest, as well as the

institutional and individual investors who participated in this

transaction, in a particularly difficult market environment, marked

by continued inflation, rising interest rates and a significant

reduction in flows invested in small caps. Their investment will

allow us to continue Advicenne’s strategic development plan around

Sibnayal® in both Europe and the United States, in both ATRd and

cystinuria.”

Results of the capital increase with preference subscription

rights

The Capital Increase with preferential subscription rights was

the subject of a global request for 2,366,520 New Shares at a unit

price of € 2.411, at a rate of 1 New Share for 4 existing shares

owned, for a total requested amount of € 5,703,313.20, representing

95.07% of the amount of the initial offer (€ 5,999,181.67).

Subscriptions were divided as follows:

- 534,864 Irreducible New Shares representing 23% of the New

Shares to be issued;

- 1,301,109 Reducible New Shares representing 55% of the New

Shares to be issued. The service rate for reducible applications is

therefore 100%.

to which were added:

- 530,547 Free subscription New Shares representing 22% of the

New Shares to be issued, allocated by the Board of Directors for

the benefit of FPS Innovation 1 and Promontoires as part of their

subscription commitment and for the benefit of other institutional

investor within the framework of its freedom to distribute shares

not subscribed irreducibly and reducible provided for in Article

L.225-134 I. 2 of the French Commercial Code.

As a reminder, the Capital Increase benefited, before its

launch, from subscription commitments representing more than 75% of

the operation (excluding the exercise of the extension clause).

In accordance with their subscription commitments:

- CEMAG INVEST, the Company’s reference shareholder, subscribed

191,411 New Shares irreducibly and 1,260,871 New Shares reducible

for a total amount of € 3,499,999.62 representing a total of

1,452,282 New Shares;

- the FPS Innovation 1 fund, a fund managed by Bpifrance

Investissement, also a management company of the Innobio fund, a

reference shareholder of the Company, subscribed 414,937 New Shares

freely for a total amount of € 999,998.17;

- Promontoires2 has subscribed 41,493 New Shares freely for a

total amount of € 99,998.13.

Settlement of delivery of New Shares

At the end of the settlement, which will take place on October

4, 2023, Advicenne’s share capital will amount to € 2,464,734.20

and will consist of 12 323 671 shares with a nominal value of

€0.20.

New Shares will be the subject of an application for admission

to trading on Euronext Growth in Paris on the same day, on the same

listing line as existing shares (ISIN code FR0013296746 – ALDVI

mnemonic code).

Impact of the issue on shareholdering structure

According to the knowledge of the Company’s share capital and

voting rights post right issue is as follows:

Share capital post right issue (on a

non-fully diluted basis)

Shares

%

Voting rights

%

Management & Employees

108 778

0,88%

186 556

1,10%

Subtotal Management &

Employees

108 778

0,88%

186 556

1,10%

Bpifrance Investissement1

2 664 505

21,62%

3 990 073

23,63%

Cemag Invest

2 217 928

18,00%

2 965 992

17,56%

Sub-total Board of

Directors

4 882 433

39,62%

6 956 065

41,19%

Irdi Soridec Gestion

435 511

3,53%

796 183

4,71%

IXO Private Equity

769 802

6,25%

1 539 604

9,12%

Free float

6 090 601

49,42%

7 410 180

43,88%

Treasury shares2

36 546

0,30%

0

0,00%

Total

12 323 671

100,00%

16 888 588

100,00%

1 All the funds managed by Bpifrance (included FPS Innovation

1). 2 Treasury shares before the launch of the share capital

increase on 8 September 2023.

Share capital post right issue (on a

fully diluted basis)

Shares

%

Voting rights

%

Management & Employees

612 278

4,63%

690 056

3,88%

Subtotal Management &

Employees

612 278

4,63%

690 056

3,88%

Bpifrance Investissement1

2 664 505

20,14%

3 990 073

22,42%

Cemag Invest

2 217 928

16,76%

2 965 992

16,67%

Sub-total Board of Directors

4 882 433

36,90%

6 956 065

39,09%

Irdi Soridec Gestion

435 511

3,29%

796 183

4,47%

IXO Private Equity

769 802

5,82%

1 539 604

8,65%

Free float

6 468 101

48,89%

7 787 680

43,76%

Treasury shares2

36 546

0,28%

0

0,00%

Total

13 229 671

100,00%

17 794 588

100,00%

1 All the funds managed by Bpifrance (included FPS Innovation

1). 2 Treasury shares before the launch of the share capital

increase on 8 September 2023.

Impact of the issue on shareholders' equity per share

The impact of the issuance of the New Shares on the shareholding

of a shareholder holding 1.00% of the Company's share capital prior

to the Capital Increase and not subscribing to it is as

follows:

Shareholder participation (%)

Undiluted basis **

Diluted basis **

After issuance of the New Shares via the

Offering

1.00 %

0.92 %

After issuance of 2,366,520 New Shares via

the Offering

0.81 %

0.75 %

* on the basis of 9,957,151 existing shares at September 11,

2023 ** if all BSPCEs are exercised, representing a total number of

shares of 906,000.

The impact of the issuance of the New Shares on consolidated

shareholders' equity per share (calculated on the basis of

consolidated shareholders' equity at June 30, 2023 is as

follows:

Share of equity per share (in

€)

Undiluted basis *

Diluted basis **

After issuance of the New Shares via the

Offering

-1.41 €

-0.61 €

After issuance of 2,366,520 New Shares via

the Offering

-1.14 €

-0.50 €

* on the basis of 9,957,151 existing shares at September 11,

2023 ** if all BSPCEs are exercised, representing a total number of

shares of 906,000.

Reminder of the main terms and conditions of the capital

increase

Legal framework of the Capital

Increase

On 11 September 2023, Advicenne's Board of Directors, making use

of the authorization granted by the 12th and 18th resolutions of

the Combined General Meeting of June 8, 2023, decided to implement

the authorization granted to it, decided to launch a capital

increase with pre-emptive subscription rights and its

implementation.

A notice to shareholders relating to the transaction was

published on September 11, 2023 in the Bulletin des Annonces

Légales et Obligatoires (BALO).

Prospectus

In accordance with the provisions of Article L.411-2-1 1° of the

French Monetary and Financial Code and Article 211-2 of the General

Regulations of the Autorité des Marchés Financiers (the "AMF"), the

Capital Increase will not give rise to a prospectus subject to

approval by the AMF, as the total amount of the offering calculated

over a twelve-month period does not exceed €8,000,000.

Undertakings to abstain from trading and

to retain shares

The Company has entered into a 6-month lock-up commitment in

connection with the Capital Increase.

Suspension of the right to exercise the

Company's BSPCE warrants

Holders of BSPCE warrants allocated by the Company are informed

of the resumption of their right to the allocation of new shares in

the Company with effect from the settlement of delivery of the New

Shares, October 4, 2023. The rights of holders of warrants

allocated or issued by the Company who have not exercised their

right to the allocation of shares in the Company by September 16,

2023 (00:00 Paris time) will be preserved in accordance with legal

and regulatory provisions.

Risk factors

Risk factors relating to the Company and its business are set

out in its 2022 universal registration document and in the 2023

half-year report, available in the Investor Relations section of

its website (https://advicenne.com/).

The occurrence of any or all these risks could have an adverse

effect on the Company's business, financial situation, results,

development, or prospects.

In addition, investors are invited to consider the following

risks specific to the Capital Increase:

- the volatility and liquidity of the Company's shares could

fluctuate significantly;

- sales of the Company's shares could occur on the market and

adversely affect the Company's share price;

- the Company's shareholders could suffer potentially significant

dilution because of any future capital increases.

Capital Increase Partners

TP ICAP

Global Coordinator,

Lead Manager and Bookrunner

Bird & Bird

Legal advice

About Advicenne

Advicenne (Euronext: ALDVI) is a specialty pharmaceutical

company founded in 2007, specializing in the development of

innovative treatments in Nephrology. Its lead product Sibnayal®

(ADV7103) has received its Marketing Approval for distal renal

tubular acidosis in EU and GB. ADV7103 is currently in late-stage

development in cystinuria in Europe and in dRTA and cystinuria in

the US and in Canada. Headquartered in Paris, Advicenne, listed on

the Euronext Paris stock exchange since 2017, has now been listed

on Euronext Growth Paris since its transfer on March 30, 2022.

For additional information, see: https://advicenne.com/.

Forward-looking statements

This press release contains forward-looking statements. These

statements are not historical facts. These statements include

projections and estimates and their underlying assumptions,

statements regarding plans, objectives, intentions and expectations

with respect to future financial results, events, operations,

product development and potential, and statements regarding future

performance. Forward-looking statements are often identified by the

words "expects", "anticipates", "believes", "intends", "estimates",

"plans" and similar expressions. Although Advicenne's management

believes that the expectations reflected in such forward-looking

statements are reasonable, investors are cautioned that

forward-looking information and statements are subject to various

risks and uncertainties, many of which are difficult to predict and

generally beyond Advicenne's control, that could cause actual

results and events to differ materially from those expressed in, or

implied or projected by, the forward-looking information and

statements. These risks and uncertainties include in particular

those inherent in the marketing and commercialization of drugs

developed by Advicenne as well as those developed or identified in

the public documents filed by Advicenne with the Autorité des

marchés financiers, including those listed in chapter 3 "Risk

Factors" of Advicenne's universal registration document filed with

the Autorité des marchés financiers on April 28, 2023 and in the

2023 half-year report, available free of charge on the website of

the Company ((https://advicenne.com/). Subject to applicable

regulations, in particular articles 223-1 et seq. of the general

regulations of the Autorité des marchés financiers, Advicenne does

not undertake to update any forward-looking information or

statements.

Disclaimer

This press release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

common shares in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful in the absence of

registration or approval under the securities laws of such state or

jurisdiction. The distribution of this press release may be subject

to specific regulations in certain countries. Persons in possession

of this document are required to inform themselves about and to

observe any such local restrictions.

This press release constitutes a promotional communication and

not a prospectus within the meaning of Regulation (EU) 2017/1129 of

the European Parliament and of the Council of June 14, 2017 (as

amended the "Prospectus Regulation"). With respect to member states

of the European Economic Area other than France (the "Member

States"), no action has been or will be taken to permit a public

offering of the securities that would require the publication of a

prospectus in any of these Member States. Consequently, the

securities cannot and will not be offered in any Member State

(other than France), except in accordance with the exemptions

provided for in Article 1(4) of the Prospectus Regulation, or in

other cases not requiring the publication by Advicenne of a

prospectus under the Prospectus Regulation and/or the regulations

applicable in those Member States. This press release does not

constitute an offer of securities to the public in the United

Kingdom. This press release may not be published, distributed or

disseminated in the United States (including its territories and

possessions). This press release does not constitute an offer or

solicitation to buy, sell or subscribe for any securities in the

United States. The securities mentioned in this press release have

not been registered under the U.S. Securities Act of 1933, as

amended (the "Securities Act"), or any applicable state or federal

securities laws, and may not be offered or sold in the United

States absent registration under the Securities Act, except

pursuant to an applicable exemption from, or in a transaction not

subject to, registration under the Securities Act. Advicenne does

not intend to register the offering in whole or in part in the

United States under or pursuant to the Securities Act or to conduct

a public offering in the United States. This press release may not

be distributed directly or indirectly in the United States, Canada,

Australia or Japan. Lastly, this press release may be drafted in

either French or English. In the event of any discrepancies between

the two texts, the French version shall prevail.

1 A discount of 27,4 % to the closing price of Advicenne’s

shares on September 8, 2023 (3,32 €) prior to the fixing of the

issue price by the Board of Directors. 2 Promontoires is managed by

Mrs. Catherine Dunand who represents CEMAG INVEST on the Board of

Directors of the Company. There is no capital link between CEMAG

INVEST and Promontoires.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231002524832/en/

Advicenne Didier Laurens, Directeur Général +33 (0) 1 87

44 40 17 Email: investors@advicenne.com Ulysse Communication

Media relations Bruno Arabian +33 (0)6 87 88 47 26 Email:

advicenne@ulysse-communication.com

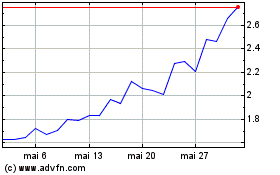

Advicenne (EU:ALDVI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Advicenne (EU:ALDVI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024