All amounts are in Canadian dollars

(TSX: HEO) – H2O Innovation Inc. (“H2O Innovation” or the

“Corporation”) announces that the Superior Court of Québec (the

“Court”) issued on October 27, 2023 an interim order (the “Interim

Order”) in connection with the previously announced acquisition by

Ember SPV I Purchaser Inc. (the “Purchaser”), an entity controlled

by funds managed by Ember Infrastructure Management, LP, a New

York-based private equity firm, of all of the issued and

outstanding common shares in the capital of H2O Innovation (the

“Shares”), other than the Shares to be rolled over by

Investissement Québec, Caisse de dépôt et placement du Québec and

certain key executives of the Corporation (collectively, the

“Rollover Shareholders”), for $4.25 in cash per Share, pursuant to

a statutory plan of arrangement (the “Arrangement”) under the

Canada Business Corporations Act. Among other things, the Interim

Order authorizes the Corporation to call, hold and conduct a

special meeting (the “Meeting”) of holders (the “Shareholders”) of

Shares to consider the Arrangement.

The Management Information Circular (the “Circular”) and related

materials for the Meeting are available under the Corporation’s

profile on SEDAR+ at www.sedarplus.ca and on H2O Innovation’s

website at www.h2oinnovation.com. H2O Innovation expects to begin

the distribution and mailing of the Circular and related materials

to Shareholders in the coming days.

The Meeting will be held on November 28, 2023 at 10:00 a.m.

(Montréal time) in virtual only format via live audio webcast

online at https://web.lumiagm.com/460305072; password:

innovation2023 (case sensitive). Shareholders of record on October

24, 2023 will be entitled to receive notice of, and to vote at, the

Meeting. Shareholders and their duly appointed proxyholders will be

able to attend, ask questions and vote at the Meeting online

following the instructions contained in the Circular. Shareholders

will have an equal opportunity to attend the Meeting online

regardless of their geographic location. The Circular, which

Shareholders are expected to receive in the coming days, provides

information on, among other things, the Arrangement and voting

procedures.

H2O Innovation’s board of directors (with any conflicted

director abstaining from voting on the matter), after receiving

legal and financial advice and a unanimous recommendation from a

committee of independent directors, unanimously determined that the

Arrangement is in the best interests of H2O Innovation and is fair

and reasonable to the Shareholders (other than the Rollover

Shareholders) and recommends unanimously, for the reasons set out

in the Circular, that Shareholders vote FOR the special resolution approving the

Arrangement at the Meeting.

Completion of the Arrangement is subject to the approval by (i)

at least 66 2/3% of the votes cast by the Shareholders voting

together as a single class, and (ii) a simple majority of the votes

cast by the Shareholders voting together as a single class,

excluding the votes attached to Shares beneficially owned, or over

which control or direction is exercised by, the Rollover

Shareholders, in each case, present virtually or represented by

proxy at the Meeting, as well as other customary conditions

including the issuance of a final order by the Court. It is

anticipated that the Arrangement will be completed in the fourth

quarter of 2023.

H2O Innovation has retained Kingsdale Advisors to act as proxy

solicitation agent and to respond to inquiries from Shareholders.

If you have any questions about the information contained in the

Circular or need assistance voting or completing your form of proxy

or voting information form, please contact Kingsdale Advisors

either (i) by email at contactus@kingsdaleadvisors.com or (ii) by

telephone at 1-866-581-1489 (toll-free in North America) or (416)

623-2516 (text or call outside North America).

Cautionary Note and Forward-Looking Statements The

Corporation’s oral and written public communications may include

forward-looking statements. These statements are included in this

press release, the Circular and may be included in other filings or

communications from the Corporation. The forward-looking statements

are made pursuant to the applicable securities legislation.

Forward-looking statements may include, but are not limited to,

statements and comments with respect to the holding of the Meeting,

the anticipated timing and the various steps to be completed in

connection with the Arrangement, including receipt of Shareholder

and Court approvals, and the anticipated timing of closing of the

Arrangement. Forward-looking information also relates to, among

other things, the Corporation’s strategies to achieve its

objectives, as well as information with respect to management’s

beliefs, plans, expectations, anticipations, estimations and

intentions, and may also include other statements that are

predictive in nature, or that depend upon or refer to future events

or conditions. The management of H2O Innovation would like to point

out that forward-looking statements involve a number of

uncertainties, known and unknown risks and other factors which may

cause the actual results, performance or achievements of the

Corporation to materially differ from any future results,

performance or achievements expressed or implied by such

forward-looking statements. In preparing its outlook, the

Corporation made assumptions that do not consider extraordinary

events or circumstances beyond its control. When used in this press

release, words such as “anticipate”, “continue”, “could”,

“estimate”, “expect”, “forecast”, “future”, “intend”, “may”,

“objective”, “outlook”, “plan”, “predict”, “project”, “should”,

“will”, “would” or the negative or comparable terminology as well

as terms usually used in the future and the conditional are

generally intended to identify forward-looking statements, although

not all forward-looking statements include such words.

The information contained in forward-looking statements is based

upon certain material assumptions that were applied in drawing a

conclusion or making expectations, forecasts, projections,

predictions, or estimations, including, without limitation: that

the Arrangement will be completed on the terms currently

contemplated, and in accordance with the timing currently expected;

that all conditions to the completion of the Arrangement will be

satisfied or waived; and that the arrangement agreement entered

into on October 3, 2023 between the Corporation and the Purchaser

regarding the Arrangement (the “Arrangement Agreement”) will not be

terminated prior to the completion of the Arrangement. A change

affecting an assumption can also have an impact on other

interrelated assumptions, which could increase or diminish the

effect of the change. Forward-looking statements are presented for

the purpose of assisting investors and others in understanding

certain key elements of the Corporation’s current objectives,

strategic priorities, expectations and plans, and in obtaining a

better understanding of the Corporation’s business and anticipated

operating environment.

Forward-looking statements are necessarily based on a number of

opinions, assumptions and estimates that, while considered

reasonable by the Corporation as of the date of this press release,

are subject to inherent uncertainties, risks and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements. Moreover, the proposed Arrangement

could be modified or the Arrangement Agreement terminated in

accordance with its terms. Several factors, risks or uncertainties

could cause the actual results to differ materially from the

results discussed in the forward-looking statements. Should one or

more of these factors, risks or uncertainties materialize or should

the assumptions underlying those forward-looking statements prove

incorrect, actual results may vary materially from those described

herein. Such factors include, without limitation: (a) the failure

of the parties to obtain any necessary regulatory approvals or the

required Shareholder and Court approvals or to otherwise satisfy

the conditions to the completion of the Arrangement, and failure of

the parties to obtain such approvals or satisfy such conditions in

a timely manner; (b) significant costs or unknown liabilities

related to the Arrangement; (c) litigation relating to the

Arrangement may be commenced which may prevent, delay or give rise

to significant costs or liabilities; (d) the Arrangement Agreement

may be terminated prior to its consummation; (e) the Corporation

may be required to pay a termination fee to the Purchaser in

certain circumstances if the Arrangement is not completed; (f) the

focus of management’s time and attention on the Arrangement may

detract from other aspects of the Corporation’s business; (g)

general economic conditions; (h) the market price of the Shares may

be materially adversely affected if the Arrangement is not

completed or its completion is materially delayed; and (i) failure

to realize the expected benefits of the Arrangement.

Failure to obtain any necessary regulatory approvals or the

required Shareholder and Court approvals, or such approvals being

obtained subject to conditions that are not anticipated, or failure

of the parties to otherwise satisfy the conditions to the

completion of the Arrangement may result in the Arrangement not

being completed on the proposed terms, or at all. If the

Arrangement is not completed, and the Corporation continues as a

publicly-traded entity, there are risks that the announcement of

the Arrangement and the dedication of substantial resources of the

Corporation to the completion of the Arrangement could have an

impact on its business and strategic relationships (including with

future and prospective employees, customers, suppliers and

partners), operating results and activities in general, and could

have a material adverse effect on its current and future

operations, financial condition and prospects. Furthermore,

pursuant to the terms of the Arrangement Agreement, the Corporation

may, in certain circumstances, be required to pay a fee to the

Purchaser, the result of which could have an adverse effect on its

financial position. The Corporation cautions that the foregoing

list of factors is not exhaustive. Additional information about the

risk factors to which the Corporation is exposed to is provided in

the Annual Information Form dated September 27, 2023, which is

available on SEDAR+ (www.sedarplus.ca).

The forward-looking statements set forth herein reflect the

Corporation’s expectations as of the date hereof, and are subject

to change after this date. The Corporation may, from time to time,

make oral forward-looking statements. The Corporation advises that

the above paragraphs and the risk factors described herein should

be read for a description of certain factors that could cause the

actual results of the Corporation to differ materially from those

in the oral forward-looking statements. Unless required to do so

pursuant to applicable securities legislation, H2O Innovation

assumes no obligation to update or revise forward-looking

statements contained in this press release or in other

communications as a result of new information, future events, and

other changes.

About H2O Innovation Innovation is in our name, and it is

what drives the organization. H2O Innovation is a complete water

solutions company focused on providing best-in-class technologies

and services to its customers. The Corporation’s activities rely on

three pillars: i) Water Technologies & Services (WTS) applies

membrane technologies and engineering expertise to deliver

equipment and services to municipal and industrial water,

wastewater, and water reuse customers, ii) Specialty Products (SP)

is a set of businesses that manufacture and supply a complete line

of specialty chemicals, consumables and engineered products for the

global water treatment industry, and iii) Operation &

Maintenance (O&M) provides contract operations and associated

services for water and wastewater treatment systems. Through

innovation, we strive to simplify water. For more information,

visit www.h2oinnovation.com.

Source: H2O Innovation Inc. www.h2oinnovation.com

This press release shall not constitute an offer to purchase or

a solicitation of an offer to sell any securities, or a

solicitation of a proxy of any securityholder of any person in any

jurisdiction. Any offers or solicitations will be made in

accordance with the requirements under applicable law. Shareholders

are advised to review any documents that may be filed with

securities regulatory authorities and any subsequent announcements

because they will contain important information regarding the

Arrangement and the terms and conditions thereof. The circulation

of this press release and the Arrangement may be subject to a

specific regulation or restrictions in some countries.

Consequently, persons in possession of this press release must

familiarize themselves and comply with any restrictions that may

apply to them.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231030563346/en/

Marc Blanchet +1 418-688-0170

marc.blanchet@h2oinnovation.com

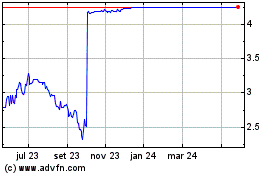

H2O Innovation (TSX:HEO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

H2O Innovation (TSX:HEO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024