Broadstone Net Lease, Inc. (NYSE: BNL) (“BNL,” the “Company,”

“we,” “our,” or “us”), today announced its operating results for

the quarter ended September 30, 2023.

THIRD QUARTER 2023 HIGHLIGHTS

INVESTMENT ACTIVITY

- During the third quarter, we invested $16.5 million in four

industrial properties and one retail property, including $4.8

million in revenue generating capital expenditures and $11.7

million in both new and existing development fundings. Revenue

generating capital expenditures had a weighted average initial cash

capitalization rate of 6.7%, a weighted average initial term of

14.1 years, and minimum annual rent increases of 2.0%.

Year-to-date, we have completed investments totaling $101.5

million, including $25.6 million in new property acquisitions,

$26.6 million in revenue generating capital expenditures, and $49.3

million in development fundings. The new property acquisitions and

revenue generating capital expenditures had a weighted average

initial cash capitalization rate of 7.1%.

- Subsequent to quarter-end, we invested an additional $9.9

million in development fundings and $15.9 million in revenue

generating capital expenditures. As of the date of this release, we

have $76.1 million of acquisitions under control, $147.4 million of

commitments to fund developments, and $12.0 million of commitments

to fund revenue generating capital expenditures with existing

tenants.

- During the third quarter we sold two properties for gross

proceeds of $62.3 million at a weighted average cash capitalization

rate of 6.2%. Year-to-date and through the date of this release, we

have sold 11 properties for gross proceeds of $189.1 million at a

weighted average cash capitalization rate of 6.0% on tenanted

properties.

OPERATING RESULTS

- Collected 99.9% of base rents due for the third quarter for all

properties subject to a lease.

- Portfolio was 99.4% leased based on rentable square footage,

with only two of our 800 properties vacant and not subject to a

lease at quarter end.

- Incurred $10.1 million of general and administrative expenses,

inclusive of $1.5 million of stock-based compensation.

- Generated net income of $52.1 million, or $0.26 per share.

- Generated adjusted funds from operations (“AFFO”) of $70.0

million, or $0.36 per share.

CAPITAL MARKETS ACTIVITY

- Ended the quarter with total outstanding debt of $1.9 billion,

Net Debt of $1.9 billion, and a Net Debt to Annualized Adjusted

EBITDAre ratio of 4.9x.

- At September 30, 2023, had $925.9 million of capacity on our

Revolving Credit Facility

- Declared an increase in our quarterly dividend from $0.28 to

$0.285, or a 1.8% increase over the prior period.

MANAGEMENT COMMENTARY

“We remained highly selective this quarter in light of the

current economic environment and rapid increase in interest rates,

deploying capital only into previously identified development

projects and revenue generating capital expenditures with existing

tenants,” said John Moragne, BNL’s Chief Executive Officer. “The

pace of cap rate expansion on new deals continued to lag the pace

of interest rate increases, eroding risk adjusted returns. Our

existing portfolio remains healthy, with 99.9% rent collections on

leased properties and minimal vacancies, and we continued to

opportunistically dispose of assets with either elevated credit

risk or lease rollover risk, recognizing accretive cap rates

relative to our cost of debt and new investment opportunities. We

continue to be opportunistic in sourcing investment opportunities

presented by this distressed lending environment and believe our

prudence in capital allocation will preserve and enhance investor

value as the economic environment evolves.”

SUMMARIZED FINANCIAL RESULTS

For the Three Months

Ended

For the Nine Months

Ended

(in thousands, except per share data)

September 30, 2023

June 30, 2023

September 30, 2022

September 30, 2023

September 30, 2022

Revenues

$

109,543

$

109,353

$

103,524

$

337,887

$

295,378

Net income, including non-controlling

interests

$

52,145

$

62,996

$

28,709

$

156,515

$

92,702

Net earnings per share - diluted

$

0.26

$

0.32

$

0.16

$

0.80

$

0.52

FFO

$

75,478

$

72,524

$

72,169

$

229,179

$

202,013

FFO per share

$

0.39

$

0.37

$

0.39

$

1.17

$

1.13

Core FFO

$

74,754

$

74,381

$

66,677

$

223,608

$

196,739

Core FFO per share

$

0.38

$

0.38

$

0.36

$

1.14

$

1.10

AFFO

$

69,958

$

69,004

$

63,386

$

206,446

$

186,590

AFFO per share

$

0.36

$

0.35

$

0.35

$

1.05

$

1.04

Diluted Weighted Average Shares

Outstanding

196,372

196,228

182,971

196,282

179,132

FFO, Core FFO, and AFFO are measures that are not calculated in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). See the Reconciliation of

Non-GAAP Measures later in this press release.

REAL ESTATE PORTFOLIO UPDATE

As of September 30, 2023, we owned a diversified portfolio of

800 individual net leased commercial properties with 793 properties

located in 44 U.S. states and seven properties located in four

Canadian provinces, comprising approximately 38.2 million rentable

square feet of operational space. As of September 30, 2023, all but

two of our properties were subject to a lease, and our properties

were occupied by 220 different commercial tenants, with no single

tenant accounting for more than 4.0% of ABR. Properties subject to

a lease represent 99.4% of our portfolio’s rentable square footage.

The ABR weighted average lease term and ABR weighted average annual

minimum rent increase, pursuant to leases on properties in the

portfolio as of September 30, 2023, was 10.5 years and 2.0%,

respectively.

BALANCE SHEET AND CAPITAL MARKETS ACTIVITIES

As of September 30, 2023, we had total outstanding debt of $1.9

billion, Net Debt of $1.9 billion, and a Net Debt to Annualized

Adjusted EBITDAre ratio of 4.9x. We had $925.9 million of available

capacity on our revolving credit facility as of quarter end, and

have no material debt maturities until 2026.

We did not raise any equity during the quarter and have

approximately $145.4 million of capacity remaining on our ATM

Program as of September 30, 2023.

DISTRIBUTIONS

At its October 26, 2023, meeting, our board of directors

declared an increase in our quarterly dividend from $0.28 to $0.285

distribution per common share and OP Unit to stockholders and OP

unitholders. This increase represents a 1.8% increase over the

prior period and is effective for our shareholders of record as of

December 29, 2023, payable on or before January 12, 2024.

2023 GUIDANCE

The Company has affirmed its per share guidance range for the

2023 full year and currently expects to report AFFO of between

$1.40 and $1.42 per diluted share.

The guidance range is based on the following key

assumptions:

(i)

investments in real estate

properties up to $250 million, revised down from between $300

million and $500 million;

(ii)

dispositions of real estate

properties of approximately $200 million, in-line with the top end

of our previous range of $150 million and $200 million; and

(iii)

total cash general and

administrative expenses between $31 million and $33 million,

revised down from between $32 million and $34 million.

Our per share results are sensitive to both the timing and

amount of real estate investments, property dispositions, and

capital markets activities that occur throughout the year.

The Company does not provide guidance for the most comparable

GAAP financial measure, net income, or a reconciliation of the

forward-looking non-GAAP financial measure of AFFO to net income

computed in accordance with GAAP, because it is unable to

reasonably predict, without unreasonable efforts, certain items

that would be contained in the GAAP measure, including items that

are not indicative of the Company’s ongoing operations, including,

without limitation, potential impairments of real estate assets,

net gain/loss on dispositions of real estate assets, changes in

allowance for credit losses, and stock-based compensation expense.

These items are uncertain, depend on various factors, and could

have a material impact on the Company’s GAAP results for the

guidance periods.

CONFERENCE CALL AND WEBCAST

The company will host its third quarter earnings conference

call and audio webcast on Thursday, November 2, 2023, at 10:00 a.m.

Eastern Time.

To access the live webcast, which will be available in

listen-only mode, please visit:

https://events.q4inc.com/attendee/492451212. If you prefer to

listen via phone, U.S. participants may dial: 1-833-470-1428 (toll

free) or 1-646-904-5544 (local), access code 001761. International

access numbers are viewable here:

https://www.netroadshow.com/events/global-numbers?confId=56723.

A replay of the conference call webcast will be available

approximately one hour after the conclusion of the live broadcast.

To listen to a replay of the call via phone, U.S. participants may

dial: 1-866-813-9403 (toll free) or 1-929-458-6194 (local), access

code 528080. The replay will be available via dial-in until

Thursday, November 16, 2023. To listen to a replay of the call via

the web, which will be available for one year, please visit:

https://investors.bnl.broadstone.com.

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that

acquires, owns, and manages primarily single-tenant commercial real

estate properties that are net leased on a long-term basis to a

diversified group of tenants. Utilizing an investment strategy

underpinned by strong fundamental credit analysis and prudent real

estate underwriting, as of September 30, 2023, BNL’s diversified

portfolio consisted of 800 individual net leased commercial

properties with 793 properties located in 44 U.S. states and seven

properties located in four Canadian provinces across the

industrial, healthcare, restaurant, retail, and office property

types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “may,” “will,” “should,”

“expect,” “intend,” “anticipate,” “estimate,” “would be,”

“believe,” “continue,” or other similar words. Forward-looking

statements, including our 2023 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, which BNL filed with the SEC on

February 23, 2023, which you are encouraged to read, and is

available on the SEC’s website at www.sec.gov. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. The Company assumes no obligation to,

and does not currently intend to, update any forward-looking

statements after the date of this press release, whether as a

result of new information, future events, changes in assumptions,

or otherwise.

Notice Regarding Non-GAAP Financial Measures

In addition to our reported results and net earnings per diluted

share, which are financial measures presented in accordance with

GAAP, this press release contains and may refer to certain non-GAAP

financial measures, including Funds from Operations (“FFO”), Core

Funds From Operations (“Core FFO”), Adjusted Funds from Operations

(“AFFO”), Net Debt, and Net Debt to Annualized Adjusted EBITDAre.

We believe the use of FFO, Core FFO, and AFFO are useful to

investors because they are widely accepted industry measures used

by analysts and investors to compare the operating performance of

REITs. FFO, Core FFO, and AFFO should not be considered

alternatives to net income as a performance measure or to cash

flows from operations, as reported on our statement of cash flows,

or as a liquidity measure, and should be considered in addition to,

and not in lieu of, GAAP financial measures. We believe presenting

Net Debt to Annualized Adjusted EBITDAre is useful to investors

because it provides information about gross debt less cash and cash

equivalents, which could be used to repay debt, compared to our

performance as measured using Annualized Adjusted EBITDAre. You

should not consider our Annualized Adjusted EBITDAre as an

alternative to net income or cash flows from operating activities

determined in accordance with GAAP. A reconciliation of non-GAAP

measures to the most directly comparable GAAP financial measure and

statements of why management believes these measures are useful to

investors are included below.

Broadstone Net Lease, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(in thousands, except per share

amounts)

September 30, 2023

December 31, 2022

Assets

Accounted for using the operating

method:

Land

$

752,708

$

768,667

Land improvements

330,214

340,385

Buildings and improvements

3,819,745

3,888,756

Equipment

9,608

10,422

Total accounted for using the operating

method

4,912,275

5,008,230

Less accumulated depreciation

(601,895

)

(533,965

)

Accounted for using the operating method,

net

4,310,380

4,474,265

Accounted for using the direct financing

method

26,751

27,045

Accounted for using the sales-type

method

572

571

Property under development

49,819

—

Investment in rental property, net

4,387,522

4,501,881

Cash and cash equivalents

35,061

21,789

Accrued rental income

152,268

135,666

Tenant and other receivables, net

1,372

1,349

Prepaid expenses and other assets

42,309

64,180

Interest rate swap, assets

79,086

63,390

Goodwill

339,769

339,769

Intangible lease assets, net

297,656

329,585

Total assets

$

5,335,043

$

5,457,609

Liabilities and equity

Unsecured revolving credit facility

$

74,060

$

197,322

Mortgages, net

79,613

86,602

Unsecured term loans, net

895,633

894,692

Senior unsecured notes, net

845,121

844,555

Accounts payable and other liabilities

44,886

47,547

Dividends payable

55,770

54,460

Accrued interest payable

9,186

7,071

Intangible lease liabilities, net

55,301

62,855

Total liabilities

2,059,570

2,195,104

Commitments and contingencies

Equity

Broadstone Net Lease, Inc. stockholders'

equity:

Preferred stock, $0.001 par value; 20,000

shares authorized, no shares issued or outstanding

—

—

Common stock, $0.00025 par value; 500,000

shares authorized, 187,272 and 186,114 shares issued and

outstanding at September 30, 2023 and December 31, 2022,

respectively

47

47

Additional paid-in capital

3,430,725

3,419,395

Cumulative distributions in excess of

retained earnings

(393,571

)

(386,049

)

Accumulated other comprehensive income

83,575

59,525

Total Broadstone Net Lease, Inc.

stockholders' equity

3,120,776

3,092,918

Non-controlling interests

154,697

169,587

Total equity

3,275,473

3,262,505

Total liabilities and equity

$

5,335,043

$

5,457,609

Broadstone Net Lease, Inc. and

Subsidiaries

Condensed Consolidated Statements

of Income and Comprehensive Income

(in thousands, except per share

amounts)

For the Three Months

Ended

For the Nine Months

Ended

September 30, 2023

June 30, 2023

September 30, 2023

September 30, 2022

Revenues

Lease revenues, net

$

109,543

$

109,353

$

337,887

$

295,378

Operating expenses

Depreciation and amortization

38,533

39,031

119,348

109,201

Property and operating expense

5,707

4,988

16,580

15,376

General and administrative

10,143

9,483

30,043

28,058

Provision for impairment of investment in

rental properties

-

—

1,473

5,535

Total operating expenses

54,383

53,502

167,444

158,170

Other income (expenses)

Interest income

127

82

370

4

Interest expense

(19,665

)

(20,277

)

(61,081

)

(54,879

)

Gain on sale of real estate

15,163

29,462

48,040

5,328

Income taxes

(104

)

(448

)

(1,030

)

(1,169

)

Other income (expenses)

1,464

(1,674

)

(227

)

6,210

Net income

52,145

62,996

156,515

92,702

Net income attributable to non-controlling

interests

(2,463

)

(2,982

)

(7,515

)

(5,319

)

Net income attributable to Broadstone

Net Lease, Inc.

$

49,682

$

60,014

$

149,000

$

87,383

Weighted average number of common

shares outstanding

Basic

186,766

186,733

186,545

168,680

Diluted

196,372

196,228

196,282

179,132

Net earnings per common share

Basic

$

0.27

$

0.32

$

0.80

$

0.52

Diluted

$

0.26

$

0.32

$

0.80

$

0.52

Comprehensive income

Net income

$

52,145

$

62,996

$

156,515

$

92,702

Other comprehensive income

Change in fair value of interest rate

swaps

13,943

19,652

15,696

93,772

Realized loss (gain) on interest rate

swaps

522

522

1,566

1,993

Comprehensive income

66,610

83,170

173,777

188,467

Comprehensive income attributable to

non-controlling interests

(3,147

)

(3,937

)

(8,285

)

(10,809

)

Comprehensive income attributable to

Broadstone Net Lease, Inc.

$

63,463

$

79,233

$

165,492

$

177,658

Reconciliation of Non-GAAP Measures

The following is a reconciliation of net income to FFO, Core

FFO, and AFFO for the three months ended September 30, 2023 and

June 30, 2023 and for the nine months ended September 30, 2023 and

2022. Also presented is the weighted average number of shares of

our common stock and OP Units used for the diluted per share

computation:

For the Three Months

Ended

For the Nine Months

Ended

(in thousands, except per share data)

September 30, 2023

June 30, 2023

September 30, 2023

September 30, 2022

Net income

$

52,145

$

62,996

$

156,515

$

92,702

Real property depreciation and

amortization

38,496

38,990

119,231

109,104

Gain on sale of real estate

(15,163

)

(29,462

)

(48,040

)

(5,328

)

Provision for impairment on investment in

rental properties

—

—

1,473

5,535

FFO

$

75,478

$

72,524

$

229,179

$

202,013

Net write-offs of accrued rental

income

—

—

297

1,326

Lease termination fees

—

—

(7,500

)

(791

)

Cost of debt extinguishment

—

3

3

231

Severance and executive transition

costs(1)

740

183

1,404

401

Other (income) expenses(2)

(1,464

)

1,671

225

(6,441

)

Core FFO

$

74,754

$

74,381

$

223,608

$

196,739

Straight-line rent adjustment

(6,785

)

(7,276

)

(21,332

)

(15,075

)

Adjustment to provision for credit

losses

—

(10

)

(10

)

(5

)

Amortization of debt issuance costs

983

986

2,955

2,704

Amortization of net mortgage premiums

—

(52

)

(78

)

(78

)

Loss on interest rate swaps and other

non-cash interest expense

522

521

1,565

1,993

Amortization of lease intangibles

(1,056

)

(1,085

)

(4,832

)

(3,501

)

Stock-based compensation

1,540

1,539

4,570

3,813

AFFO

$

69,958

$

69,004

$

206,446

$

186,590

Diluted WASO(3)

196,372

182,971

196,282

179,132

Net earnings per diluted share(4)

$

0.26

$

0.16

$

0.80

$

0.52

FFO per diluted share(4)

0.39

0.37

1.17

1.13

Core FFO per diluted share(4)

0.38

0.38

1.14

1.10

AFFO per diluted share(4)

0.36

0.35

1.05

1.04

1

Amount includes $0.7 million and

$0.2 million of employee severance costs and executive transition

costs during the three months ended September 30, 2023, and June

30, 2023, respectively. Amount includes $1.4 million of employee

severance costs and executive transition costs and $0.4 million of

employee severance costs during the nine months ended September 30,

2023 and 2022, respectively.

2

Amount includes $(1.4) million

and $1.7 million of unrealized foreign exchange (gain) loss for the

three months ended September 30, 2023 and June 30, 2023,

respectively, and $0.3 million and $(6.4) million of unrealized

foreign exchange loss (gain) for the nine months ended September

30, 2023 and 2022, respectively, primarily associated with our

Canadian dollar denominated revolving borrowings.

3

Excludes 506,172, and 504,161

weighted average shares of unvested restricted common stock for the

three months ended September 30, 2023 and June 30, 2023,

respectively. Excludes 480,849, and 381,220 weighted average shares

of unvested restricted common stock for the nine months ended

September 30, 2023 and 2022, respectively.

4

Excludes $0.1 million from the

numerator for the three months ended September 30, 2023 and June

30, 2023. Excludes $0.4 million and $0.3 million from the numerator

for the nine months ended September 30, 2023 and 2022,

respectively, related to dividends paid or declared on shares of

unvested restricted common stock.

Our reported results and net earnings per diluted share are

presented in accordance with GAAP. We also disclose FFO, Core FFO,

and AFFO, each of which are non-GAAP measures. We believe the use

of FFO, Core FFO, and AFFO are useful to investors because they are

widely accepted industry measures used by analysts and investors to

compare the operating performance of REITs. FFO, Core FFO, and AFFO

should not be considered alternatives to net income as a

performance measure or to cash flows from operations, as reported

on our statement of cash flows, or as a liquidity measure and

should be considered in addition to, and not in lieu of, GAAP

financial measures.

We compute FFO in accordance with the standards established by

the Board of Governors of Nareit, the worldwide representative

voice for REITs and publicly traded real estate companies with an

interest in the U.S. real estate and capital markets. Nareit

defines FFO as GAAP net income or loss adjusted to exclude net

gains (losses) from sales of certain depreciated real estate

assets, depreciation and amortization expense from real estate

assets, gains and losses from change in control, and impairment

charges related to certain previously depreciated real estate

assets. FFO is used by management, investors, and analysts to

facilitate meaningful comparisons of operating performance between

periods and among our peers, primarily because it excludes the

effect of real estate depreciation and amortization and net gains

(losses) on sales, which are based on historical costs and

implicitly assume that the value of real estate diminishes

predictably over time, rather than fluctuating based on existing

market conditions.

We compute Core FFO by adjusting FFO, as defined by Nareit, to

exclude certain GAAP income and expense amounts that we believe are

infrequently recurring, unusual in nature, or not related to its

core real estate operations, including write-offs or recoveries of

accrued rental income, lease termination fees, gain on insurance

recoveries, cost of debt extinguishments, unrealized and realized

gains or losses on foreign currency transactions, severance and

executive transition costs, and other extraordinary items.

Exclusion of these items from similar FFO-type metrics is common

within the equity REIT industry, and management believes that

presentation of Core FFO provides investors with a metric to assist

in their evaluation of our operating performance across multiple

periods and in comparison to the operating performance of our

peers, because it removes the effect of unusual items that are not

expected to impact our operating performance on an ongoing

basis.

We compute AFFO by adjusting Core FFO for certain non-cash

revenues and expenses, including straight-line rents, amortization

of lease intangibles, amortization of debt issuance costs,

amortization of net mortgage premiums, (gain) loss on interest rate

swaps and other non-cash interest expense, stock-based

compensation, and other specified non-cash items. We believe that

excluding such items assists management and investors in

distinguishing whether changes in our operations are due to growth

or decline of operations at our properties or from other factors.

We use AFFO as a measure of our performance when we formulate

corporate goals, and is a factor in determining management

compensation. We believe that AFFO is a useful supplemental measure

for investors to consider because it will help them to better

assess our operating performance without the distortions created by

non-cash revenues or expenses.

Specific to our adjustment for straight-line rents, our leases

include cash rents that increase over the term of the lease to

compensate us for anticipated increases in market rental rates over

time. Our leases do not include significant front-loading or

back-loading of payments, or significant rent-free periods.

Therefore, we find it useful to evaluate rent on a contractual

basis as it allows for comparison of existing rental rates to

market rental rates.

FFO, Core FFO, and AFFO may not be comparable to similarly

titled measures employed by other REITs, and comparisons of our

FFO, Core FFO, and AFFO with the same or similar measures disclosed

by other REITs may not be meaningful.

Neither the SEC nor any other regulatory body has passed

judgment on the acceptability of the adjustments to FFO that we use

to calculate Core FFO and AFFO. In the future, the SEC, Nareit or

another regulatory body may decide to standardize the allowable

adjustments across the REIT industry and in response to such

standardization we may have to adjust our calculation and

characterization of Core FFO and AFFO accordingly.

The following is a reconciliation of net income to EBITDA,

EBITDAre, and Adjusted EBITDAre, debt to Net Debt and Net Debt to

Annualized Adjusted EBITDAre as of and for the three months ended

September 30, 2023, June 30, 2023, and September 30, 2022:

For the Three Months

Ended

(in thousands)

September 30, 2023

June 30, 2023

September 30, 2022

Net income

$

52,145

$

62,996

$

28,709

Depreciation and amortization

38,533

39,031

39,400

Interest expense

19,665

20,277

20,095

Income taxes

104

448

356

EBITDA

$

110,447

$

122,752

$

88,560

Provision for impairment of investment in

rental properties

—

—

4,155

Gain on sale of real estate

(15,163

)

(29,462

)

(61

)

EBITDAre

$

95,284

$

93,290

$

92,654

Adjustment for current quarter investment

activity (1)

26

342

2,358

Adjustment for current quarter disposition

activity (2)

(400

)

(444

)

—

Adjustment to exclude non-recurring and

other expenses (3)

740

183

—

Adjustment to exclude realized /

unrealized foreign exchange (gain) loss

(1,433

)

1,681

(4,934

)

Adjustment to exclude cost of debt

extinguishments

—

3

231

Adjustment to exclude lease termination

fees

—

—

(791

)

Adjusted EBITDAre

$

94,217

$

95,055

$

89,518

Annualized EBITDAre

$

381,136

$

373,160

$

370,616

Annualized Adjusted EBITDAre

$

376,868

$

380,220

$

358,072

1

Reflects an adjustment to give

effect to all investments during the quarter as if they had been

made as of the beginning of the quarter.

2

Reflects an adjustment to give

effect to all dispositions during the quarter as if they had been

sold as of the beginning of the quarter.

3

Amount includes $0.7 million and

$0.2 million of employee severance and executive transition costs

during the three months ended September 30, 2023 and June 30, 2023,

respectively.

(in thousands)

September 30, 2023

June 30, 2023

September 30, 2022

Debt

Unsecured revolving credit facility

$

74,060

$

122,912

$

219,537

Unsecured term loans, net

895,633

895,319

894,378

Senior unsecured notes, net

845,121

844,932

844,367

Mortgages, net

79,613

80,141

94,753

Debt issuance costs

9,360

9,872

11,498

Gross Debt

1,903,787

1,953,176

2,064,533

Cash and cash equivalents

(35,061

)

(20,763

)

(75,912

)

Restricted cash

(15,436

)

(15,502

)

(6,449

)

Net Debt

$

1,853,290

$

1,916,911

$

1,982,172

Anticipated proceeds from forward equity

agreement

4.9x

—

(270,732

)

Pro Forma Net Debt

$

1,853,290

$

1,916,911

$

1,711,440

Net Debt to Annualized EBITDAre

4.9x

5.1x

5.3x

Net Debt to Annualized Adjusted

EBITDAre

4.9x

5.0x

5.5x

Pro Forma Net Debt to Annualized

Adjusted EBITDAre

4.9x

5.0x

4.8x

We define Net Debt as gross debt (total reported debt plus debt

issuance costs) less cash and cash equivalents and restricted cash.

We believe that the presentation of Net Debt to Annualized EBITDAre

and Net Debt to Annualized Adjusted EBITDAre is useful to investors

and analysts because these ratios provide information about gross

debt less cash and cash equivalents, which could be used to repay

debt, compared to our performance as measured using EBITDAre.

We compute EBITDA as earnings before interest, income taxes and

depreciation and amortization. EBITDA is a measure commonly used in

our industry. We believe that this ratio provides investors and

analysts with a measure of our performance that includes our

operating results unaffected by the differences in capital

structures, capital investment cycles and useful life of related

assets compared to other companies in our industry. We compute

EBITDAre in accordance with the definition adopted by Nareit, as

EBITDA excluding gains (losses) from the sales of depreciable

property and provisions for impairment on investment in real

estate. We believe EBITDA and EBITDAre are useful to investors and

analysts because they provide important supplemental information

about our operating performance exclusive of certain non-cash and

other costs. EBITDA and EBITDAre are not measures of financial

performance under GAAP, and our EBITDA and EBITDAre may not be

comparable to similarly titled measures of other companies. You

should not consider our EBITDA and EBITDAre as alternatives to net

income or cash flows from operating activities determined in

accordance with GAAP.

We are focused on a disciplined and targeted investment

strategy, together with active asset management that includes

selective sales of properties. We manage our leverage profile using

a ratio of Net Debt to Annualized Adjusted EBITDAre, discussed

below, which we believe is a useful measure of our ability to repay

debt and a relative measure of leverage, and is used in

communications with our lenders and rating agencies regarding our

credit rating. As we fund new investments using our unsecured

revolving credit facility, our leverage profile and Net Debt will

be immediately impacted by current quarter investments. However,

the full benefit of EBITDAre from new investments will not be

received in the same quarter in which the properties are acquired.

Additionally, EBITDAre for the quarter includes amounts generated

by properties that have been sold during the quarter. Accordingly,

the variability in EBITDAre caused by the timing of our investments

and dispositions can temporarily distort our leverage ratios. We

adjust EBITDAre (“Adjusted EBITDAre”) for the most recently

completed quarter (i) to recalculate as if all investments and

dispositions had occurred at the beginning of the quarter, (ii) to

exclude certain GAAP income and expense amounts that are either

non-cash, such as cost of debt extinguishments, realized or

unrealized gains and losses on foreign currency transactions, or

gains on insurance recoveries, or that we believe are one time, or

unusual in nature because they relate to unique circumstances or

transactions that had not previously occurred and which we do not

anticipate occurring in the future, and (iii) to eliminate the

impact of lease termination fees and other items, that are not a

result of normal operations. While investments in property

developments have an immediate impact to Net Debt, we do not make

an adjustment to EBITDAre until the quarter in which the lease

commences. We then annualize quarterly Adjusted EBITDAre by

multiplying it by four (“Annualized Adjusted EBITDAre”). You should

not unduly rely on this measure as it is based on assumptions and

estimates that may prove to be inaccurate. Our actual reported

EBITDAre for future periods may be significantly different from our

Annualized Adjusted EBITDAre. Adjusted EBITDAre and Annualized

Adjusted EBITDAre are not measurements of performance under GAAP,

and our Adjusted EBITDAre and Annualized Adjusted EBITDAre may not

be comparable to similarly titled measures of other companies. You

should not consider our Adjusted EBITDAre and Annualized Adjusted

EBITDAre as alternatives to net income or cash flows from operating

activities determined in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231101458764/en/

Company Contact:

Michael Caruso SVP, Corporate Strategy & Investor Relations

michael.caruso@broadstone.com 585.402.7842

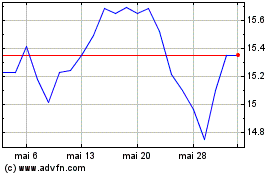

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Broadstone Net Lease (NYSE:BNL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025