Permianville Royalty Trust Announces Second Special Cash Distribution of Net Proceeds from Permian Basin Divestiture

06 Novembro 2023 - 6:15PM

Business Wire

Permianville Royalty Trust (NYSE: PVL, the “Trust”) today

announced a special cash distribution to the holders of its units

of beneficial interest of $0.077250 per unit, payable on November

22, 2023 to unitholders of record on November 16, 2023. As further

described below, this special distribution represents the majority

of the remaining net proceeds allocable to Trust unitholders from

the divestiture of certain oil and natural gas properties in the

Permian Basin (the “Divestiture Properties”) that constituted part

of the properties burdened by the Trust’s 80% net profits interest.

As previously announced, at a special meeting of the Trust

unitholders on July 19, 2023, the Trust unitholders approved a

transaction pursuant to which (i) COERT Holdings 1, LLC (the

“Sponsor”) would sell the Divestiture Properties, (ii) the Trust

would release the related net profits interest associated with the

Divestiture Properties, and (iii) the net proceeds received by the

Trust with respect to such sale would be distributed to the

unitholders.

The following table displays the aggregate net proceeds from the

sales of the Divestiture Properties and the aggregate net proceeds

allocable to Trust unitholders for this distribution:

Net Proceeds from sale of Divestiture

Properties

$6,712,000

Less: Transaction expenses

(627,149

)

Plus: Buyer proxy expense

reimbursement

288,000

Net proceeds from sale of Divestiture

Properties

$6,372,851

Less: Amount allocable to the Sponsor’s

20% interest

(1,274,570

)

Net proceeds allocable to the Trust’s 80%

Interest

$5,098,281

Less: Indemnification Escrow amount

(250,000

)

Less: October 13, 2023 Initial Cash

Distribution

(2,299,110

)

Remaining cash available for

distribution by the Trust

$2,549,171

Number of units

33,000,000

Remaining special cash distribution per

unit

$0.077250

As previously announced, the total closing proceeds received by

the Sponsor from the Divestiture Properties, after preliminary

closing adjustments, were approximately $6.7 million, before

accounting for the incremental $0.3 million of partial expense

reimbursement associated with the proxy solicitation. Transaction

expenses, including expenses associated with the purchase and sale

agreement as well as expenses associated with the special meeting

of Trust unitholders on July 19, 2023, totaled $627,149. The

initial special cash distribution announced on September 20, 2023

and paid to Trust unitholders on October 13, 2023 represented 50%

of the Trust’s share of the net proceeds, with the remaining 50%

(net of the escrow amount described below) to be temporarily

retained as a source of payment of the Trust’s proportionate share

of any post-closing purchase price adjustments, with any amount

remaining after such adjustments to be paid to the Trust within

five business days after finalization of the settlement statement

and included in a distribution to unitholders. The special cash

distribution announced today represents the remaining 50% of the

Trust’s share of the net proceeds (net of the escrow amount

described below), which were temporarily retained by the Sponsor as

described above. In addition, an escrow amount of $250,000

continues to be held by the Sponsor to cover possible

indemnification obligations under the purchase and sale agreement.

Any remaining amount held in the escrow after payment of any

indemnities contained in the purchase and sale agreement will be

released to the Trust within 12 months after the closing of the

sale and included in a distribution to unitholders.

About Permianville Royalty Trust

Permianville Royalty Trust is a Delaware statutory trust formed

to own a net profits interest representing the right to receive 80%

of the net profits from the sale of oil and natural gas production

from certain, predominantly non-operated, oil and gas properties in

the states of Texas, Louisiana and New Mexico. As described in the

Trust’s filings with the Securities and Exchange Commission (the

“SEC”), the amount of the periodic distributions is expected to

fluctuate, depending on the proceeds received by the Trust as a

result of actual production volumes, oil and gas prices, the amount

and timing of capital expenditures, and the Trust’s administrative

expenses, among other factors. Future distributions are expected to

be made on a monthly basis. For additional information on the

Trust, please visit www.permianvilleroyaltytrust.com.

Pursuant to Treasury Regulation Section 1.1445-8(b), a trust

with interests that are regularly traded on an established

securities market shall be liable to withhold tax upon the

distribution of any amount attributable to the disposition of a

U.S. real property interest, with respect to each holder of an

interest in the trust that is a foreign person. Nominees and

brokers should treat one hundred percent (100%) of this

distribution as being attributable to the disposition of a U.S.

real property interest. Nominees and brokers should withhold at a

rate of twenty-one percent (21%) on the dollar amount of

distributions made to foreign persons not to exceed such persons’

proportionate shares of the excess of (1) the amount of net gain

realized by the Trust upon all transfers of U.S. real property

interests over (2) the total amount of distributions made by the

Trust. This announcement is intended to be a qualified notice to

nominees and brokers as provided for under Treasury Regulation

Section 1.1445-8(f) by Permianville Royalty Trust.

Forward-Looking Statements and Cautionary Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. All statements contained in this

press release, other than statements of historical facts, are

“forward-looking statements” for purposes of these provisions.

These forward-looking statements include statements regarding the

anticipated distribution to unitholders as a result of the

disposition of certain properties and expected expenses. The

anticipated distribution is based, in large part, on the amount of

cash received or expected to be received by the Trust from the

Sponsor as a result of the sale of the Divestiture Properties.

Other important factors that could cause actual results to differ

materially include expenses of the Trust and reserves for

anticipated future expenses. Statements made in this press release

are qualified by the cautionary statements made in this press

release. Neither the Sponsor nor the Trustee intends, and neither

assumes any obligation, to update any of the statements included in

this press release. An investment in units issued by the Trust is

subject to the risks described in the Trust’s filings with the SEC,

including the risks described in the Trust’s Annual Report on Form

10-K for the year ended December 31, 2022, filed with the SEC on

March 23, 2023. The Trust’s quarterly and other filed reports are

or will be available over the Internet at the SEC’s website at

http://www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106992133/en/

Permianville Royalty Trust The Bank of New York Mellon Trust

Company, N.A., as Trustee Sarah Newell 1 (512) 236-6555

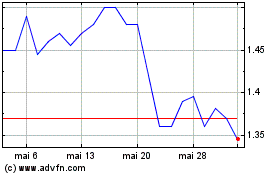

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024