Gold Resource Corporation (NYSE American:

GORO) (the “Company”) is pleased to announce its

year-to-date and quarterly operational results from its Don David

Gold Mine (DDGM) near Oaxaca, Mexico, and a corporate update on its

other activities.

Year-to-Date Highlights Include:

- Produced and sold 14,777 ounces of gold and 777,977 ounces of

silver

- Produced and sold 8,772 tonnes of zinc, 904 tonnes of copper,

and 3,681 tonnes of lead

- Total cash cost after co-product credits for the quarter was

$1,839 per gold equivalent ounce

- Cash balance of $6.7 million with no debt and working capital

of $13.8 million at September 30, 2023

- Completed Back Forty Optimization Study that indicates

after-Tax: a $214 million NPV6% with a 25.7% IRR and a 2.5 year

payback

“Our quarterly operational results to date continue to remain in

line with our 2023 mine plan and guidance even though our financial

results continue to be lower than planned,” stated Allen Palmiere,

President and CEO for the Company. “Factors that are out of our

control continue to affect our bottom line, including a

strengthening Mexican Peso to the US dollar, increased local power

costs, and lower metal prices for our co-product metals of copper,

lead, and zinc. We continue to identify and implement opportunities

for cost reductions and other operational efficiencies to offset

these factors. Our exploration drilling program at DDGM continues

to yield encouraging drill results from our underground exploration

program with the goal of increasing the average grade of our 2024

mine plan and life of mine resources. Earlier in 2023, we filed our

inaugural Environmental, Social, and Governance report, and we are

seeing very positive reception from the local communities and

government. We were also very successful this quarter in completing

the optimization work around the Back Forty project and filing an

S-K 1300 that resulted in a more robust project with an improved

project valuation and increased economic returns, while reducing

environment impacts.”

Review of Strategic Alternatives

Notwithstanding the technical successes noted above, in light of

the continued challenges facing the Company, the Company’s Board of

Directors has decided to initiate a formal review process, with the

assistance of outside financial and legal advisors, to evaluate

strategic alternatives for the Company. The comprehensive process

will begin immediately and will evaluate a broad range of options

to maximize shareholder value, including a potential sale of the

Company. The Company has engaged Cormark Securities Inc. as

financial advisor to assist in its review of strategic

alternatives. Davis Graham & Stubbs LLP has been appointed as

legal advisor in connection with the review process.

There is no deadline or definitive timetable for the completion

of the strategic alternatives review process, and there can be no

assurance regarding the results or outcome of this review. The

Company does not intend to comment further on this strategic review

process until it has been completed or the Company determines that

a disclosure is required by law or otherwise deemed

appropriate.

Third Quarter Operational Results

Don David Gold Mine

- No lost time incidents during the quarter. Our year-to-date

Lost Time Injury Frequency Rate safety record is 0.11 as compared

to the Mexican average of 0.89 (in US equivalent). Safety at Gold

Resource Corporation is paramount. Even with a good track record at

the DDGM, the Company continues to strive each quarter for improved

measures, awareness, and training.

- The DDGM diamond drilling program continued as planned during

the third quarter, using five drill rigs with encouraging results.

Drilling continued to advance on two fronts: (1) Infill drilling

designed to upgrade Inferred resources to the Indicated category;

and (2) Expansion drilling with the objective of identifying

additional Inferred resources via step-out drilling. The drilling

during the third quarter was successful in testing the northern

extensions of the Splay 31 and Marena North veins of the Arista

system, as well as in expanding the Three Sisters and Gloria vein

systems to the northwest and down-dip (Switchback system).

Back Forty Project

- Optimization work related to the metallurgy and the economic

model for the Back Forty Project in Michigan, USA, was completed,

and the Company released the Technical Report Summary (S-K 1300)

for the Back Forty Project as Exhibit 96.1 to Form 8-K filed on

October 26, 2023. Results of the work indicate a more robust

economic project with no planned impacts to wetlands that is more

protective of the environment, which should facilitate a successful

mine permitting process.

Financial

- Total cash cost after co-product credits for the quarter was

$1,839 per gold equivalent (“AuEq”) ounce, and total all-in

sustaining cost (“AISC”) after co-product credits for the quarter

was $2,669 per AuEq ounce. The year-to-date total cash cost after

co-product credits of $1,210 and total AISC after co-product

credits of $1,852 are no longer within the guidance due to the

strengthening of the peso and lower zinc prices. (See Item

2—Management’s Discussion and Analysis of Financial Condition and

Results of Operations – Non-GAAP Measures below for a

reconciliation of non-GAAP measures to applicable GAAP

measures).

2023 Capital and Exploration Investment Summary

For the nine months ended

September 30, 2023

2023 full year

guidance

(in thousands)

Sustaining Investments:

Underground Development

Capital

$

3,464

Infill Drilling

Capitalized Exploration

3,315

Other Sustaining Capital

Capital

1,485

Surface and Underground Exploration

Development & Other

Capitalized Exploration

1,131

Subtotal of Sustaining Investments:

9,395

$

9 - 11 million

Growth Investments:

DDGM growth:

Surface Exploration / Other

Exploration

2,058

Underground Exploration Drilling

Exploration

1,916

Underground Exploration Development

Capitalized Exploration

356

Back Forty growth:

Back Forty Project Optimization &

Permitting

Exploration

1,265

Subtotal of Growth Investments:

5,595

$

6 - 7 million

Total Capital and Exploration:

$

14,990

$

15 - 18 million

Trending Highlights

2022

2023

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Operating Data

Total tonnes milled

136,844

129,099

110,682

116,616

117,781

113,510

116,626

Average Grade

-

Gold (g/t)

3.00

2.63

1.98

2.51

2.33

1.59

1.52

Silver (g/t)

81

64

80

109

94

86

73

Copper (%)

0.41

0.32

0.37

0.45

0.37

0.37

0.32

Lead (%)

1.97

1.99

1.59

1.58

1.73

1.64

1.29

Zinc (%)

4.89

4.00

4.21

4.27

3.88

3.72

3.24

Metal production (before payable metal

deductions)

Gold (ozs.)

11,187

9,317

5,851

7,767

7,171

4,637

4,443

Silver (ozs.)

332,292

249,088

261,256

370,768

322,676

289,816

247,159

Copper (tonnes)

431

303

296

406

336

334

276

Lead (tonnes)

2,073

2,020

1,249

1,323

1,559

1,389

1,048

Zinc (tonnes)

5,562

4,282

3,901

4,198

3,837

3,569

3,223

Metal produced and sold

Gold (ozs.)

8,381

8,746

5,478

7,514

6,508

4,287

3,982

Silver (ozs.)

265,407

231,622

225,012

335,168

294,815

274,257

208,905

Copper (tonnes)

408

286

282

372

332

327

245

Lead (tonnes)

1,639

1,755

1,056

941

1,417

1,317

947

Zinc (tonnes)

4,359

3,590

2,943

3,265

3,060

3,141

2,571

Average metal prices realized

Gold ($ per oz.)

$ 1,898

$ 1,874

$ 1,627

$ 1,734

$ 1,915

$ 2,010

$ 1,934

Silver ($ per oz.)

$ 23.94

$ 22.05

$ 18.54

$ 21.25

$ 23.04

$ 24.93

$ 23.61

Copper ($ per tonne)

$ 10,144

$ 9,275

$ 7,115

$ 8,221

$ 9,172

$ 8,397

$ 8,185

Lead ($ per tonne)

$ 2,347

$ 2,168

$ 1,882

$ 1,954

$ 2,158

$ 2,153

$ 2,196

Zinc ($ per tonne)

$ 3,842

$ 4,338

$ 3,186

$ 2,577

$ 3,195

$ 2,485

$ 2,195

Gold equivalent ounces sold

Gold Ounces

8,381

8,746

5,478

7,514

6,508

4,287

3,982

Gold Equivalent Ounces from Silver

3,348

2,729

2,564

4,107

3,547

3,402

2,550

Total AuEq oz

11,729

11,475

8,042

11,621

10,055

7,689

6,532

Financial Data

Total sales, net (in thousands)

$ 45,417

$ 37,064

$ 23,869

$ 32,374

$ 31,228

$ 24,807

$ 20,552

Production Costs (in thousands)

$ 20,074

$ 21,722

$ 19,380

$ 19,773

$ 19,850

$ 20,302

$ 18,957

Production Costs/Tonnes Milled

$ 147

$ 168

$ 175

$ 170

$ 169

$ 179

$ 163

Operating Cash Flows (in thousands)

$ 4,230

$ 7,976

($ 4,292)

$ 6,243

$ 1,024

($ 551)

($ 7,475)

Net income (loss) (in thousands)

$ 4,019

$ 2,673

($ 9,730)

($ 3,283)

($ 1,035)

($ 4,584)

($ 7,341)

Earnings (loss) per share - basic

$ 0.05

$0.03

($ 0.11)

($ 0.04)

($ 0.01)

($ 0.05)

($ 0.08)

Trending Highlights of Non-GAAP Measures

2022

2023

Q1

Q2

Q3

Q4

Q1

Q2

Q3

(in thousands, except per oz)

Gold equivalent ounces sold (oz)

11,729

11,475

8,042

11,621

10,055

7,689

6,532

Total production costs (1)

$ 20,074

$ 21,722

$ 19,380

$ 19,773

$ 19,850

$ 20,302

$ 18,957

Treatment and refining charges (2)

2,748

3,137

2,860

3,327

3,184

3,328

2,788

Co-product credits (3)

(24,732)

(22,027)

(13,369)

(13,314)

(15,881)

(13,384)

(9,733)

Total cash cost after co-product

credits

($ 1,910)

$ 2,832

$ 8,871

$ 9,786

$ 7,153

$ 10,246

$ 12,012

Total cash cost after co-product

credits per AuEq oz sold

($ 163)

$ 247

$ 1,103

$ 842

$ 711

$ 1,333

$ 1,839

Sustaining - capitalized expenditure

(4)

$ 4,596

$ 4,028

$ 3,605

$ 4,110

$ 2,588

$ 2,187

$ 3,489

Sustaining - Exploration Expenditure

(4)

-

-

-

-

548

531

52

Reclamation and remediation (5)

62

61

58

620

195

200

216

Subtotal of DDGM sustaining costs

$ 4,658

$ 4,089

$ 3,663

$ 4,730

$ 3,331

$ 2,918

$ 3,757

DDGM all-in sustaining cost after

co-product credits per AuEq oz sold

$ 234

$ 603

$ 1,559

$ 1,249

$ 1,043

$ 1,712

$ 2,414

Sustaining - general and administrative,

including stock-based compensation expenses (6)

$ 2,673

$ 2,313

$ 2,249

$ 2,768

$ 1,790

$ 2,137

$ 1,662

Consolidated all-in sustaining cost after

co-product credits

$ 5,421

$ 9,234

$ 14,783

$ 17,284

$ 12,274

$ 15,301

$ 17,431

Total consolidated all-in sustaining

cost after co-product credits per AuEq oz sold

$ 462

$ 805

$ 1,838

$ 1,487

$ 1,221

$ 1,990

$ 2,669

Non-sustaining cost- capital expenditure

(4)

$ 1,353

$ 541

$ -

$ -

$ -

$ 147

$ 209

Non-sustaining cost- exploration

expenditure (1)

2,305

2,837

4,973

2,934

1,839

1,440

1,960

Subtotal of non-sustaining costs

$ 3,658

$ 3,378

$ 4,973

$ 2,934

$ 1,839

$ 1,587

$ 2,169

Total all-in cost after co-product

credits

$ 9,079

$ 12,612

$ 19,756

$ 20,218

$ 14,113

$ 16,888

$ 19,600

Total all-in cost after co-product

credits per AuEq oz sold

$ 774

$ 1,099

$ 2,457

$ 1,740

$ 1,404

$ 2,196

$ 3,001

(1)

Refer to Production costs in the current

and previously filed Item 1—Condensed Consolidated Interim

Financial Statements and Notes (unaudited) in Condensed

Consolidated Interim Statements of Operations.

(2)

Refer to Treatment and refining charges in

the current and previously filed Item 1—Condensed Consolidated

Interim Financial Statements and Notes (unaudited): Note 3 –

Revenue.

(3)

Refer to Realized/Unrealized Derivatives

for copper, zinc, and lead in the current and previously filed Item

1—Condensed Consolidated Interim Financial Statements and Notes

(unaudited): Note 20 – Fair Value Measurement. Note that Co-product

credits for the prior year (2022) comparable numbers were adjusted

to include realized embedded derivatives only for co-products

(which better represents the cash cost after co-product credits

because it now excludes unrealized gains or losses) and align with

the current year presentation.

(4)

Refer to Capital expenditures in the

current and previously filed Item 1—Condensed Consolidated Interim

Financial Statements and Notes (unaudited): Condensed Consolidated

Interim Statements of Cash Flows.

(5)

Refer to Reclamation and remediation in

the current and previously filed Item 1—Condensed Consolidated

Interim Financial Statements and Notes (unaudited): Condensed

Consolidated Interim Statements of Operations. Note that the prior

year’s (2022) comparable numbers were adjusted to include

Reclamation and remediation (which better represents the all-in

sustaining cost after co-product credits because Reclamation and

remediation are part of normal operating activities) and to align

with the current year’s presentation.

(6)

Refer to General and administrative

expenses and Stock-based compensation in the current and previously

filed Item 1—Condensed Consolidated Interim Financial Statements

and Notes (unaudited): Condensed Consolidated Interim Statements of

Operations.

About GRC:

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with its operations centered on the Don

David Gold Mine in Oaxaca, Mexico. Under the direction of an

experienced board and senior leadership team, the Company’s focus

is to unlock the significant upside potential of its existing

infrastructure and large land position surrounding the mine in

Oaxaca, Mexico, and to develop the Back Forty Project in Michigan,

USA. For more information, please visit GRC’s website, located at

www.goldresourcecorp.com, and read the Company’s Form 10-K for an

understanding of the risk factors associated with its business.

Q3 2023 Conference Call

The Company will host a conference call on Tuesday, November 7,

2023 at 12:00 p.m. Eastern Time.

The conference call will be recorded and posted to the Company’s

website later in the day following the conclusion of the call.

Following prepared remarks, Allen Palmiere, President and Chief

Executive Officer, Alberto Reyes, Chief Operating Officer, and Chet

Holyoak, Chief Financial Officer, will host a live question and

answer (Q&A) session. There are two ways to join the conference

call.

To join the conference via webcast, please click on the

following link:

https://viavid.webcasts.com/starthere.jsp?ei=1637564&tp_key=c391b292bd

To join the call via telephone, please use the following dial-in

details:

Participant Toll Free:

+1 (888) 886-7786

International:

+1 (416) 764-8658

Conference ID:

67122083

Please connect to the conference call at least 10 minutes prior

to the start time using one of the connection options listed

above.

Forward-Looking Statements:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. In some cases, you can identify forward-looking statements by

the following words: "may," "might," "will," "could," "would,"

"should," "expect," "plan," "anticipate," "intend," "seek,"

"believe," "estimate," "predict," "potential," "continue,"

"contemplate," "possible," or the negative of these terms or other

comparable terminology, although not all forward-looking statements

contain these words. They are not historical facts, nor are they

guarantees of future performance. Any express or implied statements

contained in this announcement that are not statements of

historical fact may be deemed to be forward-looking statements,

including, without limitation, statements regarding the timing and

scope of a process to explore strategic alternatives for the

Company, including a potential sale of the Company. It is possible

that the Company’s actual results, financial condition, and

developments may differ, possibly materially, from the anticipated

results, developments, and financial condition indicated in these

forward-looking statements. Management believes that these

forward-looking statements are reasonable as of the time made.

However, caution should be taken not to place undue reliance on any

such forward-looking statements because such statements speak only

as of the date when made. Our Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise, except

as required by law. These forward-looking statements are neither

promises nor guarantees, but involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those projected, including, without limitation: whether the

objectives of the strategic alternative review process will be

achieved; the terms, structure, benefits and costs of any strategic

transaction; the timing of any transaction and whether any

transaction will be consummated at all; the risk that the strategic

alternatives review and its announcement could have an adverse

effect on the ability of the Company to retain and hire key

personnel and maintain relationships with suppliers, employees,

shareholders, and other business relationships, and on its

operating results and business generally; the risk the strategic

alternatives review could divert the attention and time of the

Company’s management; the risk of any unexpected costs or expenses

resulting from the review; the risk of any litigation relating to

the review; and the risks and uncertainties described in “Item 1A.

Risk Factors” in our Annual report on Form 10-K for the year ended

December 31, 2022 and those described from time to time in our

future reports filed with the Securities and Exchange

Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106923792/en/

For further information, please contact: Chet Holyoak

Chief Financial Officer Chet.holyoak@grc-usa.com

www.GoldResourceCorp.com

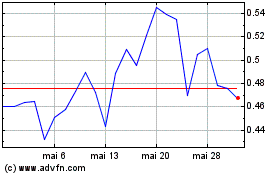

Gold Resource (AMEX:GORO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Gold Resource (AMEX:GORO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024