Declares Special Cash Dividend

Raises Fiscal Year 2023 Outlook on Key

Metrics

SharkNinja, Inc. (“SharkNinja” or the “Company”) (NYSE: SN), a

global product design and technology company, today announced its

financial results for the third quarter ended September 30,

2023.

Highlights for the Third Quarter 2023 as compared to the

Third Quarter 2022

- Net sales increased 13.1% to $1,070.6 million and Adjusted Net

Sales increased 14.6% to $1,057.4 million.

- Gross margin and Adjusted Gross Margin increased 920 and 950

basis points, respectively.

- Net income decreased 76.7% to $18.7 million. Adjusted Net

Income increased 34.0% to $133.0 million

- Adjusted EBITDA increased 38.4% to $208.7 million, or 19.7% of

Adjusted Net Sales.

Mark Barrocas, Chief Executive Officer, commented, “I’m thrilled

with our strong performance in the third quarter. This is a result

of a lot of hard work by our teams across the globe. We continue to

deliver on our three-pillar growth strategy of gaining market share

in existing categories, entering new and adjacent categories and

international expansion. We are leveraging our disruptive

innovation engine, our highly effective go-to-market strategy, and

our efficient supply chain as we strive to deliver industry-leading

growth and profitability.”

“We have good momentum as we head into the holiday season. As we

look into our future, I'm excited about the tremendous whitespace

in front of us. I am confident we’re on the right track to fulfill

our mission of positively impacting people’s lives every day in

every home around the world and to deliver substantial value to all

our stakeholders.”

Three Months Ended September 30, 2023

Net sales increased 13.1% to $1,070.6 million, compared to

$946.9 million during the same period last year. Adjusted Net Sales

increased 14.6% to $1,057.4 million, compared to $922.9 million

during the same period last year, or 12.8% on a constant currency

basis. The increase in net sales and Adjusted Net Sales resulted

primarily from growth in the cooking and beverage appliances, food

preparation appliances and other net sales product categories,

partially offset by a decline in the cleaning appliances product

category.

- Cleaning Appliances net sales decreased by $54.1 million, or

10.7%, to $449.3 million, compared to $503.4 million in the prior

year quarter. Adjusted Net Sales of Cleaning Appliances decreased

by $43.6 million, or 9.0%, from $486.1 million to $442.5 million,

driven by softness in the North America market for corded and

cordless vacuums. This net sales decline was partially offset by

growth in the carpet extraction sub-category driven by new product

innovation.

- Cooking and Beverage Appliances net sales increased by $78.9

million, or 30.3%, to $339.3 million, compared to $260.4 million in

the prior year quarter. Adjusted Net Sales of Cooking and Beverage

Appliances increased by $80.0 million, or 31.0%, from $258.2

million to $338.1 million, driven by growth in Europe, specifically

in the United Kingdom, where we strengthened our leading market

position. Our global growth was also supported by the full quarter

of sales of our outdoor grill that launched in the second half of

2022, which continues to perform well across the US and European

markets.

- Food Preparation Appliances net sales increased by $50.2

million, or 31.1%, to $211.5 million, compared to $161.3 million in

the prior year quarter. Adjusted Net Sales of Food Preparation

Appliances increased by $52.5 million, or 33.5%, from $156.8

million to $209.3 million, driven by strong sales of our ice cream

makers and compact blenders, led by the launch of our new portable

blenders.

- Other net sales increased by $48.7 million, or 223.2%, to $70.5

million, compared to $21.8 million in the prior year quarter.

Adjusted Net Sales in the other category increased by $45.7

million, or 209.3%, from $21.8 million to $67.5 million, primarily

driven by continued strength of haircare products within the beauty

category.

Gross profit increased 41.9% to $487.5 million, or 45.5% of net

sales, compared to $343.5 million, or 36.3% of net sales, in the

third quarter of 2022. Adjusted Gross Profit increased 43.1% to

$505.5 million, or 47.8% of Adjusted Net Sales, compared to $353.2

million, or 38.3% of Adjusted Net Sales in the third quarter of

2022. The increase in gross margin and Adjusted Gross Margin of 920

and 950 basis points, respectively, was primarily driven by

continued supply chain tailwinds, cost optimization efforts and a

favorable pricing and promotional mix.

Research and development expenses increased 12.5% to $60.7

million, or 5.7% of net sales, compared to $54.0 million, or 5.7%

of net sales, in the prior year quarter. This increase was

primarily driven by incremental personnel-related expenses of $7.1

million driven by increased headcount to support new product

categories and new market expansion, as well as a $2.9 million

increase in share-based compensation.

Sales and marketing expenses increased 55.9% to $207.6 million,

or 19.4% of net sales, compared to $133.1 million, or 14.1% of net

sales, in the third quarter of 2022. This increase was primarily

attributable to increases of $38.2 million in advertising-related

expenses and $9.6 million in personnel-related expenses to support

new product launches and expansion into new markets, which includes

an incremental $1.8 million of share-based compensation, and an

increase of $14.0 million in delivery and distribution costs driven

by higher volumes, particularly in our direct-to-consumer ("DTC")

business.

General and administrative expenses increased 163.5% to $124.7

million, or 11.6% of net sales, compared to $47.3 million, or 5.0%

of net sales in the prior year quarter. Included in general and

administrative expenses in the third quarter of 2023 is $41.5

million of costs related to the separation and distribution from JS

Global, as well as incremental personnel-related expenses of $21.9

million, of which $15.7 million is attributable to increased

share-based compensation.

Operating income decreased 13.3% to $94.5 million, or 8.8% of

net sales, compared to $109.1 million, or 11.5% of net sales,

during the prior year quarter. Adjusted Operating Income increased

44.1% to $190.1 million, or 18.0% of Adjusted Net Sales, compared

to $131.9 million, or 14.3% of Adjusted Net Sales, in the third

quarter of 2022.

Net income decreased 76.7% to $18.7 million, or 1.7% of net

sales, compared to $80.3 million, or 8.5% of net sales, in the

prior year quarter. Net income per diluted share decreased 76.8% to

$0.13, compared to $0.58 in the prior year quarter.

Adjusted Net Income increased 34.0% to $133.0 million, or 12.6%

of Adjusted Net Sales, compared to $99.2 million, or 10.8% of

Adjusted Net Sales, in the prior year quarter. Adjusted Net Income

per diluted share increased 33.6% to $0.95, compared to $0.71 in

the prior year quarter.

Adjusted EBITDA increased 38.4% to $208.7 million, or 19.7% of

Adjusted Net Sales, compared to $150.8 million, or 16.3% of

Adjusted Net Sales in the prior year quarter.

Nine Months Ended September 30, 2023

Net sales increased 13.5% to $2,876.2 million, compared to

$2,534.7 million during the same period last year. Adjusted Net

Sales increased 13.4% to $2,798.7 million, compared to $2,468.8

million during the same period last year, or 13.7% on a constant

currency-basis. The increase in net sales resulted primarily from

growth in the cooking and beverage appliances, food preparation

appliances and other net sales product categories, partially offset

by a decline in the cleaning appliances product category.

- Cleaning Appliances net sales decreased by $73.6 million, or

5.4%, to $1,278.0 million, compared to $1,351.6 million during the

same period last year. Adjusted Net Sales of Cleaning Appliances

decreased by $72.7 million, or 5.6%, from $1,301.3 million to

$1,228.6 million driven by softness in the North America market for

corded and cordless vacuums. This net sales decline was partially

offset by growth in the carpet extraction sub-category driven by

new product innovation.

- Cooking and Beverage Appliances net sales increased by $242.5

million, or 34.8%, to $939.1 million, compared to $696.6 million

during the same period last year. Adjusted Net Sales of Cooking and

Beverage Appliances increased by $242.2 million, or 35.1%%, from

$690.7 million to $932.9 million driven by growth in Europe,

specifically in the United Kingdom with air fryers, where we

strengthened our leading market position. Our global growth was

further supported by the full nine months of sales of our outdoor

grill that launched in the second half of 2022, which continues to

perform well across the US and European markets.

- Food Preparation Appliances net sales increased by $45.3

million, or 10.6%, to $472.7 million, compared to $427.4 million

during the same period last year. Adjusted Net Sales of Food

Preparation Appliances increased by $46.6 million, or 11.2%, from

$417.7 million to $464.4 million driven by strong sales of our ice

cream makers and blenders.

- Other net sales increased by $127.3 million, or 215.2%, to

$186.5 million, compared to $59.2 million during the same period

last year. Adjusted Net Sales in the other category increased by

$113.6 million, or 192.1%, from $59.2 million to $172.8 million

driven by continued strength of haircare products within the beauty

category.

Gross profit increased 30.2% to $1,285.0 million, or 44.7% of

net sales, compared to $986.9 million, or 38.9% of net sales, in

the same period last year. Adjusted Gross Profit increased 28.8% to

$1,305.9 million, or 46.7% of Adjusted Net Sales, compared to

$1,013.6 million, or 41.1% of Adjusted Net Sales. The increase in

gross margin and Adjusted Gross Margin of 580 and 560 basis points,

respectively, was primarily driven by continued supply chain

tailwinds, cost optimization efforts and a favorable pricing and

promotional mix. We also drove strong sales through our higher

margin DTC channel, specifically in the beauty category.

Research and development expenses increased 12.8% to $180.4

million, or 6.3% of net sales, compared to $160.0 million, or 6.3%

of net sales during the same period last year. This increase was

primarily attributable to an increase of $15.4 million in

personnel-related expenses driven by increased headcount to support

new product categories and new market expansion, as well as a $2.6

million increase in share-based compensation.

Sales and marketing expenses increased 40.1% to $568.0 million,

or 19.7% of net sales, compared to $405.3 million, or 16.0% of net

sales during the same period last year. This increase was primarily

attributable to increases of $75.2 million in advertising-related

expenses and $22.7 million in personnel-related expenses to support

new product launches and expansion into new markets, which includes

an incremental $2.0 million of share-based compensation, and an

increase of $35.2 million in delivery and distribution costs driven

by higher volumes, particularly in our DTC business. The remaining

increase in sales and marketing was driven by an increase in public

relations expenses, depreciation and amortization, professional

services, and payment processing fees related to the DTC

channel.

General and administrative expenses increased 71.2% to $263.7

million, or 9.2% of net sales, compared to $154.0 million, or 6.1%

of net sales during the same period last year. Included in general

and administrative expenses in 2023 is $76.5 million of costs

related to the separation and distribution from JS Global, as well

as incremental personnel-related expenses of $22.1 million, of

which $14.5 million is attributable to increased share-based

compensation.

Operating income increased 2.0% to $272.8 million, or 9.5% of

net sales, compared to $267.6 million, or 10.6% of net sales,

during the same period last year. Adjusted Operating Income

increased 29.5% to $438.1 million, or 15.7% of Adjusted Net Sales,

compared to $338.4 million, or 13.7% of Adjusted Net Sales, during

the same period last year.

Net income decreased 36.6% to $117.8 million, or 4.1% of net

sales, compared to $185.7 million, or 7.3% of net sales, during the

same period last year. Net income per diluted share decreased 36.7%

to $0.85, compared to $1.34 in the prior year period.

Adjusted Net Income increased 24.4% to $317.1 million, or 11.3%

of Adjusted Net Sales, compared to $255.0 million, or 10.3% of

Adjusted Net Sales in the prior year period. Adjusted Net Income

per diluted share increased 24.2% to $2.28, compared to $1.83 in

the prior year period.

Adjusted EBITDA increased 27.9% to $500.4 million, or 17.9% of

Adjusted Net Sales, compared to $391.2 million, or 15.8% of

Adjusted Net Sales in the prior year period.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents decreased to $170.4 million, compared

to $192.9 million as of December 31, 2022.

Inventories increased 44.4% to $792.2 million, compared to

$548.6 million as of December 31, 2022, primarily driven by demand

planning for the upcoming holiday season.

Total debt, excluding unamortized deferred financing costs, was

$810.0 million, compared to $437.5 million as of December 31, 2022.

In July 2023, we entered into a new credit facility to replace our

existing term loan and revolving credit agreement. The new credit

facility provides for a $810.0 million term loan and a $500.0

million revolving credit facility.

Special Cash Dividend

On November 8, 2023, our board of directors approved the

declaration and payment of a special cash dividend of $1.08 per

share, or approximately $150 million in the aggregate, payable on

or about December 11, 2023 to our shareholders of record as of

December 1, 2023. The dividend is expected to be funded by cash on

hand.

Fiscal 2023 Outlook

For fiscal year 2023, SharkNinja expects:

- Net sales to increase 11.5% to 12.5% and Adjusted Net Sales to

increase between 12.5% and 13.5% compared to the prior year.

- Adjusted Net Income per diluted share between $3.06 and $3.14,

reflecting a 29% to 32% increase compared to the prior year.

- Adjusted EBITDA between $690 million and $705 million,

reflecting a 33% to 36% increase compared to the prior year.

- A GAAP effective tax rate of approximately 42% to 43%,

inclusive of approximately 14 to 15 percentage points of impact

related to withholding taxes and non-deductible costs associated

with the separation and distribution from JS Global and certain

related party transactions, and approximately 3 percentage points

of impact related to withholding taxes associated with the special

cash dividend in the fourth quarter.

- Diluted weighted average shares outstanding of approximately

139.3 million.

- Capital expenditures of $120 million to $140 million primarily

to support investments in new product launches and technology.

Conference Call Details

A conference call to discuss the third quarter 2023 financial

results is scheduled for today, November 9, 2023, at 8:00 a.m.

Eastern Time. A live audio webcast of the conference call will be

available online at http://ir.sharkninja.com. Investors and

analysts interested in participating in the live call are invited

to dial 1-877-407-4018 or 1-201-689-8471. The webcast will be

archived and available for replay.

About SharkNinja, Inc.

SharkNinja, Inc. (NYSE: SN) is a global product design and

technology company, with a diversified portfolio of 5-star rated

lifestyle solutions that positively impact people’s lives in homes

around the world. Powered by two trusted, global brands, Shark and

Ninja, the company has a proven track record of bringing disruptive

innovation to market, and developing one consumer product after

another has allowed SharkNinja to enter multiple product

categories, driving significant growth and market share gains.

Headquartered in Needham, Massachusetts with more than 2,800

associates, the company’s products are sold at key retailers,

online and offline, and through distributors around the world. For

more information, please visit SharkNinja.com and follow

@SharkNinja.

Forward-looking statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our future

business, financial condition, results of operations and prospects

and Fiscal 2023 outlook. These statements are often, but not

always, made through the use of words or phrases such as “may,”

“should,” “could,” “predict,” “potential,” “believe,” “will likely

result,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would” and “outlook,”

or the negative version of those words or phrases or other

comparable words or phrases of a future or forward-looking nature.

These forward-looking statements are not statements of historical

fact, and are based on current expectations, estimates and

projections about our industry as well as certain assumptions made

by management, many of which, by their nature, are inherently

uncertain and beyond our control. These forward-looking statements

are subject to a number of known and unknown risks, uncertainties

and assumptions, which you should consider and read carefully,

including but not limited to:

- our ability to maintain and strengthen our brands to generate

and maintain ongoing demand for our products;

- our ability to commercialize a continuing stream of new

products and line extensions that create demand;

- our ability to effectively manage our future growth;

- general economic conditions and the level of discretionary

consumer spending;

- our ability to expand into additional consumer markets;

- our ability to maintain product quality and product performance

at an acceptable cost;

- our ability to compete with existing and new competitors in our

markets;

- problems with, or loss of, our supply chain or suppliers, or an

inability to obtain raw materials;

- the risks associated with doing business globally;

- inflation, changes in the cost or availability of raw

materials, energy, transportation and other necessary supplies and

services;

- our ability to hire, integrate and retain highly skilled

personnel;

- our ability to maintain, protect and enhance our intellectual

property;

- our ability to securely maintain consumer and other third-party

data;

- our ability to comply with ongoing regulatory

requirements;

- the increased expenses associated with being a public

company;

- our status as a “controlled company” within the meaning of the

rules of NYSE; and

- our ability to achieve some or all of the anticipated benefits

of the separation.

This list of factors should not be construed as exhaustive and

should be read in conjunction with the other cautionary statements

that are included in this press release. We operate in a very

competitive and rapidly changing environment. New risks emerge from

time to time. It is not possible for us to predict all risks, nor

can we assess the impact of all factors on our business or the

extent to which any factor or combination of factors may cause

actual results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, the future events and trends

discussed in this press release, and our future levels of activity

and performance, may not occur and actual results could differ

materially and adversely from those described or implied in the

forward-looking statements. As a result, you should not regard any

of these forward-looking statements as a representation or warranty

by us or any other person or place undue reliance on any such

forward-looking statements. Any forward-looking statement speaks

only as of the date on which it is made, and we do not undertake

any obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law. In addition,

statements that contain “we believe” and similar statements reflect

our beliefs and opinions on the relevant subject. These statements

are based on information available to us as of the date of this

press release. While we believe that this information provides a

reasonable basis for these statements, this information may be

limited or incomplete. Our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all relevant information. These statements are

inherently uncertain, and investors are cautioned not to unduly

rely on these statements. We qualify all of our forward-looking

statements by the cautionary statements contained in this press

release.

SHARKNINJA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

(unaudited)

As of

September 30, 2023

December 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

170,377

$

192,890

Restricted cash

—

25,880

Accounts receivable, net

938,081

766,503

Inventories

792,195

548,588

Prepaid expenses and other current

assets

86,471

181,831

Total current assets

1,987,124

1,715,692

Property and equipment, net

149,250

137,341

Operating lease right-of-use assets

64,156

67,321

Intangible assets, net

481,754

492,709

Goodwill

833,972

840,148

Deferred tax assets, noncurrent

—

6,291

Other assets, noncurrent

48,983

35,389

Total assets

$

3,565,239

$

3,294,891

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

646,697

$

328,122

Accrued expenses and other current

liabilities

451,400

552,023

Tax payable

2,615

1,581

Current portion of long-term debt

19,127

86,972

Total current liabilities

1,119,839

968,698

Long-term debt

785,443

349,169

Operating lease liabilities,

noncurrent

62,616

61,779

Deferred tax liabilities, noncurrent

47,266

60,976

Other liabilities, noncurrent

27,730

25,980

Total liabilities

2,042,894

1,466,602

Commitments and contingencies

Shareholders’ equity:

Ordinary shares, $0.0001 par value per

share, 1,000,000,000 shares authorized and 138,982,872 shares

issued and outstanding as of September 30, 2023 and December 31,

2022

14

14

Additional paid-in capital

959,248

941,206

Retained earnings

571,174

896,738

Accumulated other comprehensive loss

(8,091

)

(9,669

)

Total shareholders’ equity

1,522,345

1,828,289

Total liabilities and shareholders’

equity

$

3,565,239

$

3,294,891

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Net sales(1)

$

1,070,617

$

946,897

$

2,876,211

$

2,534,720

Cost of sales

583,124

603,413

1,591,254

1,547,843

Gross profit

487,493

343,484

1,284,957

986,877

Operating expenses:

Research and development

60,691

53,968

180,430

159,955

Sales and marketing

207,599

133,137

568,035

405,319

General and administrative

124,655

47,299

263,682

154,035

Total operating expenses

392,945

234,404

1,012,147

719,309

Operating income

94,548

109,080

272,810

267,568

Interest expense, net

(13,003

)

(8,479

)

(28,523

)

(18,561

)

Other (expense) income, net

(5,865

)

2,033

(41,315

)

(8,841

)

Income before income taxes

75,680

102,634

202,972

240,166

Provision for income taxes

56,958

22,325

85,218

54,451

Net income

$

18,722

$

80,309

$

117,754

$

185,715

Net income per share, basic

$

0.13

$

0.58

$

0.85

$

1.34

Net income per share, diluted

$

0.13

$

0.58

$

0.85

$

1.34

Weighted-average number of shares used in

computing net income per share, basic

139,073,181

138,982,872

139,059,206

138,982,872

Weighted-average number of shares used in

computing net income per share, diluted

139,430,805

138,982,872

139,179,724

138,982,872

(1) Net sales in our product categories were as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2023

2022

2023

2022

Cleaning Appliances

$

449,319

$

503,388

$

1,277,986

$

1,351,576

Cooking and Beverage Appliances

339,328

260,438

939,060

696,568

Food Preparation Appliances

211,461

161,256

472,685

427,422

Other

70,509

21,815

186,480

59,154

Total net sales

$

1,070,617

$

946,897

$

2,876,211

$

2,534,720

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2023

2022

Cash flows from operating

activities:

Net income

$

117,754

$

185,715

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

77,394

61,560

Share-based compensation

24,502

5,415

Provision for credit losses

2,266

1,149

Non-cash lease expense

9,688

12,318

Amortization of debt discount

694

700

Loss on extinguishment of debt

968

—

Deferred income taxes, net

3,905

(13,620

)

Loss from equity method investment

—

361

Changes in operating assets and

liabilities:

Accounts receivable

(192,209

)

137,191

Inventories

(258,982

)

(86,068

)

Prepaid expenses and other assets

65,508

(104,114

)

Accounts payable

343,603

(93,877

)

Tax payable

883

18,308

Operating lease liabilities

(9,280

)

(11,603

)

Accrued expenses and other liabilities

(90,914

)

(74,006

)

Net cash provided by operating

activities

95,780

39,429

Cash flows from investing

activities:

Purchase of property and equipment

(70,501

)

(52,872

)

Purchase of intangible asset

(6,905

)

(4,919

)

Capitalized internal-use software

development

(683

)

(4,986

)

Cash receipts on beneficial interest in

sold receivables

16,777

—

Investment in equity method investment

—

(361

)

Other investing activities, net

(3,051

)

(300

)

Net cash used in investing activities

(64,363

)

(63,438

)

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(continued)

(in thousands)

(unaudited)

Nine Months Ended September

30,

2023

2022

Cash flows from financing

activities:

Proceeds from issuance of debt, net of

issuance cost

800,915

259,895

Repayment of debt

(437,500

)

(155,000

)

Intercompany note to Former Parent

—

(49,286

)

Distribution paid to Former Parent

(435,292

)

(45,438

)

Recharge from Former Parent for

share-based compensation

(3,165

)

(15,300

)

Net cash used in financing activities

(75,042

)

(5,129

)

Effect of exchange rates changes on

cash

(4,768

)

(11,782

)

Net decrease in cash, cash equivalents,

and restricted cash

(48,393

)

(40,920

)

Cash, cash equivalents, and restricted

cash at beginning of period

218,770

240,597

Cash, cash equivalents, and restricted

cash at end of period

$

170,377

$

199,677

Non-GAAP Financial Measures

In addition to the measures presented in our consolidated

financial statements, we regularly review other financial measures,

defined as non-GAAP financial measures by the SEC, to evaluate our

business, measure our performance, identify trends, prepare

financial forecasts, and make strategic decisions.

The key non-GAAP financial measures we consider are Adjusted Net

Sales, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted

Operating Income, Adjusted Net Income, Adjusted Net Income Per

Share, Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Net

Sales growth on a constant currency basis. These non-GAAP financial

measures are used by both management and our Board, together with

comparable GAAP information, in evaluating our current performance

and planning our future business activities. These non-GAAP

financial measures provide supplemental information regarding our

operating performance on a non-GAAP basis that excludes certain

gains, losses and charges of a non-cash nature or which occur

relatively infrequently and/or which management considers to be

unrelated to our core operations and excludes the financial results

from our former Japanese subsidiary, SharkNinja Co., Ltd., and our

Asia Pacific Region and Greater China distribution channels, both

of which were transferred to JS Global Lifestyle Company Limited

(“JS Global”) concurrently with the separation (the

“Divestitures”), as well as the cost of sales from (i) inventory

markups that will be eliminated as a result of the transition of

certain product procurement functions from a subsidiary of JS

Global to SharkNinja concurrently with the separation and (ii)

costs related to the transitional Sourcing Services Agreement with

JS Global that was entered into in connection with the separation

(collectively, the “Product Procurement Adjustment”). Management

believes that tracking and presenting these non-GAAP financial

measures provides management and the investment community with

valuable insight into our ongoing core operations, our ability to

generate cash and the underlying business trends that are affecting

our performance. We believe that these non-GAAP measures, when used

in conjunction with our GAAP financial information, also allow

investors to better evaluate our financial performance in

comparison to other periods and to other companies in our industry

and to better understand and interpret the results of the ongoing

business following the separation and distribution. These non-GAAP

financial measures should not be viewed as a substitute for our

financial results calculated in accordance with GAAP and you are

cautioned that other companies may define these non-GAAP financial

measures differently.

SharkNinja does not provide a reconciliation of forward-looking

Adjusted Net Income and Adjusted EBITDA to GAAP net income because

such reconciliations are not available without unreasonable

efforts. The is due to the inherent difficulty in forecasting with

reasonable certainty certain amount that are necessary for such

reconciliation, including, in particular, the realized and

unrealized foreign currency gains or losses reported within other

expense. For the same reasons, we are unable to forecast with

reasonable certainty all deductions and additions needed in order

to provide forward-looking GAAP net income at this time. The amount

of these deductions and additions may be material, and, therefore,

could result in forward-looking GAAP net income being materially

different or less than forward-looking Adjusted Net Income and

Adjusted EBITDA. See “Forward-looking statements” above.

We define Adjusted Net Sales as net sales as adjusted to exclude

certain items that we do not consider indicative of our ongoing

operating performance following the separation, including net sales

from our Divestitures. We believe that Adjusted Net Sales is an

appropriate measure of our performance because it eliminates the

impact of our Divestitures that do not relate to the ongoing

performance of our business.

The following table reconciles Adjusted Net Sales to the most

comparable GAAP measure, net sales, for the periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2023

2022

2023

2022

Net sales

$

1,070,617

$

946,897

$

2,876,211

$

2,534,720

Divested subsidiary net sales adjustment

(1)

(13,196

)

(24,003

)

(77,544

)

(65,873

)

Adjusted Net Sales(2)

$

1,057,421

$

922,894

$

2,798,667

$

2,468,847

(1)

Adjusted for net sales from SharkNinja Co., Ltd. (“SNJP”) and the

APAC distribution channels for the three and nine months ended

September 30, 2023 and 2022, as if such Divestitures occurred on

January 1, 2022.

(2)

The following tables reconcile Adjusted Net Sales to net sales per

product category, for the periods presented:

Three Months Ended September

30, 2023

Three Months Ended September

30, 2022

($ in thousands, except %)

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Cleaning appliances

$

449,319

$

(6,838

)

$

442,481

$

503,388

$

(17,285

)

$

486,103

Cooking appliances

339,328

(1,190

)

338,138

260,438

(2,259

)

258,179

Food Preparation Appliances

211,461

(2,133

)

209,328

161,256

(4,459

)

156,797

Other

70,509

(3,035

)

67,474

21,815

—

21,815

Total net sales

$

1,070,617

$

(13,196

)

$

1,057,421

$

946,897

$

(24,003

)

$

922,894

Nine Months Ended September

30, 2023

Nine Months Ended September

30, 2022

($ in thousands, except %)

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Cleaning appliances

$

1,277,986

$

(49,392

)

$

1,228,594

$

1,351,576

$

(50,303

)

$

1,301,273

Cooking appliances

939,060

(6,161

)

932,899

696,568

(5,895

)

690,673

Food Preparation Appliances

472,685

(8,289

)

464,396

427,422

(9,675

)

417,747

Other

186,480

(13,702

)

172,778

59,154

—

59,154

Total net sales

$

2,876,211

$

(77,544

)

$

2,798,667

$

2,534,720

$

(65,873

)

$

2,468,847

We define Adjusted Gross Profit as gross profit as adjusted to

exclude certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

the net sales and cost of sales from our Divestitures and the cost

of sales from the Product Procurement Adjustment. We define

Adjusted Gross Margin as Adjusted Gross Profit divided by Adjusted

Net Sales. We believe that Adjusted Gross Profit and Adjusted Gross

Margin are appropriate measures of our operating performance

because each eliminates the impact our Divestitures and certain

other adjustments that do not relate to the ongoing performance of

our business.

The following table reconciles Adjusted Gross Profit and

Adjusted Gross Margin to the most comparable GAAP measure, gross

profit and gross margin, respectively, for the periods

presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2023

2022

2023

2022

Net sales

$

1,070,617

$

946,897

$

2,876,211

$

2,534,720

Cost of sales

(583,124

)

(603,413

)

(1,591,254

)

(1,547,843

)

Gross profit

487,493

343,484

1,284,957

986,877

Gross margin %

45.5

%

36.3

%

44.7

%

38.9

%

Divested subsidiary net sales adjustment

(1)

(13,196

)

(24,003

)

(77,544

)

(65,873

)

Divested subsidiary cost of sales

adjustment(2)

7,628

15,387

45,116

41,323

Product Procurement Adjustment(3)

23,574

18,341

53,369

51,231

Adjusted Gross Profit

$

505,499

$

353,209

$

1,305,898

$

1,013,558

Adjusted Net Sales

$

1,057,421

$

922,894

$

2,798,667

$

2,468,847

Adjusted Gross Margin

47.8

%

38.3

%

46.7

%

41.1

%

(1)

Adjusted for net sales from SNJP and the APAC distribution channels

for the three and nine months ended September 30, 2023 and 2022, as

if such Divestitures occurred on January 1, 2022.

(2)

Adjusted for cost of sales from SNJP and the APAC distribution

channels for the three and nine months ended September 30, 2023 and

2022, as if such Divestitures occurred on January 1, 2022.

(3)

Represents cost of sales incurred related to the Product

Procurement Adjustment. As a result of the separation, we purchase

100% of our inventory from one of our subsidiaries, SNHK, and no

longer purchase inventory from a purchasing office wholly owned by

JS Global. Thus, the markup on all inventory purchased subsequent

to the separation will be completely eliminated in consolidation.

As a result of the separation, we pay JS Global a sourcing service

fee to provide value-added sourcing services on a transitional

basis under a Sourcing Services Agreement.

We define Adjusted Operating Income as operating income

excluding (i) share-based compensation, (ii) certain litigation

costs, (iii) amortization of certain acquired intangible assets,

(iv) certain separation and distribution costs and (v) certain

items that we do not consider indicative of our ongoing operating

performance following the separation, including operating income

from our Divestitures and cost of sales from our Product

Procurement Adjustment.

The following table reconciles Adjusted Operating Income to the

most comparable GAAP measure, operating income, for the periods

presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2023

2022

2023

2022

Operating income

$

94,548

$

109,080

$

272,810

$

267,568

Share-based compensation(1)

21,337

969

24,502

5,415

Litigation costs(2)

3,965

19

4,600

4,024

Amortization of acquired intangible

assets(3)

4,897

4,897

14,690

14,691

Separation and distribution related

costs(4)

41,455

275

76,549

275

Product Procurement Adjustment(5)

23,574

18,341

53,369

51,231

Divested subsidiary operating income

adjustment(6)

287

(1,668

)

(8,456

)

(4,811

)

Adjusted Operating Income

$

190,063

$

131,913

$

438,064

$

338,393

(1)

Represents non-cash expense related to restricted stock unit awards

issued from the JS Global and SharkNinja equity incentive plans.

(2)

Represents litigation costs incurred for certain patent

infringement claims and false advertising claims against us.

(3)

Represents amortization of acquired intangible assets that we do

not consider normal recurring operating expenses, as the intangible

assets relate to JS Global’s acquisition of our business. We

exclude amortization charges for these acquisition-related

intangible assets for purposes of calculating Adjusted Net Income,

although revenue is generated, in part, by these intangible assets,

to eliminate the impact of these non-cash charges that are

significantly impacted by the timing and valuation of JS Global’s

acquisition of our business, as well as the inherent subjective

nature of purchase price allocations.

(4)

Represents certain costs incurred related to the separation and

distribution from JS Global.

(5)

Represents cost of sales incurred related to the Product

Procurement Adjustment. As a result of the separation, we purchase

100% of our inventory from one of our subsidiaries, SNHK, and no

longer purchase inventory from a purchasing office wholly owned by

JS Global. Thus, the markup on all inventory purchased subsequent

to the separation will be completely eliminated in consolidation.

As a result of the separation, we pay JS Global a sourcing service

fee to provide value-added sourcing services on a transitional

basis under a Sourcing Services Agreement.

(6)

Adjusted for operating income from SNJP and the APAC distribution

channels for the three and nine months ended September 30, 2023 and

2022, as if such Divestitures occurred on January 1, 2022.

We define Adjusted Net Income as net income excluding (i)

share-based compensation, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net (iv) amortization of certain

acquired intangible assets, (v) certain separation and distribution

costs, (vi) certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

net income from our Divestitures and cost of sales from our Product

Procurement Adjustment, (vii) the tax impact of the adjusted items

and (viii) certain withholding taxes.

Adjusted Net Income Per Share is defined as Adjusted Net Income

divided by the diluted weighted average number of ordinary

shares.

The following table reconciles Adjusted Net Income and Adjusted

Net Income Per Share to the most comparable GAAP measures, net

income and net income per share, diluted, respectively, for the

periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except share and per

share amounts)

2023

2022

2023

2022

Net income

$

18,722

$

80,309

$

117,754

$

185,715

Share-based compensation(1)

21,337

969

24,502

5,415

Litigation costs(2)

3,965

19

4,600

4,024

Foreign currency losses (gains),

net(3)

3,862

(839

)

43,479

11,783

Amortization of acquired intangible

assets(4)

4,897

4,897

14,690

14,691

Separation and distribution related

costs(5)

41,455

275

76,549

275

Product Procurement Adjustment(6)

23,574

18,341

53,369

51,231

Tax impact of adjusting items(7)

(4,704

)

(5,206

)

(30,686

)

(19,232

)

Tax withholding adjustment (8)

19,474

—

19,474

—

Divested subsidiary net income

adjustment(9)

394

479

(6,586

)

1,055

Adjusted Net Income

$

132,976

$

99,244

$

317,145

$

254,957

Net income per share, diluted

$

0.13

$

0.58

$

0.85

$

1.34

Adjusted Net Income Per Share

$

0.95

$

0.71

$

2.28

$

1.83

Diluted weighted-average number of shares

used in computing net income per share and Adjusted Net Income Per

Share(9)

139,430,805

138,982,872

139,179,724

138,982,872

(1)

Represents non-cash expense related to restricted stock unit awards

issued from the JS Global and SharkNinja equity incentive plans.

(2)

Represents litigation costs incurred for certain patent

infringement claims and false advertising claims against us.

(3)

Represents foreign currency transaction gains and losses recognized

from the remeasurement of transactions that were not denominated in

the local functional currency, including gains and losses related

to foreign currency derivatives not designated as hedging

instruments. The total net gain (loss) recognized on our derivative

instruments related to forward contracts outstanding not designated

as hedging instruments included in the total of foreign currency

losses, net, was $0.7 million and $9.2 million for the three months

ended September 30, 2023 and 2022, respectively, and $(31.6)

million and $12.8 million for the nine months ended September 30,

2023 and 2022, respectively.

(4)

Represents amortization of acquired intangible assets that we do

not consider normal recurring operating expenses, as the intangible

assets relate to JS Global’s acquisition of our business. We

exclude amortization charges for these acquisition-related

intangible assets for purposes of calculated Adjusted Net Income,

although revenue is generated, in part, by these intangible assets,

to eliminate the impact of these non-cash charges that are

significantly impacted by the timing and valuation of JS Global’s

acquisition of our business, as well as the inherent subjective

nature of purchase price allocations.

(5)

Represents certain costs incurred related to the separation and

distribution from JS Global.

(6)

Represents cost of sales incurred related to the Product

Procurement Adjustment. As a result of the separation, we purchase

100% of our inventory from one of our subsidiaries, SNHK, and no

longer purchase inventory from a purchasing office wholly owned by

JS Global. Thus, the markup on all inventory purchased subsequent

to the separation will be completely eliminated in consolidation.

As a result of the separation, we pay JS Global a sourcing service

fee to provide value-added sourcing services on a transitional

basis under a Sourcing Services Agreement.

(7)

Represents the income tax effects of the adjustments included in

the reconciliation of net income to Adjusted Net Income determined

using the tax rate of 22.0%, which approximates our effective tax

rate, excluding (i) the withholding adjustment described in

footnote (8), (ii) divested subsidiary net income adjustment

described in footnote (9), and (iii) certain share-based

compensation costs and separation and distribution-related costs

that are not tax deductible.

(8)

Represents withholding taxes associated with the cash dividend paid

to JS Global in connection with the separation and related

refinancing.

(9)

Adjusted for net income (loss) from SNJP and the APAC distribution

channels for the three and nine months ended September 30, 2023 and

2022, as if such Divestitures occurred on January 1, 2022.

(10)

In calculating net income per share and Adjusted Net Income Per

Share, we used the number of shares transferred in the separation

and distribution for the denominator for all periods prior to

completion of the separation and distribution on July 31, 2023.

We define EBITDA as net income excluding: (i) interest expense,

net, (ii) provision for income taxes and (iii) depreciation and

amortization. We define Adjusted EBITDA as EBITDA excluding (i)

share-based compensation cost, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net, (iv) certain separation and

distribution costs and (v) certain items that we do not consider

indicative of our ongoing operating performance following the

separation, including Adjusted EBITDA from our Divestitures and

cost of sales from our Product Procurement Adjustment. We define

Adjusted EBITDA Margin as Adjusted EBITDA divided by Adjusted Net

Sales. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA

Margin are appropriate measures because they facilitate a

comparison of our operating performance on a consistent basis from

period to period that, when viewed in combination with our results

according to GAAP, we believe provide a more complete understanding

of the factors and trends affecting our business than GAAP measures

alone.

The following table reconciles EBITDA, Adjusted EBITDA and

Adjusted EBITDA Margin to the most comparable GAAP measure, net

income, for the periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2023

2022

2023

2022

Net income

$

18,722

$

80,309

$

117,754

$

185,715

Interest expense, net

13,003

8,479

28,523

18,561

Provision for income taxes

56,958

22,325

85,218

54,451

Depreciation and amortization

25,602

21,395

77,394

61,560

EBITDA

114,285

132,508

308,889

320,287

Share-based compensation(1)

21,337

969

24,502

5,415

Litigation costs(2)

3,965

19

4,600

4,024

Foreign currency losses (gains),

net(3)

3,862

(839

)

43,479

11,783

Separation and distribution related

costs(4)

41,455

275

76,549

275

Product Procurement Adjustment(5)

23,574

18,341

53,369

51,231

Divested subsidiary Adjusted EBITDA

adjustment(6)

264

(459

)

(11,020

)

(1,800

)

Adjusted EBITDA

$

208,742

$

150,814

$

500,368

$

391,215

Adjusted Net Sales

$

1,057,421

$

922,894

$

2,798,667

$

2,468,847

Adjusted EBITDA Margin

19.7

%

16.3

%

17.9

%

15.8

%

(1)

Represents non-cash expense related to restricted stock unit awards

issued from the JS Global and SharkNinja equity incentive plans.

(2)

Represents litigation costs incurred for certain patent

infringement claims and false advertising claims against us.

(3)

Represents foreign currency transaction gains and losses recognized

from the remeasurement of transactions that were not denominated in

the local functional currency, including gains and losses related

to foreign currency derivatives not designated as hedging

instruments. The total net gain (loss) recognized on our derivative

instruments related to forward contracts outstanding not designated

as hedging instruments included in the total of foreign currency

gains (losses), net, was $0.7 million and $9.2 million for the

three months ended September 30, 2023 and 2022, respectively, and

$(31.6) million and $12.8 million for the nine months ended

September 30, 2023 and 2022, respectively.

(4)

Represents certain costs incurred related to the separation and

distribution from JS Global.

(5)

Represents cost of sales incurred related to the Product

Procurement Adjustment. As a result of the separation, we purchase

100% of our inventory from one of our subsidiaries, SNHK, and no

longer purchase inventory from a purchasing office wholly owned by

JS Global. Thus, the markup on all inventory purchased subsequent

to the separation will be completely eliminated in consolidation.

As a result of the separation, we pay JS Global a sourcing service

fee to provide value-added sourcing services on a transitional

basis under a Sourcing Services Agreement.

(6)

Adjusted for Adjusted EBITDA from SNJP and the APAC distribution

channels for the three and nine months ended September 30, 2023 and

2022, as if such Divestitures occurred on January 1, 2022. The

divested subsidiary Adjusted EBITDA adjustment represents net

(loss) income from our Divestitures excluding interest expense,

income tax expense, depreciation and amortization expense and

foreign currency gains and losses recorded at the subsidiary level.

We refer to growth rates in Adjusted Net Sales on a constant

currency basis so that results can be viewed without the impact of

fluctuations in foreign currency exchange rates. These amounts are

calculated by translating current year results at prior year

average exchange rates. We believe elimination of the foreign

currency translation impact provides useful information in

understanding and evaluating trends in our operating results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109107622/en/

Investor Relations: Arvind Bhatia, CFA VP, Investor Relations

IR@sharkninja.com Anna Kate Heller ICR SharkNinja@icrinc.com Media

Relations: Sarah McKinney VP, Corporate Communications

PR@sharkninja.com

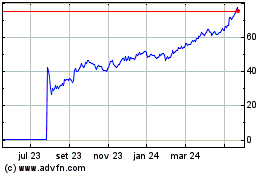

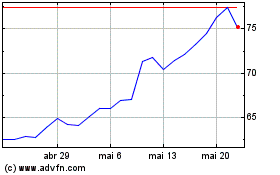

Sharkninja (NYSE:SN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Sharkninja (NYSE:SN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024